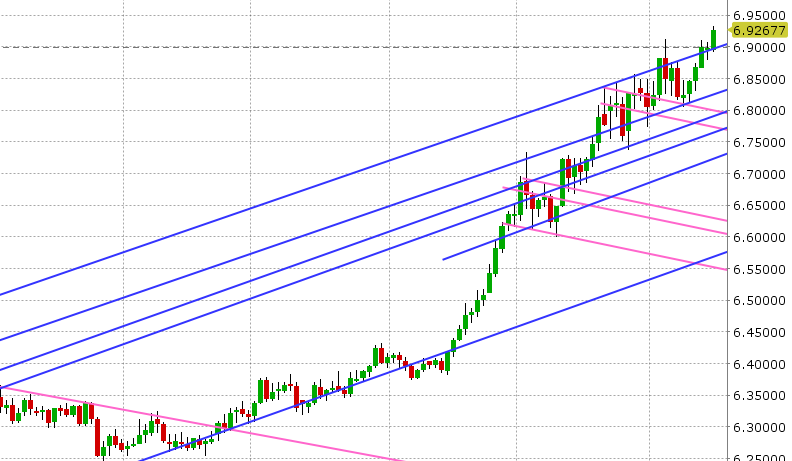

China worries + new highs in USDCNH leading broad USD strength. Markets ignoring stop-gap measures in Turkey. US Retail Sales beats.

Summary

-

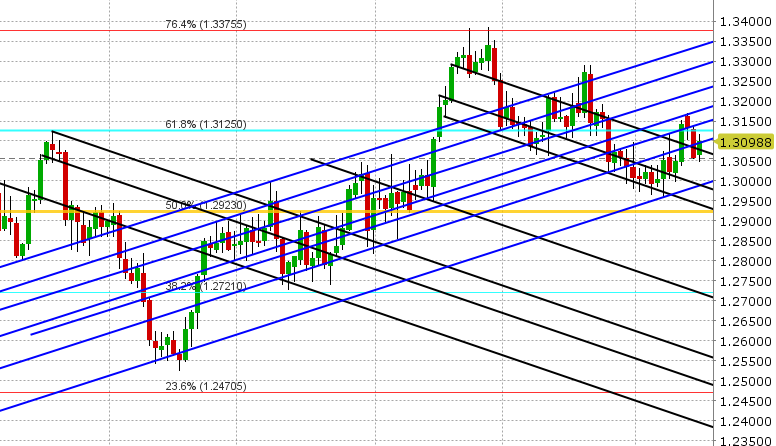

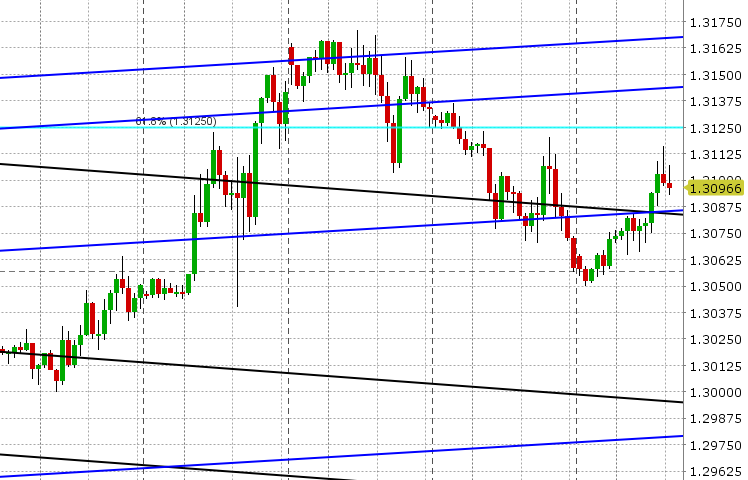

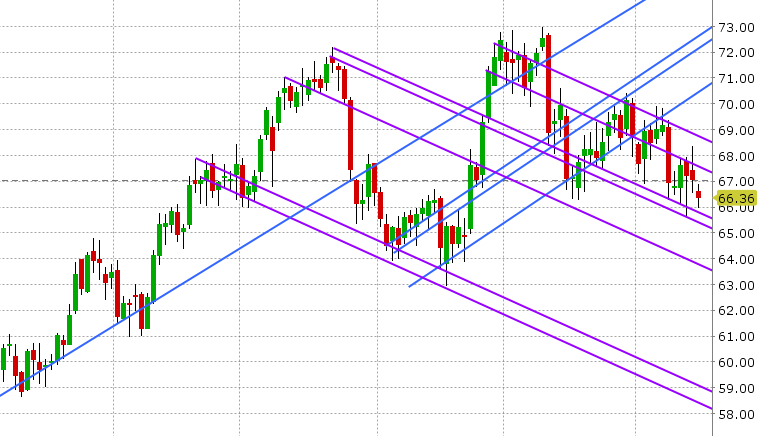

USDCAD: Dollar/CAD is recovering this morning after crude oil volatility saw us trade on both sides of the key 1.3090 level yesterday, but ultimately finish well below it. Today’s focus for markets appears to have shifted to worries about Chinese growth, as we see the Shanghai down 2%, USDCNH at new highs (6.92s), crude oil down 1%, copper down another 2.5% after dropping the same amount yesterday. Combine this with the weak Chinese Retail Sales/Industrial Production data reported yesterday and market talk of softer oil demand out of Asia, and we have a bit of a “risk off” scenario in play today that is causing EM FX pressure and broad demand for USD and JPY. Markets are ignoring the drop in USDTRY below 6.00 today (bounce in TRY) as the measures taken by Turkey over the last 24hrs (suspending mark-to-market accounting for banks and limiting their ability to short TRY via FX swaps) appear to be stop-gap measures that don’t really address the fundamental problems behind the economic crisis. USDCAD has drifted back over the 1.3090 level amidst all this and is now seeing some light profit taking ahead of US July Retail Sales at 8:30amET. Markets are expecting +0.1% MoM on the headline and +0.3% ex autos. In the 9am hour, we’ll get the July reads on Canadian Existing Home Sales and US Industrial Production. Finally, traders will be watching the weekly EIA oil inventory report at 10:30amET, where expectations are for a draw of 2.5M barrels (the weekly API report out last night showed a build of 3.6M barrels). US Retail Sales has just been reported +0.5% on headline and +0.6% on core (beating expectations), but the broad USD uptick following the release has been mild so far. With USDCAD trading back above 1.3090, we think the market drifts in a range-bound to higher pattern. Trade back below and it’s a different story. We see chart resistance today at 1.3125-1.3140.

-

EURUSD: Euro/dollar continues to leak lower today after breaching support in the 1.1370s yesterday. Today’s broad “risk off” tone and demand for USD is the underlying driver. BTP/Bund spreads remain elevated (+275bp). Liquidity in Europe is lacking today, with banks in Italy and France closed for Assumption Day. Today is also a “Fed SOMO” day, something we haven’t reported on much this year, but does tighten liquidity and boost demand for USD on the day it occurs every month since October 2017. More here, courtesy of DailyFX.com: https://www.dailyfx.com/forex/market_alert/2018/08/15/EURUSD-to-Extend-Losses-on-Todays-Federal-Reserve-Balance-Sheet-Unwind.html. We think EURUSD remains on the defensive here so long as we stay below 1.1350.

-

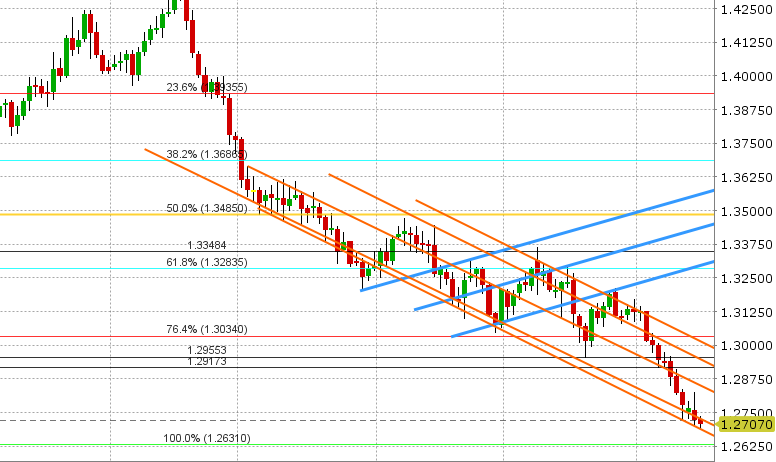

GBPUSD: Sterling continues to hug downward sloping trend-line support in the 1.2710s this morning, with the July release of UK CPI providing no excitement for traders (reported today in-line with expectations of 2.5% YoY on headline and +1.9% YoY on core). GBPUSD made a new daily low following the US Retail Sales beat, but has since bounced back above the 1.2700 handle, where 1.4blnGBP in options expire shortly. We wouldn’t be surprised to see a bounce today, but we think sellers remain in control sub 1.2750.

-

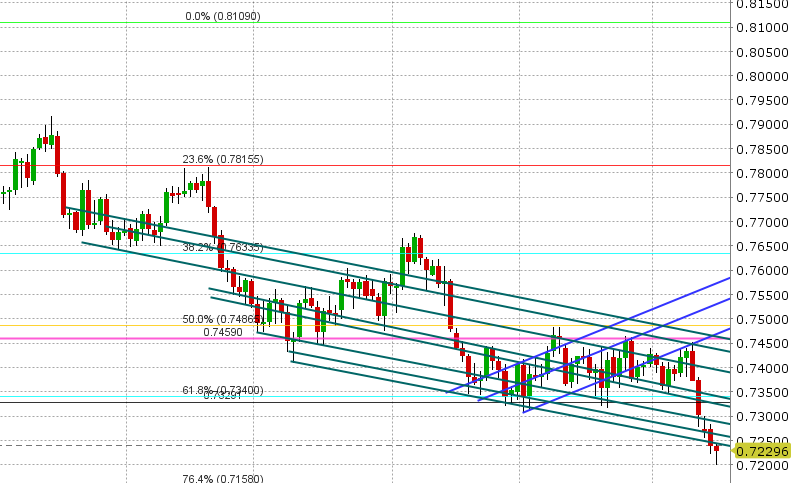

AUDUSD:The Aussie is trading marginally lower again this morning, after breaking below support in the 0.7250s yesterday. Today’s broad demand for USD, concerns about China and weak copper prices are the culprits, but we would note the downward momentum has been choppy (likely because market positioning is already quite short). While we think AUDUSD remains on the defensive sub 0.7250, we would not be surprised to see short covering ahead of the Australian jobs report tonight (9:30pmET). Traders are expecting +15k jobs for July.

-

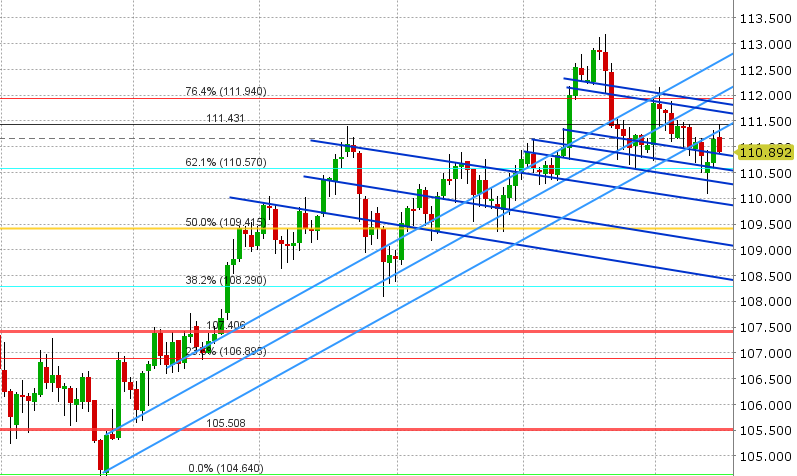

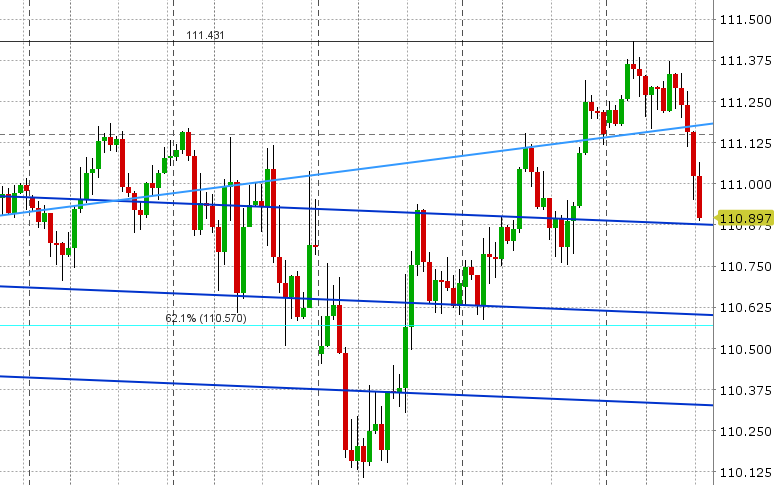

USDJPY: Dollar/yen is moderately offered this morning as “risk flows” took over following a test of chart resistance in the 111.40s overnight. Global equities are 0.5-1.0% lower and developed market bond yields are trading down as well. With USDJPY now back below the 111.10s (the trend-line level it broke above in Asian trade last night), we think we may see a renewed attempt by the market to establish short positions (recall futures traders are still net long USDJPY). Watch 125 as a key support level in EURJPY. Japan reports Trade Figures for July tonight (7:50pmET).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

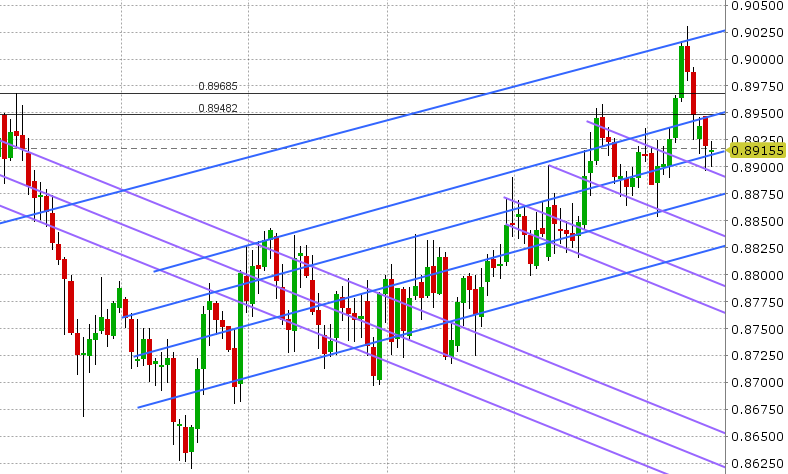

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.