USD chops around ahead of today's expected hold on monetary policy from the Fed

Summary

-

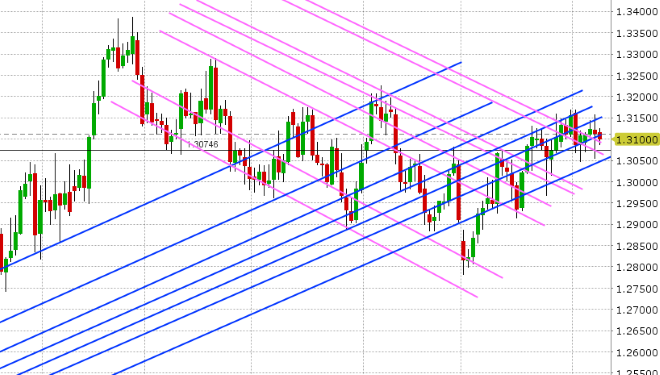

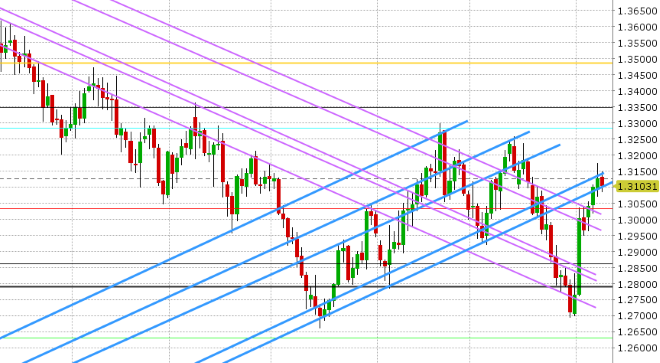

USDCAD: Dollar/CAD traders are showing signs of indecision this morning after yesterday’s “risk-on” USD sell-off was cancelled out by another swift fall in crude oil prices. The EIA reported another higher than expected build in US oil inventories, a 7th straight week of gains in stockpiles, and a 400k bpd increase in US oil production to a new record high of 11.6M bpd. The news saw USDCAD immediately regain the 1.3110 support level, which the market managed to hold for the rest of the NY session and into Asian trade overnight, but we’re slipping back lower now as EURCAD sales weigh (EURCAD broke chart support at 1.4990 in European trade). Canadian Housing Starts for October were just reported 205.9k vs 200k expected. We think USDCAD continues to chop until the 1.3050-1.3150 range gives way.

-

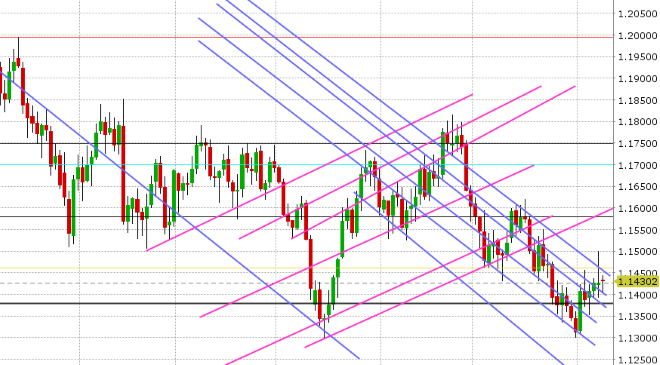

EURUSD: Euro/dollar is trading with a slippery, downward tone this morning after loosing trend-line support in the 1.1460s yesterday afternoon. This has now sort of ruined the market’s positive momentum going into today’s Fed announcement on interest rates. While the Fed is not expected to do anything notable today (especially considering the fact that there won’t be a press conference), we think they’ll still be focus on the press release for dovish clues and we think any hint at the Fed taking its foot off the rate hiking gas peddle could easily see EURUSD regain the 1.1460s. Should that happen, the market would be off the races again to attack the massive option expiry at 1.1500 tomorrow (now 6.4blnEUR in size). This morning’s headlines out of Europe aren’t great, with the European Commission lowering growth forecasts and specifically citing Italy as a problem come 2020. More here. The EU’s Moscovici still expects the Italians to revise their budget by the EU’s November 13th deadline. Support in EURUSD is currently 1.1400, then 1.1380. USDCNH continues to meander sideways. Mario Draghi will be speaking at 10:20amET in Dublin.

-

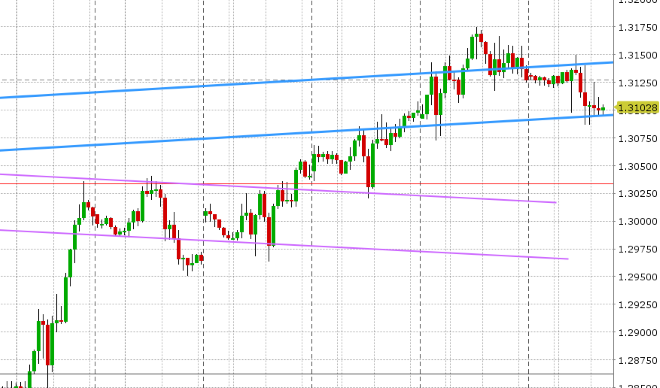

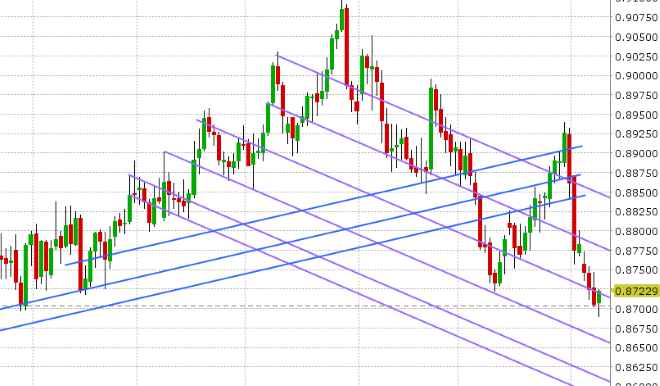

GBPUSD: Sterling is slipping lower this morning as it lost the upper bound of the upward sloping resistance channel we spoke about yesterday (1.3140) in the final minutes of trade before the NY close. This set the stage for choppy range, bound price action within the 1.3080-1.3140 channel in overnight trade. There were reports out of an Austrian newspaper that a Brexit deal could be reached in the coming days, but the Irish and the EU are throwing cold water on that. Theresa May’s cabinet is also reportedly unlikely to meet again until next week. Until such time, GBP traders continue to deal with the headlines as they come and we expect more before the week is out. EURGBP broke below the 0.8720s yesterday, which is a quite bearish development, but traders appears to be trying to regain it now. We think a dovish tilt to the Fed’s statement today could help GBPUSD as well, but we’d be wary of EURGBP bounce (that would come from negative Brexit headlines). We think the marketplace is giving Theresa May’s latest efforts a bit too much benefit of the doubt here.

-

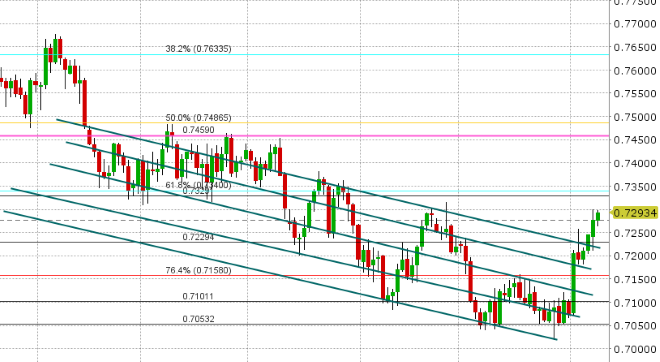

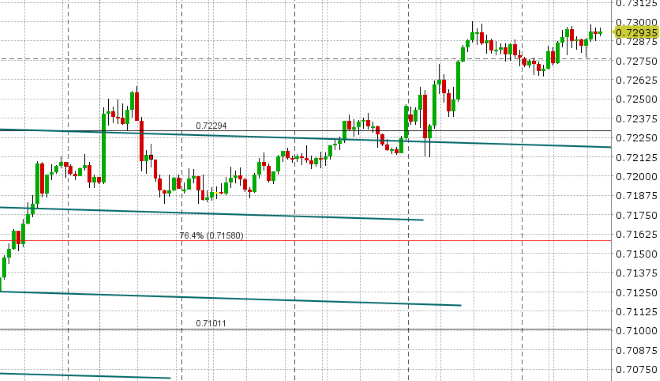

AUDUSD: The Aussie is drifting higher this morning, as it appears traders are celebrating China’s strong October import data last night and following the Kiwi into its 1blnNZD options expiry at 0.6800 today. The RBNZ kept New Zealand interest rates on hold late yesterday, made a subtle hint towards hiking in Q2 2020 vs Q4, but tempered that with comments that they would still consider a rate cut if GDP fell short of projections. All in all, this was a non-event for markets, but traders are still talking about the stellar employment out of New Zealand from the day before. AUDUSD didn’t slip with EURUSD late yesterday. It’s not slipping with copper prices taking it on the chin today either (-1.6%). The next resistance level in AUDUSD is 0.7330-40. Over 1.4blnAUD in options expire at the 0.7275 strike tomorrow.

-

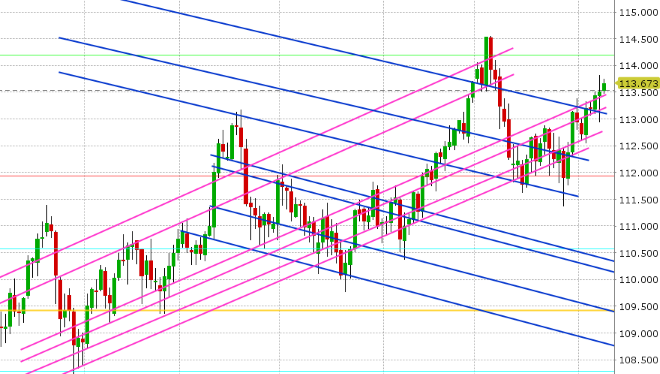

USDJPY: Dollar/yen is defying gravity this morning after the market roared back late yesterday with a surging stock market. Yesterday’s developing bearish outside day pattern never panned out, and more importantly USDJPY regained the 113.40s into the NY close. This set the stage for further gains in overnight trade, and the market continues to hold up despite a 10pt dip in US equity futures over the course of European trading. Japan reported Machine Orders for September last night, and the numbers dramatically missed estimates, but it appears this was earthquake driven and so traders didn’t over react. With USDJPY now trading comfortably back above the 113.40s, we think the fund longs will continue to feel emboldened here. The next resistance levels are 113.80, then 114.20.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

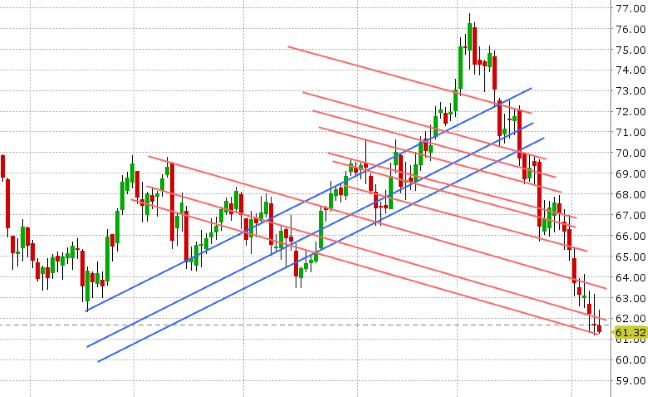

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

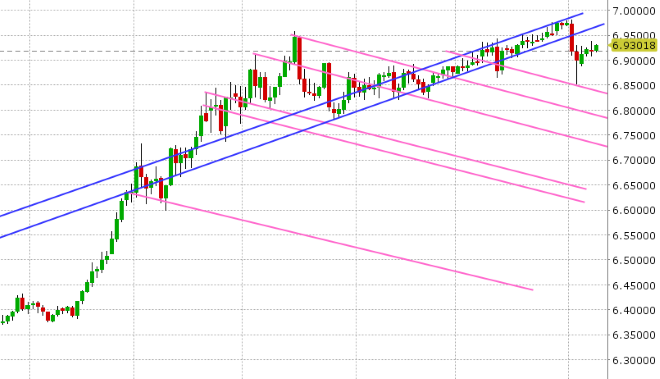

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

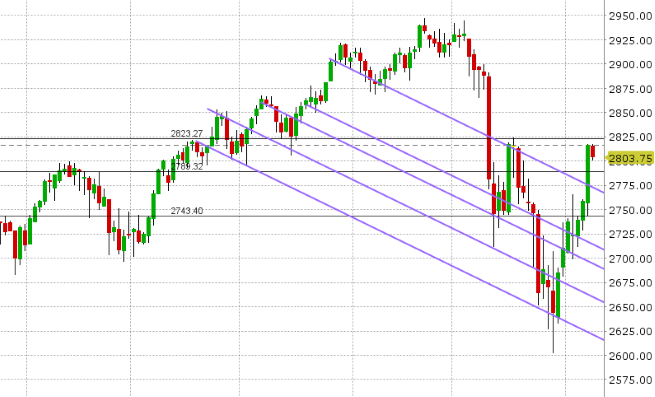

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.