USD bid to start week. CAD traders watching NAFTA, EURUSD and oil. Big week ahead of Australian data.

Summary

-

USDCAD: Dollar/CAD is starting the week with an neutral to offered tone as EURUSD continues higher and crude rallies off its London lows. Friday’s employment report from Canada missed expectations and that has allowed the market to regain trend-line support in the 1.2760s, but there hasn’t been much momentum behind the rebound. Downward sloping trend-line resistance in the 1.2790s is capping for the moment. NAFTA will be on traders mind again this week after trade negotiators on Friday acknowledged there’s still more work to do, yet we are just three days away from House speaker Paul Ryan’s supposed May 17th deadline. North American data this week will feature US Retail Sales and Cdn Existing Home Sales tomorrow, US Housing Starts on Wednesday, US Philly Fed on Thursday, and Cdn Retail Sales/CPI on Friday. There’s a fair deal of Fed speak this week as well, with a couple a speeches each day this week from FOMC members. The 7-week old USD net long position (CAD short) position at CME decreased marginally in the week ending May 8 as shorts added more than longs...all this as USDCAD topped out just shy of 1.3000. We think USDCAD wanders today and perhaps firms a bit as EURUSD and AUDUSD back off resistance levels.

-

EURUSD: The Euro is enjoying further gains to start the week. While market chatter is attributing this to some hawkish comments from the ECB’s Villeroy this morning (end of QE is approaching, first rate hike will be quarters, not years away), we think this EUR strength is more technical in nature. With Friday’s move above chart resistance in the 1.1940s, the market found legs to probe higher, and while the 1.1960s resisted on Friday, the level fell overnight and we’re now simply moving to the next resistance level (which is 1.1985-90). USDCNH continues to trade with a soft tone, while EURJPY rallies strongly today (after breaking resistance at 130.60 in Asian trade overnight). All this is helping EUR at the moment. There were some tense developments in Italian politics over the weekend, but the market is ignoring it as usual. It’s going to be a light week for EU data, with just German and Eurozone Q1 GDP tomorrow, along with the German ZEW survey. ECB President Mario Draghi is scheduled to speak on Wednesday. We think EURUSD stalls here a bit given the chart resistance we noted above, but we would expect buyers on dips to 1.1940-60. Should resistance give way, we could see a quick pop to the 1.2030-1.2040 area. The net EUR long position barely changed in the week ending May 8 as both longs and shorts added marginally in their positions at CME as the EURUSD continued its fall into the 1.18s.

-

GBPUSD: Sterling is trading higher this morning as well, but really just on the coattails of a higher EUR. Support in the 1.3540-50 level was tested and then buying came in following the Villeroy comments and the EUR pop. The market now sits just shy of the 1.3600 after failing to probe above resistance at that level. EURGBP is trading steady, but with a bid tone following the technically positive break above the 88 figure post BoE meeting last week (this could be a drag on GBP). The UK calendar is light this week, with just the UK emplyment report tomorrow. We think GBPUSD continues to follow EURUSD at the moment until the UK numbers tomorrow morning. We would note there’s not a lot of technical resistance above 1.3600 at the moment, which is something to note for near term shorts. Sterling longs continued to bail in the week ending May 8 as the market showed no desire to bounce ahead of the BoE meeting. The net GBP long position at CME is now back to December levels.

-

AUDUSD: The Aussie is starting the week with a neutral to bid tone as EURUSD rallies, but copper falls (-0.8%). Options might exert a downward pull on prices early this week, as 1.7bln and 1.2bln in expiries are on deck for tomorrow and Wednesday at the 0.7500 strike. Australian data will be more abundant too, with the RBA Minutes out tomorrow, Westpac Consumer Confidence and Wage Price Index out Wednesday, following by the Australian employment report on Thursday. AUDUSD is techincally sitting above support (0.7540-50), which is positive, but there’s not much momentum behind the market at the moment and so resistance in the 0.7570s hasn’t been tested yet. Should we rally and close above that level, that would bode well for a further rally into the mid 76s.

-

USDJPY: Dollar/yen is quiet to start the week, with the market hugging familar support levels in the 109.30s. Chart resistance at the 110 level has successfully held the market back twice now in the last two weeks, which means USDJPY needs a renewed push higher in US yields before it can give the upside another go. Next support below here is 108.95-109.00. Markets will be watching Japanese Q1 GDP this week (out tomorrow) and Japanese CPI for April (out Thursday). We think USDJPY continues to wander around here.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

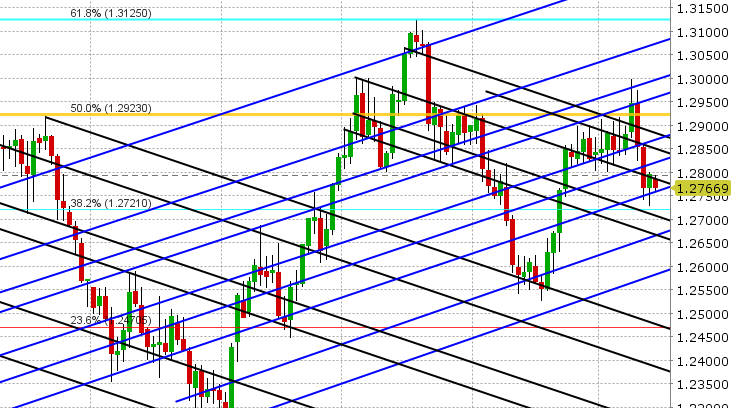

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

USD/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.