FX makets continue to range ahead of Trump/Juncker and ECB meetings.

Summary

-

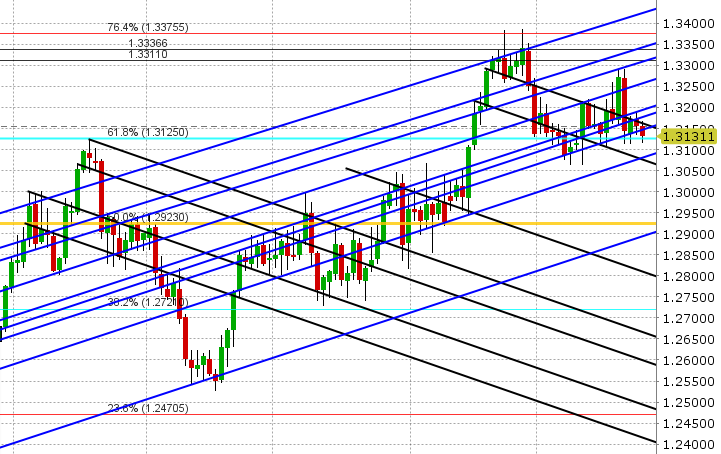

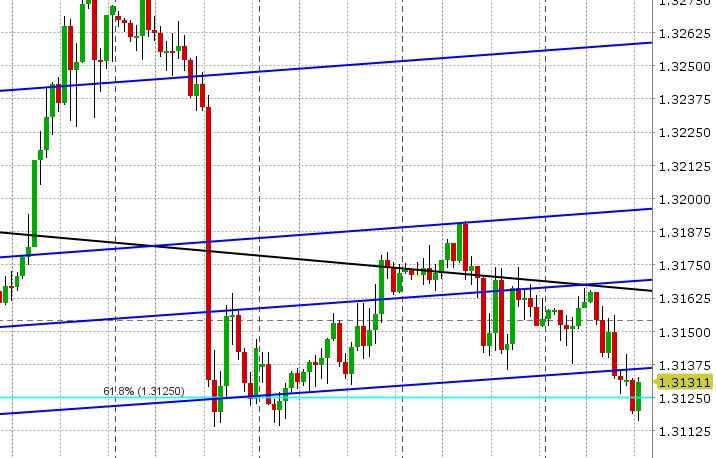

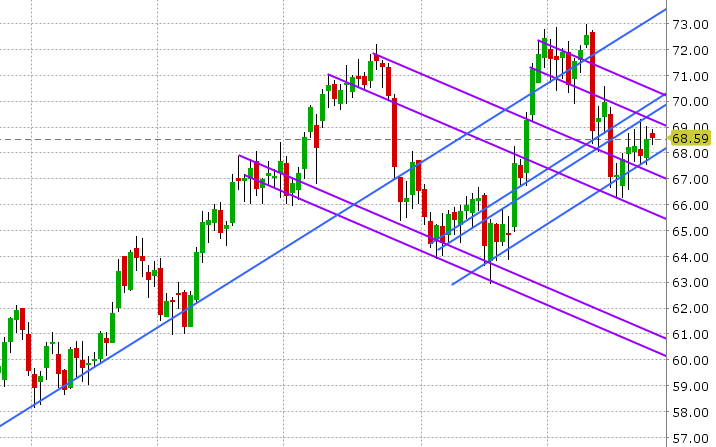

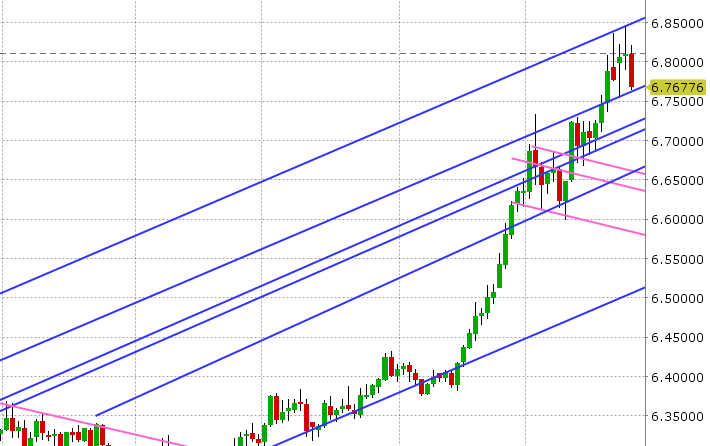

USDCAD: A lack of meaningful headlines continues to keep the broader USD and USDCAD range-bound going into NY trade today. Overnight action was quiet, with the only notable mover being USDCNH, which pulled back below 6.80 after recording a doji candle pattern on yesterday’s daily close. This has caused some broad, but very mild, USD selling in Europe today. USDCAD has leaked lower to chart support in the 1.3120s ahead of what’s expected to be another dull day. The weekly EIA oil inventory data at 10:30amET could shake things up (traders now expecting a draw of 2.33M barrels), as could potential comments from Trump regarding trade (when he receives the EU’s Jean Claude Juncker at the White House later today, 1:30pmET). We think USDCAD continues to trade range bound here, but should another wave of broad USD selling come in and/or oil pop higher today, it’s quite possible the 1.3120s could fall and pave the way for a move to the next support level in the 1.3080s.

-

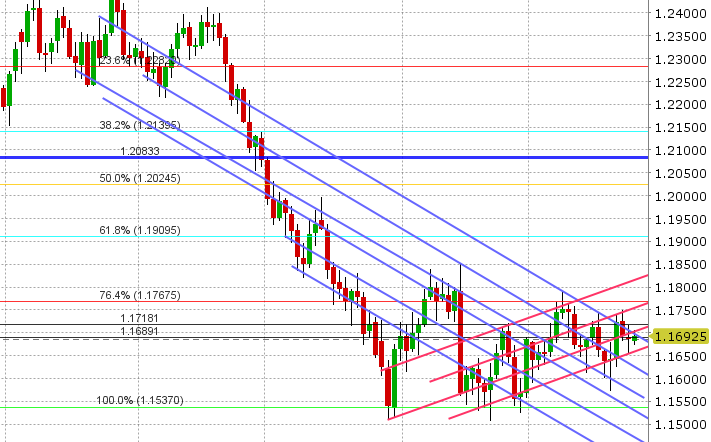

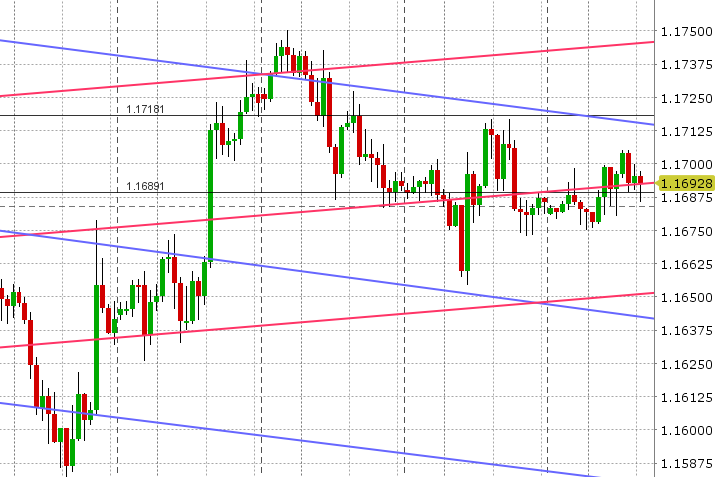

EURUSD: Euro/dollar is trading marginally higher this morning, but within the familiar 1.1690-1.1720 range. A weaker USDCNH today and some better than expected numbers from the German IFO survey are helping with the positive tone, but the gains are mild and lack momentum. Today’s focus will most definitely be on the Trump/Juncker meeting later this afternoon. More here: https://www.cnbc.com/2018/07/25/trump-set-for-tense-trade-talks-with-top-eu-chief-juncker.html. Then of course all eyes will turn to Mario Draghi and the ECB’s latest decision on monetary policy, which comes out tomorrow at 7:45amET, followed by a press conference at 8:30amET. Option expiries continue to abound, with close to 1blnEUR rolling off today at 1.1700, followed by a similar amount tomorrow and Friday at the same strike (in other words, odds are we go nowhere fast and tomorrow’s ECB’s meeting could be a dud). Overnight at-the-money straddles (buying both a put and call right here) in EURUSD are indicated at a measly 50pts at this hour.

-

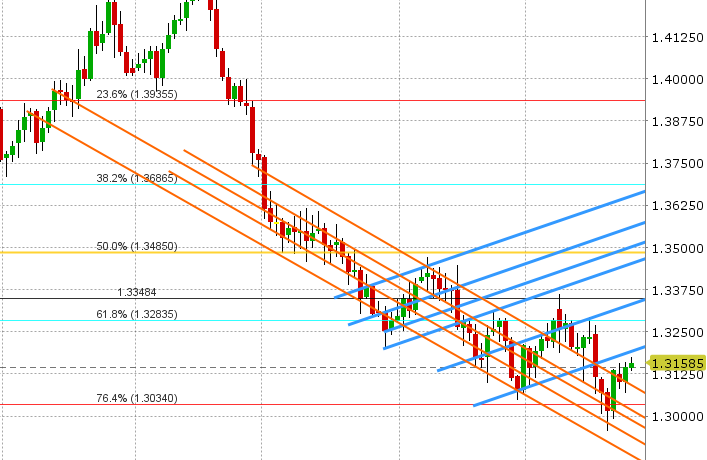

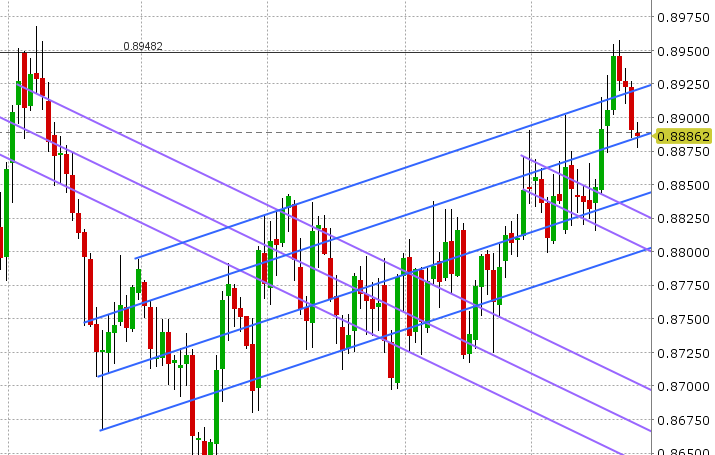

GBPUSD:Sterling continues to inch higher today, following yesterday’s breach of chart resistance in the 1.3120s, but like everything else today the gains are very mild and lacking momentum. It’s possible we could see further gains to the 1.3180-90s (the next key resistance level), but EURGBP appears to be regaining its composure in the 0.8880s today. The lack of negative Brexit headlines certainly seems to be helping GBP here, but there is still much work to do in a short period of time. Yesterday, Theresa May announced she’s personally taking charge of Brexit negotiations, with the new foreign secretary Dominic Raab deputising her. More here: https://www.bbc.co.uk/news/uk-politics-44941792. Germany’s foreign minister Heiko Maas says the UK needs to get moving (https://www.cnbc.com/2018/07/25/britain-must-move-in-brexit-negotiations-germany-says.html).

-

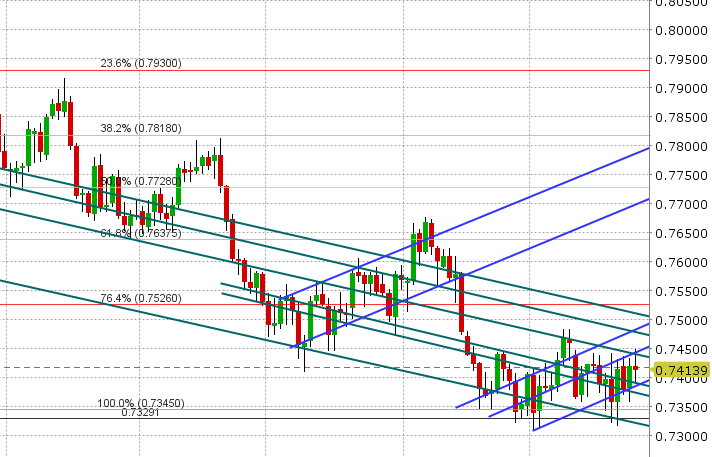

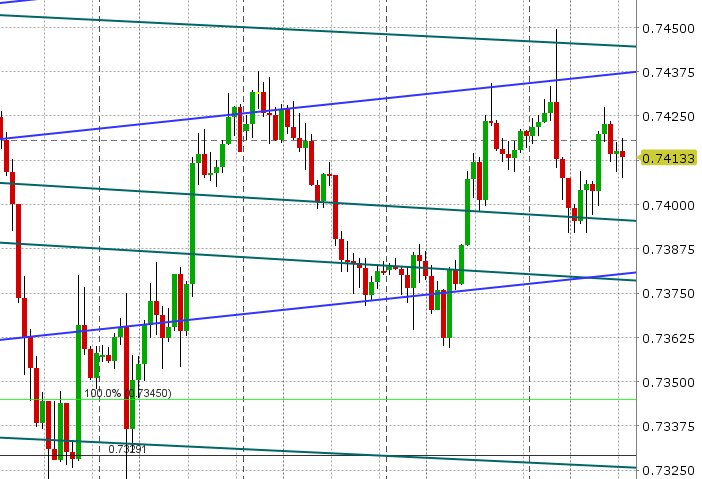

AUDUSD: The Aussie is trading with a neutral tone this morning after last night’s slightly weaker than expected Australian CPI print for Q2 saw prices graze chart resistance in the 0.7440s, but then fall lower. The decline extended to support just below the 74 figure, but we’ve since seen a bounce as the USD trades broadly weaker in Europe. Copper is bid again this morning, holding gains above 2.80, as BHP’s Escondida mine made a final offer in talks with its union to avert a looming strike. August gold appears to have formed a near term base in the 1220s as well, spurred on by the rally in US yields. None of this is helping AUDUSD today however, as traders seem content to play the range yet again.

-

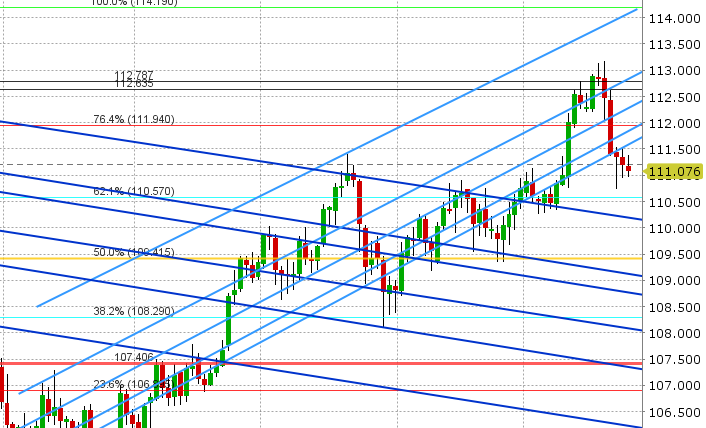

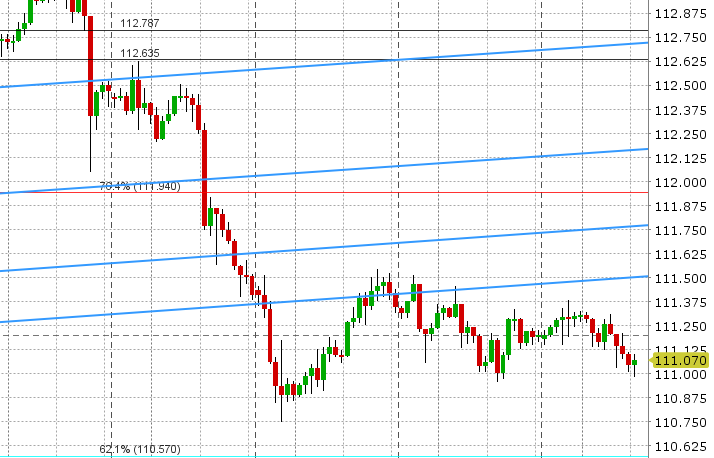

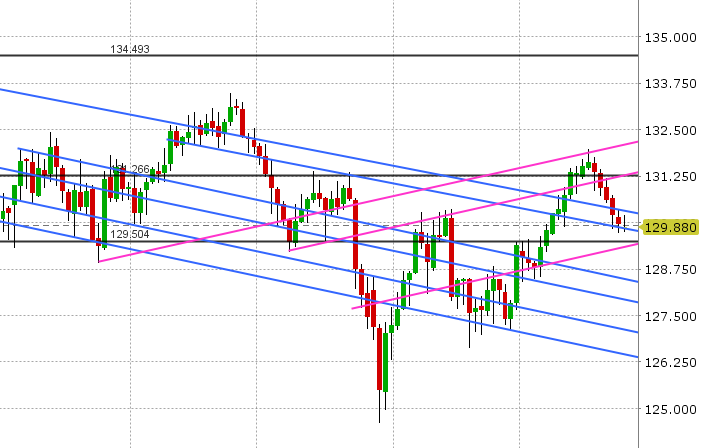

USDJPY:Dollar/yen continues to trade with a defensive tone after no real attempt was made to regain the important 111.40-50 resistance level in NY trade yesterday. US equities gave back most of their gains yesterday as well. We’re paying close attention to the de-coupling of USDJPY from US yields over the last two trading sessions, postulating that things may be out of whack until the BOJ clarifies its yield curve policy position for the JGB market next week. With no notable option expiries on deck for USDJPY, negative technicals, and a broadly weaker USD theme still in play, we would not be surprised to see USDJPY continue to leak lower here.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Daily

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.