Democrats take control of the House. Risk-on tone sweeps across markets.

Summary

-

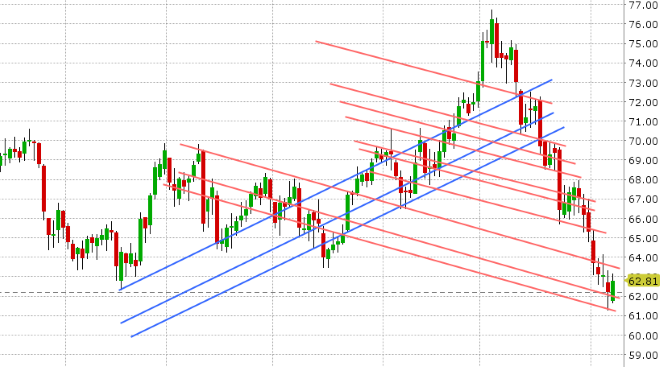

USDCAD: Dollar/CAD is falling back this morning as a “risk-on” tone sweeps over markets following the Democrats retaking the House of Representatives during the US mid-term elections last night. Equites are trading higher and the USD is moving broadly higher, as it appears the market likes the thought of some gridlock now in Washington. There’s also chatter, according to Bloomberg, that the OPEC+ countries are discussing output cuts for 2019. This combination of fundamental updates along with a second reject of the 1.3140s chart resistance level in overnight trade invited the sellers back in, and USDCAD now sits at support in the 1.3070s. Today’s session will feature the EIA weekly oil inventory data at 10:30amET (last night’s APIs were bearish) and a press conference from President Trump at 11:30amET (just announced). We think traders have to be on guard here for a technical reversal lower. A bearish outside day candle is now taking shape on the daily chart. The 1.3070s support level could face further pressure should EUR and oil prices continue to press higher. The only saving grace right now are EURCAD flows above 1.5000, which continue to stem the USDCAD selling here we feel. The next support level in USDCAD is 1.3040.

-

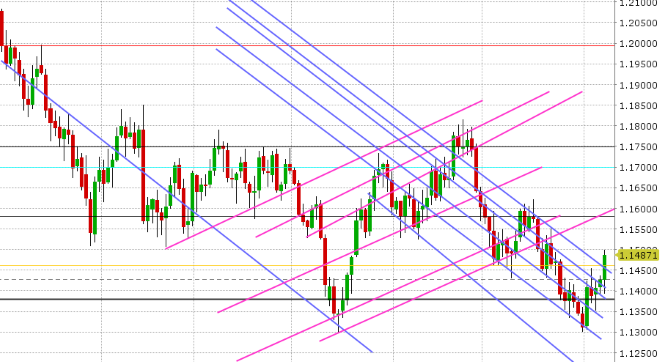

EURUSD: Euro/dollar is up 0.5% this morning, after a wild overnight session that saw the market swing back and forth as the US mid-term election results came in. The 1.1410s held going into the NY close, which provided the positive backdrop for further gains. We then saw resistance in the 1.1460s give way in early European trade, and this paved the way for further gains to the 1.1500 level where now over 2blnEUR in options expire for today’s NY cut. Speaking of options, there’s also a massive expiry coming this Friday (6bln+EUR at 1.1500). This will come right after the Fed’s latest decision on interest rates, which will be announced tomorrow at 2pmET. We think EURUSD’s technical outlook has improved even further today. The BTP/Bund spread is trading marginally tighter today at +290bp.

-

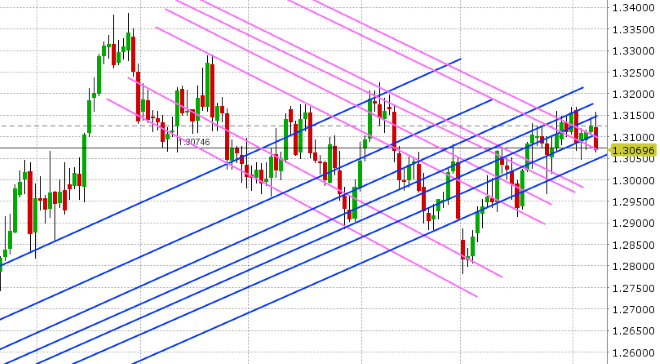

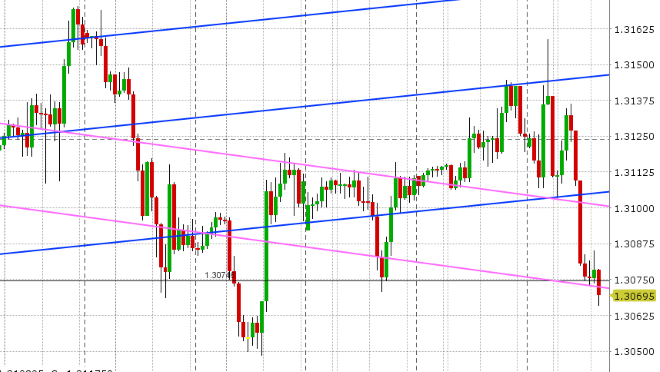

GBPUSD: Sterling continues to chug higher, led by EURUSD price action in overnight trade. The EURGBP cross continues to struggle at support in the 0.8710-20s as the latest Brexit headlines hint at Theresa May having a deal in place by Nov 19th. The upward sloping resistance channel that the market entered late yesterday (1.3080-1.3140) has given way this morning too and we think how the market reacts to the upper bound of this zone will set the tone for the next 24hrs leading up to the Fed announcement. Stay above and the 1.32s are well within grasp, but trade back below and we’ll likely see a pause in the recent rally.

-

AUDUSD: Everything is going right for the Aussie this morning as it leads the G7 FX space higher. It all started with a stellar Q3 employment report out of New Zealand late yesterday, which saw a sharp NZDUSD rally boost AUDUSD back over the 0.7220s support level. The mid-term election results then ultimately led to broad USD selling, which has picked up steam since European traders came in. We think the short AUDUSD fund position will continue to scramble here if it hasn’t done so already. The Reserve Bank of New Zealand (RBNZ) announces its latest decision on interest rates today at 3pmET, so be on the lookout for more potential AUD volatility around that hour.

-

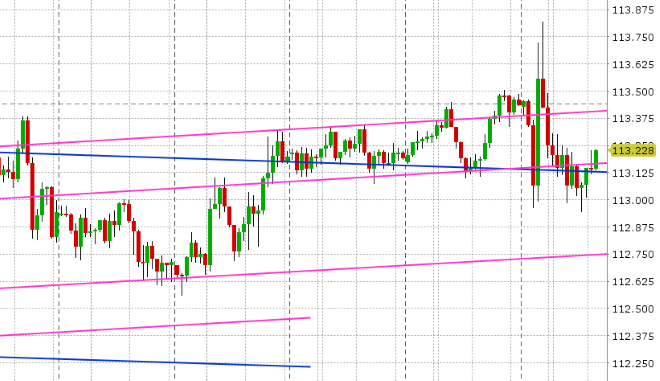

USDJPY: Dollar/yen is struggling this morning as appears the broad wave of USD selling is outweighing the “risk-on” tone to equities. A brief surge above the 113.30s has also completely reversed, which doesn’t bode well for the USDJPY chart here. While a bearish outside day pattern is in the works on the daily chart, there isn’t much momentum behind it at this hour, and so we wouldn’t be surprised if USDJPY regains the 113.10s and coasts ahead of the Fed tomorrow.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

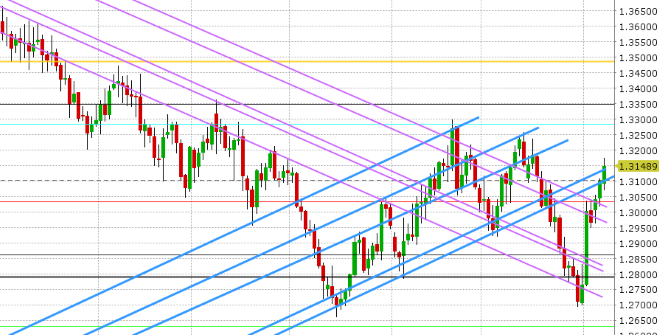

EUR/USD Daily Chart

EUR/USD Hourly Chart

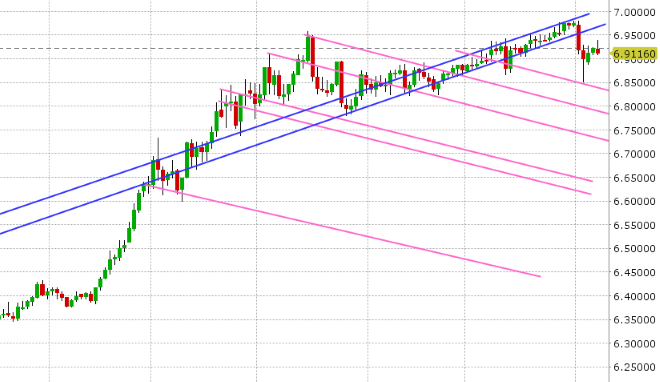

USD/CNH Daily Chart

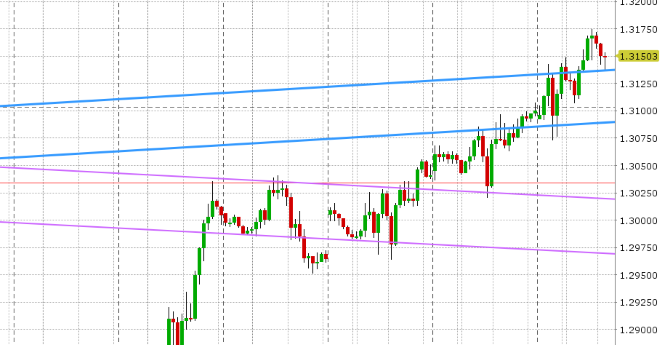

GBP/USD Daily Chart

GBP/USD Hourly Chart

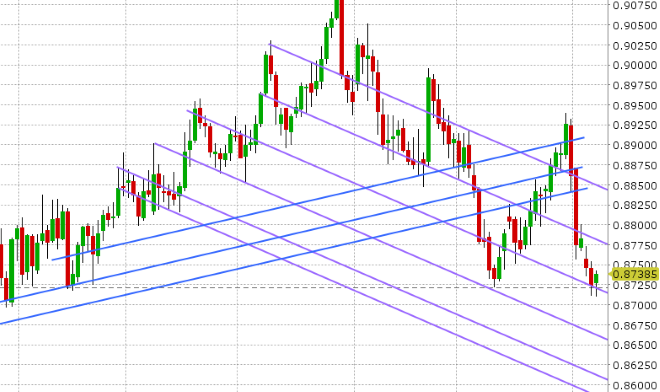

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

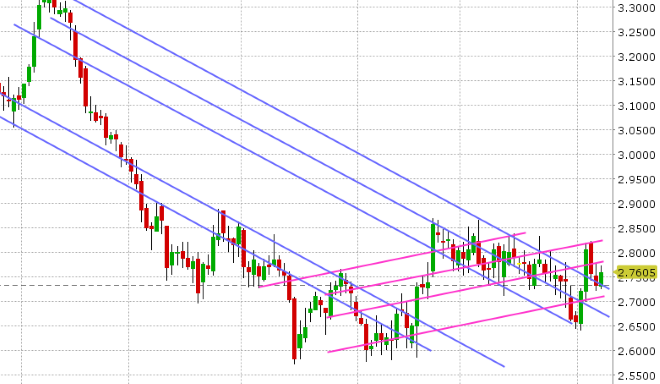

December Copper Daily Chart

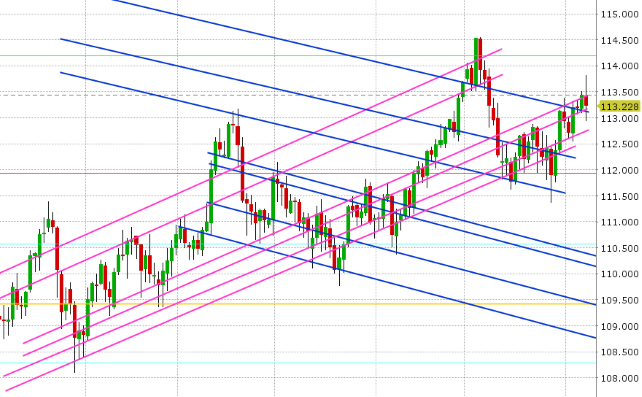

USD/JPY Daily Chart

USD/JPY Hourly Chart

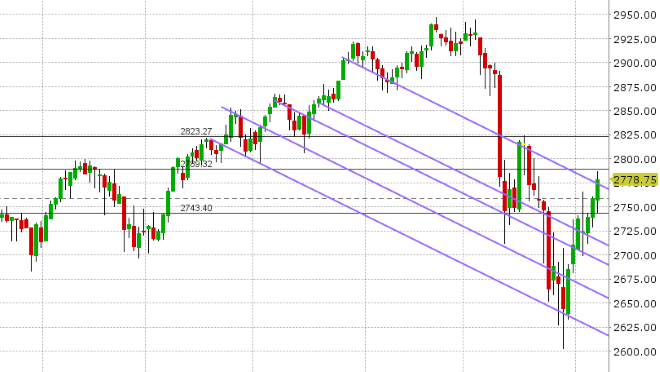

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.