Positive outcome of Trump/Juncker meeting leads to broad "risk-on" USD selling, but the USD recovers somewhat today. ECB keeps monetary policy unchanged. Press conference begins shortly.

Summary

-

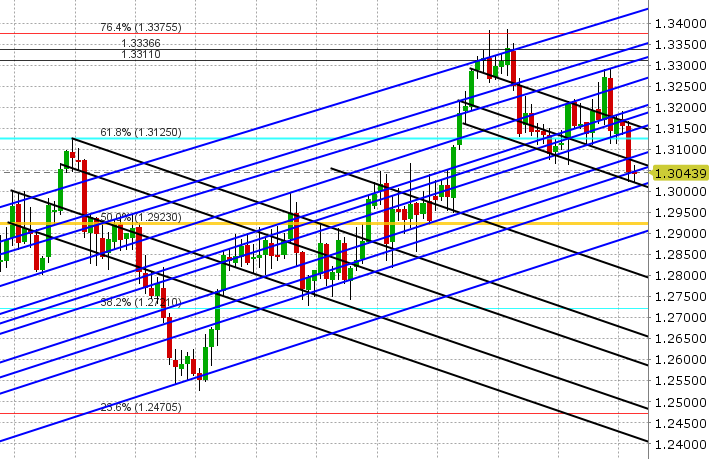

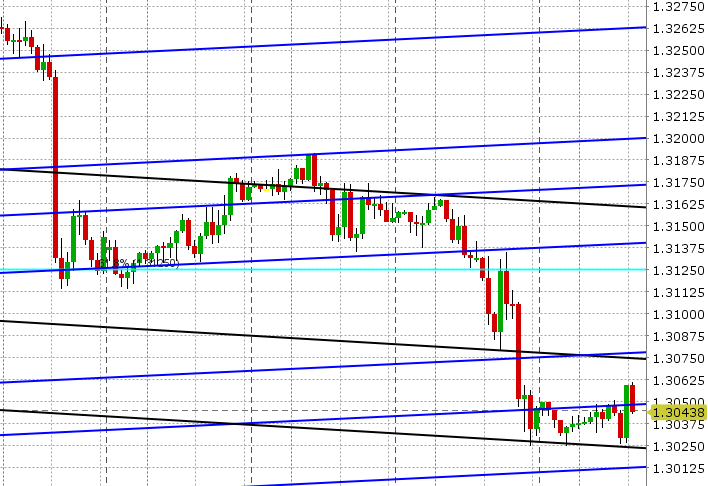

USDCAD: Dollar/CAD longs are nursing losses this morning as the positive pre-meeting and post meeting comments from Trump and the EU’s Juncker alleviated some of the trade tension that’s been brewing between the US and the EU. More here: https://www.cnn.com/2018/07/25/politics/trump-juncker-tariffs-trade/index.html. This saw the USD depreciate broadly in afternoon trade yesterday, taking USDCAD back down through key support in the 1.3080s (which the market bounced off of post oil inventories). The next stop was chart support in the 1.3050s, which traders briefly gave up but tried to regain into the NY close, but the bounce was weak. CAD cross selling has been the theme so far in Europe today and so USDCAD has not been able to benefit from the recovery in the broader USD over the last 5hrs. We think this will be short lived however as EURCAD finds support in the 1.5260s and GBPCAD holds the line in the 1.7160s, which means USDCAD could finally bounce here. August crude oil is very quiet so far this morning.

-

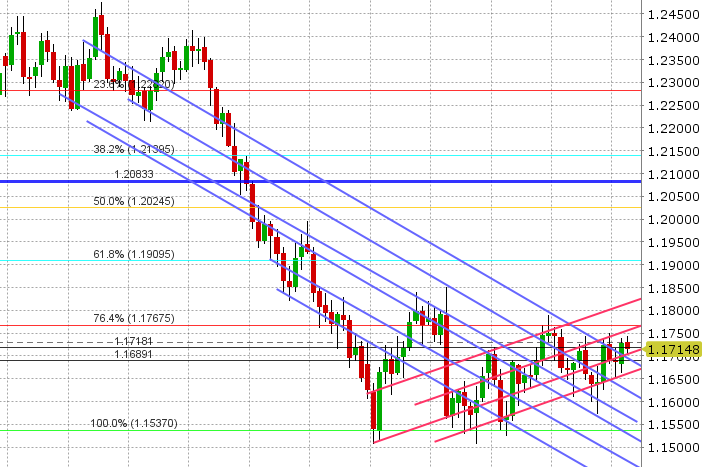

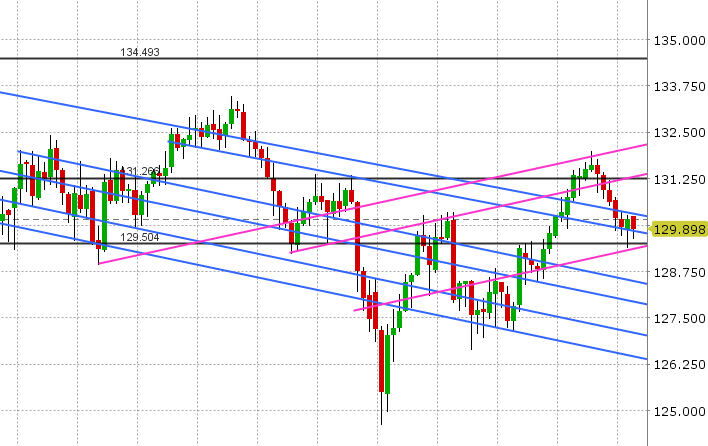

EURUSD: All eyes are on the Euro this morning as the ECB announces its latest decision on monetary policy. Markets aren’t expecting much of anything, with breakevens (at the money option straddles) continuing to price a lack of volatility. We think the “clarification of what summer 2019” means might get some play, seeing as this is the forward (albeit slightly vague) guidance the governing council gave the market last time around with regard to the first interest rate hike. Yesterday’s pre-meeting comments from Trump/Juncker saw EURUSD recover back above the 1.1680s (which it lost earlier on a WAPO article), and the post meeting press conference saw us breach familiar resistance in the 1.1720s. We’re not surprised to see some “backing and filling” now ahead of the ECB announcement, which comes out at 7:45amET, followed by a press conference at 8:30amET. We also get the June US Durable Goods and Trade Balance figures at 8:30amET (with markets expecting +3.0% YoY, +0.5% MoM on the former and -$67bln for the latter). The ECB has just announced no change to its monetary policy (as expected) and no clarity on the definition of summer of 2019 in the press release.

-

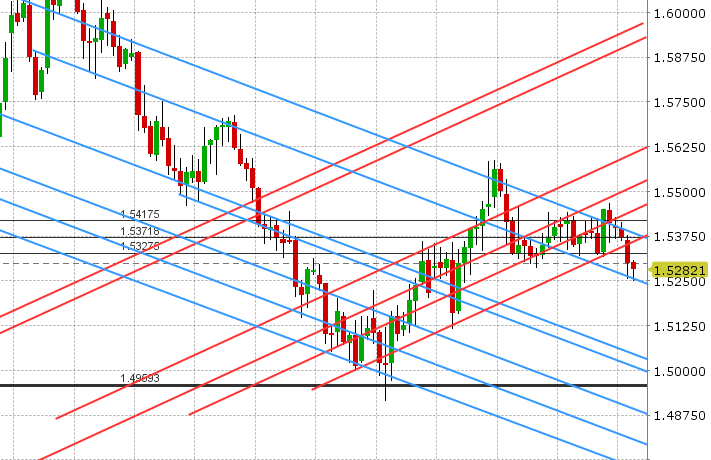

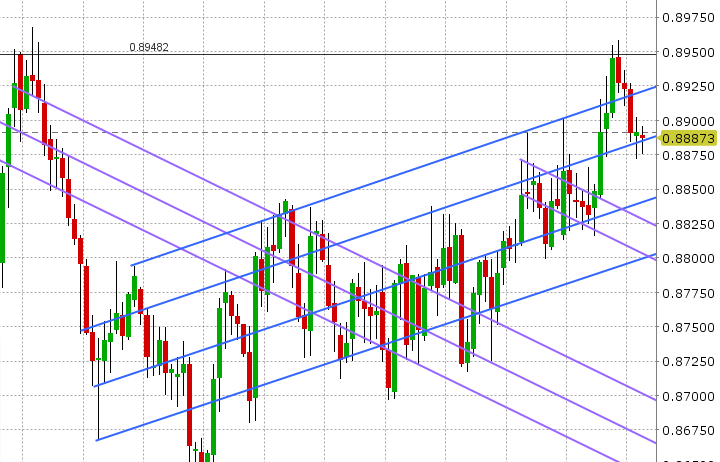

GBPUSD:Sterling is pulling back with EURUSD here as well, after yesterday’s (Trump/Juncker led) run higher. We think the upward sloping trend-line level in the 1.3190s is the pivot for today’s trade. Stay below, as we are now, and we’ll likely see more softness into 1.3150-60. Rally back above and Fibo resistance at the 1.3280s comes into focus. EURGBP continues to hold the 0.8880, which could be a drag on GBP should the cross bounce. There’s been little out of the UK today (and this week for that matter) with regard to Brexit. Here’s a nice recap of the road ahead: https://www.theguardian.com/politics/2018/jul/26/eight-months-to-brexit-what-happens-next

-

AUDUSD: The Aussie gave longs their July 11th gap fill on the charts during the wave of broad USD selling that followed the Trump/Juncker meeting yesterday, but then the market took it all away during Asian trade last night. USDCNH seemed to be driver yet again, initially probing lower after a weaker USDCNY fix, but rocketing back higher once European traders entered the fray. AUDUSD now sits back below two converging trend-line levels in the 0.7440s (which is a bit bearish seeing as there wasn’t the bullish follow through higher after breaching it to the upside yesterday). Copper and gold are also off their post Trump/Juncker highs as well, which is adding to the pressure. Expect AUDUSD to take its cue from EURUSD’s reaction to the ECB press conference (8:30amET) and possibly NZDUSD’s large option expiry at the 0.6800 strike today. AUD and NZD (the antipodeans) have been correlating well over the last month.

-

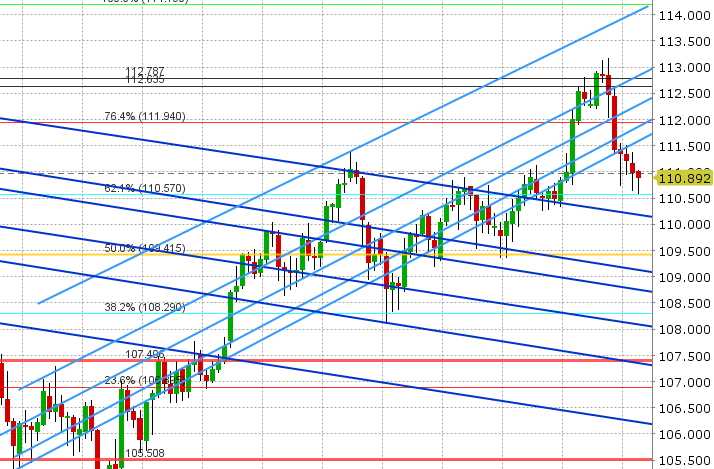

USDJPY:Dollar/yen is crawling back from overnight losses in Asia today, helped by a bounce off Fibo support in the 110.50s and a positive close for EURJPY yesterday, but the move has been sluggish as US equity futures digest the shocking Facebook earnings report last night. We think USDJPY could drift higher today if Nasdaq futures attempt to fill the Facebook gap lower. Tonight features Tokyo CPI for July, followed by the first look at US Q2 GDP tomorrow at 8:30amET. Traders are expecting +4.1% on the headline figure.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.