BOJ taper panic sparks EURJPY sell off, pressuring EUR further, causing broad USD bid again.

Summary

-

ECONOMIC DATA UPDATE: Australian Building Approvals come in at +17.1% in Nov, well above expectations. The German trade surplus widened to 23.7bln in Nov, higher than expectations; and German industrial production was reported +3.4% MoM for Nov, also higher than expectations. Canadian Housing Starts for December just came in at +217k, beating expectations of +211k.

-

USDCAD: Dollar/CAD held steady yesterday as expected, supported by a broad based USD bid and trend-line chart support. We expect more of the same today as the USD is well bid again across the board. EURCAD and GBPCAD continue to be a drag on USDCAD ever since Friday’s plunge lower. The US/CA 2yr yield spread is trading tighter again, now at +16bp (USDCAD negative). The market deemed the Business Outlook Survey from the Bank of Canada yesterday as yet another hawkish (CAD positive) data point, and so there’s a growing consensus now in the marketplace that the Bank of Canada will hike interest rates again next Wednesday. Near term support is now 1.2390-1.2400. Resistance 1.2450-1.2470. We expect follow though should either of these levels break.

-

AUDUSD: The Aussie put in a good fight yesterday, hugging the familiar trend-line extension level we’ve been plotting on our charts for a couple weeks now. It rallied back above the line in Asian trade overnight on the back of the good Australian data, but gave it all back and then some as EURUSD sales resumed in European trade. AUDUSD found buyers as we expected, close to the support zone we mentioned yesterday, and this has come as EURUSD has bounced as well in the last hour. So goes the EUR, so goes AUD of late as there’s no other Australian data on the horizon this week and the RBA doesn’t meet until early February. Copper prices had a quiet start to the week yesterday and are up 0.5% today. The AU/US 2yr yield spread is holding steady at +5-6bp. We expect traders to take another stab at the familiar trend-line extension level (now at 0.7845 today) in an attempt to close the market above it (which would bring back more upward momentum). Should today’s lows give way, we expect more support throughout the zone we mentioned, as low as 0.7780.

-

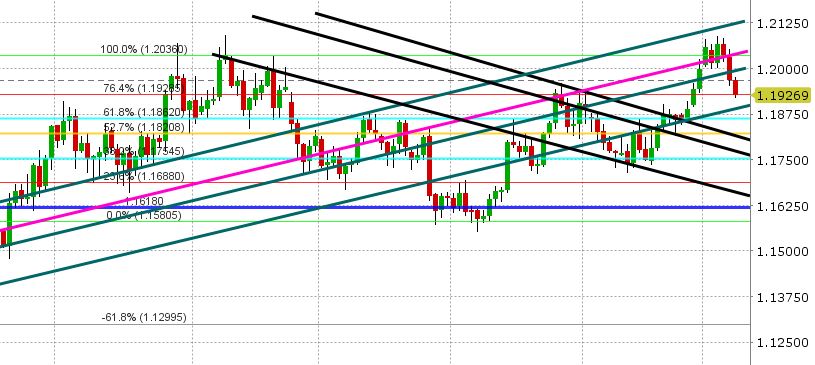

EURUSD: The Euro has a miserable session yesterday, closing at its lows for the day, and below trend-line support in the 1.1980s (which is bearish). Not even some dovish talk from a few Fed speakers could ignite a bid. Overnight, it was EURJPY selling that weighed on EUR. With that, EURUSD has broken lower again and is now testing Fibo support at 1.1930. The positive German data points overnight gave EURUSD a small bid around 2am, but that was quickly erased as the market made no attempt to break back the support level it broke from the NY session. Interest rate traders are doing a little bit of “I told you so” this morning as the US/GE 10 yr yield spread firms again, now trading at +207bp. EURGBP has had a complete reversal of fortune after Friday’s reversal lower, and now looks poised to head back below the 88 handle. EURJPY continues to crater as we write, now off 200pts from last week’s high, and now below the psychological 135 level (that traders got excited above when the market finally traded above it). We expect further pressure here in EURUSD , and possibly even a test of the 1.1880s near term. A strong close above 1.1990-1.2000 would be needed to stall the negative momentum created since Friday’s session.

-

GBPUSD: Sterling recovered nicely during the NY session yesterday, but the market got capped again in the 1.3570s (trend-line extension resistance) and has succumbed again to the broad based USD bid during European trading today. The support zone we mentioned yesterday (1.3510-1.3520) is getting tested again as we write. January’s low is 1.3490 (another minor support level). Should this whole support region break, it would be clear sailing for shorts until the mid 1.34s. A strong close back above the 1.3570s is need to rebuild positive momentum. We feel the GBPUSD will continue to ebb and flow with the broader USD near term until Brexit headlines dominate market chatter once again. EURGBP selling has been a mildly supportive influence, while GBPJPY selling has not.

-

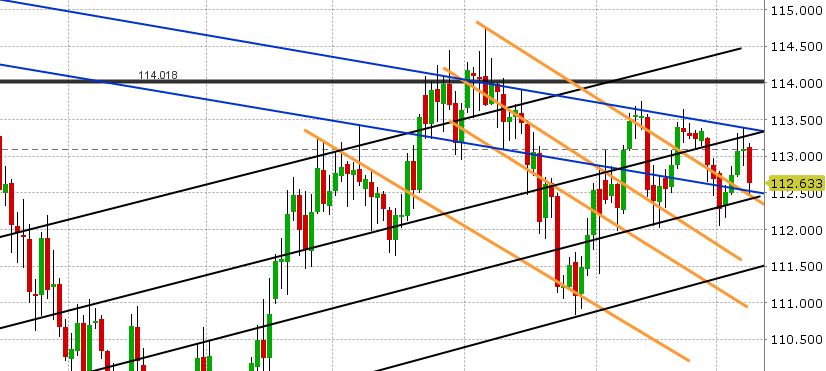

USDJPY: The BOJ’s latest daily purchase of JGBs as part of its QE program, was all the talk of FX traders overnight as the central bank bought a little bit less than what they usually do. A debate is now raging as to whether or not this constitutes a new trend of tapering asset purchases (tightening of monetary policy). We’ll have more on this tomorrow as we investigate, but for the time being JPY shorts are freaking out an covering across the board. USDJPY plunged lower in Asian trade, recovered half the loss in European trade, and we’re now testing the Asian lows again as NY traders file in. Chart support is being tested at 112.50. It’s thick (a number of lines converging) and so we expect it to hold today. EURJPY and GBPJPY are working on big technical reversal here though, and that’s not very positive for USDJPY. US stocks and US yields continue to tick higher, with the latter touching 2.50 again and threatening to break out again (this is USDJPY supportive).

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.