USD trading mixed ahead of US Retail Sales

Summary

-

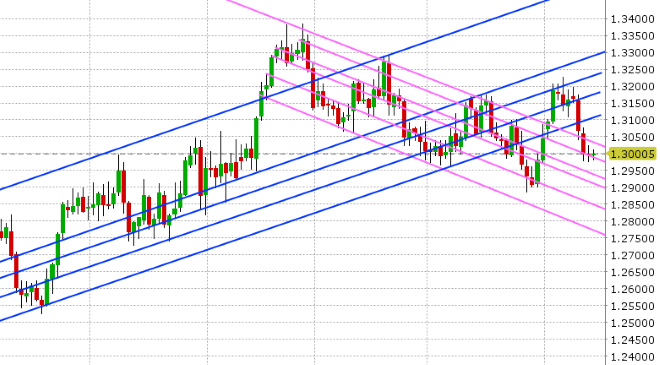

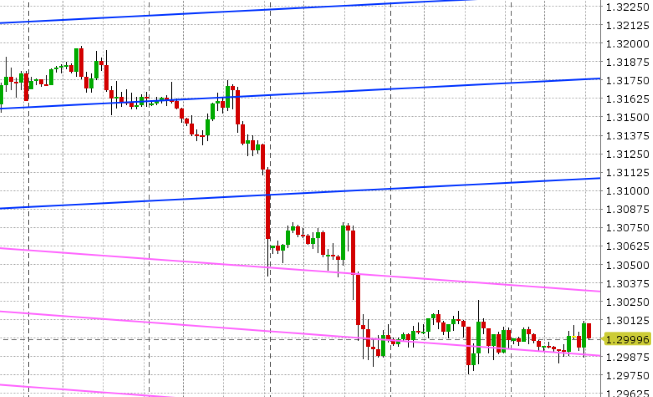

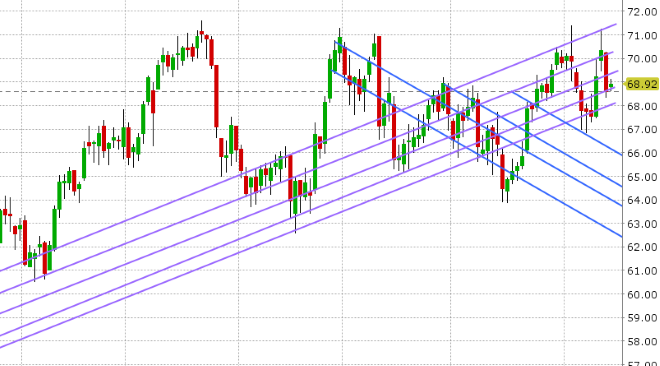

USDCAD: Dollar/CAD didn’t offer much up to traders yesterday; trading slightly below trend-line support at the 1.3000 level after the weaker US CPI numbers and then trading back above it after Trump’s “no pressure to make a deal with China” tweet. The market continues to hug this trend-line level as we head into US Retail Sales this morning at 8:30amET. Traders are expecting +0.4% MoM for August and +0.5% ex Autos. The broader USD is trading weaker so far today for the most part. October crude oil trades steady above trend-line support in the 68.70s, but well off yesterday’s highs as tropical storm weather premium comes out of the market. With EURUSD and GBPUSD backing off their overnight highs, we think USDCAD could bounce here. Support 1.2990. Resistance 1.3030.

-

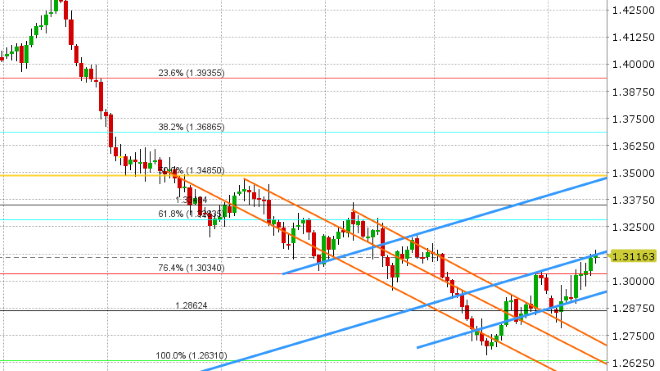

EURUSD: Euro/dollar benefited handsomely from the weak US CPI yesterday, rocketing higher past chart resistance in the 1.1660s after basing at support in the 1.1610s pre-number. Mario Draghi’s post meeting ECB press conference didn’t offer much in terms of new monetary policy clues we felt, but one could argue he was slightly upbeat in tone. EURUSD hit Fibo resistance at the 1.1700 level, backed off a bit, surpassed it in early European trade today, and has since backed off new resistance at 1.1720. USDCNH trades steady at this hour after yesterday’s downward momentum post US CPI was completely erased following Trump’s tweet. The BTP/Bund spread also isn’t doing much, continuing to hold in the mid 230s. Turkey’s Erdogan made headlines overnight when he expressed his displeasure with yesterday’s rate hike from the CBRT, saying “we’ll see the results of this [central bank] independence”, and that he has “patience only up to a point” with regard to the central bank and rates. This has reversed the upward momentum in TRY and some other EM currencies a bit this morning. Russia unexpectedly raised interest rates by 25bp to 7.5% overnight, which is helping RUB this morning. We think EURUSD may leak lower into 1.1660s support today, but we could very well be range bound too as there’s not much momentum in price at this hour. Monday features a large option expiry at the 1.1765 strike (2.1blnEUR).

-

GBPUSD: Sterling followed EURUSD higher yesterday and it continues to do so today for the most part, but the market has just undergone a negative technical development. Europe’s rally over trend-line resistance in the 1.3120s has failed, and we’re now just getting reports that the UK’s Labour Party will vote against Theresa May’s Brexit deal (aka Chequers proposal). While this shouldn’t be a surprise given what we know about Corbyn’s opposition to May, it’s not a great headline and traders are hitting the sell key. EURGBP has popped on the news as well, and looks like it might now want to test resistance in the 0.8940-50s.

-

AUDUSD: Like EURUSD, the Aussie benefited from the US CPI print yesterday, popping up to trend-line resistance at the 0.7220s in short order. However, it continued to show its increased sensitivity to USDCNH and US/China trade news by falling quickly lower after the Trump tweet. This left the AUDUSD chart looking directionless going into the NY close, which then sort of explains the mood today…lower in Asia, higher in early Europe, lower again now, but not really doing much. Support remains 0.7155-65. Resistance is now 0.7210. The upward momentum in copper also got hit yesterday following the Trump tweet, with the daily candle forming a doji pattern (indecision).

-

USDJPY: Dollar/yen pulled back a little bit after the weak US CPI print yesterday, but bounced quickly back up when US stocks celebrated the lower inflation reading by rallying higher. When the 111.50 option expiry passed in USDJPY at 10amET (a downside weight), we saw further buying. Broad “risk-on” JPY selling then picked up steam (ie. EURJPY), and before we knew it the market raced up to the 112.00-112.10 resistance level we talked about earlier this week. Japan’s Abe made some headlines overnight when he said the BOJ should not maintain ultra-easy policy forever, and with that USDJPY backed off resistance a bit. Markets now sit just below the 112 figure awaiting further direction from US stocks/yields and the broader USD tone. Japan is out on holiday on Monday. The BOJ meets on Wednesday (Tuesday night ET) to announce its latest decision on monetary policy. Over 1blnUSD in options are set to expire at the 112.00 strike on Tuesday.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

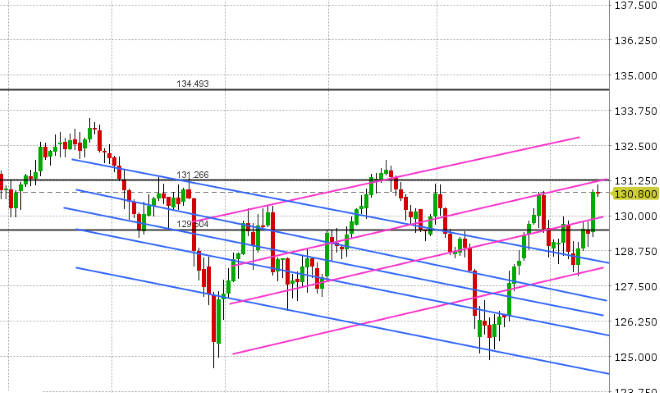

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

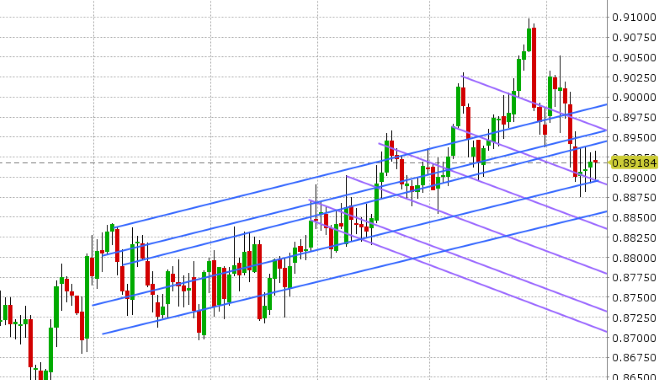

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

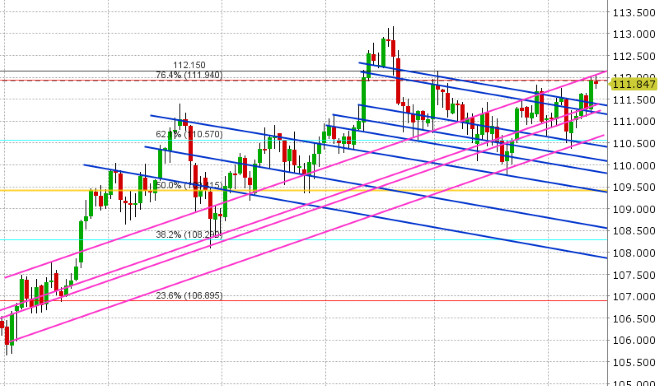

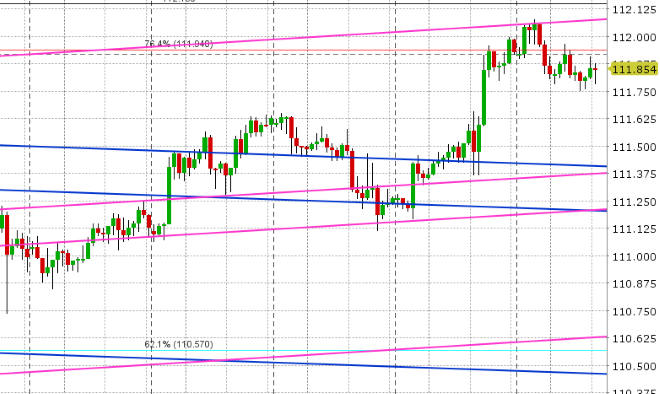

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.