Bank of Canada shocks market with hawkish hold on rates. Talk of euro-skeptic Savona being aside helps Italian bonds and EUR. Canada March GDP on deck.

Summary

-

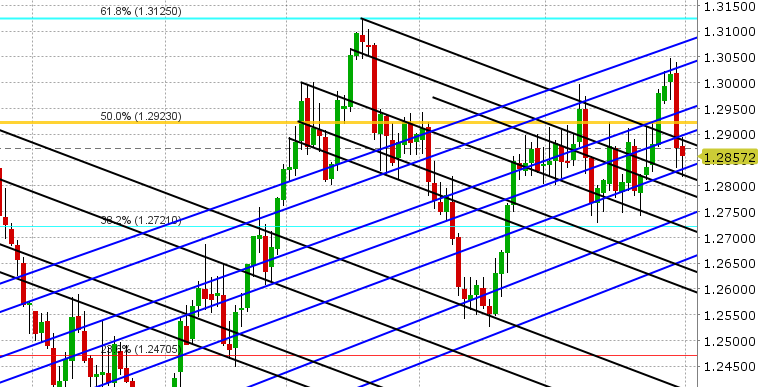

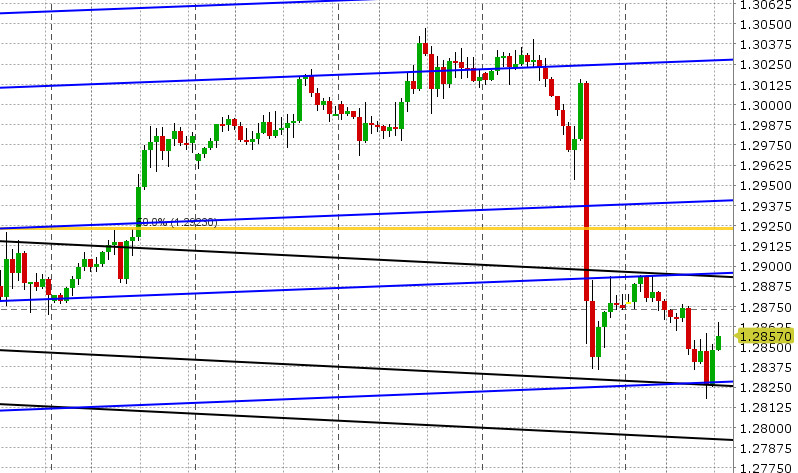

USDCAD: Dollar/CAD longs are licking their wounds this morning after the Bank of Canada shocked markets yesterday with a hawkish hold on interest rates. The central bank kept rates unchanged at 1.25%, but talked positively about Q1 growth and more importantly dropped references to being “cautious” on rates and the need for “monetary policy accommodation”. They also ushered the words “gradual approach” with regard to policy adjustment, which is more a little more directional than their previous rhetoric of “higher interest rates warranted over time”. This sparked a swift move lower in USDCAD and a sharp re-pricing of July rate hike odds in the OIS market (from 30% up to 80%). Key USDCAD support levels in the low 1.29s were blown through, leaving the market scrambling for support as the day wore on. A 2% rally in crude oil following some bullish headlines from OPEC didn’t help the cause (OIL MARKET MOVING TOWARDS BALANCE BUT OPEC, NON-OPEC ALLIES "NOT READY YET TO FULLY LIFT CONTROLS" – RTRS). Some buyers stepped in at the next trend-line support level in the 1.2830s, and the market managed to rebound a little going into the NY close, however the 1.2890s capped (formally support turned resistance). This mediocre close, combined with a bullish NY close for EURUSD and AUDUSD created a negative setup that continued overnight and into early European trading this morning. USDCAD now sits just above trend-line support in the 1.2830s after probing below it briefly in the 6am hour. Canada reports March GDP this morning at 8:30amET (markets are expecting +3.0% YoY and +0.3% MoM). The US reports core PCE at the same time as well (one of the Fed favorite inflation gauges). Markets are expecting +1.8% YoY there and +0.1% MoM. We think USDCAD risks bouncing higher this morning should the Canadian GDP number get reported weaker or even in-line with expectations, as the BoC hinted yesterday at good numbers today (good numbers likely now priced in). After Canadian GDP, traders will be watching the weekly oil inventory data (11amET today) and a speech from BoC deputy governor Sylvain Leduc in Quebec (to see if he tries to explain the Bank of Canada’s change in tone yesterday). Recall there was no press conference yesterday following the Bank of Canada announcement.

-

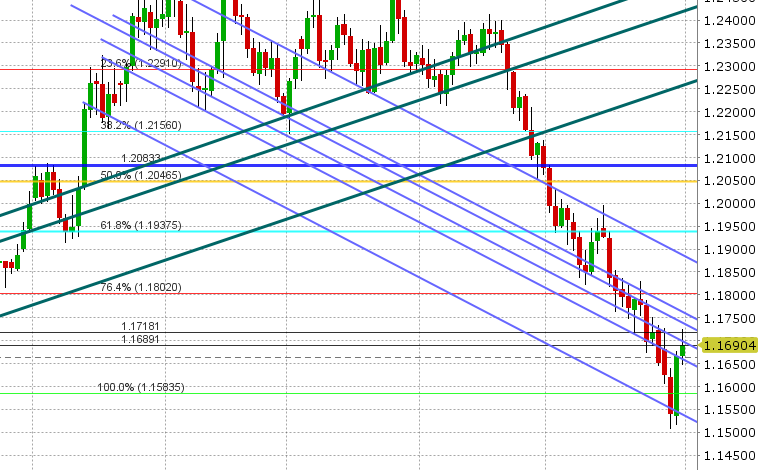

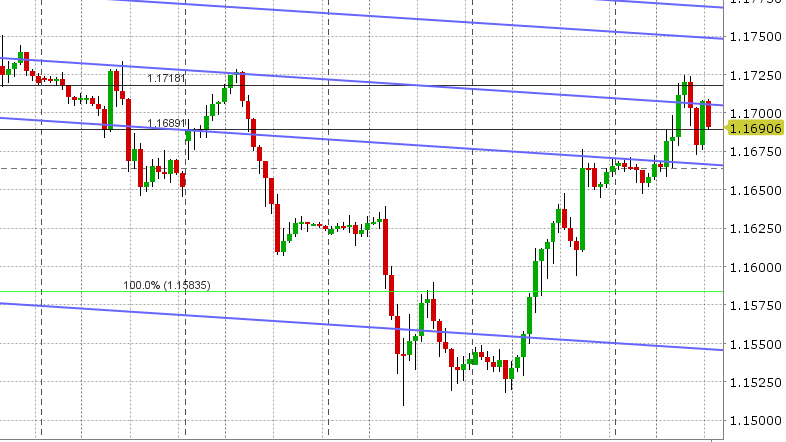

EURUSD: The Euro scored a bullish NY close yesterday, continuing its recovery higher as Italian bond yields dropped further. While a lot still remains in the air regarding the political situation in Italy, there seemed to be a willingness yesterday on the part of Italian politicians to walk back talk of anti-euro sentiment. The 5 and 10yr Italian bond auctions yesterday were not that bad. There also seemed to be some desire from Lega and 5-Star to find some way to work together in an effort to stem off new elections and push the controversial Savona to the side (or at least into another cabinet position). EURUSD spiked higher intra-day following the Savona headlines and with that the market tested key trend-line resistance in the 1.1660s. The market was able to close right at this level, which created the bullish setup we see continuing to play out today. Italian bond (BTP) yields are trading lower again today (as low as 0.79% at one point) following a poll from Euromedia and Piepoli saying 60-72% of Italians want the country to stay in the EU. EURUSD has extended to chart resistance in the 1.1710-20 area, and is now backing off a bit as BTP yields rise a bit again and large option expiries loom for the NY cut at 10am (3blnEUR+ rolling off between the 1.1700 and 1.1720 strikes). We think EURUSD consolidates yesterday’s gains today.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.