Brexit headlines whip sterling around in otherwise quiet start to the week

Summary

-

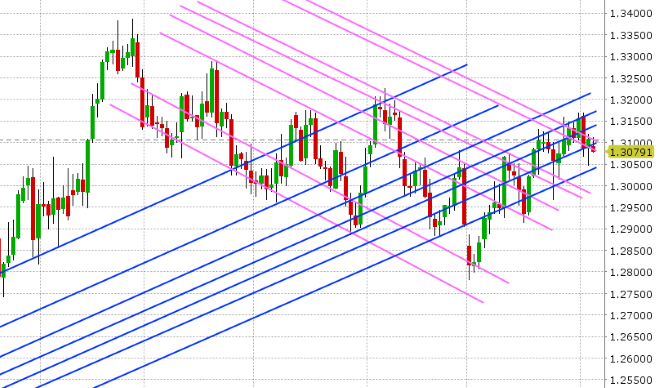

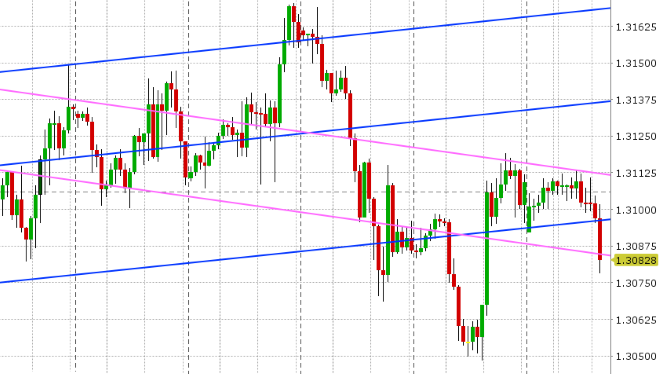

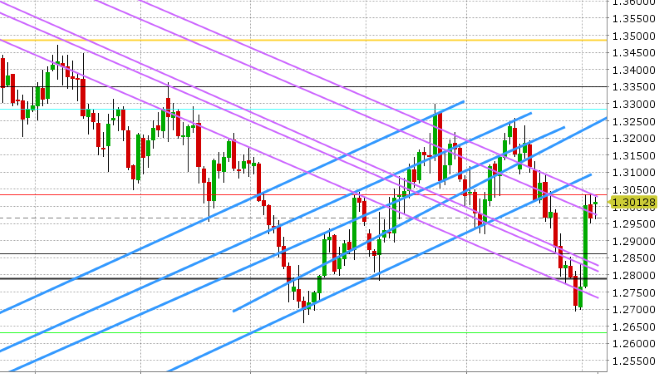

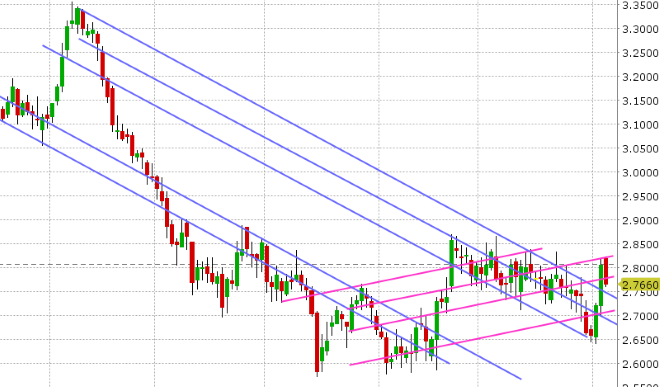

USDCAD: Dollar/CAD is entering NY trade this morning with a directionless tone as the broader USD trades quietly. This week could be an eventful one for markets, with the US mid-term elections tomorrow night and the FOMC meeting on Thursday being the key features. We’ll also get Canadian Building Permits tomorrow, Canadian Housing Starts on Thursday and US PPI on Friday. It all starts off though with a speech from the Bank of Canada’s Stephen Poloz around 8:15amET before the UK Chamber of Commerce, followed by a press conference at 9:30amET and then US Non-Manufacturing ISM at 10amET. The market’s ability to snapback on Friday above the 1.31 level, during the aftermath of the strong US and weak Canadian job reports, was technically constructive for price but we think it forces a range trade at best for now. Support 1.3075-1.3100. Resistance 1.3115, then 1.3140. The funds became marginally net longer USD/CAD during the week ending Oct 30th by virtue of some shorts covering, but the overall net long USD (CAD short) position is still close to the lowest it has been all year. We think a break of either of these support and resistance levels will determine the next direction.

-

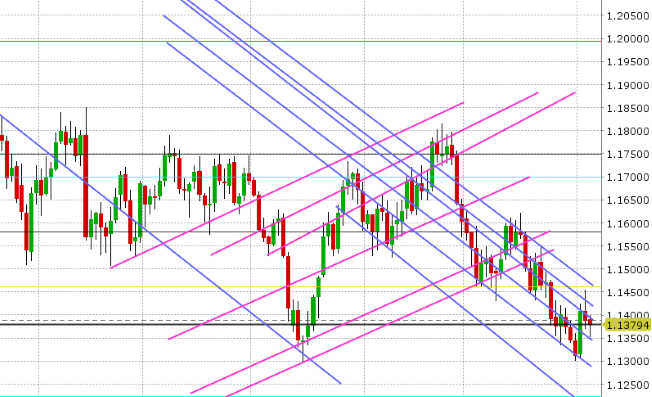

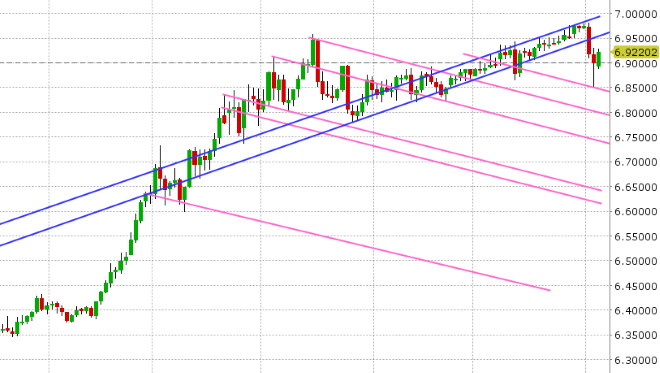

EURUSD: Euro/dollar is starting the week with a soft tone after Friday’s upbeat US jobs report and talk of new TLTROs from the ECB took the wind out of the sails for momentum chasers. Open interest declined almost 2600 contracts and USDCNH bounced firmly off the 6.85 level. This week features the big US events we mentioned above, plus German Factory Orders, the European Services PMIs, a speech from the ECB’s Lautenschlager (tomorrow), and German Industrial Production (Wednesday). The funds added to both long and short positions during the week ending Oct 30th, leaving the market slightly net shorter for the 4th week in a row ahead of last Thursday’s big rally. USDCNH is building upon Friday’s bounce and is drifting higher today is search of chart resistance (6.95s we would argue). We’re just seeing headlines cross that the EU is to propose discipling Italy on Nov 21, and with that EURUSD has ticked lower. We think the market might test the 1.1350s today, with any move below likely to embolden the shorts. Hold it however and we’ll likely range trade with 1.1400 serving as chart resistance. Over 1blnEUR in options expire at both the 1.1350 and 1.1400 strikes this morning, which may very well see us stuck around current levels. The BTP/Bund spread is starting to creep higher from its session lows, trading now at +294bp.

-

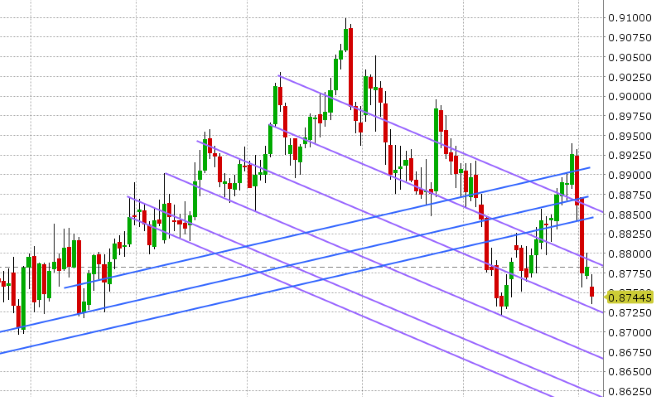

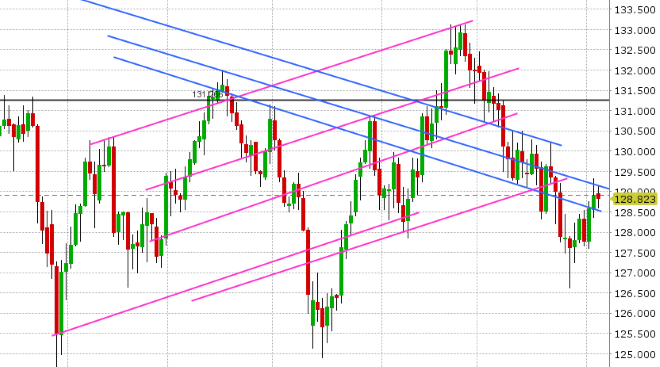

GBPUSD: Sterling is dominating the FX headlines again this morning as it appears the UK is now giving itself a week to resolve the political infighting at home before it re-engages Brussels. GBPUSD gapped higher to start the week after the Sunday Times reported that Theresa May had won some concessions from the EU and that preparations for a Brexit deal were “far more advanced” than previously disclosed. The UK’s Brexit secretary Raab, however, is now reported to be taking a hardline stance on the Irish border backstop (demanded that the UK be able to pull out after 3 months), and with this some GBPUSD selling has emerged and the Sunday opening gap has filled. The weaker than expected UK Services PMI print for October also played a part is this dip as well. There’s now talk of a cabinet meeting to discuss Brexit tomorrow and the headlines are quickly starting to turn negative again. Support in the 1.2970s continues to hold however. Resistance is 1.3025-35. We think how the market responds to the upper and lower bounds of this range will determine the next direction. The funds added to both long and short positions during the week ending Oct 30th, but the shorts more so, leaving the funds slightly more net short, but this latest read of positioning excludes Thursday’s ferocious rally (which saw open interest surge higher) and Friday’s slight pullback (which saw open interest fall back). Needless to say, we’ll know more when it comes to recent position changes when the CFTC releases it commitment of traders report this Friday. Friday will also be a big day for UK data, seeing as we’ll get the Industrial and Manufacturing Production Numbers for October, the Trade Balance for September, GDP for September, and the first look at GDP for Q3.

-

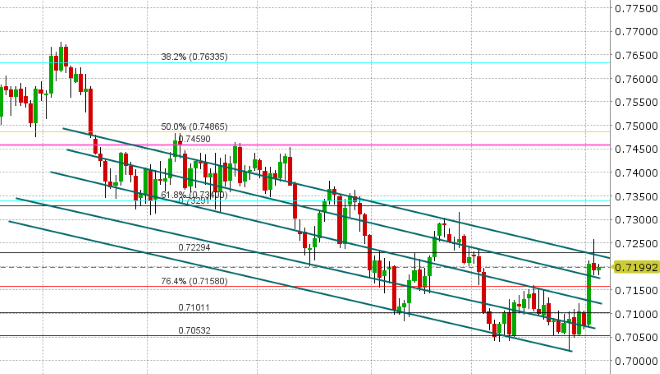

AUDUSD: The Aussie is starting the week with a slightly negative tone after the remainder of Friday’s session saw the various US officials throw cold water on Trump’s claims of instructing the creation of a new trade deal with China. This, along with the strong US jobs report, saw AUDUSD pull back below support in the 0.7220s and this level now serves as chart resistance. Copper prices have pulled back as well, and when you combine this with USDCNH rising and EURUSD falling to start the week, it’s not surprising to see AUDUSD lack upside momentum here. The Reserve Bank of Australia (RBA) will announce its latest interest rate decision tonight at 10:30pmET, but no change is expected in the overnight rate or the forward guidance. They will also release their quarterly Monetary Policy Statement on Thursday at 7:30pmET, where again no major changes to the dovish outlook are expected. We think the chart structure in AUDUSD has improved however and we would not be surprised to now see buyers on dips to the 0.7150s. China reports CPI on Thursday night.

-

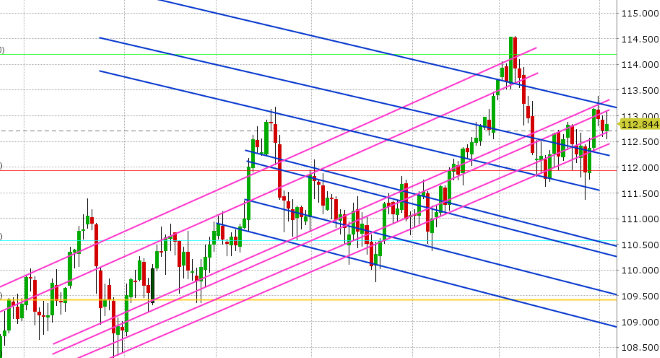

USDJPY: Dollar/yen is drifting higher this Monday morning, but the move has been very choppy as traders deal with overhead chart resistance in the 113.30s and support in the 113.10-20 area. The S&Ps are drifting as well at this hour, but continue to hold the 2700 support level. The BOJ’s Kuroda spoke overnight but he stuck to the script when it came to the monetary policy talking points. The funds liquidated both long and short positions a little bit during the week ending Oct 30th, leaving the net position still net long USD (short JPY). We think the longer USDJPY stays above the 113.00 level, the greater the odds that resistance in the 113.30s breaks. We would not be surprised to see the resolve of longs tested one more time though (perhaps a dip back into the high 112s at some point this week).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

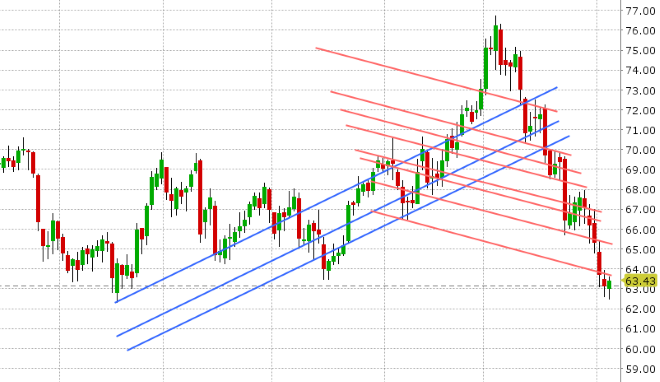

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.