USD starts the week with a mixed tone

Summary

-

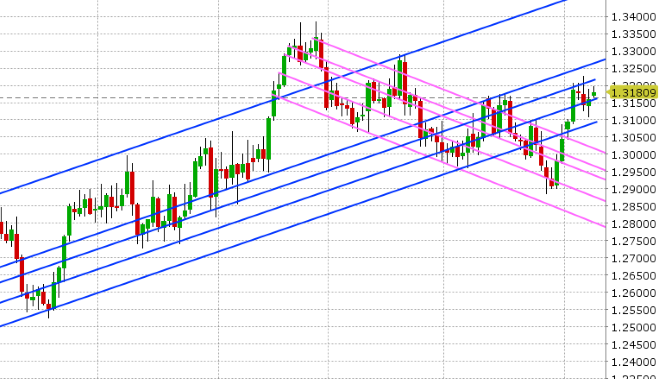

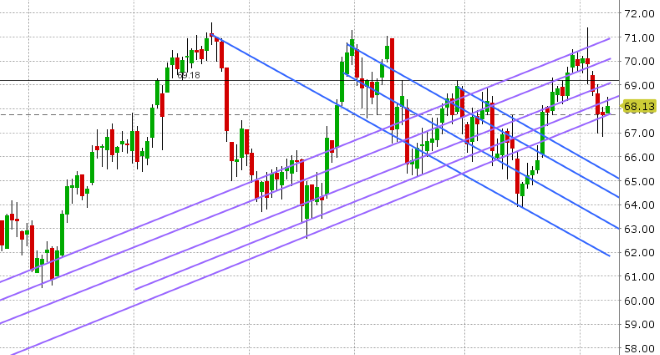

USDCAD: Dollar/CAD is starting the week with a range-bound tone after Friday’s strong US and weak Canadian employment reports lifted the market back above trend-line support in the 1.3150s. The broader USD is trading mixed so far today, the CAD crosses are bid, and October crude oil is bid after the market was able to regain the 67.70s in late NY trade on Friday. This week’s calendar features Canadian Housing Starts (Tuesday), US PPI and the Fed’s Beige Book (Wednesday), US CPI (Thursday) and US Retail Sales/BoC’s Review (Friday). The funds added marginally to their net long USD (short CAD) position during the week ending Sep 4th. We think USDCAD range trades here near-term until we get a break of the 1.3150-1.3215 channel.

-

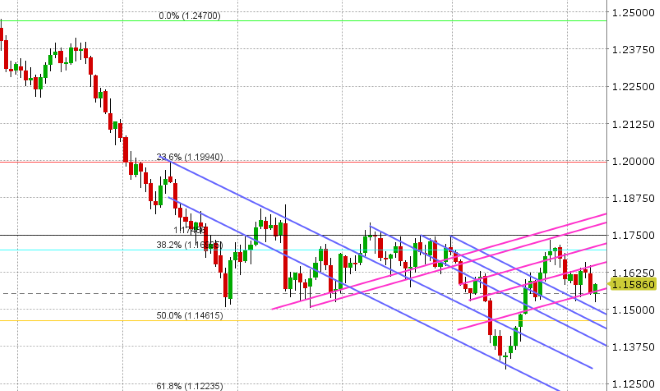

EURUSD: Euro/dollar is entering NY trading this morning with a bid tone, but this was after probing below and bouncing back above trend-line support in the 1.1550s during overnight trade. An rally in Italian assets this morning appears to be driver in an otherwise quiet tape. Italian stocks are up almost 2%, the 10yr BTP/Bund spread has contracted to +235bp and the Italian 2yr yield is trading at its lowest level in over a month. The net fund position flipped back to net long EUR (short USD) during the week ending Sep 4th, as shorts covered. This week’s calendar features the German ZEW survey (tomorrow), Eurozone Industrial Production (Wednesday), German CPI and finally the ECB meeting (both on Thursday). While EURUSD looks in better shape this morning on the charts compared to late Friday, we’d be wary of large options expiries at the 1.1500 strike over the next 24hrs as possibly exerting downside influence (2.2blnEUR+ today and almost another 2blnEUR tomorrow).

-

GBPUSD: Sterling is trading with a flat tone to start the week, after Friday’s Brexit related pop and NFP driven decline leaves traders a bit undecided. GBPUSD tested support at 1.2900 overnight, and bounced off the level when EURUSD bounced. Then we got some UK data, which was mixed on net (weaker than expected manufacturing/industrial production figures for July but better than expected Juyl GDP numbers). This week’s calendar features the UK employment (tomorrow) and the Bank of England monetary policy meeting on Thursday (no change to interest rates expected). We’re also hearing talk this morning that Theresa May will hold a cabinet meeting on Thursday to discuss preparations for a no-deal Brexit. The EU’s Barnier has been given a mandate to strike a Brexit deal at the upcoming Salzburg summit (Sep 20). The fund net short GBP (long USD) position contracted slightly in the week ending Sep 4th as shorts covered and longs added. While we think GBPUSD trades range-bound here until we get a catalyst to break us out of 1.2900-1.3030, we still think the entrenched short position is looking increasingly vulnerable to positive Brexit headlines. JUST CROSSING: EU'S BARNIER: GETTING BREXIT DEAL IS `REALISTIC' IN 6-8 WEEKS

-

AUDUSD: The Aussie is starting the week with a light bid, but this comes after Friday’s plunge lower. The stronger than expected US jobs numbers and the escalation of trade war rhetoric from Trump on Friday afternoon was just too much for those traders looking for a bounce. Fibo chart support in the 0.7150s (which held for most of last week) finally gave way and we’ve now ventured into levels on the chart not seen since early 2016. Support is 0.7100, then 0.7050. The funds piled into an almost equal amount of new long and short positions during the week ending Sep 4th, leaving the net short AUD (long USD) position unchanged. We think a combination of weak technicals, divergent US/Australian monetary policy and the lack of progress on US/China trade negotiations will keep AUDUSD on the backfoot near term. This week’s Australian calendar features the Westpac Consumer Confidence numbers on Tuesday night ET, and the August employment report on Wednesday night ET.

-

USDJPY: Dollar/yen is entering NY trade this morning with a slight bid, edged on by a upbeat tone to global equities so far today. Friday’s better than expected US payrolls number helped the market recover to an upward sloping trend-line level in the low 111s that now acts a resistance. The funds added marginally to their net long USD (short JPY) position in the week ending Sep 4th as shorts liquidated and longs added. We think USDJPY can drift higher here, with tomorrow’s large option expiry at 111.25 (1.5blnUSD) and positive technicals for US equities/US yields as supportive factors.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

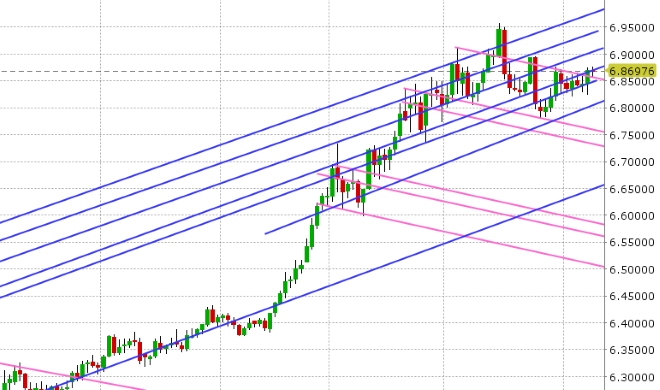

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

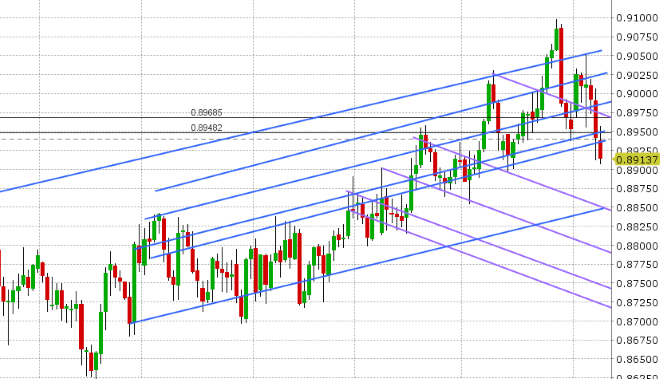

EUR/GBP Daily Chart

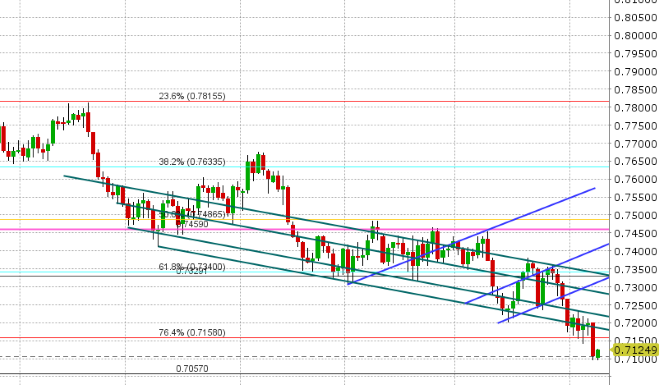

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

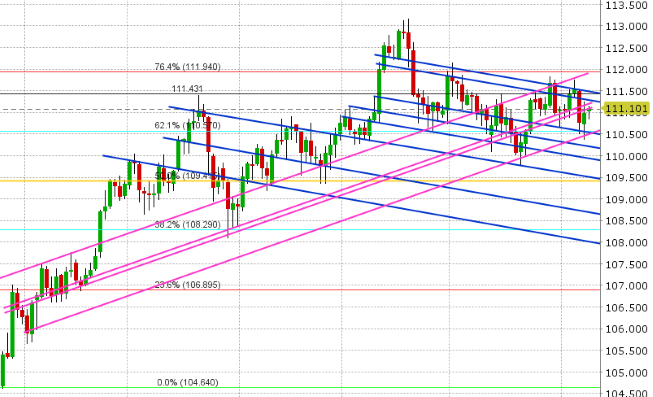

USD/JPY Daily Chart

USD/JPY Hourly Chart

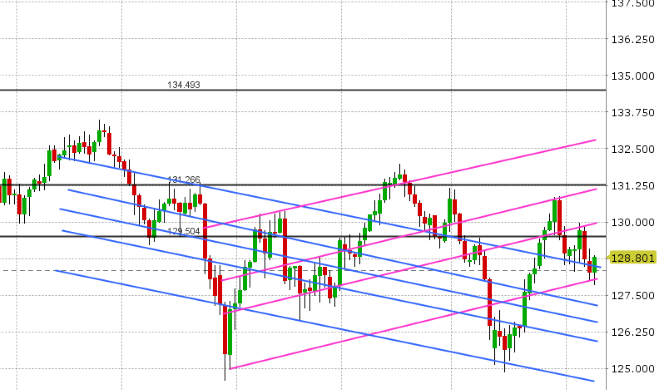

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.