Month-end USD demand noted yesterday. FOMC gives market slightly hawkish hold on rates. US ISM on deck and US NFPs tomorrow.

Summary

-

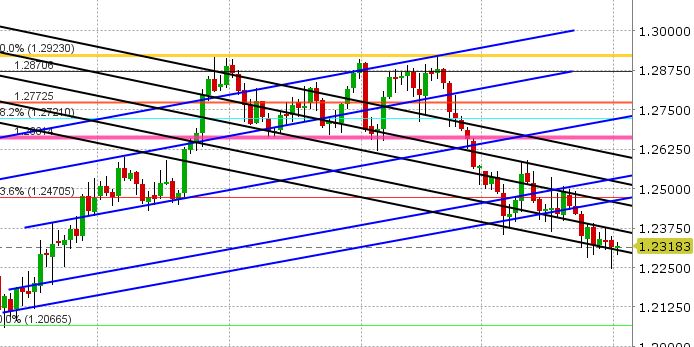

USDCAD: Month-end USD demand was evident leading up to the London fix yesterday (11amET). This theme rescued USDCAD, bringing the pair quickly back above the important trend-line support level we’ve been talking about (1.2315). Later on, the FOMC kept rates unchanged (which was widely expected), but they inserted the word “further” into their statement, which wasn’t in there last time around. “The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,". The market chatter we’ve been hearing since the announcement suggests that this was a slightly hawkish (USD positive) hold from the Fed, and increases the odds of four rate hikes in 2018 as opposed to three. All that being said, FX markets didn’t react much to the FOMC. The broader USD held its post London-fix bid, for the most part, going into the NY close. USDCAD is currently trading marginally above trend-line support (which is positive considering yesterday’s turn-around), but it doesn’t have much momentum behind it as the broader USD is trading mixed so far today (higher against AUD and JPY, but lower against EUR and GBP). Plus we have a couple of big US headlines on deck (US Jan ISM at 10am and US non-farm payrolls at 8:30amET tomorrow). EURCAD and GBPCAD cross demand is helping USDCAD this morning. US/CA 2s remain firm at +31bp at this hour.

-

AUDUSD: The wave of USD buying into the London fix yesterday took a big dent out of the Aussie rally. The 0.8080s gave way easily and we went straight down to test support in the 0.8030-0.8050 region. This area held post FOMC, but it gave way overnight after an awful print on Australian Dec Building Approvals (-5.5% YoY vs +11.5% expected). AUDUSD has fallen all the way back to trend-line support in the 0.7990-0.8000 level. This support level is holding for now. If it breaks, the next support level is 0.7960-0.7970. Resistance is now 0.8030-0.8050 (yesterday’s support). Copper is steady today, and not providing much influence. A reminder that the RBA meets to announce monetary policy on Tuesday next week.

-

EURUSD: The Euro slumped into the London fix yesterday as well. We saw further selling into the upper 1.23s when the 1.2430s gave way, and while the FOMC announcement didn’t do much to repair the technical chart damage, we’ve seen a fresh round of EURUSD buying come in as Europe got going today. With that, the market is now comfortably back above the 1.2430s (trend-line support), keeping the bulls in charge. There hasn’t been much in the way of EUR specific news today, aside from some decent PMIs from Italy, France, Germany and the broader Eurozone. Traders will now focus on today’s US ISM numbers and tomorrow’s NFP report. USDCNH has stalled today, after regaining 6.30 late yesterday. Given recent correlations, we would not be surprised if EURUSD stalls at some point today as well. Option expiries could be a negative influence today going into 10am with over 4.4bln EUR going off between 1.2400 and 1.2425, but we don’t see this happening unless the 1.2430s give way in the next hour. EURGBP has completely given up its brief pop from month-end flows, and is now trading back below trend-line support in the 0.8770s (EURUSD negative). EURJPY, on the other hand, continues roaring higher, now back above 136.50 (close to recent highs). This has probably been the biggest influence on EURUSD today.

-

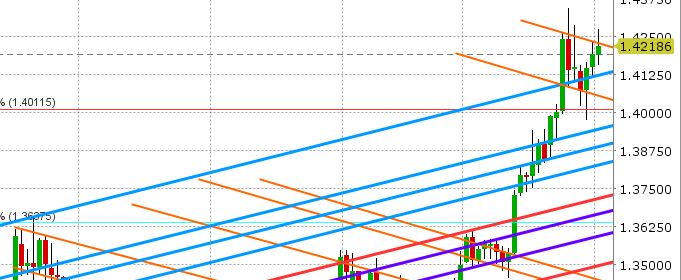

GBPUSD: Sterling had a mixed session yesterday, and had a rather muted response to both the month end USD demand and the slightly hawkish hold from the FOMC. Combine that with the fact that GBPUSD closed comfortably above trend-line support in the 1.4120s, and traders felt comfortable taking prices higher overnight. GBPUSD failed however at 1.4250-1.4260 (Friday’s highs) earlier, and has since pulled back, and it’s currently testing the upper end of yesterday’s NY range (which is a bit negative). We think today could potentially be mixed to lower for GBPUSD if EURGBP recovers and the broader USD goes range-bound ahead of the NFPs tomorrow.

-

USDJPY: Dollar-yen benefitted handsomely from the month end USD demand into the London fix yesterday. The market punched through chart resistance at 109.25, and while it wobbled around post FOMC, it managed to close right at this resistance level (which given recent price action is pretty positive). The positive momentum continued overnight, led by broad JPY selling and rising US yields. Global equities are taking some heat over the last hour, and this is starting to chip away at the USDJPY gains for the day. USDJPY also ran into horizontal and trend-line chart resistance at 109.70 over the last hour, which didn’t help. Support today in USDJPY checks in at 109.25-109.35.

The EBC Trading Desk is now on Twitter @EBCTradeDesk. Stay tuned for real-time news, commentary and analysis throughout the trading day!

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

EUR/GBP Chart

USD/CNH Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.