Broad USD selloff continues in thin MLK Day conditions. Bank of Canada in focus for CAD traders. USDCNH breaks down.

Summary

-

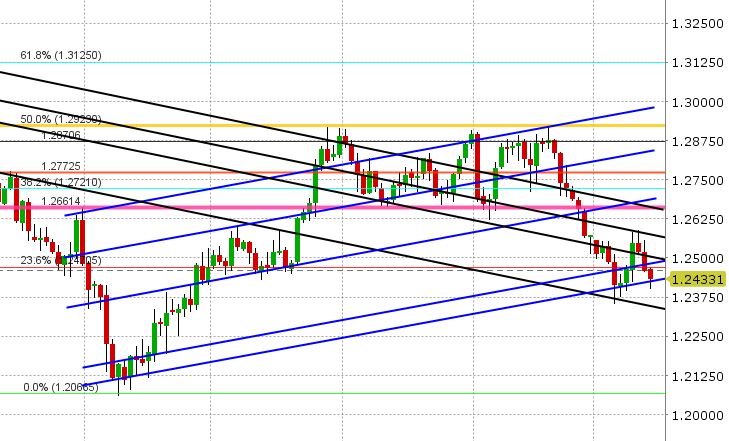

USDCAD: Dollar/CAD had a tough time on Friday countering the broad based USD weakness that followed the release of the US CPI and Retail Sales reports. Chart support at 1.2510 was taken out and then the 1.2480s gave way late in the day. With the broader USD lower to start the week, USDCAD is searching for support yet again. Buyers have stepped in at trend-line support in the 1.2410-1.2420 area, but the bounce has been mild. The big event of the week is the Bank of Canada monetary policy announcement on Wednesday, with markets still expecting a rate hike despite the NAFTA headlines from last week (OIS swaps pricing in 80%+ chance). The Axios headline over the week about Trump developing a “softer attitude” on NAFTA doesn’t help USDCAD bulls here. The latest read on futures positioning from the CFTC shows just a modest increase to the net USD short (net CAD long position) as of Jan 9th, suggesting room for accumulation (the market is a lot less short USD now compared to the last time it was in the 1.24s) – USDCAD bearish. EURCAD and GBPCAD buying continues to support in the sense that its preventing much steeper losses in USDCAD, but these crosses are up multiple days in a row and could see a pullback here. The CA/US 2yr yield spread remains firm at +24bp. With the market seemingly brushing aside the NAFTA risks and the broader USD falling apart now against EUR, GBP and JPY, we feel the path of least resistance is once again to the downside in USDCAD. Should support 1.2410-1.2420 give way, the next stop will be 1.2375, then 1.2340. A firm close about 1.2500-1.2510 would halt declines near term and create a more range-bound outlook.

-

AUDUSD: The Aussie scored a very bullish trading pattern on Friday; testing key support at 0.7850-60 post US CPI/Retail Sales and then rocketing higher to close the week, well past resistance at the 0.7900 level. The latest CFTC positioning report shows shorts capitulating into Jan 9th, bringing the market to a net long AUD position again. The broad breakdown in the USD is the dominant theme here. Copper has resumed its rally higher today, after a week of consolidation, and this is AUDUSD supportive. The AU/US 2yr yield spread is at +5-6bp. Technically speaking, there’s not much resistance here on the AUDUSD chart to prevent the market from charging higher towards 0.8050 or the 0.81 level. We think AUDUSD will continue to be supported on dips, and we see a risk of gains accelerating today amidst holiday trading conditions (MLK Day in the US). The key Australian data point this week will be the Aussie jobs report on Thursday.

-

EURUSD: The Euro surged higher on Friday, making quick work on the resistance level we mentioned that capped activity into the CPI/Retail Sales release. With this breakout to 3yr highs, traders are now being forced to pull up their weekly charts in an attempt to find resistance levels, but truth be told, there’s not much now until the mid 1.25s. So technically speaking, Friday’s move has opened the door for significant EUR gains here ahead of the ECB meeting next Thursday. We’ve plotted a few trend-line extension resistance levels on the daily chart, but the market has not shown any failure yet at these levels. It’s a light week for EUR data with the highlight being Eurozone CPI on Wednesday, but it’s the final figure for December (ie. a revision). We see thin holiday markets today as a factor that has exacerbated the move higher in EUR (similar to what occurred over the Christmas holidays). Add to this a breakout in CNH overnight, with the USDCNH chart breaking decisively below 6.45, and we have a pretty negative USD story across the board right now. EURJPY continues its rally above 135. EURGBP is struggling a bit as GBPUSD surges higher too, but it should still be a EURUSD supportive influence should it stay above the 0.8870s. With the technical breakout in EURUSD, the absence of significant chart resistance overhead, the hawkish ECB minutes, the positive German political news and the market adopting a view that the ECB is now going to move sooner rather than later (compared to a well telegraphed Fed), we see EURUSD being supported on dips. Support comes in 1.2200-1.2220. The latest read on futures positioning from the CFTC showed another new high in the net EUR long position going into Jan 9th.

-

GBPUSD: Sterling exploded higher on Friday too, with the big headline here being Spain and Holland agreeing to work together to push for a Brexit deal that maintains close ties between the UK and the EU. Couple that with the surge higher in EUR, and GBPUSD raced through chart levels with ease. GBPUSD is hitting some light trend-line resistance here (1.3820), but like EURUSD, there is very little technical chart resistance overhead for multiple figures. We’re also now in the extremely wide post Brexit EU referendum range, which makes it difficult to plot anything meaningful on the daily chart in terms of resistance. The 23.6% Fibo retracement of the April to October 2016 down move comes in at 1.4050, but that’s still well above here. On the UK data front this week, the highlight is Dec CPI tomorrow with markets expected +3.0% YoY. We also get UK Retail Sales on Friday. CFTC data showed position liquidation into Jan 9th, but more so from shorts, leaving the market more net long GBP than the week prior. While the technical outlook looks exciting here for GBPUSD, we would not be surprised to see a bit of a pull back here. The 1.3740-1.3750 must hold to maintain the positive momentum.

-

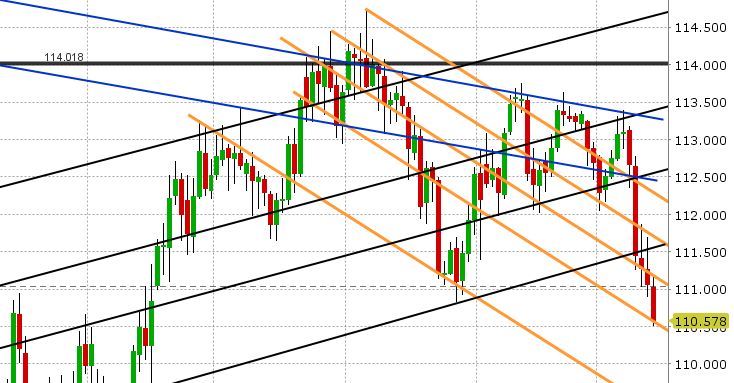

USDJPY: The carnage continues for USDJPY, as Friday’s broad rout in the USD added further weight to a market that is now obviously positioned the wrong way. CFTC confirmed that on Friday, showing USD longs (JPY shorts) adding on the dip to 112.50 (which was the wrong move). The market is now testing support at 110.50-110.60. Dovish comments overnight from the BOJ’s Kuroda are not helping USDJPY as one might think, nor are US treasury yields, which continue to remain firm after their breakout higher. With the broad USD selloff and long USD (short JPY) market positioning that has yet to capitulate, we feel USDJPY will be vulnerable to selling on strength. The BOJ meets next on Jan 23.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.