USDCAD recovers on in-line Cdn GDP, metal tariff news and crude oil weakness. EUR bid as Italy finally set to form government + Spain shakes off Rajoy oust. USD broadly bid ahead of US payroll report.

Summary

-

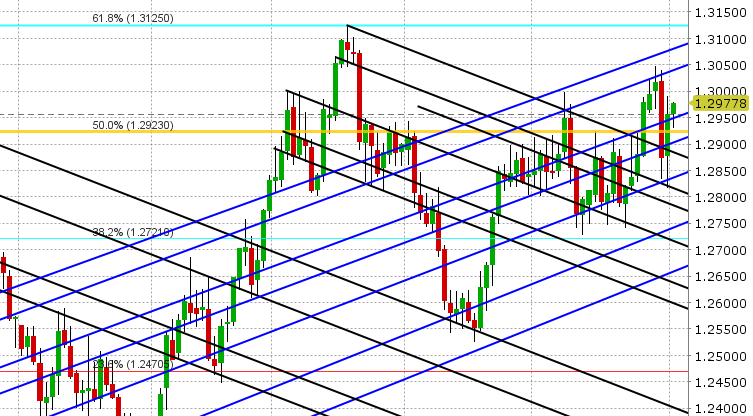

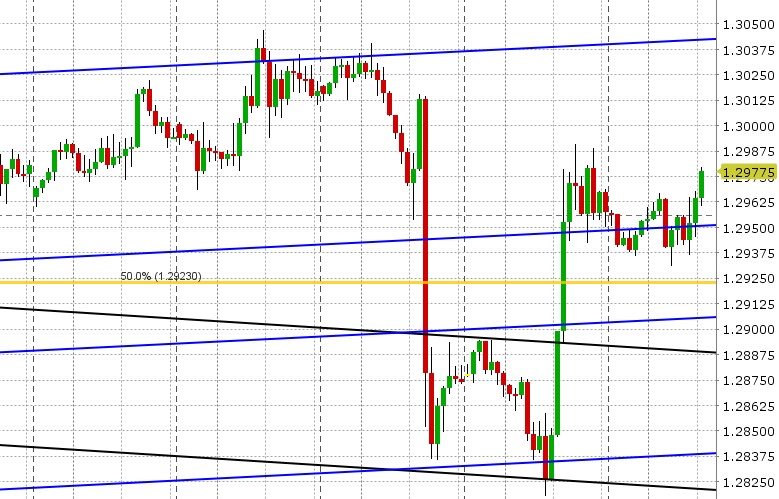

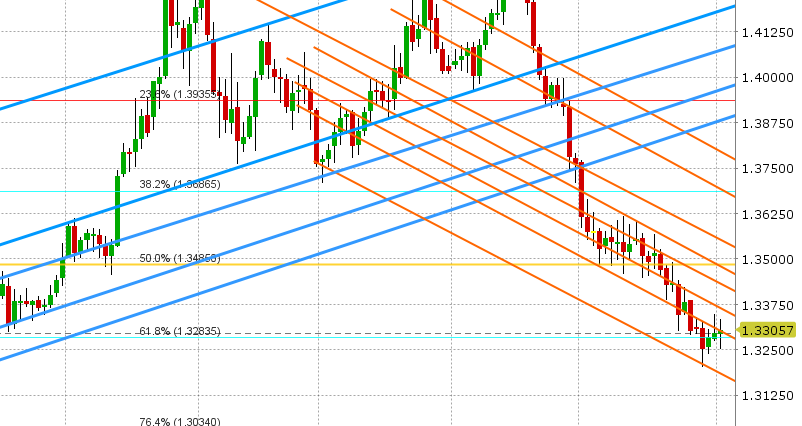

USDCAD: Dollar/CAD is quiet this morning after an headline heavy day yesterday that saw the market retrace half the losses spurred on the Bank of Canada’s hawkish hold to interest rates on Wednesday. Yesterday’s move higher started with an in-line read for Canadian March GDP, which we alluded to being priced into markets. This allowed USDCAD to rally back to resistance in the 1.2890s. Then we got the surprise decision out of the Trump administration regarding metal tariffs on Canada, Mexico and the EU. This combined with a weak NY open for crude oil took USDCAD to the next resistance level in the 1.1940s. The market then waffled around as Canada and Mexico announced retaliatory measures. Crude oil gave up gains and then some despite a larger than expected draw announced in the weekly DOE inventory data. All this combined to give USDCAD a strong NY close. Markets are quiets now however, as is typical before the release of the monthly US employment report (8:30amET). Markets are expecting +190k jobs on the headline for May, 3.9% on the unemployment rate, +2.6% YoY and +0.2% MoM on wage growth. Recall the ADP employment report on Wednesday missed expectations by a bit. The US reports ISM Manufacturing Survey at 10amET. We think USDCAD could easily shoot higher today if the US numbers beat expectations, as there is not much resistance on the charts until the 1.3030s.

-

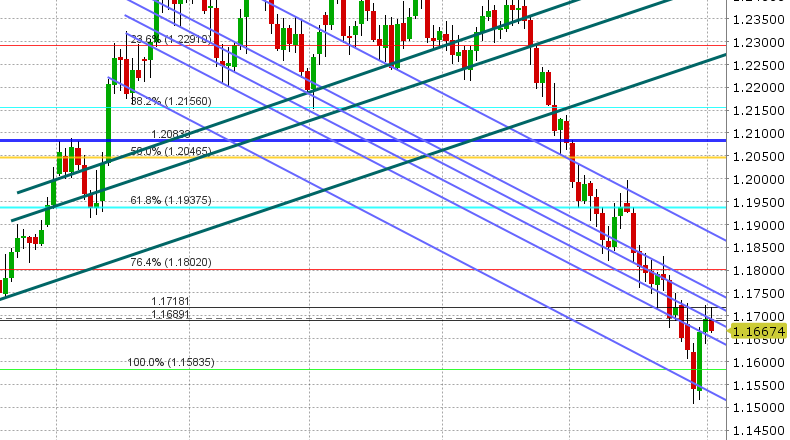

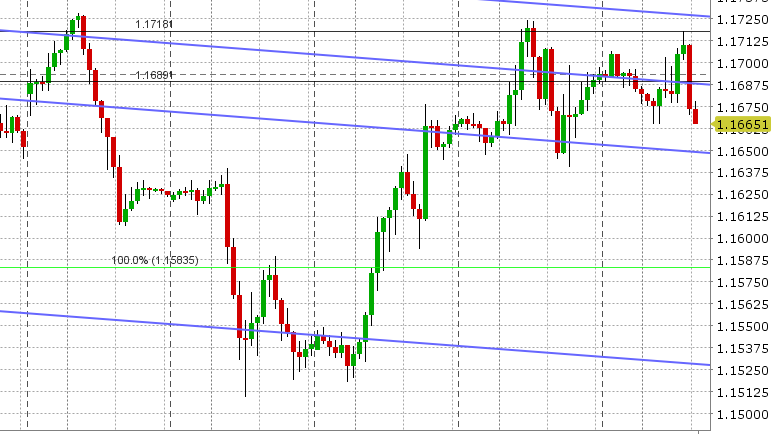

EURUSD: Euro/dollar is flat to bid this morning, following range-bound but eventful session yesterday. The broader risk appetite across markets continues to improve as the Italians finally look set to form a government (expecting to be announced today, with Conte as PM). The controversial Savona has stepped into another cabinet role (EU affairs minister) and the moderate Giovanni Tria will replace him as Italy’s finance/economy minister. Italian 2s have dropped back below 1% and the 10yr BTP/Bund spread has dropped back to +230s. We also learned yesterday that the Italian Treasury bought back 500M EUR of its own bonds this week amid the chaos in the Italian bond market. Rajoy was ousted as Spain’s prime minister today (lost a non-confidence vote), with pro-EU socialist Pedro Sanchez taking his place. Spanish markets are taking this in stride, bidding up both Spanish debt (-15bp) and its stock market (+2%). The big event today for EURUSD traders today is the US jobs report as well. From a technical perspective, the market looks a bit stuck here, with resistance in the 1.1720s and support in the 1.1650s. We have a massive EURUSD option expiry today (almost 5bln+EUR at the 1.1700 strike), so this is likely explains the price action as well. Yesterday’s move from the Trump administration regarding metal tariffs, while surprising, is not bothering EURUSD traders all that much.

-

GBPUSD: Sterling is marginally higher this morning, but this comes after a weak NY close yesterday (market surpassed 1.3280s resistance only to close right back down at it). GBPUSD dipped below the important 1.3280 level overnight but then recovered as the UK PMI data for May beat expectations earlier today (54.4 vs. 53.5). With GBPUSD now trading above downward sloping trend-line resistance at the 1.3300 level and EURGBP firmly rejecting the 0.8800 level earlier, we think sterling can drift higher here. Next up is US payrolls at 8:30am, then ISM at 10amET.

-

AUDUSD: The Aussie did relatively well yesterday considering Wednesday bullish outside day pattern and EURUSD’s buoyancy, but downward sloping technical resistance at the 0.7580 level reasserted itself once again as the tariff headlines starting hitting. Combine this with a weak NY close and lackluster action in copper prices and we’re seeing what looks to be profit taking ahead of the US payrolls report this morning. AUDUSD is currently hugging trend-line support in the 0.7530s.

-

USDJPY: Dollar/yen is leading gains this morning as US yields continue their recovery from Wednesday’s lows and global equities go bid once again. The BoJ reduced the amount of JGBs it buys in its scheduled QE operation today to 430bln JPY vs. 450bln JPY previously, and while USDJPY spiked lower initially in Asia, buyers swooped in and reasserted the 108.70s as support. The BoJ has said previously stated that it wants markets to ignore these scheduled operations because it targets the yield curve with QE, not actual JGB buying amounts. Some more conciliatory tones between North and South Korea today is also helping the tone. USDJPY has extended well above the 109 handle as we write, and we think USDJPY could easily test resistance in the 109.60-90 level today. Watch US yields as usual.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.