Positive US/China trade sentiment spurs risk-on tone ahead of US & Canadian employment reports

Summary

-

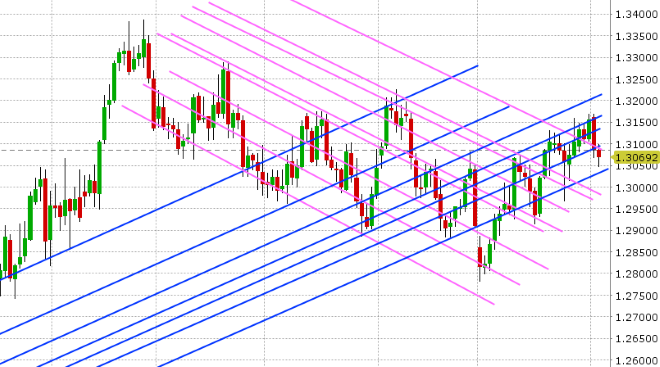

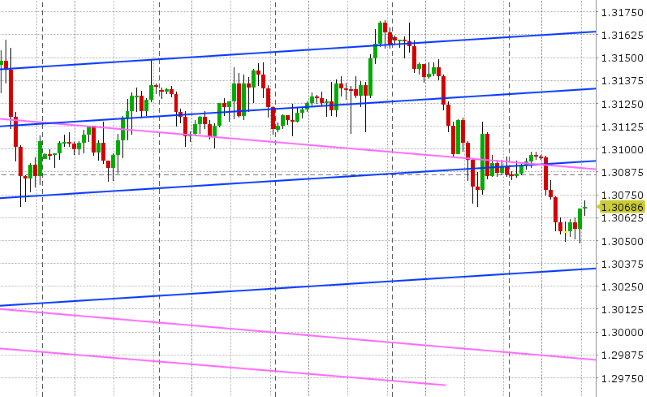

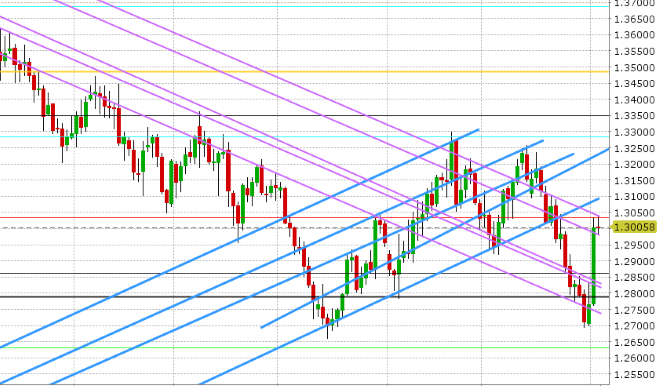

USDCAD: Dollar/CAD enters NY trading this morning with a weak tone yet again, as the momentum from yesterday’s strong USD selling wave continues to trip chart support levels across the board. Yesterday’s “risk-on” sentiment was all about positive progress on Brexit. Today, it’s all about Trump and reports that he has asked his cabinet to draft a trade deal with China. Up next are the US and Canadian employment reports for October, where traders expect 190k jobs gained stateside and +10k for Canada. Wages are expected to grow 3.1% YoY in the US, and +2.3% YoY in Canada. Finally, the consensus for the unemployment rates are 3.7% and 5.9% respectively. December crude is struggle to find support after the market plunged below $64 yesterday. Reports overnight that the Trump administration will grant waivers to Iran’s major oil importers essentially makes next week’s sanctions meaningless in our opinion, but we’re not surprised by this considering Iran’s continued covert tanker activity over the last month, and we think physical oil traders knew this all along. Add to this continued talk of the market now being oversupplied (if we look at OPEC+Russia production over the last month) and we continue to have bearish crude oil outlook here that is supportive USDCAD, all else being equal. Expect further weakness to the 1.2980s on weak US/strong Canadian numbers; a bounce into the mid-1.31s should we get the opposite, and chop around 1.3030-90 should we get mixed results.

-

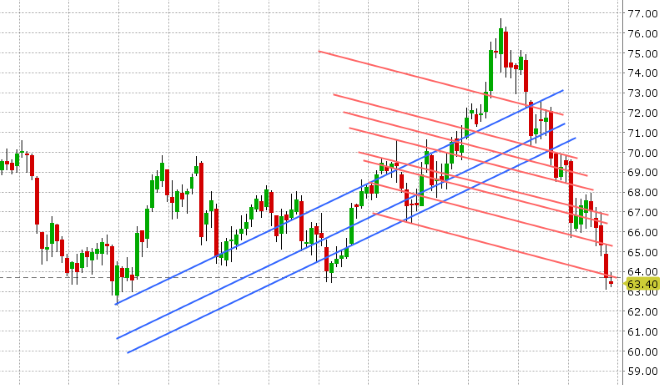

EURUSD: Euro/dollar continues to power higher after a brief pause at trend-line resistance in the 1.1410s late yesterday. The Yuan’s positive reaction to the US/China trade headlines overnight was the catalyst for the rally to continue today in our opinion. Yesterday’s downside break of the 6.9450s in USDCNH also helped pave the way for this move we feel. EURUSD now sits above support in the 1.1430s but just shy of resistance in the 1.1460-70 area. The US jobs report is up next, and so too are a slew of option expiries (mostly to the downside) – 1blnEUR at 1.1450, 3bln at 1.1400, 1.4bln at 1.1370-80. Expect traders to challenge resistance on weak US numbers, or support in the 1.1380-1.1410 zone should we get better than expected figures.

-

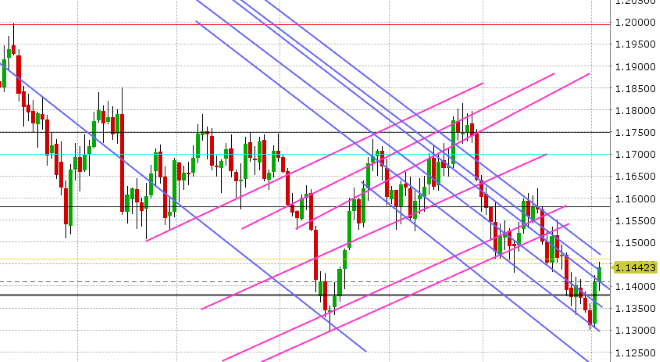

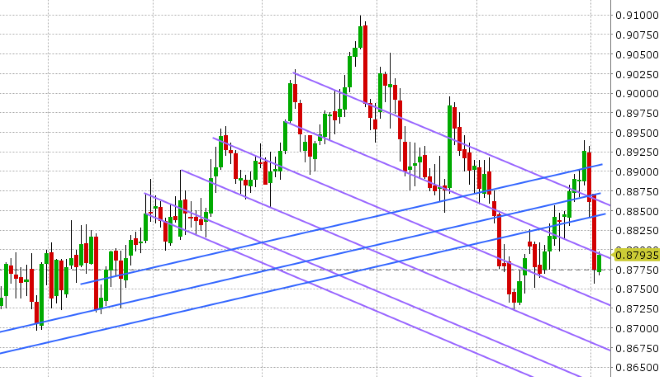

GBPUSD: Sterling is bid this morning, but it is currently struggling at yesterday’s NY highs ahead of the US jobs. Yesterday’s monstrous move higher off the positive Brexit headlines saw futures open interest jump over 7k contracts, which suggests new longs piling in, instead of shorts scrambling to get out. We think this might prove bullish for GBPUSD still, especially if chart resistance in the 1.3100 level gives way. The EURGBP cross is finally bouncing this morning, but this is after getting crushed over the last 48hrs. We think how the market responds to the 0.8800 level will be pivotal for today’s action and broader GBP sentiment going into next week. Support for GBPUSD ahead of the US jobs report is the 1.2980s, but then there’s a gap until the 1.2860-70s (because of yesterday’s swift move higher without retracements), so sterling could be a bit vulnerable to a beat on US jobs.

-

AUDUSD: The Aussie is atop the leader board again this morning as the trade-sensitive currency benefited handsomely from the positive developments on the US/China trade front overnight. The 0.7220s resistance level gave way when USDCNH fell apart, and European traders appear to be buying dips so far, but we’re seeing a bit of selling now ahead of the US jobs report. Copper prices are surging this morning (+2.5%), as one might expect, and it sure looks like the bullish, inverted head & shoulders pattern is taking shape again (after faking out longs on the fall below 2.70 earlier this week). We think AUDUSD might easily pull back here if the US employment report beats expectations. Key support is the 0.7170s.

-

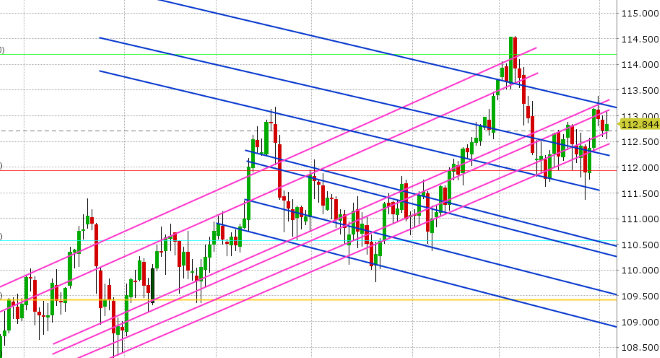

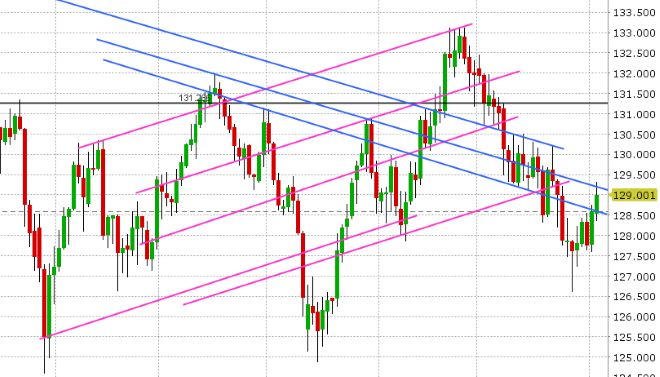

USDJPY: Dollar/yen continues to pause below the 113 handle today as the broad “risk-on” sentiment of the last 48hrs get cancelled out by the broad USD selling flows. We think the market continues to coast here and we think the fund long position will hang in there so long as we stay above 112.25.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

December Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

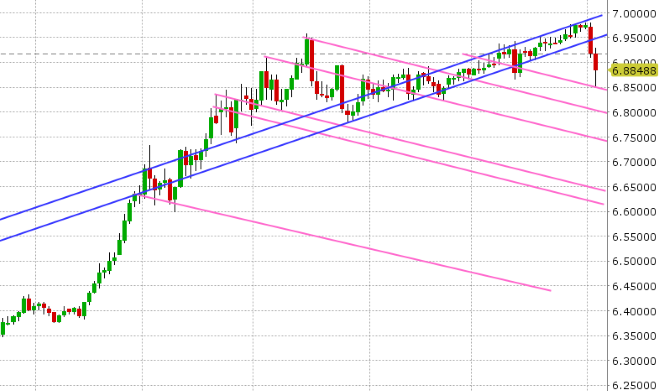

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.