EUR surging on German coalition breakthrough. GBP following suit. Commodities lagging. US CPI/Retail Sales on deck

Summary

-

UPCOMING ECONOMIC DATA: Dec US CPI and Dec US Retail Sales. Markets expecting +2.1% YoY and +0.5% MoM respectively.

-

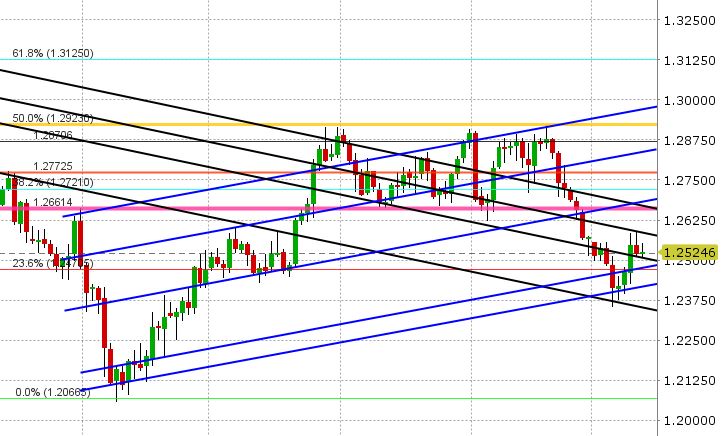

USDCAD: Dollar/CAD struggled for most of the NY session yesterday as broad based USD selling elsewhere cancelled out some of the negative NAFTA market chatter. That theme continues this morning as EURUSD makes a new swing high, and so USDCAD is hugging the trend-line it broke out from on Wednesday. EURCAD and GBPCAD are surging today, and that’s helping USDCAD from not being much lower. AUDUSD, copper and commodity prices in general are not benefiting from this recent wave of USD weakness, and CAD is being lumped in there right now as well (mildly USDCAD supportive). The CA/US 2yr yield spread is up again today, now +23bp (USDCAD supportive). We feel USDCAD coasts today as any broader bid from the USD post CPI/Retail Sales would likely be offset by CAD cross sales. Chart support at 1.2510, then 1.2480s. Resistance 1.2570-1.2580.

-

AUDUSD: The Aussie is struggling big time today, and while it’s not down much overnight, it cannot muster any strength amidst the EUR rally now underway. Copper came under pressure in European trade as it continues to run into chart resistance. AUDUSD also failed technically overnight at chart resistance around the 0.7900 level. Resistance now 0.7890-0.7900. Support 0.7850-0.7660. Today’s large option expiry at 0.7810-0.7815 won’t likely be a factor unless 0.7850 gives way. We feel that AUDUSD will likely coast today as well.

-

EURUSD: The Euro is all the rage this morning as traders take the market to new swing highs on the positive German political news. It was reported overnight that Merkel has reached a breakthrough with the SD party; a development that hopefully ends the political quagmire that has been gripping Germany since December and will allow Merkel to finally form a coalition government. Combine this bullish news with a strong close on the charts yesterday and a break of chart resistance early this morning (1.2030-1.2040), and we have the perfect scenario for news highs that we alluded to yesterday. EURUSD has just breached another trend-line resistance level in the 1.2120s, but it’s struggling a bit here ahead of the US numbers. This will be an important level to watch today. The US/GE 10 yr yield spread is understandably softer, now at +202bp. USDCNH is lower again today, completely reversing this week’s move, but it’s finding some mild support here ahead of the US numbers.

-

GBPUSD: Sterling is surging higher today as well, almost in lockstep with EURUSD. The bullish inverted hammer reversal, that we alluded to yesterday, did come to fruition. Combine this bullish trading pattern yesterday with a break of two trend-line resistance levels overnight and a surging EURUSD and traders had all the confidence they needed to push GBPUSD higher as well. The market is running into another trend-line resistance level now (1.3640), and like EURUSD, it’s struggling here a bit ahead of the US numbers.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

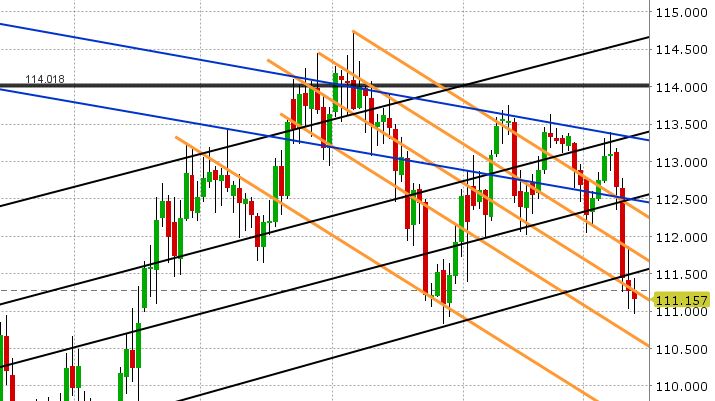

USD/JPY Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.