Surprisingly hawkish, copy/paste, Fed statement boots USD into week's end

Summary

-

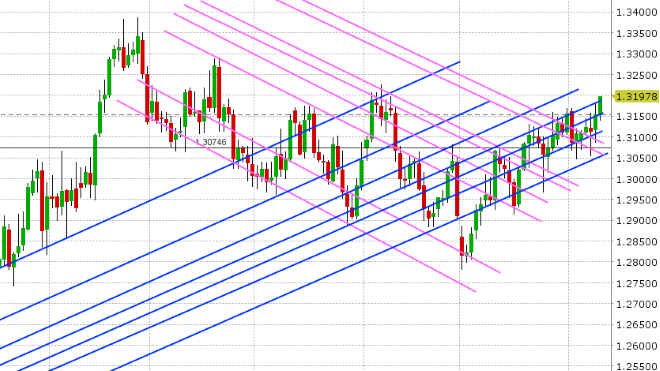

USDCAD: Dollar/CAD is trading over 100pts higher than yesterday’s lows this morning after a combination of a surprisingly hawkish hold on interest rates from the Fed, and negative headlines about Canada having issues with the final text of the USMCA deal, vaulted the market through chart resistance in the 1.3150s. The next resistance level (1.3180s) capped trade for the rest of the NY session and then we saw a pullback in prices. Buyers stepped in again however at the 1.3150s (resistance turned support), and have been inching the market up ever since. Today’s further collapse in oil prices below $60, along with broad USD strength (particularly in the EM space), appear to be the drivers of price action as the market awaits the October read for US PPI (8:30amET). A federal US judge has also just blocked construction of the Keystone XL oil pipeline, saying the US government had not completed a full environmental analysis. We think this helps USDCAD here as well, as the proposed pipeline is key to removing the bottlenecks on Canadian oil exports. Technically speaking, USDCAD needs to hold the 1.3180s to maintain upward momentum. A move back below would invite some profit taking ahead of the weekend.

-

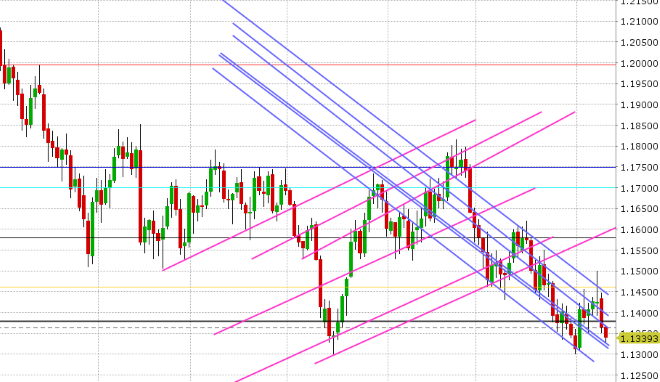

EURUSD: Euro/dollar is slipping lower again this morning after yesterday’s Fed statement saw the market break chart support at the 1.1400 level. The press release was more or less a copy/paste of the prior Fed meeting, and therefore had no dovish hints in it. We think this came as a surprise to many market participants (ourselves included), especially in light of recent equity/interest rate volatility. This seals the deal, we feel, for a 25bp rate hike from the Fed in December. EURUSD traders tipped their hats this morning and moved the market down to the next support level in the 1.1320s. Some buyers have stepped in here head of US PPI, and while we think today’s plethora of option expiries at and above the market could hold things up here (1.8blnEUR between 1.1340 and 1.1375) near term, the chart technicals have turned sour once again. There hasn’t be any progress with regard to Italy’s budget revision for the EU.

-

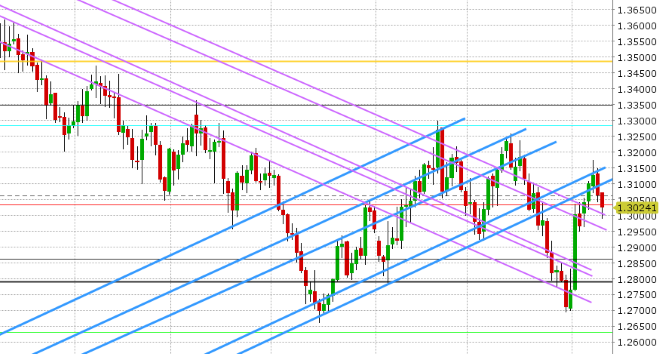

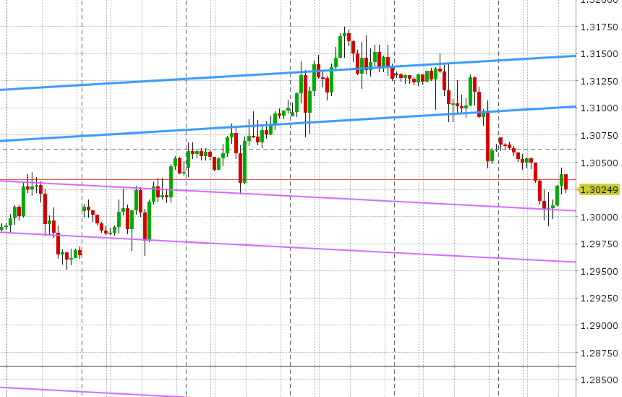

GBPUSD: Sterling fell through the bottom end of the 1.3080-1.3140 upward sloping price channel yesterday after the Fed statement was released. This invited the shorts back in, and it’s been a slow and steady move down to the next trend-line support level in the 1.3010s ever since. Buyers have stepped in here as well, and are probably taking solace from the slight bounce in EURUSD. The UK reported a raft of economic data this morning, but it was mixed on net and so we feel the market largely shrugged it off (in-line to slight beats on Industrial & Manufacturing Production, in-line to slight misses on the GDP figures, and a slightly better than expected Trade Balance). We think GBPUSD could bounce here today as the EURGBP cross still struggles to find a base.

-

AUDUSD: The Aussie is drifting lower this morning as the broader USD respects the Fed’s hawkish tone going into December. Chart support in the 0.7230s (the level the market broke above on Wednesday) is holding for the time being though. The RBA’s quarterly Statement on Monetary Policy was largely a non-event for markets last night as it didn’t signal any desire to increase interest rates in the short term.

-

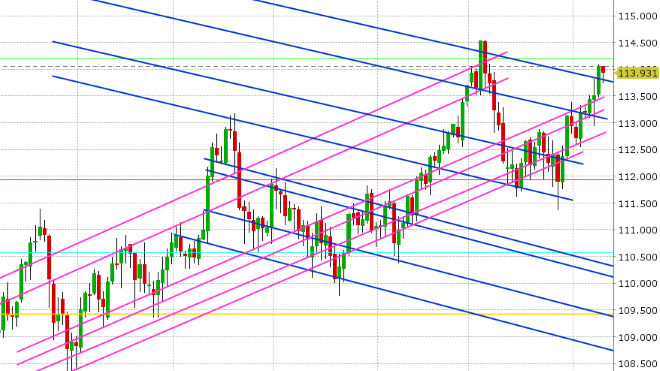

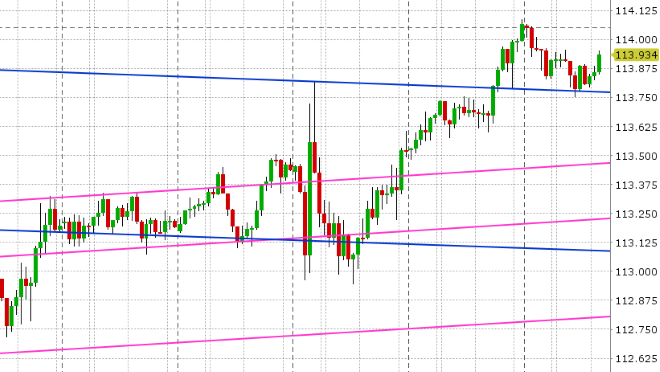

USDJPY: Dollar/yen made a bee-line for the 114 handle yesterday, spurred on from Wednesday’s technical reversal higher. The Fed’s hawkish hold on interest rates affirmed new chart support at the 113.70s and this level continues to hold despite a bit of a risk-off tone to global equities today. Next up is US PPI for October and 1.2blnUSD in options expiring at the 114.00 strike (10amET). The think USDJPY can continue to build upon gains here should the 113.70s hold.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

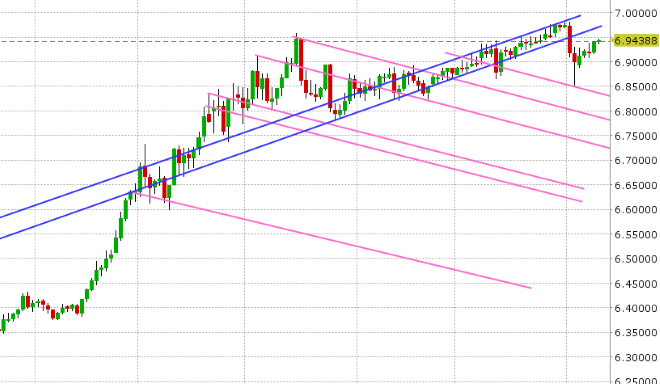

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

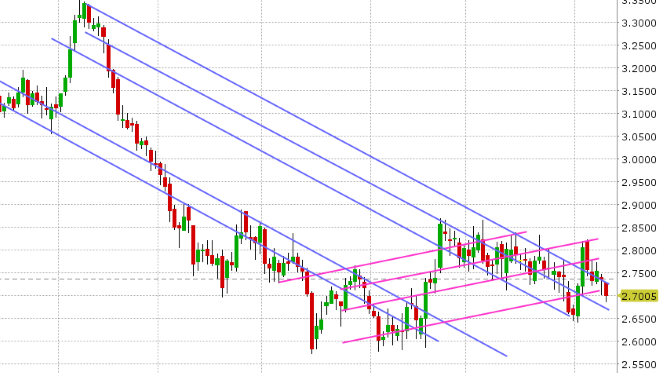

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

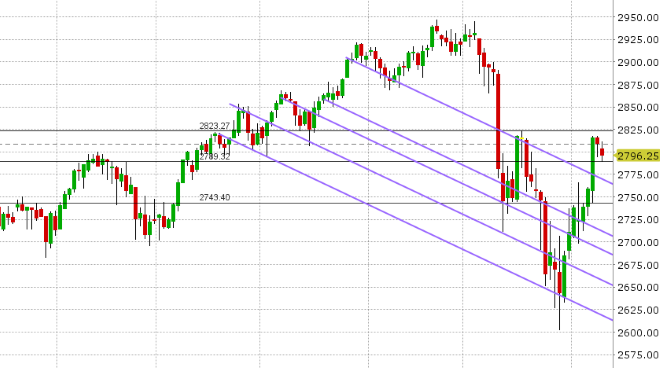

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.