Risk sentiment bid ahead of Trump press conference

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Trump to speak at 5:30pmET tonight. “Major” actions to support economy expected.

- Saudi Arabia to flood oil markets with supply but Russia still seems willing to cooperate on “joint measures”.

- President Xi appears to celebrate conoravirus victory in China today while Italy goes on full lockdown.

- S&P futures +3%. April crude +8%. US 10s now 33bp off yesterday’s lows. Implied Fed Funds at 0.54%.

- The funding currencies (EUR and JPY) are getting sold as risk recovers. Broad USD rally hurts GBP.

- AUDUSD daily chart looking messy after yesterday’s extreme volatility. NY close below 0.6600 weighing.

- UK reports raft of January economic data tomorrow. ECB expected to cut 10bp on Thursday.

ANALYSIS

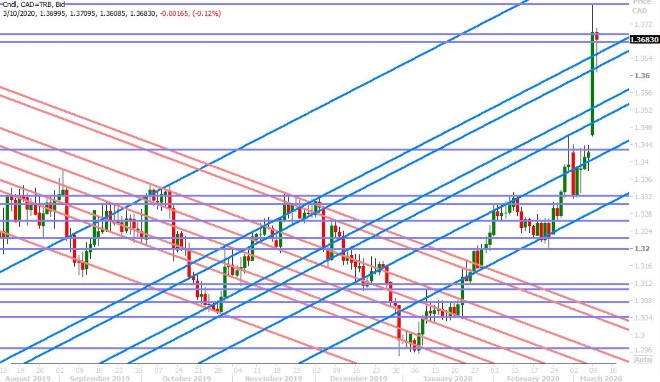

USDCAD

Risk sentiment is recovering strongly across global markets this morning, with Reuters citing “stimulus hopes” ahead of President Trump’s press conference at 5:30pmET tonight. Speaking at the White House last night, Trump said he plans to announce “major” actions to support the economy and “very substantial relief” for businesses hit by the coronavirus. Saudi Arabia dramatically escalated its new price war with Russia overnight by announcing it will flood the oil market with 12.3M bpd in April (which on the surface sounds really bearish), but it appears this tactic is bringing Russia back to the negotiating table. Russian energy minister Novak said today that “Russia Does Not Rule Out Joint Measures With Opec To Stabilize Market” and with that we’ve seen April crude oil futures rally 10%. Some are also citing President Xi’s appearance in Wuhan today as another reason for the improved risk mood, with Chinese state media touting the visit as a sign that “victory is near”. The S&P futures traded 5% locked limit up at one point this morning and the US 10yr yield reached a high of 0.7414%, which is a 43bp recovery from yesterday’s lows.

We’re having a hard time believing any of this optimism this morning, especially in light of Italy going into full lockdown today and with the number of US coronavirus cases continuing to grow, but we have respect the price action we’re seeing. Dollar/CAD recovered above the 1.3610s yesterday and rallied all the way back to the 1.3700 mark amidst the oil market’s poor performance into the NYMEX close, but it has retraced in the overnight session following the broad improvement in risk sentiment.

We think the upper end of the new pivotal 1.3610-1.3690s price range will be the focus for USDCAD traders today, as opposed to yesterday where the bottom end was the focus. There are no major economic or central bank speeches scheduled. The Canadian dollar is better bid against the EUR and GBP today as well, but both the EURCAD and GBPCAD crosses are finding dip buyers at well-defined support levels.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar finally pulled back late yesterday, but it took a fourth failed attempt on the part of buyers to get the market above weekly resistance in the 1.1460-90 zone. Today’s relative calm across global markets is adding to the negative vibe for EURUSD as the risk currencies get bought and the funding currencies get sold. Some are saying it’s time to start selling the euro again today based on Euro-specific factors like Italy going on complete lockdown and the now 100% odds that the ECB cuts its deposit rate by 10bp to -0.60% on Thursday. We’re not so sure about clinging to this narrative just yet because traders continue to demonstrate a preference for trading EURUSD off broad risk sentiment.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling is slipping back with the broad improvement in risk sentiment this morning because the relative gap between expected UK vs US monetary policy is looking less dovish on the US side. While the OIS markets have scaled back BOE rate cut odds to just 60% of a 50bp cut on March 26th, the Fed Fund markets have scaled back Fed easing expectations even further...to just 50bp for the March 18th FOMC meeting. That’s effectively 50bp of re-tightening in just the last 24hrs!

We think yesterday’s slip for GBPUSD back below the 1.3120s into the NY close didn’t help the market’s technical setup heading into Asian trade last night. The UK will be reporting a bunch of economic figures for January at 5:30amET tomorrow morning (GDP, Industrial Output, Manufacturing Output, Trade Balance).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie couldn’t muster a bullish reversal into the NY close yesterday. In fact, the close was rather negative with AUDUSD buyers completely giving up the 0.6600 handle that they achieved into the London close yesterday. One could argue that yesterday’s violent snap back for the Australian dollar was as much an overreaction as was Sunday night’s flash crash.

We think the AUDUSD daily chart is a bit of a mess now technically. The lows appear to have now been forged but the market has not clearly ended its downtrend.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

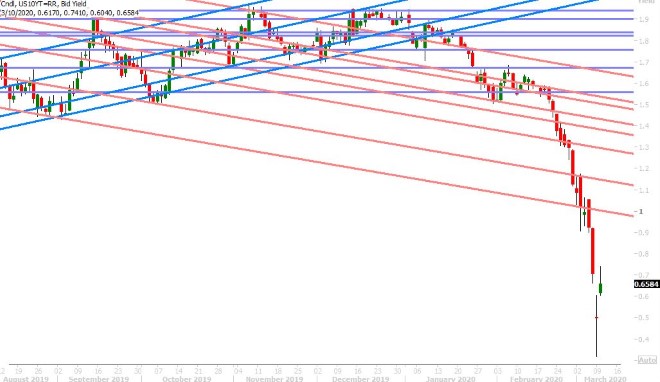

Today’s bounce in broad risk sentiment is naturally helping dollar/yen. With the US 10yr yield now retracing the bulk of Sunday night’s move lower, USDJPY has been able to do the same and has now filled its Sunday opening gap in the low 105s.

So what now? We can already see that traders struggled with the 105.10s twice this morning and we think this will remain the case so long as nothing demonstrably positive leaks out of the Trump administration during NY trade today. It’s looks like tonight’s 5:30pmET press conference from President Trump could be the next major pivot for price action.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.