USDCAD technical structure reverses quickly. EUR bid on hawkishness leading up to ECB meeting next week. AUD bid following Australian GDP, but not benefitting from copper breakout.

Summary

-

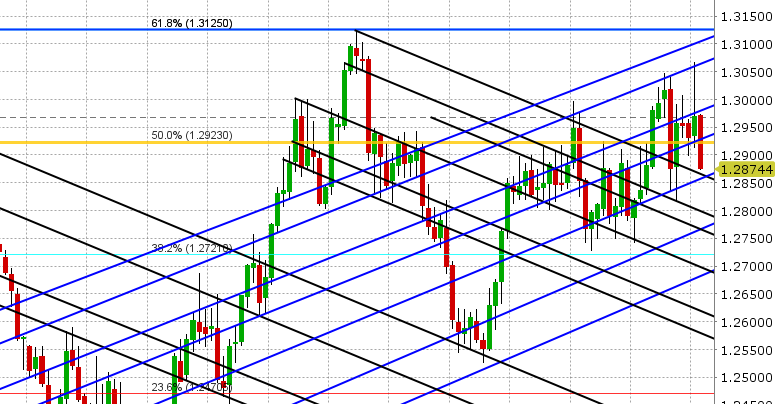

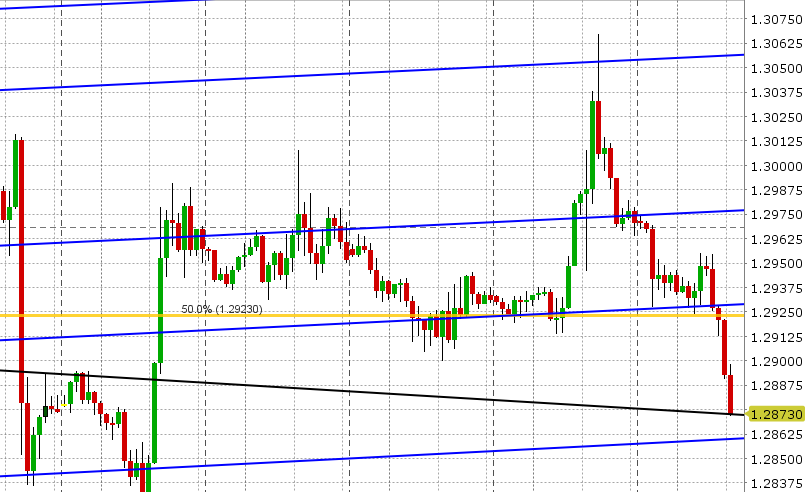

USDCAD: Dollar/CAD is entering NY trading this morning with a decidedly more bearish technical setup compared to yesterday morning. The rally coming into yesterday’s session picked up steam further after the NAFTA comments from Kudlow and extended even further after the beat on US Services ISM, but a near term technical objective was achieved in very short order when USDCAD vaulted to 1.3030-1.3050 (the next trend-line resistance level). Traders quickly took profits and when crude oil bounced and EURUSD spiked higher following a hawkish report from Bloomberg regarding the ECB meeting next week, that profit taking turned into a rush for the exits that continued all the way into the NY close. Asian trading last night got off to a rough start as well. Yesterday’s NY close was not positive technically (back below trend-line support at 1.2975), and then we got the story from ABC News about Treasury secretary Mnuchin urging Trump to exempt Canada from tariffs. This took the floor out from USDCAD again and the market quickly dropped to the next support level, which was the 1.2920s. We saw some buyers step in during early European trade this morning, but the market has now broken support as EURUSD has resumed its short covering rally today. Today’s calendar features Canadian and US Trade figures, plus and Canadian Building Permits at 8:30amET. Then we get the weekly oil inventory data from the Department of Energy (DOEs) at 10:30amET. We think USDCAD remains on the defensive today so long as we stay below the 1.2920s. The next trend-line support level (1.2860-70s) has just been tested ahead of the 8:30am headlines.

-

EURUSD: Euro/dollar is enjoying another bout of short covering this morning after a slew of hawkish comments from ECB members today (Knot, Praet, Hansson and Weidmann). This follows yesterday’s swift reversal higher following a Bloomberg article citing ECB sources that see next week’s ECB meeting as a “live” meeting to debate QE exit. These hawkish comments also come a day ahead of the ECB’s blackout period going into monetary policy meetings, so the markets are now quickly starting to price in an upbeat ECB when the committee meets next Thursday June 14. EURUSD finally broke free of chart resistance in the 1.1720-40 level earlier today and now looks poised to test resistance in the 1.1800-1.1820 area. EURJPY has been an positive influence today as it explodes higher towards the 130 handle and works on a major weekly reversal. USDCNH finally losing support in the 6.39s is also lending support to EURUSD. We think EURUSD drifts higher, but may still be sensitive to declines in Italian stocks and bonds. Over 3blnEUR notional in options expire at the 1.1800 strike this morning.

-

GBPUSD: It’s been a relatively uneventful overnight session for sterling, but the market is drifting higher following a bullish NY close yesterday. It’s been all about EURUSD in the last 24hrs given the absence of major UK specific headlines. With GBPUSD now trading above trend-line resistance in the 1.3410-15 level, we think traders will be eyeing the next resistance level at 1.3450. The only problem now is today’s move is choppy and lacking momentum and EURGBP has regained the 0.8760s (which is dragging down GBP relative to EUR). Be on the lookout for sellers should support (1.3410) give way. There haven’t been any notable Brexit negotiation headlines to note yet this week.

-

AUDUSD: The Aussie has resumed its recent rally today following a beat for Q1 Australian GDP last night (3.1% YoY vs +2.8% expected). AUDUSD regained its composure following a weak NY close and up-ticked through chart resistance in the 0.7620s following the number. We now sit sandwiched between horizontal support in the 0.7640-50 level and downward sloping trend-line resistance in the 0.7660s. The explosion higher in copper prices yesterday and the further 1.2% gain today is having very little influence on AUD, which is bit concerning given recent correlations. Copper rallied over 2.5% higher yesterday’s following a blast at an iron ore mine in China and ongoing disruptions at the Escondida copper mine in Chile. We think AUDUSD follows EURUSD today until the Australian Trade Balance figures (to be announced later tonight at 9:30pmET).

-

USDJPY: Dollar/yen has broken higher this morning, following a rather quiet session yesterday. This comes as global equities and US yields ticked higher overnight. Chart resistance in the 109.80s has now given way, which clears a path to the 110.50s now in our opinion.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.