USD bid into NY trading. GBP volatile after conflicting Brexit headlines. AUD backs off highs after positive Australian employment report.

Summary

-

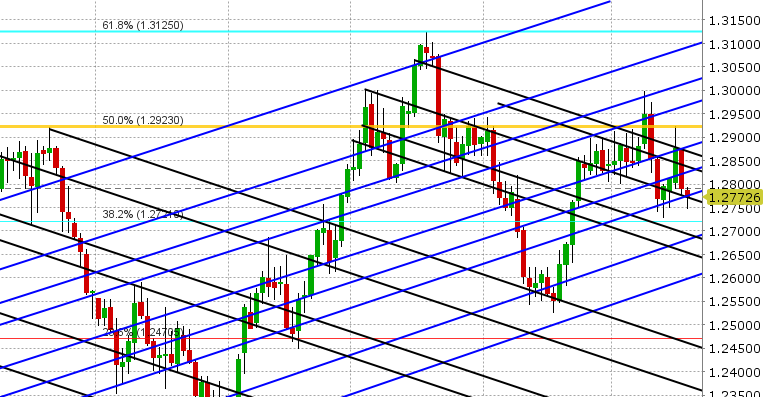

USDCAD: Dollar/CAD is entering NY trading this morning with a bid tone as the broader USD resumes its march higher. Wednesday’s failure at the 1.2925 Fib resistance level and yesterday’s AUD/crude oil driven losses have damaged the chart structure for longs, but traders are finding some solace this morning with the fact that the market is trying to regain support at 1.2780. Oil prices are making headlines again this morning with Brent hitting $80 and WTI up another 1%, but this is not really hurting USDCAD at this hour. The North American calendar is light today with just the Philly Fed survey and a couple of Fed speakers (Kashkari and Kaplan). Expect some more NAFTA headlines today following Canada and Mexico’s assertion that a deal will not be reached by today (US Speaker Paul Ryan’s deadline). We think USDCAD struggles to regain its composure today ahead of two big Canadian data points tomorrow: Retail Sales and CPI.

-

EURUSD: The Euro can’t find any legs despite a pause in the rout that’s hitting emerging market currencies. Widening yield spreads (US over Germany) seemed to come back into play yesterday as US 10s broke decisively back above 3%. Chart support at 1.1800-1.1815 has given way again (after the market tried to regain the level overnight), and so this is a bit disconcerting for longs at this hour. We think the setup for EURUSD could quickly become precarious should the 1.1800-1.1815 level not be regained soon because there is very little in the way of chart support below the market right now.

-

GBPUSD: Sterling has had a volatile overnight session and it all started with a headline out of the Telegraph late yesterday. The report said the UK will tell the EU that it’s prepared to stay in the EU customs union beyond 2021, and this lifted GBPUSD quickly above Fib support in the 1.3480s. The market reached the mid 1.35s going into European trading this morning and then PM May’s office dismissed the report, and so GBPUSD has give back all its gains at this hour. Support at 1.3475-1.3485 is still holding, but the momentum has turned back to the downside. The market needs a rally back above the 1.3530s to get longs confident again in our opinion.

-

AUDUSD: Australia reported slightly better than expected employment gains for April overnight, and this allowed AUDUSD to extend higher after a positive NY close (firm close above 0.7500 resistance). The next trend-line resistance level was tested (0.7540s) but the market could not overcome it once EURUSD selling resumed. Gains in copper prices this morning are helping to stem the AUDUSD pullback, leaving the market in a quiet range above 0.7520 support as we head into NY trading. We think AUDUSD drifts here, and possibly tries to trade higher again if EURUSD can recover.

-

USDJPY: The rally in USDJPY continues today, with the break higher in US yields and recent negative Japanese GDP data supporting. The market has now broken above the 61.8% Fibonacci retracement of the Nov-Apr down move, and some trend-line resistance in the 110.75 area is capping for now, but the momentum is still higher at this hour. We think USDJPY continues higher here. Japan reports CPI for April tonight.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.