Oil prices plunge 30% last night after Saudis start price war with Russia.

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Saudi Arabia slashes official April selling prices by $6-$8/barrel, to increase April oil production over 10M bpd.

- Decision in response to Russia disagreeing to OPEC+ production cut proposal, Saudis now looking to re-take market share + pressure Russia.

- Oil markets panicked at Sunday open last night as new price war has effectively begun. April and Brent crudes fell 30%.

- S&P futures went 5% locked limit down. Cash S&P were halted 15mins after US stock market opened 7%. US 10s plunged below 0.50%.

- Traders destroyed the oil-sensitive CAD and flash crashed the AUD over 4% going into 10pmET last night.

- The negative yielding funding currencies (EUR and JPY) continue to benefit from risk-off flows + dramatic rush to price 0% implied Fed funds rate.

- Some cooler heads prevailing now as the US stock market bounces 1.5% off its lows, but still nothing yet from the Fed on rates.

ANALYSIS

USDCAD

Global markets are a sea of red this morning following the shocking weekend news that Saudi Arabia effectively started a price war with Russia in response to OPEC+ talks breaking down last week. The news broke on Saturday and led to a tumultuous open for most markets last night. April crude oil futures gapped down more than 30%, the S&P futures plunged 5% lower and went quickly locked-limit down and USDCAD exploded 100pts higher right out of the gates. US yields collapsed below 0.5%, USDJPY cratered 300pts and the Australian dollar flashed crashed over 4% at one point. USDCAD spiked as high as 1.3765 on the AUD flash crash, and while it has since pulled back a bit on the AUD bounce back to break-even, it’s still trading over 100pts higher from Friday’s close. Everybody is now watching the US stock market, which is managing to bounce 1.5% off its lows, but this comes after the S&P gapped 7% lower at the open and got halted for 15 minutes due to the automatic triggering of trading circuit breakers. The Fed Funds futures curve priced in 100% chance of in an emergency 125bp rate cut to zero at the worse of it all...they now see 100% of just 100bp in cuts.

With USDCAD moving into “uncharted” territory now on the daily chart, we’re forced to look at intra-day patterns exclusively and hints from chart technicals in other markets. We see the pivotal range for USDCAD today being the 1.3610s-1.3690s. A move back above this range could create enough positive momentum for yet new swing highs, whereas a move below it could bring about some profit taking from traders who have stuck with the market’s uptrend since late January.

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar is surging 1.5% higher this morning as the market continues to benefit from broad risk-off flows, but this time it’s coming from today’s oil market crash and a frantic rush to price in a 100bp emergency rate cut from the Fed. The market blew past trend-line extension resistance in the 1.1380s during the AUD flash crash last night and touched weekly resistance in the 1.1460-90s during this move. Sellers have emerged three times since hitting these levels in overnight trade, which is making us wonder if the market is finally getting tired of going up.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Sterling continues to benefit from the relative;y less dovish UK vs US monetary policy trade. While the OIS markets have now priced in a 100% chance that the Bank of England cuts rates by 50bp on March 26th, the Fed Funds markets are now pricing in 100% chance that the Fed cuts 100bp to zero on March 18th. Chart resistance in the 1.3180s have since capped prices in the overnight session though and we’re now seeing GBPUSD slip below the 1.3120s, which is mildly bearish on an intra-day basis.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar flash crashed 4% lower going into 10pmET last night, sending already panicked global markets into a tailspin after the oil markets plunged 30% lower at the 6pmET open. We heard rumors that some funds were forced to liquidate long AUD positions due to margin calls. The selling could have also come from a large player trying to take advantage of the unusual AUD outperformance at the start of Asian trade and the Aussie's relative ill-liquid nature vis a vis EUR and JPY. The market has roared back since however, proving the flash crash theory, and we’re now looking at an AUDUSD daily chart they could amazingly record a bullish reversal.

AUDUSD HOURLY

USDCNH DAILY

USDJPY

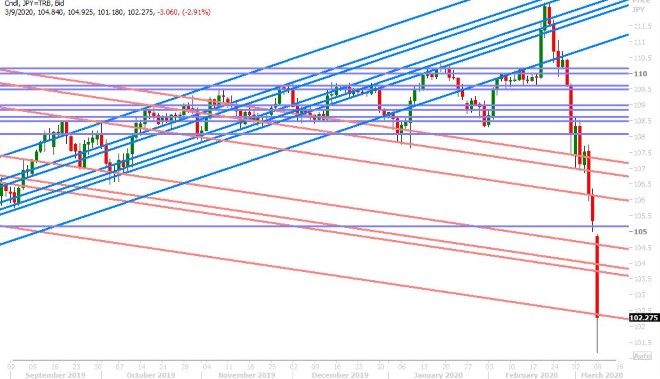

Dollar/yen got absolutely hammered in the overnight session after the US 10yr yield resumed its plunge lower, but it’s trying to regain chart support in the 102.30s now following a 1.5% bounce in the US stock market. The bounce in stocks came after the US exchanges halted trading for 15 minutes due to the 7%-down circuit breaker being triggered. US yields are bouncing mildly too. Still nothing yet from the Fed however in terms of an emergency rate cut, but implied Fed funds for March 18th have up-ticked back to 0.21% after being at zero.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Exchange Bank of Canada, EBC – Canada’s Foreign Exchange Bank, is the only Schedule 1 Canadian bank specializing in foreign currency exchange and international payments for financial institutions and corporations. EBC provides innovative foreign exchange management and integrated international payment solutions tailored to meet business needs on a global scale. Leveraging industry leading technology and a client-focused team of experts EBC delivers comprehensive, cost-effective and trusted payment processes and foreign exchange currency solutions to create financial and operational efficiencies. To learn more, visit: www.ebcfx.com.