Trump no-shows. BOE cuts 50bp. US CPI slightly beats expectations.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Trump does not attend last night’s coronavirus press conference at the White House.

- Markets now re-living yesterday’s mid-session fears that the US coronavirus response is not ready yet.

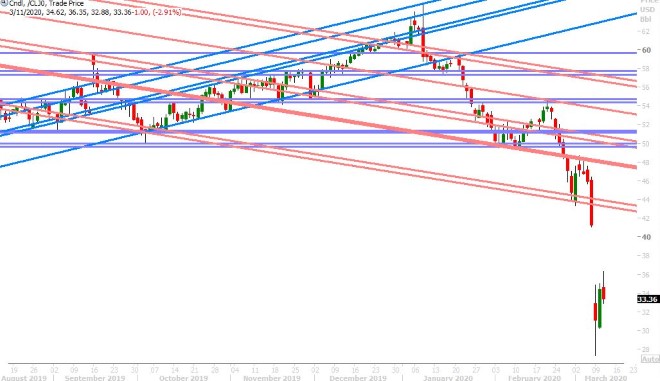

- Saudi Aramco directed to increase its maximum capacity from 12M to 13M barrels per day.

- S&Ps -2.5%. April crude oil -2%. US yields back down to 0.70%. USDJPY heavy while USDCAD bid.

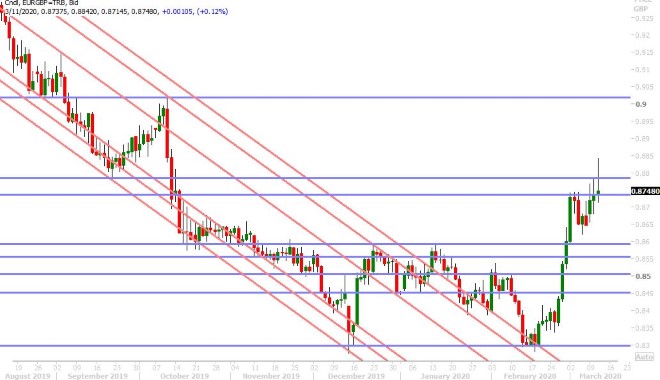

- Bank of England cuts 50bp while UK unveils 30blnGBP spending package. GBP traders look un-surprised.

- US CPI for February slight beats expectations, +2.3% YoY vs +2.2%. UK January GDP +0.6% YoY vs +0.9% expected.

ANALYSIS

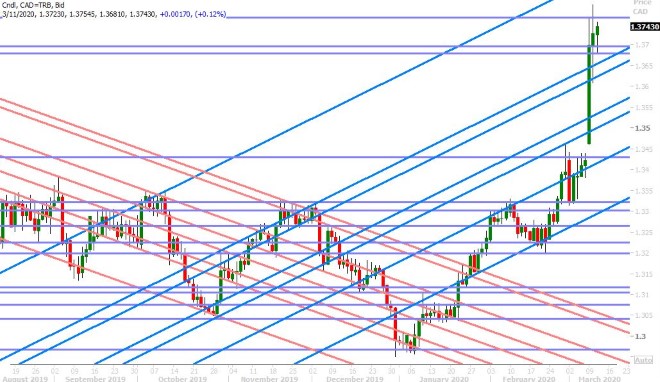

USDCAD

Dollar/CAD is trading with a bid tone this morning after President Trump was a “no-show” at last night’s coronavirus press conference at the White House. Risk sentiment has naturally soured as a result because this gives credence to yesterday’s intra-day headlines about the US administration’s conoravirus response not being ready yet. We also think we’re seeing some negativity following the Saudi Aramco announcement that it has been directed by the Ministry of Energy to increase its maximum capacity from 12M to 13M barrels per day. The S&P and April crude oil futures are falling 3%, and the US 10yr yield has retreated 10bp from its overnight highs.

The Bank of England is stealing some of the limelight this morning with its emergency intra-meeting 50bp rate cut, but we can’t say the move was all that surprising given recent OIS market pricing. The fact that the BOE made this move on the same day as the UK government announces its 2020 budget is interesting from a PR perspective, but rumors swirled yesterday about this and so one could argue even the timing of this 50bp cut was not shocking. GBPUSD has therefore not seen a strong directional move in either direction this morning, which unfortunately is not providing any additional clues for the broader USD tone heading into NY trade.

The US just reported its CPI data for the month of February and the numbers came in slightly better than expected

U.S. FEB CPI +0.1 PCT (+0.0889; CONSENSUS UNCHANGED), EXFOOD/ENERGY +0.2 PCT (+0.2229; CONS +0.2 PCT)

U.S. FEB CPI YEAR-OVER-YEAR +2.3 PCT (CONS +2.2 PCT), EXFOOD/ENERGY +2.4 PCT (CONS +2.3 PCT)

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

The “Trump-pump” drove risk sentiment higher and the euro lower yesterday, but this optimism has since been scaled back following the President’s “no-show” last night and is allowing EURUSD to bounce. Traders are now dealing with a lot of technical congestion on the charts around the 1.1340 to 1.1380 level however and we think this could force a miserable trading range heading into tomorrow ECB meeting. The pressure is on Christine Lagarde big time to follow suit with the coronavirus-inspired rate cutting actions we’ve seen from the RBA, BOC, Fed, and BOE this month. The EONIA curve is pricing in a 100% chance that the deposit rate gets cut by 10bp to -0.6%. The ECB chief called on EU leaders late yesterday to ramp up their coronavirus responses, saying a further loosing of monetary policy would only work if combined with fiscal stimulus. More here from the Financial Times.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

The Bank of England sort of surprised markets with a 50bp rate cut this morning at 3amET, but not really. Interest rate traders had been pricing this scenario in for a while now and even the timing of the move (today) was reflected in relative sterling underperformance yesterday. The UK central bank cited “an economic shock that could prove sharp and large” that is “likely to be associated with Covid-19” as its rational for taking decisive action. Today’s action also included a Term Funding Scheme aimed at directly financing small and medium sized businesses, and a reduction in the countercyclical capital buffer rate from 1% to 0% for UK banks. Full press release here.

Chancellor Rishi Sunak unveiled a 30blnGBP package to help the economy get through the coronavirus outbreak when announcing the UK government’s 2020 budget earlier. See here for more details from the BBC. Sterling traders don’t seem all that excited though to push GBPUSD to new session highs, perhaps because the scale of this response was largely expected as well. The market now sits well above its post BOE spike lows, higher than yesterday’s 1.2900-1.2920 support zone, but still below its London highs at resistance in the 1.2970s. The UK reported weaker than expected January GDP, Industrial Output and Manufacturing Output numbers earlier this morning.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is seeing a mild bounce today despite the broad deterioration in risk sentiment. We wouldn’t read too much into it however as the rally makes sense technically given yesterday’s seller failure in the 0.6460s. The daily chart structure is still looking like it’s in a state of flux because of Sunday night’s flash crash.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is struggling today as the US 10yr yield falls back to 0.70%. Blame it on the Trump “no-show” last night and how traders quickly pulled the market back below the 105.20s which was surpassed just a few hours earlier. We’ve seen some buyers on dips to chart support in the lows 104s this morning, but there’s a more offered tone to the market today compared to yesterday. This morning’s US CPI report was very much a non-event.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.