USD trading mixed post escalation of US/China trade tensions. US ADP beats expectations. US ISM and FOMC on deck.

Summary

-

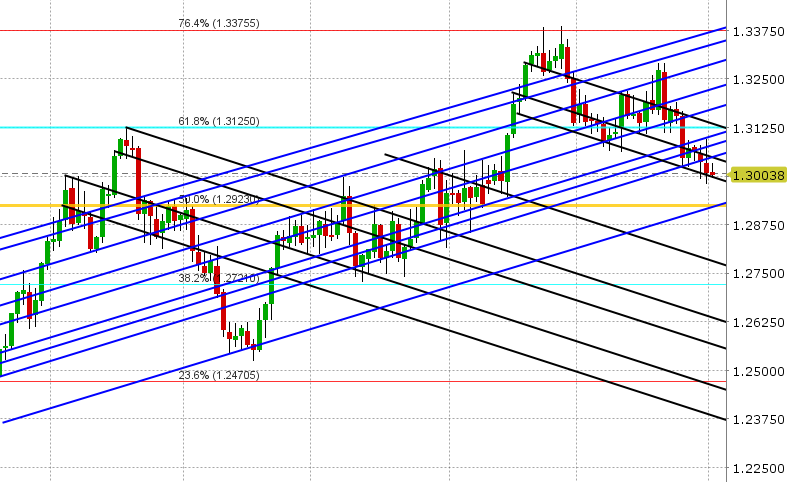

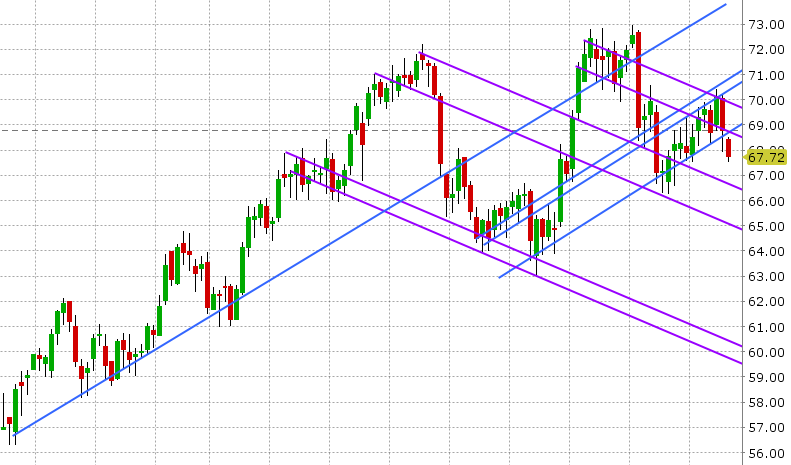

USDCAD: Dollar/CAD is trading with a neutral tone this morning after traders managed to hold the key 1.3000 support level going into the NY close yesterday. Last night’s threat by the Trump administration to increase proposed tariffs from 10% to 25% on 200bln of Chinese goods caused a USDCNH led rally in the broader USD during Asian trade, but the move was mild and was faded in early European trade after talk of Chinese banks selling USDCNH above 6.83 made the rounds (USDCAD negative). August crude oil has broken below support in the 68.20s as traders fear a larger than expected build in the EIA weekly oil inventory figures to be released today at 10:30amET (USDCAD positive). The US ADP employment figures just came in at +219k vs. +185k expected. US July ISM is up next at 10amET (markets are expecting 59.5). We also have the FOMC meeting later today at 2pmET, but no changes to rates or monetary policy guidance is expected, especially considering this meeting will not feature a press conference afterwards. We think USDCAD continues to trade with a neutral tone here so long as the market remains within 1.3000-1.3050. Any move outside this range will likely see follow-through.

-

EURUSD: Euro/dollar is not doing much today either; inching lower to test chart support in the 1.1670s when USDCNH rallied in Asia but then bouncing when USDCNH backed off. Yesterday’s concerns from the IMF about Greece took the bullish wind out of the sails on the EURUSD chart (market gave up the 1.1720s which it broke above), and the stronger than expected Chicago PMI data didn’t help. We think the bulls need the market to regain the 1.17 handle in short order otherwise pressure will mount soon to break support and test the 1.1650s.

-

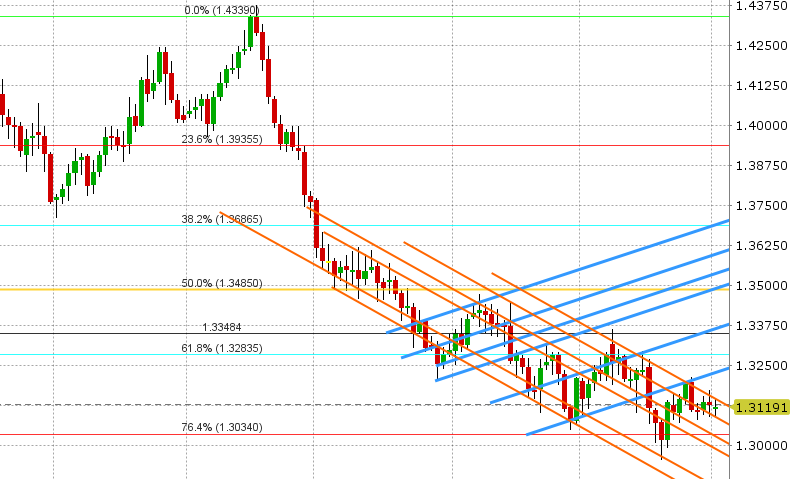

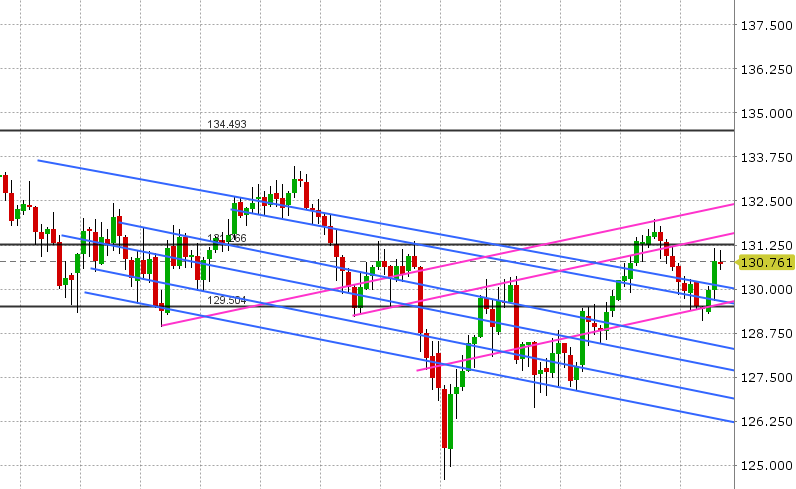

GBPUSD:Sterling continues to range trade, testing the lower bounds of support just below the 1.31 figure on two occasions over the last 24hrs, and bouncing higher in both cases. The slightly weaker than expected Markit manufacturing PMI data for the UK (released at 4:30amET today) was a non-event for markets. The focus for GBP traders remains on the Bank of England’s expected rate hike tomorrow (7amET), followed by Governor Carney’s press conference at 7:30amET. We think a hawkish tilt to the rate hike may likely see resistance in the 1.3160s give way to gains into the 1.32s, while a dovish, “one-and-done” type rate hike will invite the short sellers back in.

-

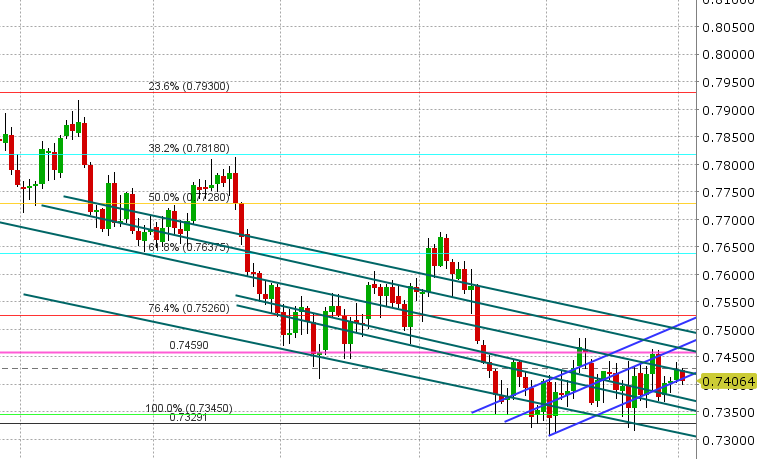

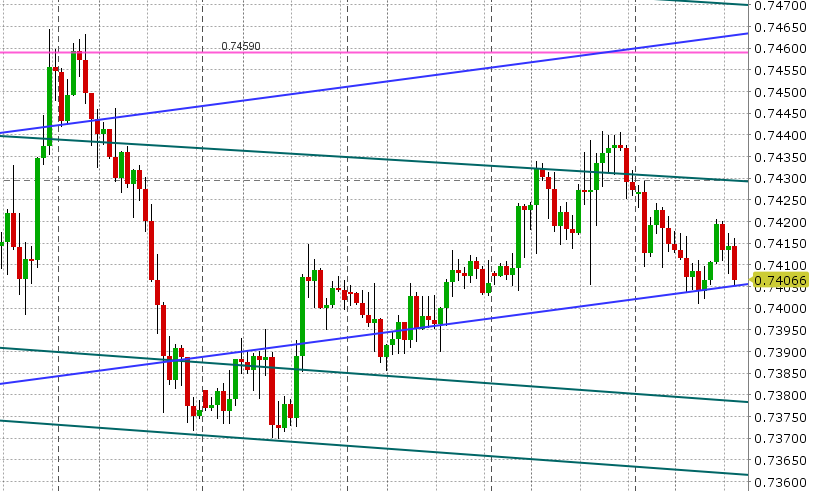

AUDUSD: The Aussie is trading lower today, having failed to close above the key 0.7430 resistance level despite numerous pushes above the level during NY trading yesterday. It appeared broad USD buying against EUR and GBP post Chicago PMI overpowered the positive influence of copper’s strong rally in the 2.83s. Last night’s escalation in US/China trade tensions, and the subsequent USDCNH rally saw AUDUSD pull back, and the collapse in copper prices during European trade today (-2.5%) is not helping. We think AUDUSD hugs support at the 0.7400-0.7405 level today, and possibly breaks below it.

-

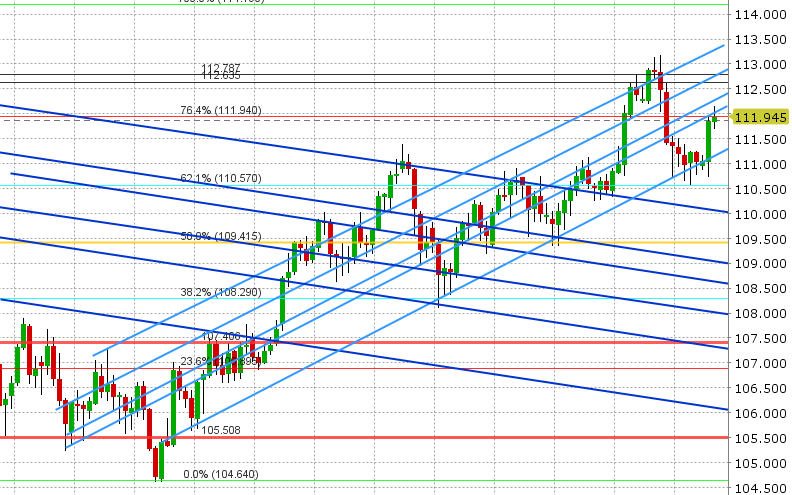

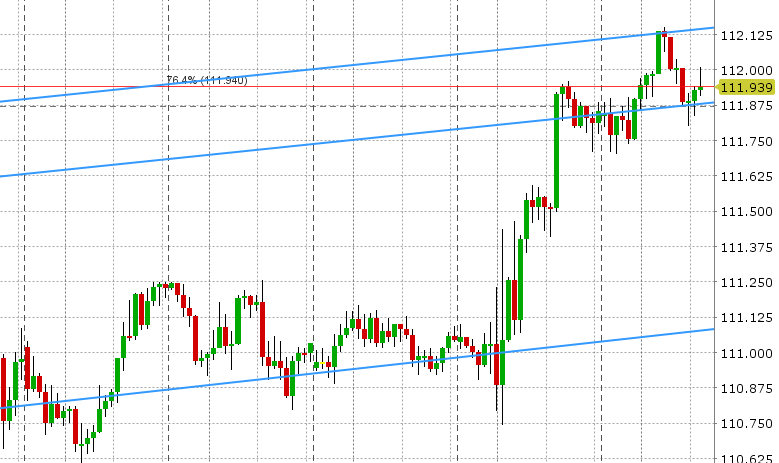

USDJPY:Dollar/yen has stalled out today around the 112 handle after traders pushed the market to the next major resistance level in short order after the dovish BOJ meeting yesterday. Option expiries abound today at the 112.00 strike (as we mentioned yesterday) and so we’re not expected much movement ahead of the Fed. Support today is in the 111.80s, while resistance is 112.15. US 10yr yields have broken above 3% again this morning after the US Treasury announced it will be issuing $78bln in long term debt this quarter vs. $73bln in Q2 (USDJPY positive).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

September Crude Oil Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.