USD broadly weaker into NY open with Italian bonds leading

Summary

-

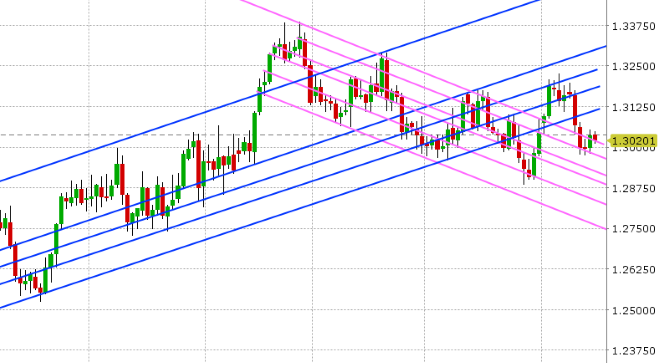

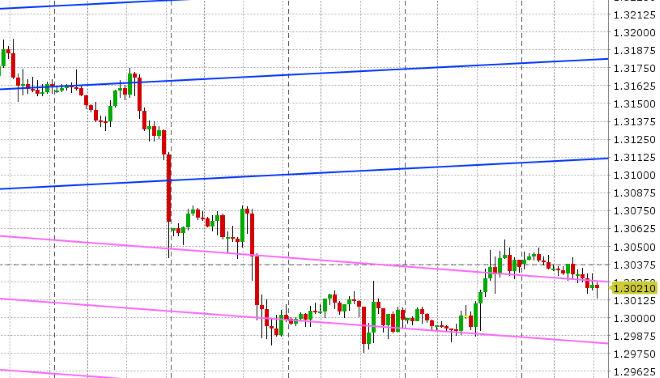

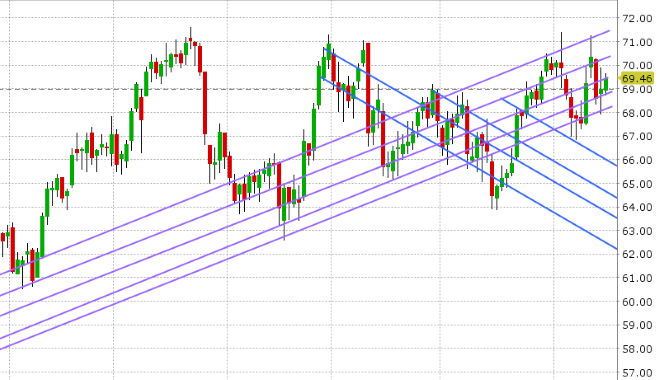

USDCAD: Dollar/CAD is trading slightly off Friday’s NY highs this morning as the broader USD quietly reverses some of its Retail Sales driven gains. Trump is dominating FX headlines to start the week with reports that his administration is set to go ahead with a 10% tariff on $200bln of Chinese imports. One would expect a bit more of a “risk-off” type move as a result but markets are taking the news in stride (Nikkei higher, S&Ps flat, USD an JPY weaker). Perhaps the fact that Tokyo traders are out on holiday has helped dampen liquidity and the urge to move things around much so far. This week’s calendar is fairly light for US and Canada data, with the key economic headlines likely to come from US Housing Starts on Wednesday, the US Philly Fed on Thursday and Canadian Retail Sales+CPI on Friday. The funds mildly trimmed long and short positions by an equal amount during the week ending Sep 11th, leaving the net long USD (short CAD) position unchanged. October crude oil is starting the week bid above trend-line resistance in the 69.40s (opens up move to 70.25). We think the downward sloping trend-line at 1.3025 today will be the anchor for direction today. Stay below and we’ll likely leak lower, but regain the level and we’ll probably see some more buying. Chart support is 1.2985.

-

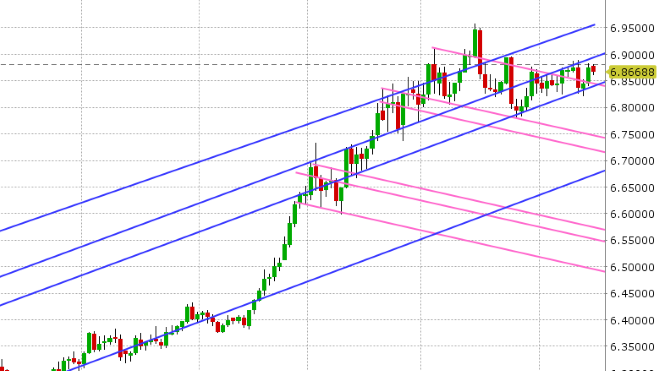

EURUSD: Euro/dollar is bouncing this morning on not much news other than reports from Italy that the 2019 budget will likely be just 1.6% of GDP. This is helping Italian bonds rally (yield spreads contract) relative to German bonds. USDCNH is starting the week rather quiet, and has not depreciated despite the Trump headlines and the continued slump in the Shanghai Composite (new 4 year lows). This week’s calendar is relatively light on the European front as well, with just some Markit PMI data out of Germany at week’s end. Mario Draghi will be speaking twice however, first at tomorrow’s ACPR event in Paris, and then on Wednesday at the Hertie School of Governance in Berlin. The funds trimmed positions in EURUSD as well during the week ending Sep 11th, but net position still remains marginally long. We think EURUSD has a chance to totally erase Friday’s negative candle today, but the market needs to regain and hold the 1.1670s. Failure to do so would invite some selling back in.

-

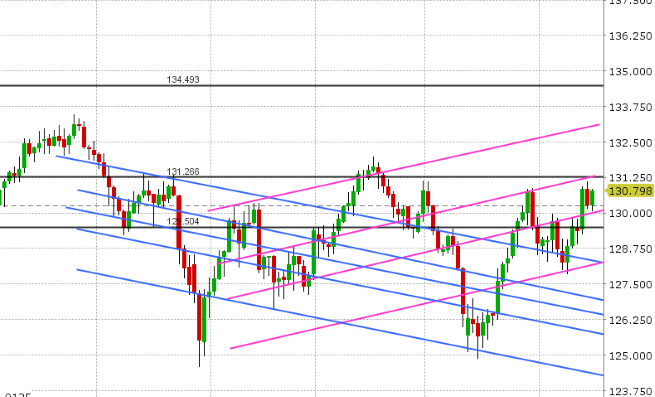

GBPUSD: Sterling is bouncing with EUR this morning in an otherwise quiet tape, shaking off Friday’s negative Brexit headlines. This week’s UK calendar could be eventful, as we have CPI data on Wednesday and Retail Sales on Thursday. We’ll also have a gathering of EU leaders on Thursday at what’s being dubbed the Salzburg summit. More here. The funds trimmed short positions during the week ending Sep 11th, bring the net GBP short (long USD) position back down to mid-summer levels. With GBPUSD now rallying back up to trend-line resistance (1.3130s) into the NY open and EURGBP looking in no mood to challenge the 89 handle today, we think the odds of another upside break increase.

-

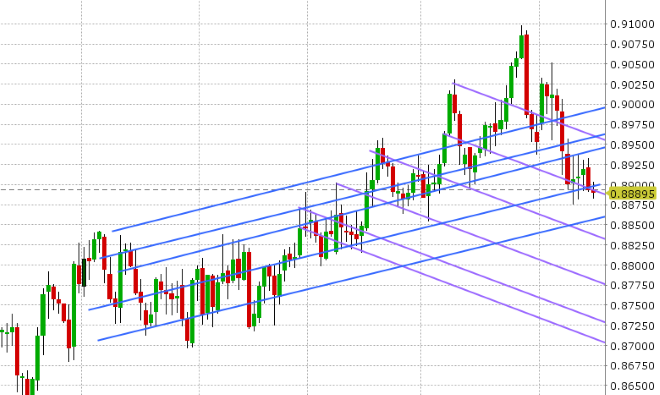

AUDUSD: The Aussie is starting the week with a better tone, much like EUR and GBP. The funds added sizably to both longs and shorts during the week ending Sep 11th, but we think this has more to do with the September-to-December futures roll currently underway as the net short AUD (long USD) position remained largely unchanged. This week’s Australian calendar is very quiet, with just the RBA Minutes out tonight (9:30pmET) and a speech from the RBA’s Kent tomorrow at around the same time. Copper futures are starting the week slightly softer, as Friday’s technical damage to the charts keeps the market underneath resistance in the 2.63s. We think AUDUSD could creep back higher here if EURUSD continues its rally. Chart resistance is 0.7205.

-

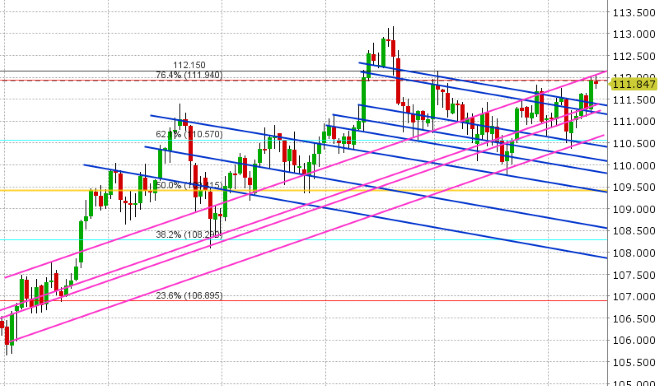

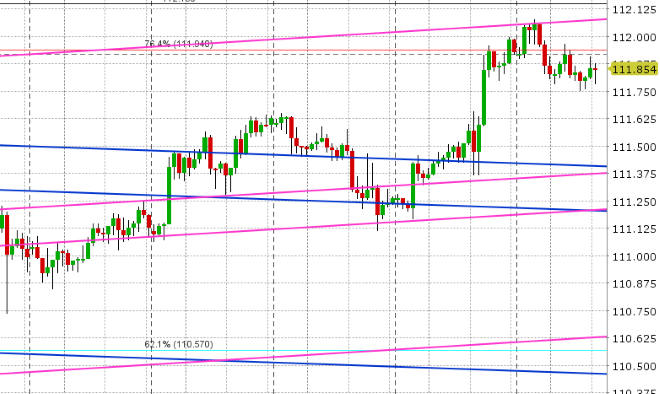

USDJPY: Dollar/yen is pretty much drifting so far today with Japanese traders out for the “Respect for the Aged” holiday. The funds added marginally to both long and short positions during the week ending Sep 11th, leaving the net USD long (JPY short) position steady at early summer levels. US 10yr yields are starting the week bid over 3%, which is USDJPY supportive. Over 1blnUSD in options expire today at the 112.00 strike, which will likely continue to keep activity range bound. The Bank of Japan meets tomorrow night to announce its latest decision on monetary policy. JGBs are trading steady at 11-12bp. Chart resistance today is 112.10-15. Support is 111.85-90.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.