US ADP and Cdn GDP beats. Trump speech a yawner. USD broadly weaker led by USDCNH breakdown. FOMC on deck at 2pm.

Summary

-

USDCAD: President Trump’s first State of the Union speech came and went last night without much substance for markets. He asked Congress for a $1.5 trillion infrastructure plan (which lacked detail) and he barely talked about trade, and so the markets largely shrugged off the speech. Attention shifted quickly overnight to the Chinese Yuan (USDCNH), which plunged below 6.30. This has caused broad USD weakness across the board. Some traders are also talking about month-end flows potentially chasing the move lower in USD today, and so today’s London fix (11amET) could be interesting. USDCAD has cracked through crucial trend-line support (1.2315) on this broad USD selloff (which is bearish). This now opens the door to even lower prices in our opinion, unless the market can muster a quick recovery today. EURCAD has been quiet so far today while GBPCAD is adding a little pressure here. The Canadian Nov GDP figures were just released, beating estimates slightly (+3.5% YoY vs. +3.4% expected) – USDCAD bearish. We also get Chicago PMI at 9:45am and of course, the FOMC meeting at 2pm today. The markets aren’t expecting much at all from the Fed today as it’s Janet Yellen’s last meeting and odds are she won’t rock the boat. Markets are expecting the Fed to make its first interest hike of 2018 at the March meeting.

-

AUDUSD: The market finally received some Australian data last night in the form of CPI (released quarterly), and it came in slightly less than expected (+1.9% YoY in Q4 2017 vs +2.0% expected). AUDUSD sold off a bit, but the market found support again at the top end of the 0.8030-0.8050 support region. The market recovered further through Trump’s speech as there was no tough talk on trade concerning China, and extended further as USDCNH fell apart. Today’s candle is shaping up to be another positive one because, sure enough, we’re trading right back above the 0.8080s as we write; a level which we’ve been saying is important for bulls. Resistance today is 0.8110-0.8120, then 0.8136 (Friday’s high). With the softer than expected Australian CPI just reported, we’re hearing some analysts are pushing back expectations for the RBA’s first rate hike to early 2019. In other words, no hawkish changes expected at next week’s RBA meeting on Feb 6th. Copper is having a decent day, up almost 1% after yesterday’s intra-day recovery (AUDUSD supportive).

-

EURUSD: We said yesterday’s close on EURUSD would be key, and while the market didn’t manage to close above the 1.2430s by 5pm, it regained the level very easily and then some overnight as USDCNH broke down. Market chatter continues about today’s widely reported massive option expiry at 1.2500 (we talked about it yesterday). After these options roll off at 10am, we’re hearing talk of month end demand for EURs into the London fix (11amET), then of course we get the FOMC meeting. Momentum is on the side of EURUSD bulls at this hour, but we’d reiterate again how important it is for the 1.2430s to hold. A close below this level would invite some profit taking in our opinion, which could lead prices back into the upper 1.23s. There is not much chart resistance above head at this point and USDCNH is struggling to find support (EURUSD supportive). A firm bounce higher today from EURGBP, after yesterday’s bearish engulfing candle, is helping EURUSD. So too is EURJPY, as it continues its recovery higher for the 2nd day in a row. Today’s positive German employment report (new low in the unemployment rate) and the in-line read on Jan Eurozone CPI (+1.3% YoY) were not market movers overnight, but the data is a nice backdrop for EURUSD bulls.

-

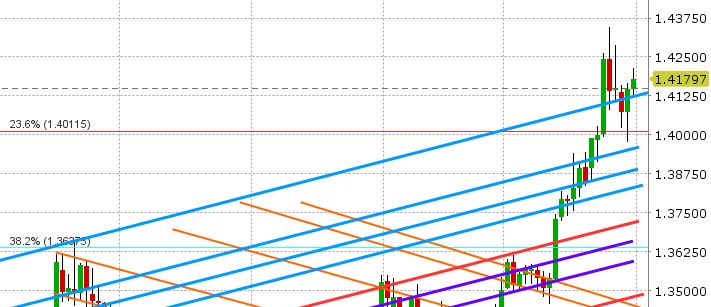

GBPUSD: Sterling had a very positive close yesterday (bullish engulfing candle), and while it benefited further from the broad resumption of USD selling in early European trading, it got whacked around the 4am hour on reports of large EURGBP purchases coming in at month end. However, GBPUSD has still managed to stay above important, upward sloping, trend-line support, which today checks in 1.4120-1.4125. Resistance is at today’s European highs (1.4210-1.4220).

-

USDJPY: Dollar/yen continues to struggle as traders hug a couple trend-line support levels in the 108.70-90 level. There’s been movement slightly above and below this area so far this week, but nothing notable. Broad based JPY selling is prominent again today, but it’s not helping USDJPY much as it continues to want to trade off the broader USD theme. The better than expected Jan ADP jobs report just released (+234k vs. +185k expected) is helping USDJPY a bit here, but we really need a firm close above 109.25 at this point to arrest the downward momentum. The BOJ made a bit of a statement last night (in response to JGB yields ticking above 0.1%) by buying more JGBs yesterday than it normally does in the 3-5yr sector. This boosted USDJPY only temporarily. Reuters is reporting $1.6bln+ in option expiries today between 109.10 and 109.30. Support today continues to be 108.70-108.90.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

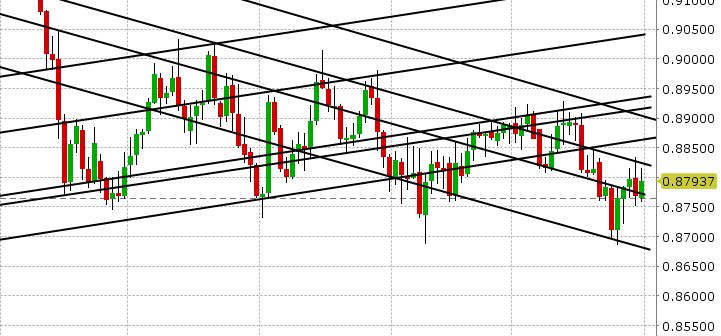

EUR/GBP Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.