US bond yields break out, but USD broadly lower on speculation of China scaling back UST purchases. JPY surges on stop run, BOJ taper speculation.

Summary

-

ECONOMIC DATA UPDATE: China inflation data came in mixed overnight, with Dec PPI at +4.9% YoY (slightly higher than expectations) and Dec CPI at +1.8% YoY (slightly lower than expectations). Some UK data came in mixed as well, with Nov Industrial Production at +2.5% YoY (beats) and the Nov trade deficit coming in wider than expected. Today’s North American session is quiet on the data front, with Nov Canadian Building Permits and the US Export Price Index.

-

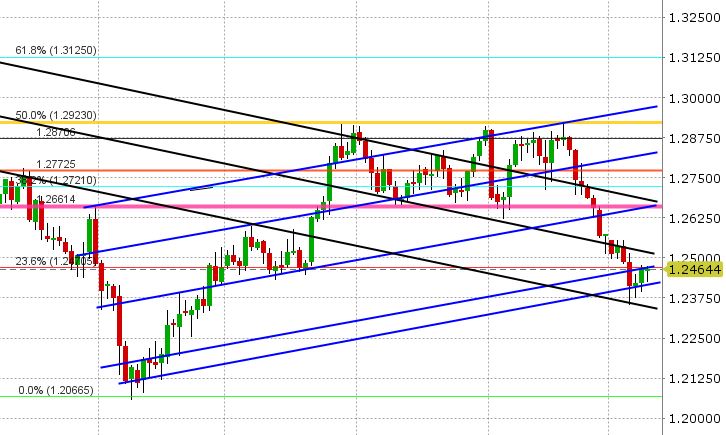

USDCAD: Dollar/CAD is holding up remarkably well, despite the broad based USD selloff on the China news that crossed the wires a few hours ago. Bloomberg’s top story this morning is “China May Halt Purchases of US Treasuries”, citing “people familiar with the matter”. This is potentially a huge development for global markets as China is well known to be a massive holder of US debt, and with US yields breaking out to the upside yesterday, this could be the fuel that adds to a substantial rally higher in US interest rates. There’s been no official response out of China yet, but for the time being the markets are selling anything US related (stocks, treasuries and the USD). USDCAD had a technically positive NY close yesterday, and so that is limiting the downside effect from this broader USD move. The consensus view that the Bank of Canada is going to hike next week, also seems to be getting too much air time in our opinion, which could be causing some USD shorts to cover here. The US/CA 2yr yield spread is holding steady (+17bp) and EURCAD buying is lending support today after marking a hammer low on its chart yesterday. We feel USDCAD will drift around in a tight range again today, with trend-line support coming in at 1.2400-1.2410 and trend-line resistance checking in at 1.2465-1.2475. Should resistance break, we could see a quick move to 1.2510-1.2520, but we would expect sellers to emerge again. Should support break, we would expect follow through and a move back down to the 1.2350s.

-

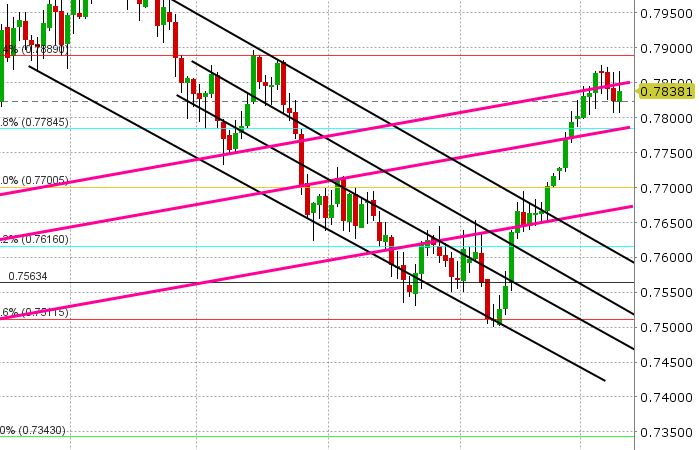

AUDUSD: The Aussie had a poor NY close yesterday, falling below the trend-line (pink line on our charts) that we’ve been talking about recently. That move has been corrected somewhat on the China news overnight, with AUDUSD attempting to break back above the line and hold. We currently trade just below it. Copper, other base metals and precious metal prices are all bid on the broad based USD selloff, and that’s helping AUD a bit too. There’s market chatter about a massive 2bln+ AUD option expiry at 0.7810-0.7815 for Friday’s session, which could prove to be an interesting negative influence should traders fail to close AUDUSD higher today. Key resistance today is 0.7850-0.7860. Support checks in at 0.7810, similar to yesterday.

-

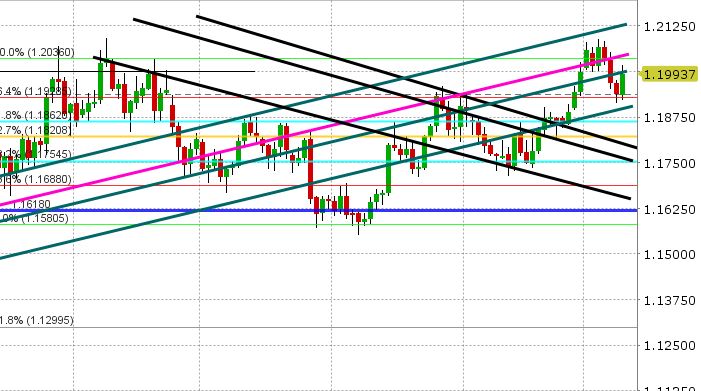

EURUSD: The Euro has benefited from the China news, and this comes as a relief to the entrenched net EUR long position as the US/GE 10 yr yield has shot higher (now +211 bp) amidst the surge higher in US yields. EURUSD has also decoupled from EURJPY for the time being, another welcome relief for EUR longs as that cross continues to plummet. EURGBP has found buyers today as well as GBPUSD pares some of its gains made after the China headlines. We’re noticing a increased inverse correlation between EURUSD and USDCNH of late, with yesterday’s move from the PBOC (removing a Yuan supportive factor in the daily fix calculation) getting much talk amongst traders. If we look at USDCNH technicals and follow the correlation, Monday was a bullish outside day (EUR negative), Tuesday’s rally in USDCNH coincided with EURUSD selling, and today’s pullback in USDCNH has coincided with EURUSD buying. With all the cross currents going on right now in EURUSD, well feel the market will now look to create a trading range until the fundamental picture becomes a little clearer. Technically speaking, the market has recovered and is now testing trend-line resistance at 1.1990-1.2000. A strong close above here would invite a upward test of 1.2030-1.2040. Should the market fail at the level we’re now at, we could see a complete reversal of today’s rally.

-

GBPUSD: Sterling traders had a scary moment during European trading earlier today as the market attacked stops around the 1.35 level after the UK data come out, but GBPUSD recovered smartly after the China headlines, surging back into the trend-line extension channel range (two purple lines on our chart). Some EURGBP buying has come in during the last hour, dampening the GBP bid, but the market is very much in a range now. We’re calling it 1.3510-1.3580.

-

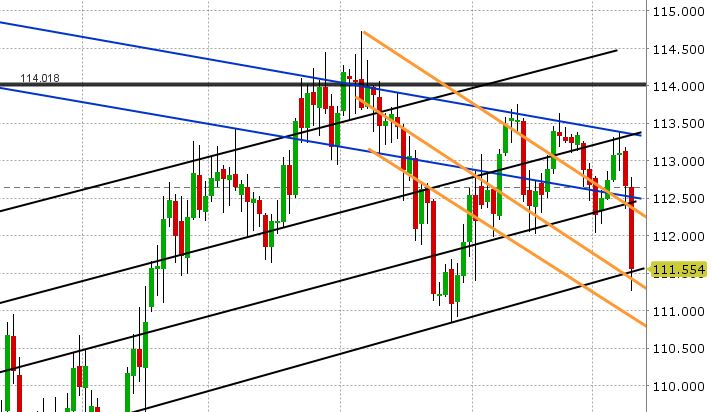

USDJPY: It’s been a bloodbath for the entrenched USDJPY long position today. Despite all the claims yesterday of the market overreacting to the BOJ’s scale back of JGB purchases on Tuesday (BOJ targeting the price level of JGB yields and inflation, not asset purchase amounts) there were still plenty of news outlets that used the word “taper” in their headlines to explain JPY action yesterday, and so speculation of a change in Japanese monetary policy continues to swirl. USD longs (JPY shorts) are bailing on mass, taking out stops and key support levels in USDJPY, EURJPY and GBPJPY. Option traders are bidding up the cost of 2 week USDJPY puts, which cover the next BOJ meeting. Add to this the negative USD mood created by the China news overnight, and we have a “risk-off” scenario in play as well for USDJPY. The Nikkei is off 1% and the S&Ps are off 10 pts. One would think the breakout higher in US yields (now at 2.60) would lend some support to USDJPY here given traditional correlations, but it has played no factor today at all as JGB (Japanese) yields are rising too. USDJPY has found some support here between 111.30-111.50 (this coincides with two trend-line support levels), but the chart technicals are starting to look ugly once again with a daily head and shoulders top taking shape. JPY futures traders liquidated almost 9k contracts yesterday.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.