BOJ disappoints hawks with dovish guidance following tweak to yield curve control policy. USDCAD spikes higher on negative NAFTA headlines, then recedes following Cdn GDP beat. EURUSD traders eyeing upside after break of chart resistance.

Summary

-

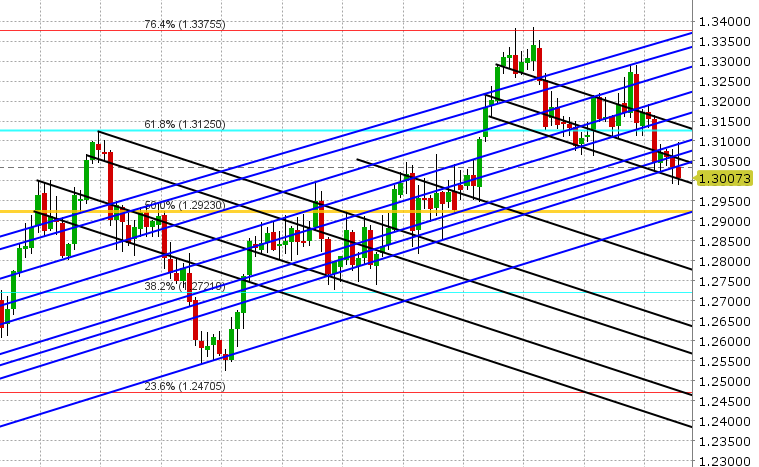

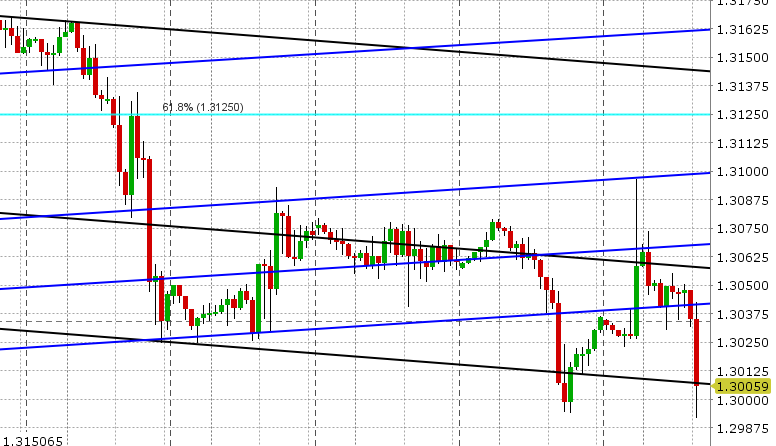

USDCAD: Dollar/CAD is trading with a neutral tone this morning following last night’s spike higher on the negative NAFTA article from the National Post: https://nationalpost.com/news/world/canada-rejected-in-bid-to-be-part-of-high-level-nafta-talks-between-mexico-and-u-s-sources. Chart resistance in the 1.3090s capped the move higher however, and it’s been a slow and steady grind back lower as the broader USD gets sold in Europe. Today’s calendar features the US core PCE price index and Canadian GDP for May. With USDCAD now trading back below the 1.3040s (the level it broke above last night) and market positioning still considerably “longer” USD compared to the last time we were at these levels in June, we think the market trades with a negative tone as the NY trading day progresses. Canada just reported May GDP of +0.5% YoY vs +0.3% expected, putting chart support at 1.3000-1.3010 under threat again. The next major support level is 1.2920-30 (a long way off from here).

-

EURUSD: Euro/dollar is trading with a bullish tone this morning, following yesterday’s strong rally back above the 1.17 handle and today’s move above chart resistance in the 1.1720s (at this point erasing the losses from the ECB meeting last week). The German employment figures for July slightly missed expectations earlier (6k less unemployed vs. 10k less expected) and the Eurozone data released an hour later was lukewarm for growth, but positive in terms of inflation (Eurozone Q2 GDP +2.1% YoY vs 2.2% expected and Eurozone July CPI +2.1% YoY vs +2.0% expected). With 1blnEUR+ in options rolling off today between 1.1700-1.1720, we think EURUSD might be a little heavy going into 10amET, but the prospects of a breakout higher continue to increase now that we’re trading above the 1.1720s. The next major resistance level is 1.1765-75. USDCNH is trading in a quiet range today.

-

GBPUSD:Sterling is trading higher this morning too, largely in sympathy with EURUSD, but unlike EURUSD is still well below Thursday’s highs. This is largely because of EURGBP’s rally back above the 89 handle yesterday, something that’s not surprising to see given the typical month end flows in this cross. The main event for GBP traders occurs on Thursday, when the Bank of England is expected to raise interest rates by 25bp. We think GBPUSD takes its cue from the broader USD until then, with tomorrow’s Fed meeting being another key event risk (no change in US interest rates expected). Chart resistance today is 1.3170, then 1.3215. Support is 1.3115 (the overnight lows).

-

AUDUSD: The Aussie is trading marginally higher this morning, largely on the back of a higher EURUSD and stronger than expected Australian Building Permit data for June, but trend-line resistance in the 0.7430s is capping. Copper’s struggle to hold the 2.79s isn’t helping either. Like EURUSD, option expiries may weigh early on in NY trade, with 1blnAUD going off between the 0.7410 and 0.7425 strikes. Be on guard for a break above chart resistance in the 0.7430s, as it would invite a short covering rally to the 0.7460s in our opinion.

-

USDJPY:Dollar/yen was the feature of FX markets overnight, following the BOJ’s latest decision on monetary policy. In an interesting move, the Japanese central bank kept its 10yr yield target of 0% in place, but allowed for a wider band of market fluctuation (up to a yield of 0.2% vs the current 0.10%) before which they would intervene. They then supplemented this somewhat hawkish development with very dovish guidance on inflation and their quantitative easing program in general, which seems to be what USDJPY traders focused on at the end of the day by virtue of the market’s rally back above the 111 handle. More here: https://www.wsj.com/articles/bank-of-japan-sticks-to-ultra-easy-money-policy-defying-expectations-1533013091. With USDJPY now comfortably back above chart support, we think traders might take a stab at the 112 level, where large option expiries lie for both today and tomorrow. The 111.90-112.10 area is also the next major chart resistance zone.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.