Trump bans all EU flights. Markets in panic mode again. ECB adds to QE.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- US to ban all incoming flights from Europe for 30 days starting this Friday.

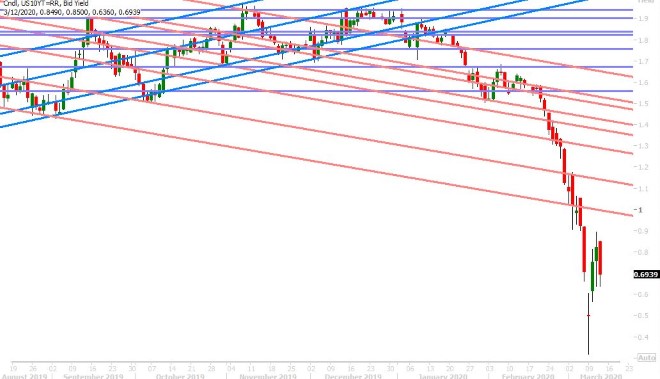

- S&P and oil futures plunge. US 10yr yields retreat back to 0.70%. USDCAD bid.

- ECB leaves rates on hold, but adds 120blnEUR in QE and new LTRO + lowers bank capital ratios.

- EURUSD falls during Christine Lagarde’s press conference, 1.1150-1.1200 support zone being tested.

- Sterling craters after weak NY close + Trump EU ban. Traders now testing 1.2580s support.

- AUDUSD finally succumbs to broad risk-off flows. Sunday flash crash lows in sight.

- USDJPY rallying despite 8% plunge in cash S&P. Perhaps BOJ intervention rumors making the rounds?

ANALYSIS

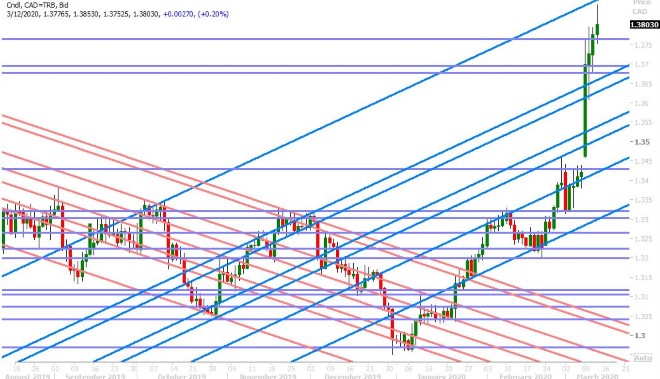

USDCAD

Dollar/CAD traded higher earlier this morning as global investors panicked about President Trump’s decision to ban all in-bound flights from Europe for 30 days, but the market seemed to struggle with the fact that the implied Fed Funds rate crashed back to 0%. The S&P futures traded 5% locked limit down again overnight; April crude oil prices fell 6%, and the US 10yr yield shook off yesterday’s bond auction anxiety to trade back down to 0.70%. USDCAD inched above chart resistance in the 1.3760s as a result, but the upward momentum going into the NY open was not as strong as one might expect given all the red on the screens.

The European Central Bank just surprised the financial markets by not cutting their deposit interest rate. This led to a sharp bounce for EURUSD initially because the EONIA curve had to price out the 10bp of cuts that traders were expecting, but the reality of the dire European economic situation appears to be setting in now after traders digest the headline about the level of QE being increased by 120blnEUR (cumulatively for the remaining months of 2020). The resulting EURUSD weakness was supportive for the broader USD and USDCAD for a little while but we’re now seeing broad USD selling come in as USDJPY spikes higher. Perhaps some BOJ intervention rumors making the rounds? Stay tuned.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

All eyes are now on the Christine Lagarde as she explains the ECB’s decision to increase the level of asset purchases by 120bln EUR, conduct additional LTROs, and lower bank capital ratios in response to the coronavirus. Full press release here. Live press conference link here. EURUSD has now tested the lower bounds of the 1.1150-1.1200 chart support zone.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling is severely under-performing its G7 peers this morning. We’ve heard some analysts chalk it up to a delayed reaction to yesterday’s 50bp BOE cut and today’s general rise in risk aversion, but we think today’s fall has more do with yesterday’s very poor NY close on the charts (technically selling) + fear that the UK could be next to experience a US-initiated travel ban. President Trump specifically excluded the UK from the new 30-day ban on all incoming flights from Europe, but what if he changes his mind on this given the fast moving coronavirus developments across the pond? GBPUSD traders now have their sights set on trend-line support in the 1.2580s after the 1.2740s gave way.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is finally succumbing to the deterioration in broad risk sentiment which re-commenced late Tuesday. Last night’s oval office address from President Trump was definitely the catalyst for last night’s move below 0.6460s support in AUDUSD, and the market has since plunged back to its Sunday flash-crash lows in the low 0.63s.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is rallying here despite the cash S&P plunging 8% lower following another 15-minute trading halt at the stock market open. US 10yr yields aren’t bouncing. Could this unusual strength be coming from BOJ intervention rumors? Where are you Mr. Kuroda?

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.