EM FX bounces with TRY up 4%. CAD outperforming on crude oil strength and CAD cross demand. UK employment report disappoints on wage growth.

Summary

-

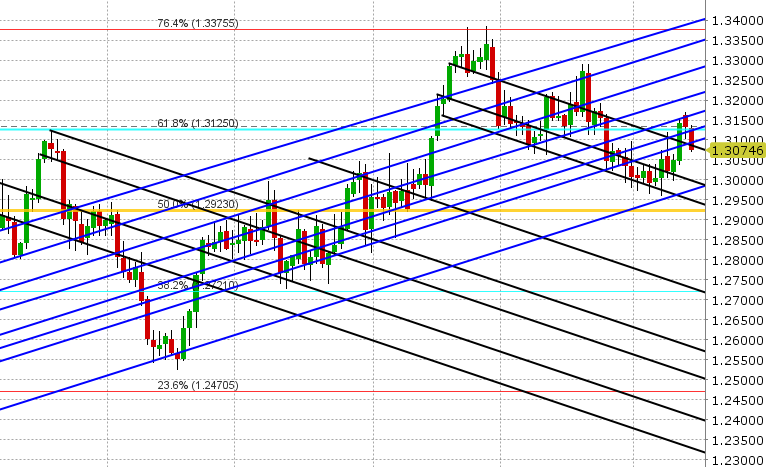

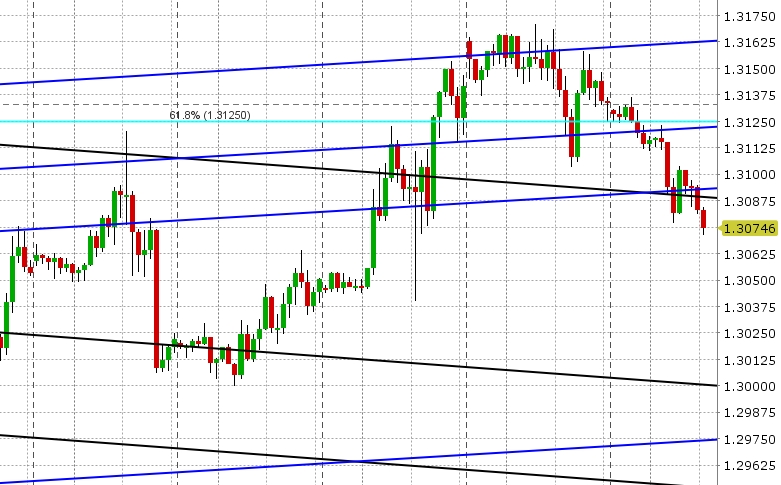

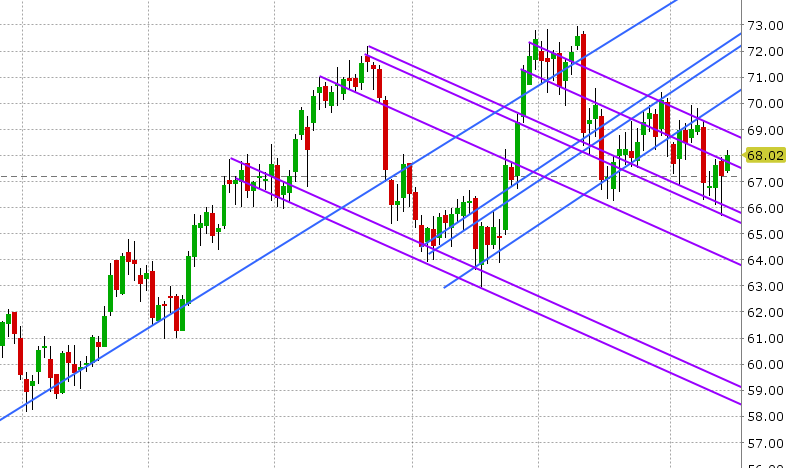

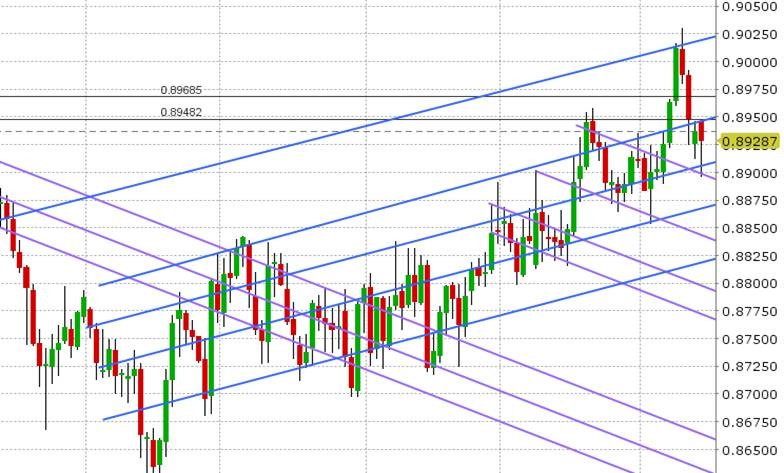

USDCAD: Dollar/CAD is seeing some selling this morning as the broader EM FX space recovers from yesterday’s rout lower. The Turkish lira is taking a breather as well (+4% at this hour), with the higher yielding TRY rate in today’s CBRT’s swap auction and Albayrak’s announced teleconference with global investors lending support. http://www.hurriyetdailynews.com/turkeys-treasury-and-finance-minister-albayrak-to-address-foreign-investors-135770. September crude oil is trading up 1%, following yesterday’s late reversal higher, and has just broken above trend-line resistance in the 67.90 area. We’re also seeing broad demand for CAD on the crosses this morning ahead of upcoming NAFTA talks, with CADJPY leading the way. We think USDCAD trades with a heavy tone today, so long as the market stays below support in the 1.3090s.

-

EURUSD: Euro/dollar is trading range-bound so far today, with broad EM FX USD selling being offset by mixed European economic data and the still elevated BTP/Bund yield spread (still close to yesterday’s wides of +275bp). German Q2 GDP came in mixed (beating 0.1% on the QoQ figure, but missing estimates by 0.1% on the YoY figure). Eurozone Q2 GDP beat expectations, but Eurozone Industrial Production for June missed estimates. The German ZEW survey beat expectations, coming in at 72.6 vs 72.3. USDCNH has backed off the 6.90 level following a PBOC fix last night that didn’t edge higher by much (slight EURUSD positive). With the market’s inability to extend its bounce further yesterday, today’s mixed data, and nothing on the US calendar until tomorrow’s US Retail Sales number, we think EURUSD coasts here for the time being. Support 1.1370s. Resistance 1.1460s.

-

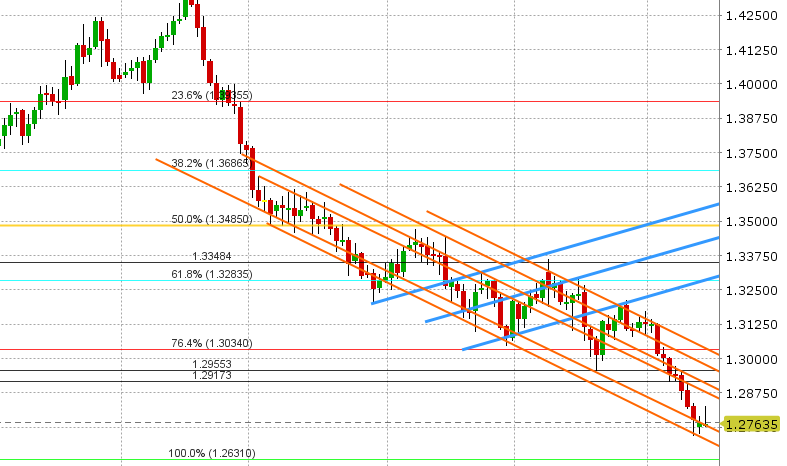

GBPUSD: Sterling is trading flat on the session at this hour, as an earlier breakout above chart resistance in the 1.2770s was squashed by a soggy UK employment report for June. The headline unemployment claimant count missed expectations (+6.2k vs +3.8k expected), and average weekly earnings came in soft as well (+2.4% 3M/yr vs +2.5% expected). With EURGBP bouncing strongly off its overnight lows and GBPUSD working on a bearish inverted hammer candle pattern, we think GBPUSD hugs the downward sloping trend-line level in the 1.2760s. A break below would invite further selling, while buying at these levels will likely keep us range-bound. Tomorrow we’ll get UK CPI for July.

-

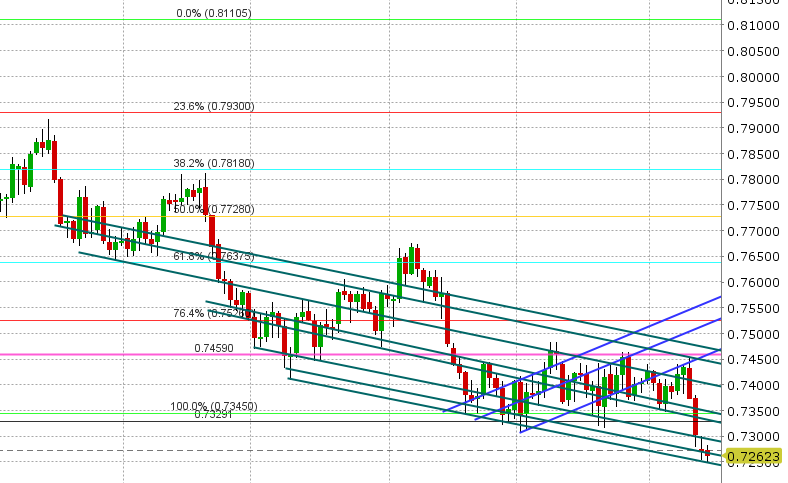

AUDUSD: The Aussie is leaking lower again this morning as weak Chinese data, lower copper prices, and technical weakness outweigh broad USD selling in EM FX today. China reported Retail Sales and Industrial Production for July overnight and both figures missed expectations. We think AUDUSD possibly bounces today, but we would need to see a bounce in EURUSD and copper as well. Support 0.7250s. Resistance 0.7290s. The Australian employment report for July is out tomorrow night.

-

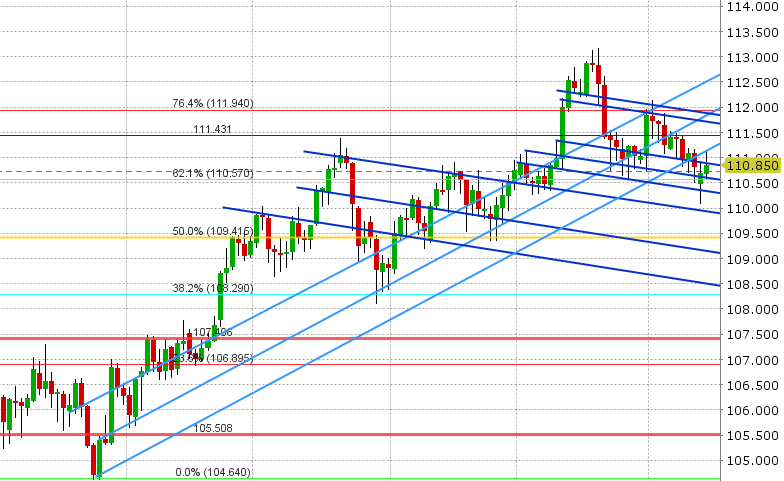

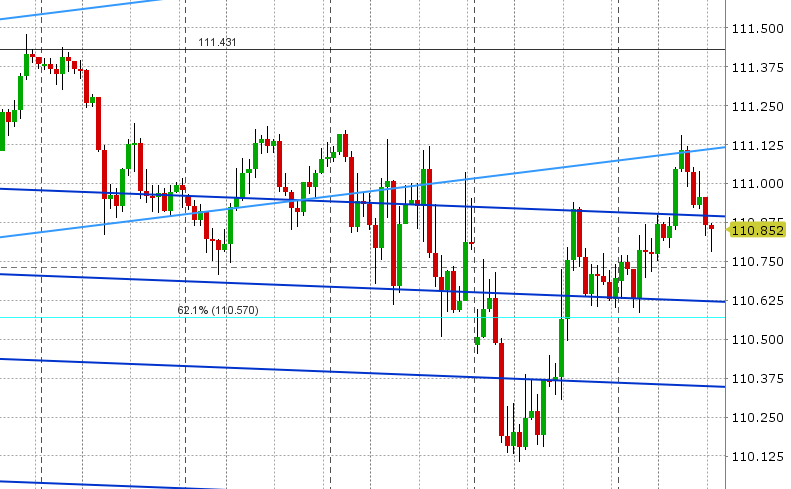

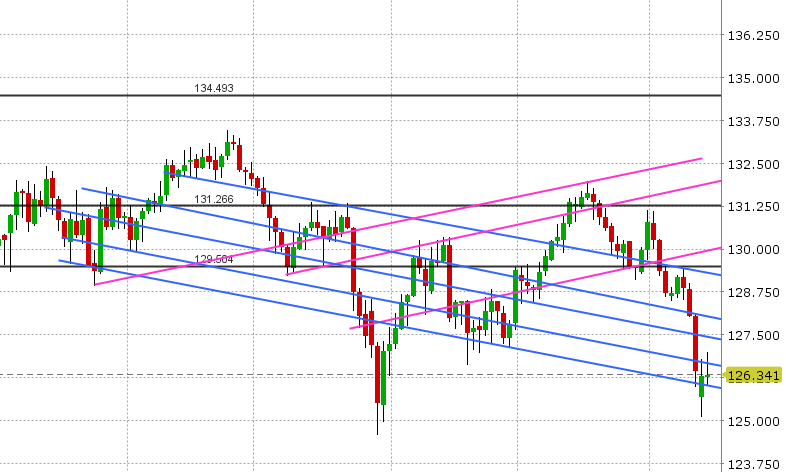

USDJPY: Dollar/yen extended its bounce higher in European trading today, with the improved tone to “risk” leading the way (global equities and DM bond yields trading higher) following a calming down in emerging markets, but trend-line resistance in the 111.10s has capped prices. With EURJPY rallying but failing above the 126.70s, we think USDJPY settles into a little range here (110.70-111.00).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/TRY Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.