Pressure in EM FX space driving broad USD strength this morning. UK reports mixed employment report. US Retail Sales up next.

Summary

-

USDCAD: Dollar/CAD traders are walking into gains this morning, after a broad USD rally yesterday afternoon allowed the market to close well above chart resistance at 1.2790. Overnight action was a bit choppy, but we have now broken above the next upside target (1.2825) which opens the door to 1.2850. A poor NY close for EURUSD yesterday and significant weakness in the EM currency space this morning (ie. new lows in Turkish Lira) is helping the cause at this hour as well. June crude oil is up 53 ticks this morning but it’s not bothering USDCAD longs right now. The US reports Retail Sales for April this morning at 8:30amET. Markets are expecting +0.3% MoM and +0.5% ex auto. Canada also reports April Existing Homes Sales at 9am. Markets are expecting +1.4% MoM. We think there’s enough momentum behind USDCAD at this hour to see the market test 1.2850, and then we’ll likely stall for a bit. Watch emerging market currencies today as the driver of broader USD sentiment, ie. TRY, ZAR, MXN, RUB, etc.

-

EURUSD: The Euro looks in miserable shape this morning following a weak NY close yesterday (inverted hammer below 1.1940 support), strong selling the EM FX space this morning, and weaker than expected German GDP figures. Market chatter this morning is that Turkey’s President Erdogan wants to take control of the country’s monetary policy when he centralizes power in June. Markets don’t like it and USDTRY is now exploding higher (+2%) to new highs (new lows for TRY). This is dragging other emerging market currencies lower as well and causing a broad USD bid that is spilling over into the majors. We think EURUSD will continue to struggle today as the next support level is 20pts lower from here (1.1855-60). Next up is US Retail Sales.

-

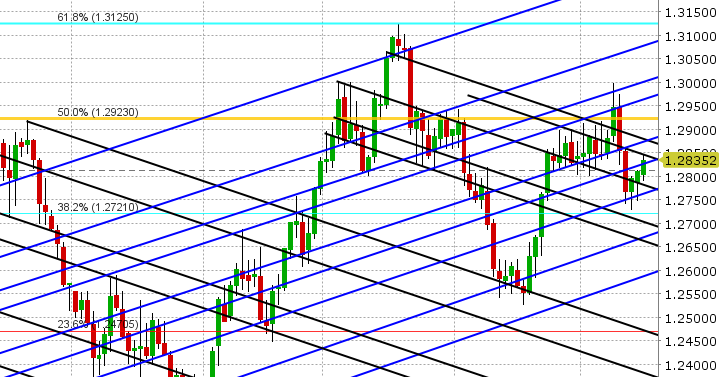

GBPUSD: The UK reported a mixed employment report for March earlier this morning. The headline job creation figure beat expectations but the average weekly earnings figure (+2.6% 3M/YoY) was reported in-line with expectations (which is nothing to get excited about for markets that are still looking for a BoE rate hike in August). The net effect of all this was a slight pop higher in GBPUSD, but the market has been weighed down ever since as selling in the EM space and EURUSD has picked up steam. Technically speaking, GBPUSD didn’t have a great NY close yesterday either. We closed well off the highs and broke below trend-line support in the 1.3530s earlier this morning. EURGBP is trading mixed to weaker. We think GBPUSD now risks trading all the way back down to 1.3490-1.3500 (the next major support level).

-

AUDUSD: The Aussie is weaker this morning, as one might expect given the broad USD strength overnight. The RBA Minutes released last night didn’t offer anything of substance for markets and the Chinese data was mixed (weaker than expected Retail Sales but better than expected Industrial Production). Copper is directionless at this hour. With two support levels now broken in overnight trade (0.7530s and 0.7505), we think AUDUSD goes into a bit of range here ahead of the large option expiries at the 75 strike over the next 48hrs.

-

USDJPY: Dollar/yen has made a run for 110 this morning as broad USD buying pressure and stronger US yields drive have propelled the market higher. Yesterday’s NY close was positive (well above support in the 109.30s). The uptrend in USDJPY now looks back on track. Resistance at 110.10-15 now needs to give way to clear a path for further gains to 110.50-110.80. Support today lies at 109.80-85. Japan reports Q1 GDP tonight.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

USD/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.