Broader USD catches small bid on slight uncertainty entering German political arena, and softer than expected UK core CPI. Key technical levels in focus.

Summary

-

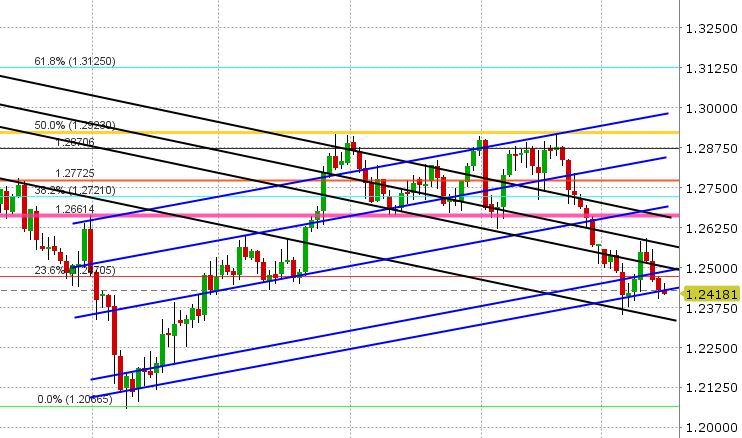

USDCAD: Broad USD selling kept USDCAD under pressure yesterday, but the market managed to regain the 1.2410-1.2420 support level going into the close, which is mildly positive. Europe is giving USDCAD a bit of a bid here, but it’s more of a broad based USD bid off European headlines this morning more than anything else and the near term technical trend in USDCAD is still lower until such time the 1.2470-1.2500 region gives way to the upside. Markets are still expecting a 25bp hike from the Bank of Canada when it announces its decision on interest rate policy tomorrow at 10amET. EURCAD and GBPCAD are a touch softer today and the US/CA 2yr yield spread is steady. We expect USDCAD to tread water today ahead of the key event tomorrow and would note any recovery attempts higher today in EURUSD and GBPUSD as a potential threats to the 1.2410-1.2420 support level in USDCAD.

-

AUDUSD: The Aussie is a touch weaker in overnight trading, but this comes on the heels of another strong NY close yesterday with AUDUSD piercing through trend-line resistance at the 0.7950 level. We traded as high as the 0.7978 but have since pulled back on some EURUSD weakness and a market call out of Barclays calling for an imminent drop in iron ore prices. Copper traders didn’t like the sounds of that either and have smashed the metal 10 cents lower from its highs yesterday (AUDUSD negative). The good news is that AUDUSD continues to hold the 0.7950 level as we write. This will be the key level to watch today. Should the EUR and copper recover, we could see another attempt higher towards the 80 handle and beyond. Should support give way today, we would expect to see selling into the 0.7910-0.7920 region.

-

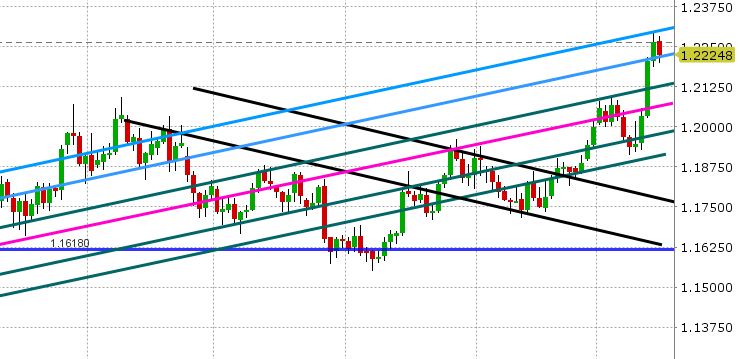

EURUSD: The Euro is marginally weaker overnight after a tremendous three-day run to new highs. Traders are circulating a story about a segment of Germany’s SD party voting against their leader’s proposed coalition with Merkel. Schulz (the SDP leader) has until Sunday apparently to get responses from the party’s 600 delegates across Germany. While this introduces a little bit of EUR uncertainly this week, we would argue rhetoric out of the ECB is more important near term, especially with the ECB meeting next Thursday. Yesterday’s market talk was all about the ECB’s Hansson who said “QE could be ended in one step with any problems” and that the “ECB should hike rates a few times before trimming its balance sheet”. He also said QE could end after September if inflation and the economy develop as expected. While this hawkish commentary didn’t have a huge effect on markets (momentary EUR spike higher), it will put more of a spot light on Mario Draghi during next week’s ECB meeting. If we look at market technicals here, EURUSD is looking a touch tired but not weak. Support at 1.2200-1.2220 has been bought and is holding for the time being. Option traders report continued demand for upside strikes. The US/GE 10 yr yield spread is back below +200bp, now +197. We feel the EURUSD continues to have a positive outlook here, but would note that support needs to hold today. Should 1.2200 give way, it invites selling back into the mid to low 1.21s. The fall in USDCNH halted overnight with the market finding support at 6.4250 (slightly EURUSD negative, given recent correlations)

-

GBPUSD: Sterling is softer overnight as well, with traders pointing to the weaker than expected print overnight in Dec UK core CPI (+2.5% YoY vs +2.6% expected). The headline figure was reported in-line with estimates (+3.0%) and the Retail Price Index component actually beat estimates by 2 tenths. So the report was technically a mixed bag, but traders took GBPUSD lower over the 4am hour to test trend-line support in the 1.3750s. This coincided with a move lower in EURUSD around the same time. GBPUSD is holding support for now, but like EURUSD, we feel its support level (1.3750) will be the key to watch today. Next up for UK data is Retail Sales on Friday. The BOE meets next on Feb 8. EURGBP has been directionless to start the week, but it continues to hold the 0.8870-0.8880 level, which is mildly bearish GBPUSD.

-

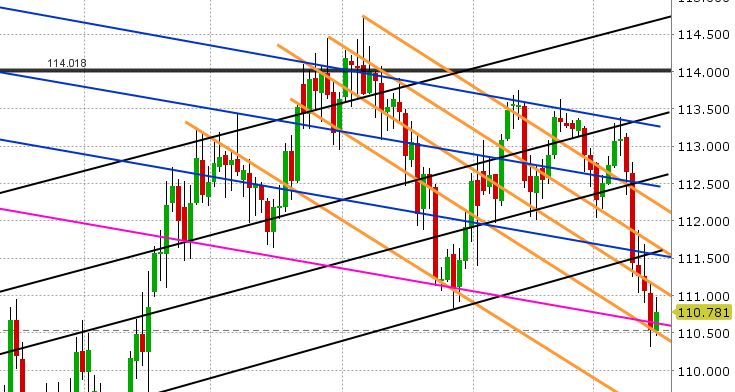

USDJPY: Dollar/yen finally caught a bid overnight with some traders circulating a Reuters piece about sizable option expiries on Thursday’s NY cut (2.5bln USD between 110.80-111.00). As we’ve noted before, option expiries can often have a magnetizing effect on prices especially if the notional amounts are large and the strikes are not too far from current prices. The broad based bid overnight in USD is certainly a welcome backdrop for USDJPY as well, but we would note London was quick to sell USDJPY when it came in. Resistance is now 110.95-111.00. Support checks in today at 110.50-110.60. Some traders were talking about an ominous head and shoulders topping pattern on the daily chart again yesterday (neckline being the pink trend-line support on our charts). We acknowledge this as well, but would note a firm push below 110.30 would be needed to see this pattern play out, and with the BOJ on deck for next Tuesday, we doubt any serious movement before then. US yields are softer today but global stocks continue their march higher.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.