Markets shrug off formal escalation in US/China trade war

Summary

-

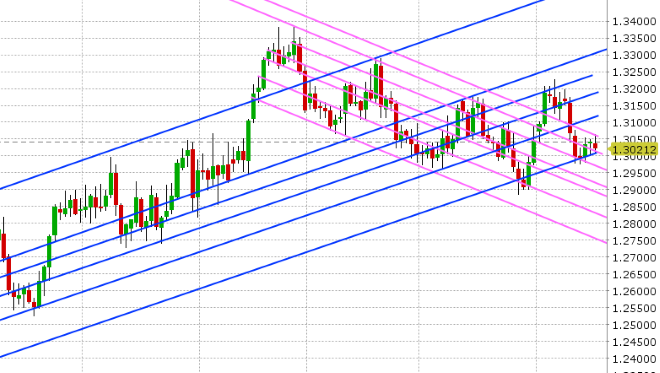

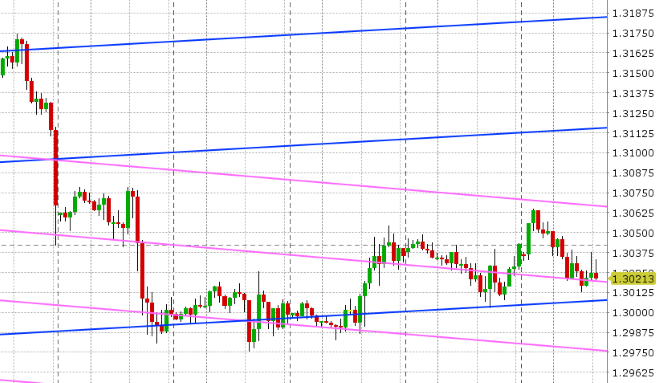

USDCAD: Dollar/CAD has a had a whippy overnight session. The market rallied higher in Asia after closing above trend-line support in the 1.3020s and the formal announcement of the 10% tariff on $200bln of Chinese imports was the key driver initially (“risk-off” USD positive headline). However, markets quickly shrugged off the news and a bid returned to risk assets after USDCNH hit chart resistance in the 6.8920s and reversed lower. China’s response has been calm and collected as usual, and we’ve also had a PBOC advisor cross the wires downplaying the impact of the trade war so far. The pullback in USDCNH saw the USD broadly sell off into European trade and then we got the headlines out of Saudi Arabia saying that the kingdom is “comfortable with Brent oil above $80”. All this has combined to pressure USDCAD back down towards trend-line support in the 1.3020s, and the market has bounced off this level for the time being. Nothing major awaits us on the North American economic calendar today. Given the mixed tone to the broader USD at this hour, we think USDCAD chops around today. Near term support 1.3010-20. Resistance 1.3065.

-

EURUSD: Euro/dollar has also had a volatile session so far. The tariff headlines saw EURUSD pull back into chart support in the 1.1660s, but then we bounced strongly after USDCNH topped out and reversed lower. The market probed above the 1.17 handle for a short while in early European trade and then quickly failed in its breakout attempt higher as USDCNH regained its composure. We think the upcoming option expiry today at 1.1680 (1blnEUR) might have played a part in these selling flows as well. Trend-line support (now in the 1.1670s) has stemmed the selling again however, and we trade right back up to the 1.17 mark again. We got nothing out of Draghi today in Paris. EURUSD bulls continue to have the upper hand so long as the 1.1670s hold.

-

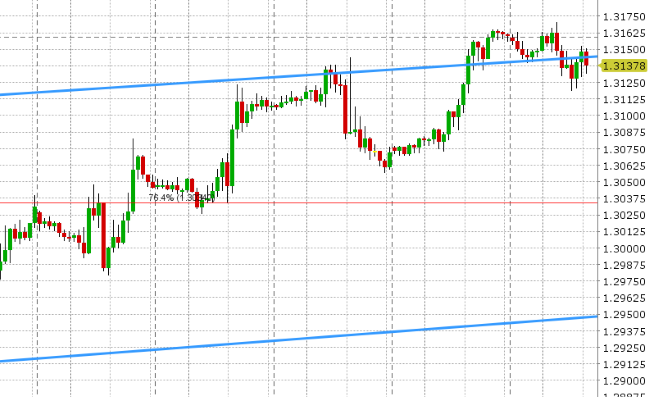

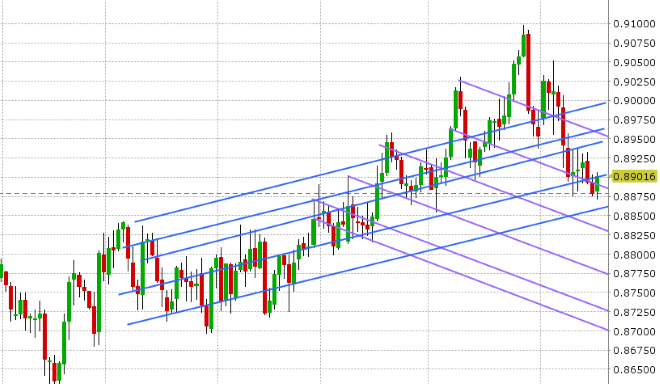

GBPUSD: Sterling has had a relatively subdued overnight session; following the ebb and flow of EURUSD for the most part. The upward sloping trend-line resistance level (1.3130s) that the market surpassed yesterday (now support) was breached to the downside this morning, but was regained just now as EURUSD rallied back above the 1.1700 level. EURGBP has rallied strongly back above the 89 handle this morning after making a new 6-week low earlier today. We think the GBPUSD rally risks running out of steam here if the 1.3030s give way again.

-

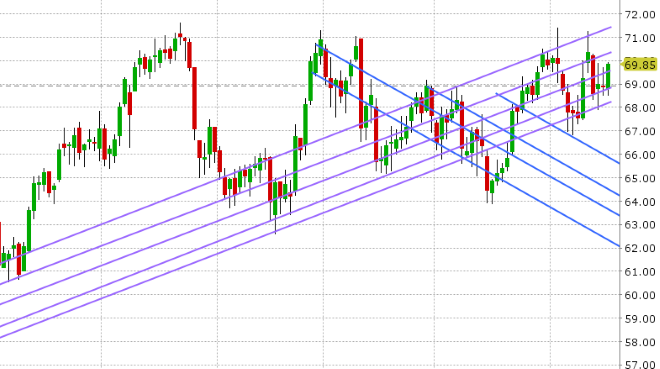

AUDUSD: The Aussie has been all over the map today; sharply lower initially from the NY close on the China tariff headlines, then sharply higher after the USDCNH reversal lower and the bounce in risk assets globally. Copper is forming a massive bullish outside pattern on the daily chart, after plunging lower initially on the tariff headlines but then violently reversing higher. Over 1blnAUD in options expire at the 0.7175 strike this morning, which might pressure AUDUSD near term here. A close above trend-line resistance at 0.7200 for the NY session would be technically positive on the charts.

-

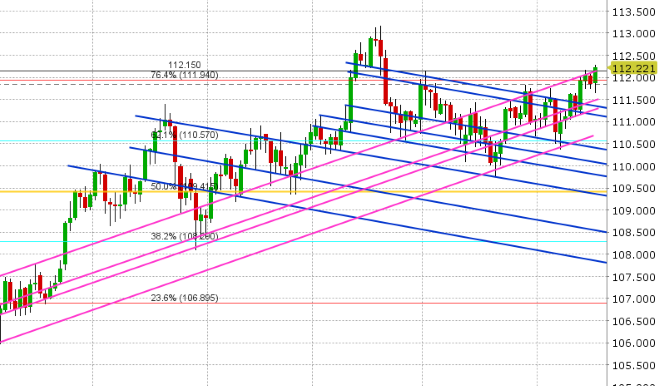

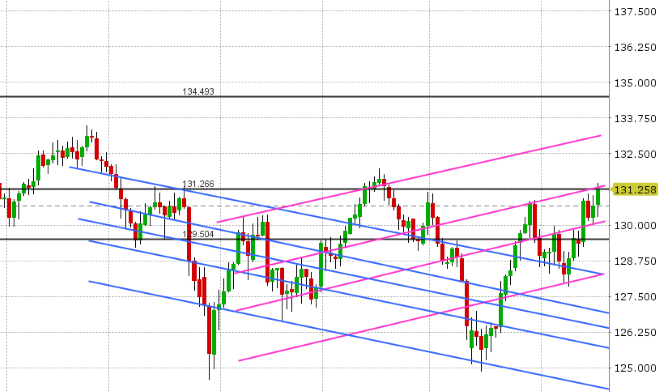

USDJPY: Dollar/yen continues to track US stocks and yields higher this morning, as the world brushes off a formal escalation in the US/China trade war. Chart resistance at the 112.15 level in USDJPY and the 131.30s in EURJPY looks increasingly under threat. These bullish technical setups could make tonight’s BOJ meeting particularly meaningful in terms of a further catalyst for broad JPY weakness. There is no set time for the BOJ announcement (which is normal), but a press conference from governor Kuroda will follow at 2:30amET tomorrow morning. We think USDJPY could breakout higher here if resistance gives way as there’s not much holding back price (from a technical analysis perspective) until the mid 113s.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

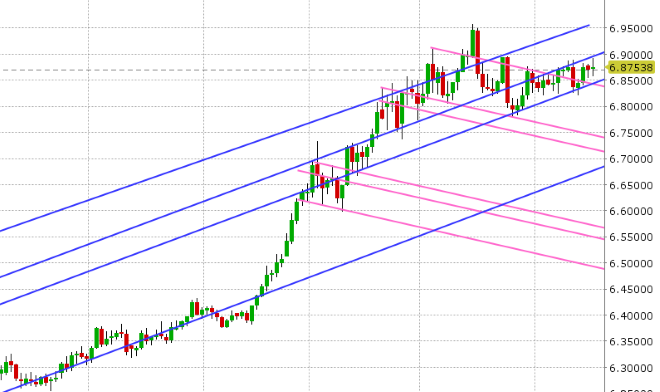

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.