CAD hit by NAFTA headlines. China says Bloomberg report "could be based on wrong information". US yields softer

Summary

-

ECONOMIC DATA RECAP: Nov Australian Retails sales +1.2% vs +0.4% expected. German GDP grew 2.2% YoY in 2017, the fastest since 2011, but shy of expectations of +2.4%. US PPI comes in light at +2.6% YoY for Dec, vs expectations of +3.0%

-

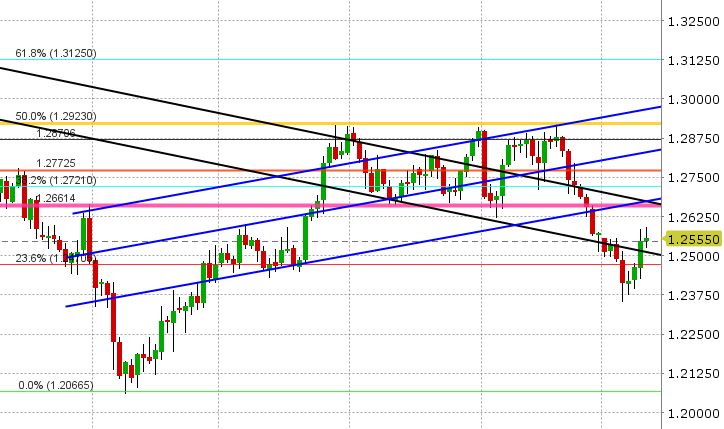

USDCAD: It was all about NAFTA yesterday for USDCAD traders, with the market surging higher after headlines crossed about Canadian officials being “increasingly convinced President Trump will shortly announce the US is pulling out of NAFTA”. While we knew NAFTA negotiations were not going great, this was not a headline that CAD bulls (USD bears) wanted to see ahead of the next round of talks (commencing Jan 23) and especially ahead of the Bank of Canada meeting next week, where markets were expecting a 25bp hike in interest rates. While the White House followed this headline with a denial claiming “no change in Trump’s position on NAFTA”, the damage was done. Traders often shoot first and ask questions later. USDCAD’s ability to break chart resistance (1.2460-1.2475) gave the market an upward bias going into the headline and then the market put up no fight at the next resistance level (1.2510-1.2520) when the news broke. We saw selling with the White House denial, but buyers stepped in at 1.2510-1.2520 (now new support). We traded back up towards the highs to end the session and the market has trickled higher overnight. All this is positive from a technical standpoint and opens the door to a test of chart resistance in 1.2650-1.2670 region. This development now also adds more uncertainty to next week’s Bank of Canada monetary policy decision (overnight interest rate swaps now pricing a 70-75% of a hike vs. 80-85% prior). Add to this a new trade complaint as Canada has taken the US to the WTO, alleging 200 examples of US wrongdoing, and we ask the question: will the BOC feel comfortable hiking with all this potential negativity on the horizon? Perhaps they stand pat next week? Traders and investors will debate this over the next few days, but in the interim we have to respect what the charts are telling us. We now view USDCAD as range-bound to higher, with support checking in at 1.2530, then 1.2515. Should overnight resistance at 1.2590 give way, we would not be surprised to see a quick move higher into the 1.26s. EURCAD continues its strong rally from yesterday, with today’s run higher being supported by EURUSD and the release of the hawkish ECB minutes at 7:30amET. GBPCAD has stalled today as GBP experiences broad based selling elsewhere. The CA/US 2yr yield spread is higher this morning, as we might expect, now trading at +20bp. CAD traders are not watching oil prices, as this traditional correlation continues to break down again.

-

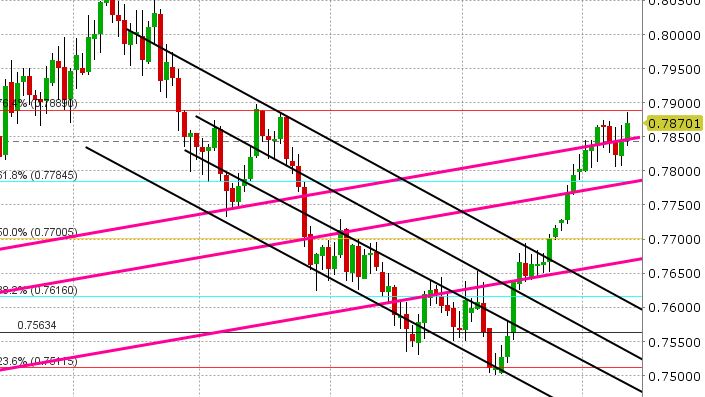

AUDUSD: The Aussie had a nice bump higher overnight on the stronger than expected Australian retail sales data, and this followed a decent NY close (despite EURUSD giving up most of its gains post China headlines). AUDUSD now sits back above the familiar trend-line extension level we’ve been talking about of late (today that line checks in at 0.7850), which is positive but the market had a hard time holding gains when it attempted a run higher above 0.7880 in early European trade. Overnight headlines from China claiming Bloomberg may have had “the wrong information” in its report yesterday caused a broad USD bid. Add to that reports of a option barrier at 0.7900 and we have some excuses for a little weakness here as the US session gets going. We’re calling it range-bound to higher for AUDUSD today, but the 0.7840-0.7850 area must hold. Should this support level break, it puts tomorrow’s massive option expiry at 0.7810-0.7815 on the radar.

-

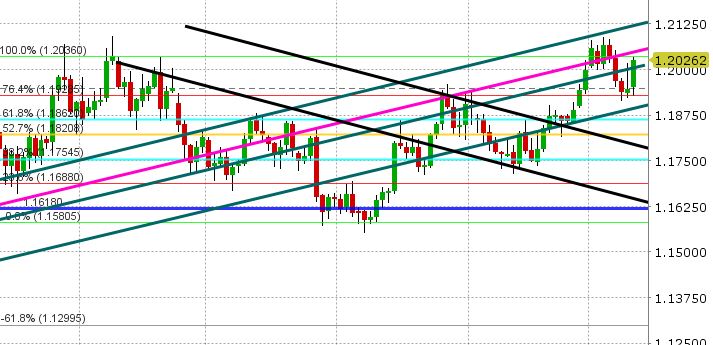

EURUSD: The Euro failed at the 1.1990-1.2000 trend-line resistance level in the hours following the China headlines yesterday, and so as we feared it completely retraced all its gains for the remainder of the US session. The daily close gave us an inverted hammer candle on the charts (which is bearish) and so we had a pretty negative setup for most of the overnight trade. The release of the ECB minutes, from the December policy meeting, has changed all that just now as the tone of the commentary is being deemed hawkish by markets. The ECB members had a “widely shared” view that they will need to gradually shift guidance and that their policy stance “could be revisited early in the coming year”. With this, EURUSD is right back at yesterday’s highs, and is now trading above the trend-line resistance level that capped trade yesterday (which is positive technically). EUR is being bought across the board against GBP, JPY and CAD, and this is a positive backdrop as well. The technical picture has improved here for EURUSD and we therefore see scope for further gains into the 1.2030-1.2040 area. Should this level break to the upside, we expect a resumption of the 2 month rally towards new highs. USDCNH (our new favorite correlative influence) is trading with a softer tone again today.

-

GBPUSD: Sterling traders struggled to get much going after the pop higher from the China headlines yesterday, and the poor NY close along with the China denial overnight added more pressure in European trade. GBPUSD is getting a little sympathy bid here as EURUSD trades higher post ECB minutes, but it’s only recovering overnight losses and it’s running into resistance now at 1.3510 (recall this was a support level we mentioned yesterday). While the break below 1.3510 overnight was negative technically, we feel a reversal may be in the works, should the EUR bid cause some broader based USD selling. A strong close back above 1.3510 today would create a bullish inverted hammer close on the charts.

-

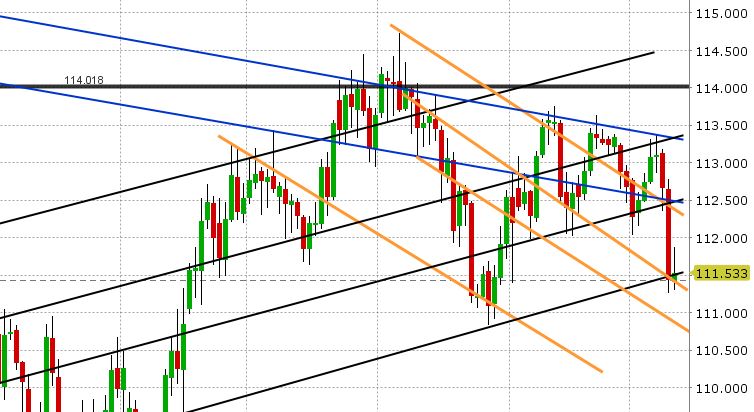

USDJPY: Dollar/yen had a very weak close yesterday, despite the pullback in US yields off their highs, despite some selling in global equities, and despite some broad based USD strength going into the London close and beyond. Even the Chinese challenge to the Bloomberg story couldn’t ignite much of a bid. USDJPY is trading right back at the 111.50 support level. While JPY cross selling since the release of the ECB minutes is helping stem the selling for now, the tide definitely seems to be turning for USDJPY. Should support in the 111.30-50 area give way, we could see a further plunge into the 110s.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.