USDCAD resumes rally as AUD gives up gains post RBA and oil declines post Trump request to OPEC. UK Services PMI rescues GBP. Trump now considering bilateral talks with Canada and Mexico.

Summary

-

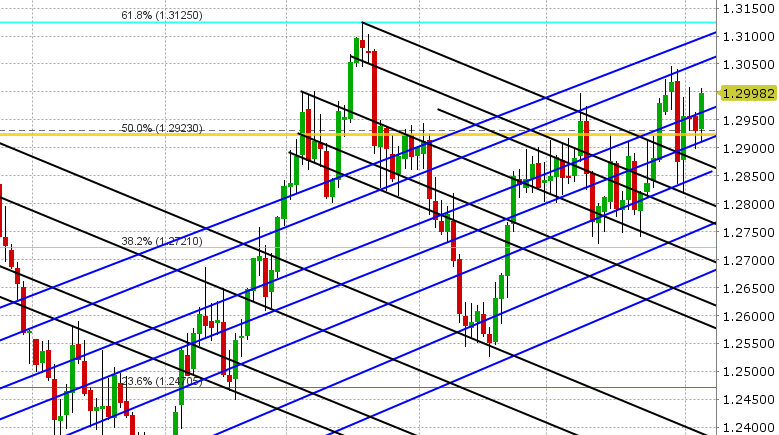

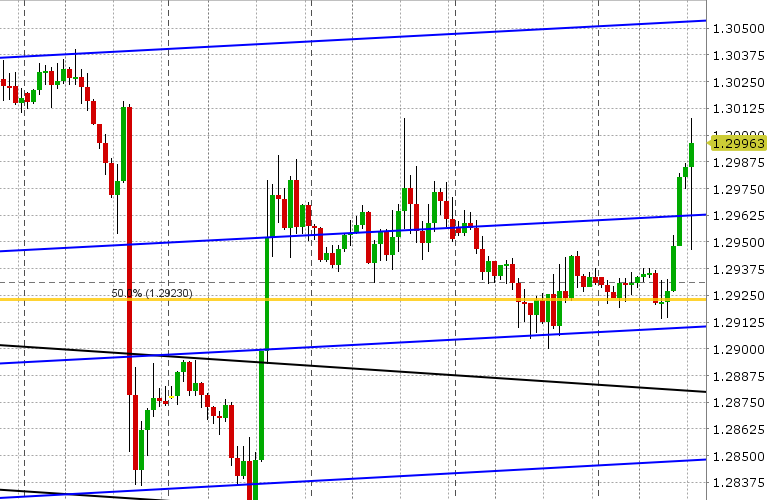

USDCAD: Dollar/CAD is up strongly this morning on a combination of AUD weakness, CAD cross demand and another drop in crude oil prices. The AUD weakness comes after an lackluster RBA meeting last night. Demand for EURCAD and GBPCAD entered the fray as the crosses broke through chart resistance of 1.5140 and 1.7280 respectively. Finally, we’re seeing weakness in oil again this morning after the US has quietly asked Saudi Arabia and some other OPEC producers to increase production by 1mln barrels per day. If you recall, OPEC hinted at a supply increase a few weeks ago to deal with over-compliance on agreed cuts, then walked back the rhetoric a little bit, and now it appears we have pressure from a Trump administration that is concerned about US gas prices. All this has allowed USDCAD to vault off chart support in the 1.2910-25 area and surpass resistance in the 1.2960s. This now opens the door for the 1.3030-40 level again in our opinion, so long as we stay above the 1.2960s. Today’s North American calendar features the US Services ISM at 10amET (markets expecting +57.5). Just as we finish typing, US economic advisor Kudlow said Trump is seriously considering shifting NAFTA negotiations into bilateral talks with Canada and Mexico. USDCAD has spiked lower and then reversed higher, while the Mexican peso is now plunging lower.

-

EURUSD: Euro/dollar is trading with a range-bound pattern so far today, which is not surprising after the market failed to overcome the 1.1720-40 resistance zone yesterday. We’ve settled back in around the 1.1680-1.1700 area where some option expiries lie today. The new Italian PM Conte was speaking earlier (more here: https://www.usnews.com/news/world/articles/2018-06-05/highlights-italian-prime-minister-giuseppe-contes-inaugural-speech, and while we’ve seen some selling in BTPs and Italian stocks as he spoke, it hasn’t been major. USDCNH rebounded back over a key trend-line support level in early London trade and we think this is weighing on EURUSD here a bit too. We expect EURUSD to remain directionless until either the 1.1670s give way to the downside or the 1.1720 give way to the upside. We have also learned from S&P that Spain’s new government will have no immediate impact on the country’s credit rating.

-

GBPUSD: Sterling has had a volatile 24hrs. We were drifting higher to the next resistance level early yesterday only to have the market completely fall apart when the 1.3360s gave way. It was a bit of a head scratcher given the lack of headlines and left GBPUSD in rough shape going into the NY close. The UK Services PMI came to the rescue early this morning however (reported 54.0 vs. 53.0 expected) and with that GBPUSD has rallied right back above trend-line resistance, which today slopes down into the 1.3340s. The BoE’s Jon Cunliffe also spoke earlier, but his comments were not noteworthy for markets. We think GBPUSD trades with an range-bound to higher tone today as EURUSD waffles around and EURGBP presses support in the 0.8730s.

-

AUDUSD: The Aussie is slumping back down this morning after a rather lackluster hold on interest rates from the Reserve Bank of Australia last night. The tone of the press release was balanced but certainly not exciting if you’re an AUD bull, and so it’s not surprising to see AUDUSD back down in the low 76s. More here: http://www.rba.gov.au/media-releases/2018/mr-18-14.html. Support today checks in at 0.7600. Resistance is 0.7625-35, then 0.7650. Australia reports Q1 GDP tonight at 9:30pmET (markets expecting +2.7-2.8% YoY and +0.8-0.9% QoQ). Copper is extending yesterday’s gains and now looks poised to attack the 3.15 level it couldn’t breach two weeks ago.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

July Copper Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.