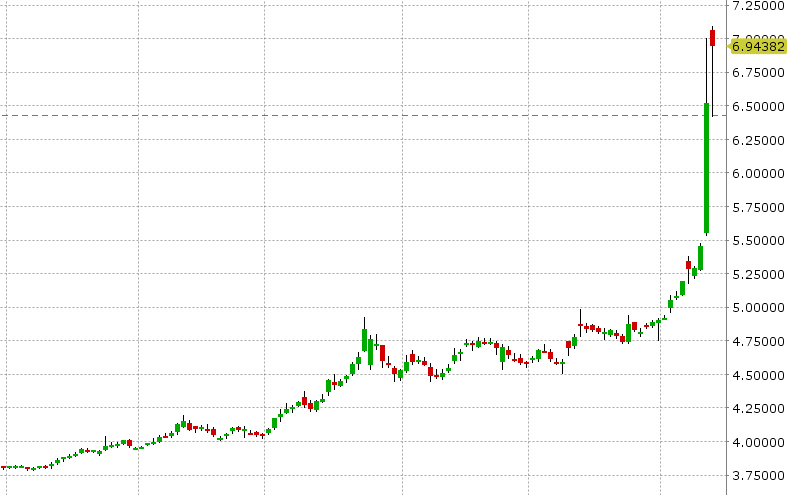

Markets glued on Turkey, but USD gains focused in EM space. ZAR flash crashes. Unconfirmed Pastor Brunson headlines sees USDTRY gains stall + USD offers.

Summary

-

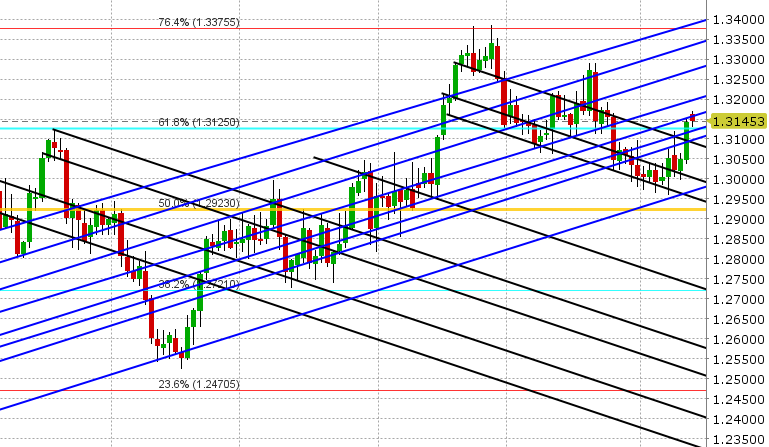

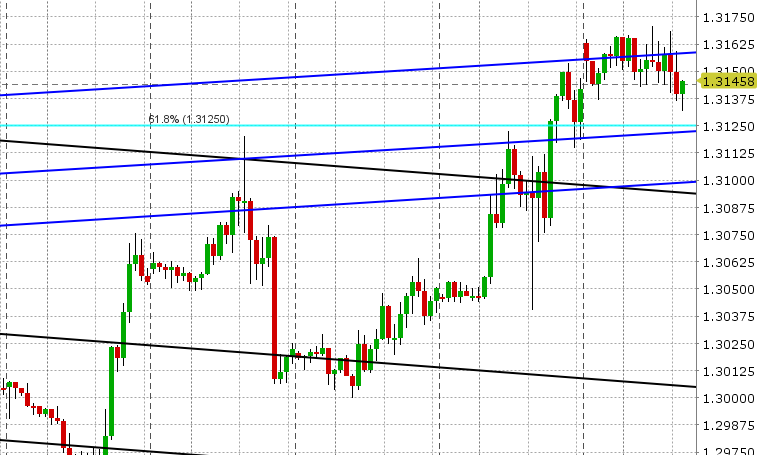

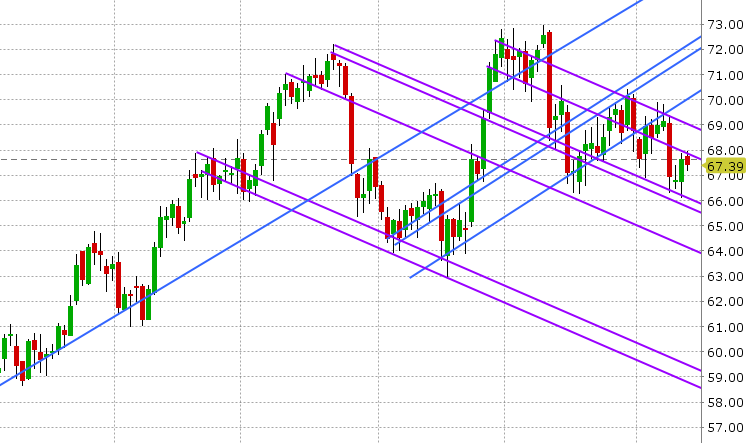

USDCAD: Dollar/CAD is bid this morning as continued selling in TRY and emerging markets leads a broad, but mild USD rally today. USDTRY hit a record high of 7.2150 in early Asian trade before the Turkish central bank announced measures to increase liquidity in the Turkish banking system (more here: https://www.businessinsider.com/turkey-central-bank-emergency-measures-to-save-financial-system-after-lira-collapse-2018-8), but they didn’t deliver any interest rates hikes (which is what the markets really want)…so the bounce in TRY (dip in USDTRY) was lackluster and the pressure on EM currencies intensified throughout European trade. ZAR flash crashed 10% lower at one point, MXN sold off another 2%, and the central banks of India and Indonesia also had to intervene to stem selling in their currencies. All this, along with some mild crude oil weakness, is helping to keep USDCAD at trend-line resistance in the 1.3160s as the week gets started. This week’s North American economic calendar is relatively light, with just US Retail Sales and Industrial Production on Wednesday, US Housing Starts and the Philly Fed on Thursday, and Canadian CPI on Friday. Canadian dollar futures traders added to long positions in the week ending Aug 7th, trimming the net long USD (CAD short) position back down to mid-June levels, which was slightly ill timed given the Saudi/Turkish headlines that followed later last week. We think USDCAD trades with a range-bound tone today, with Turkey remaining front and center. Chart support is 1.3125, then 1.3090-1.3100.

-

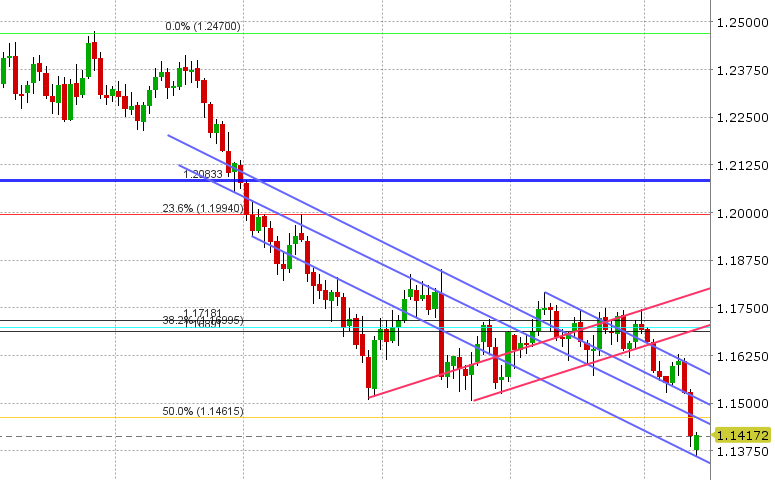

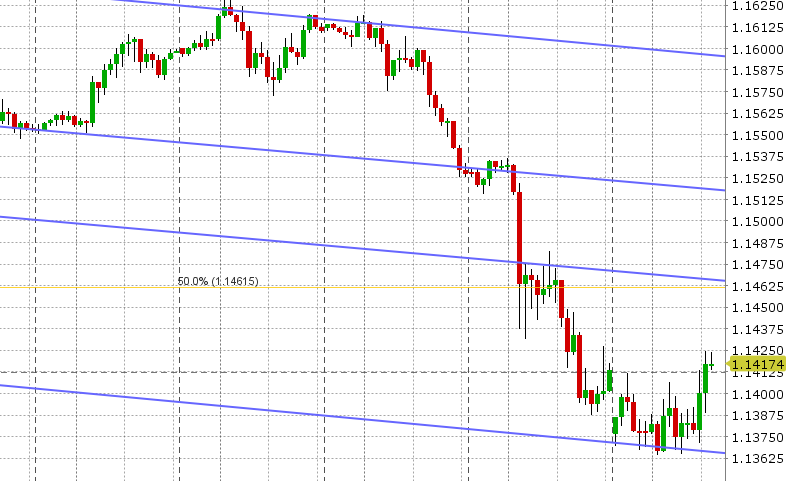

EURUSD: Euro/dollar is offered this morning as fears of contagion from Turkey continues to grip emerging markets, although the selling is not as bad as one might think given the moves in USDTRY and other EM currencies overnight, and trend-line support in the 1.1370s seems to be holding price. Italian debt continues to get hit (BTP/Bunds +277bp) as the shares of Unicredit (rumored exposed to Turkey) trade down another 3%. USDCNH has been quietly inching higher throughout all this, and is now knocking on the door at chart resistance in the 6.89-6.90 level. EURJPY continues to hemorrhage as the traders continue to dump EUR in exchange for the safe-haven JPY. Unconfirmed reports have just crossed the wires that Pastor Brunson is to be released from house arrest in Turkey (recall this has been the source of ongoing tensions from the US and Turkey), but the US embassy in Turkey has just as quickly denied these reports. Euro futures traders piled on new short positions during the week ending Aug 7th, bringing the net speculative fund position ever closer to flat. This week’s European calendar features German Q2 GDP, German ZEW survey for August, June Eurozone Industrial Production and Eurozone Q2 GDP (Tuesday), and Eurozone July CPI (Friday). We think EURUSD shorts use the Pastor Brunson headlines as an excuse to take profits today, which means we expect a range-bound to higher tone here. Of course, keep a close eye on USDTRY…currently -7.25%.

-

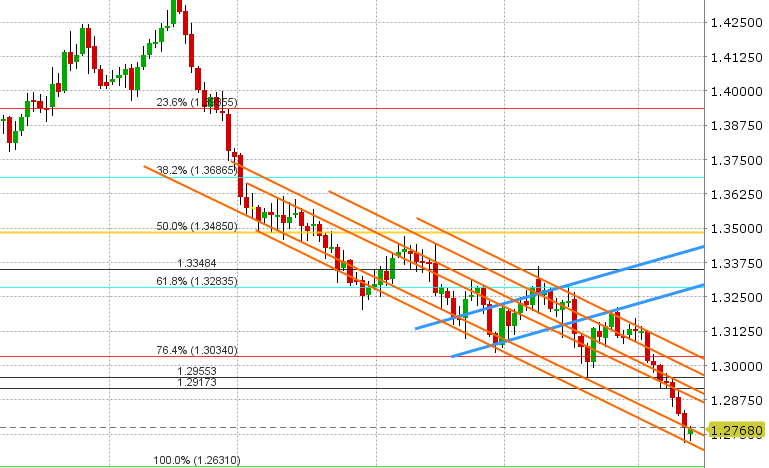

GBPUSD: Sterling is trading range-bound to start the week, after seven down days in a row. Support in the 1.2720s is holding while resistance in the 1.2770s is capping bounces. This week is another big week for UK data: June Employment Report (Tuesday), CPI (Wednesday), and Retail Sales (Thursday). Brexit negotiations are also expected to resume in Brussels on Thursday. Both longs and shorts added to speculative futures positioning in the week ending Aug 7, but shorts more so, leaving the GBPUSD net short position the largest in almost a year (this was as GBPUSD broke down again through 1.3000). We think GBPUSD could see some short covering here should we trade above the 1.2770s with some momentum.

-

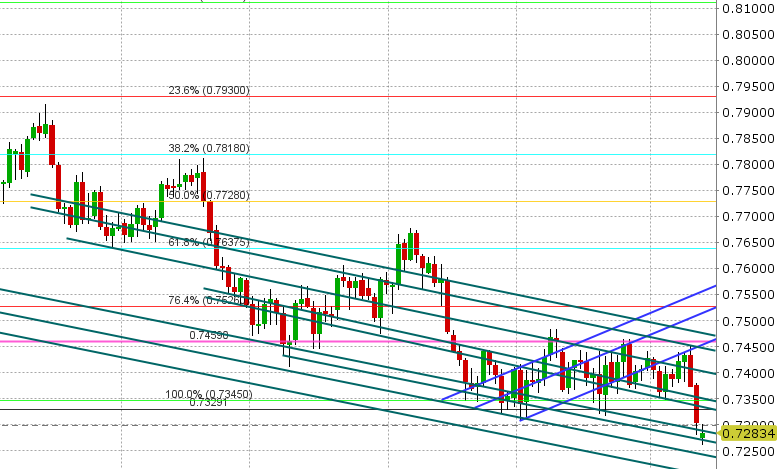

AUDUSD: The Aussie is mildly offered this morning, but like the rest of the majors, the selling is not as bad as emerging market currencies would lead you to believe. Copper is bouncing with EURUSD here, following the Pastor Brunson headlines. Equity futures have ticked back into the green. Support today lies at 0.7270s, then the 0.7240s. Resistance is 0.7290. We think AUDUSD remains under pressure so long as we stay below 0.7290, with any rally above likely to produce near term short covering into 0.7330. Shorts added to speculative futures positions in the week ending Aug 7, extending the market’s net short positioning further to -54k contracts. This week’s calendar features the Australian Q2 Wage Price Index (Tuesday night ET), the Australian Employment Report (Wednesday night ET), a speech from RBA Governor Lowe (Thursday night ET), and a speech from RBA assistant Governor Ellis (early Friday morning ET).

-

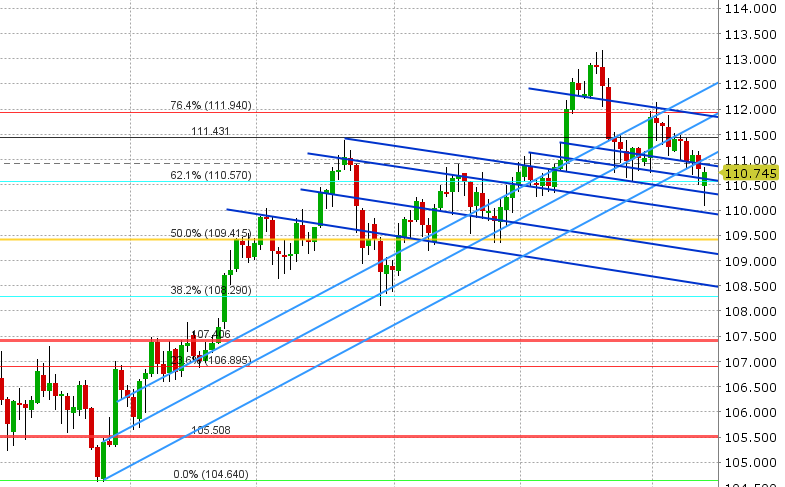

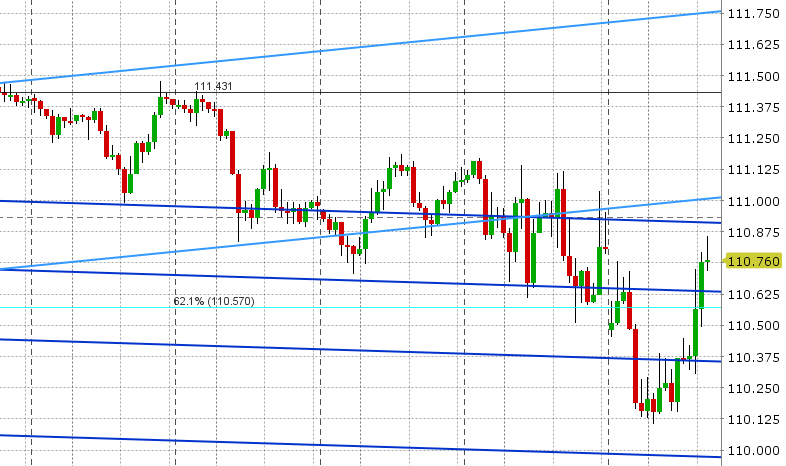

USDJPY: Dollar/yen took the brunt of the “risk off” move we saw in Asian trade last night following the continued surge in USDTRY. Friday’s failure by Erdogan to calm markets and Trump’s doubling down on Turkish tariffs killed any attempt to regain the 111 handle, and with that selling in USDJPY was the path of least resistance to start the week. Some sense of calm seems to be returning now following the Pastor Brunson headlines (despite reports of the news being unconfirmed), and with that USDJPY is trading back above 110.50-60. This level will now serve as support. Resistance is 110.90-111.00. Both longs and shorts liquidated futures positions during the week ending Aug 7, leaving the net long USD (short JPY) speculative position slightly smaller, but still higher than early July levels or the last time we were trading in the mid-110s. We think USDJPY finally bounces here, with EURJPY leading the way. This week’s Japanese calendar is light, with just June Industrial Production out early tomorrow and the July Japanese trade balance figures out on Wednesday night ET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/TRY Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.