It's jobs Friday!

Summary

-

USDCAD: Dollar/CAD enters NY trade this morning with an offered tone after the BoC’s Wilkins said the central bank debated dropping “gradual approach” to rate hikes at its most recent meeting on Wednesday. This hawkish sounding headline knocked USDCAD lower into trend-line support at the 1.3140-50s, solidified a bearish outside day pattern on the daily chart, and is now setting the tone ahead of the August employment reports for both the US and Canada. Traders are expecting +191k jobs in the US last month, +2.7% YoY and +0.2% MoM growth on wages, and 3.8% on the unemployment rate. The expectation for the Canadian numbers are +5k jobs, +3.0% YoY growth in wages, and 5.9% on the unemployment rate. Expect a test of the 1.32 level should we get a strong US/weak Canadian result, and conversely a move into 1.3050-80 should we get a weak US/strong Canadian result. A large option expiry looms today as well at the 1.3100 strike (1.1blnUSD). There are still no major developments on NAFTA negotiations this week, but talks will continue today and Trump had some positive comments during a rally in Montana last night.

-

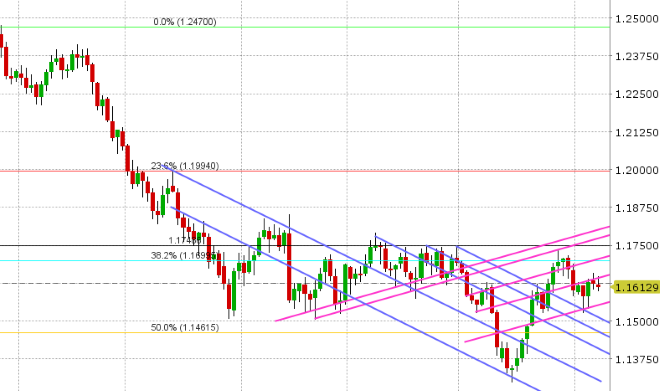

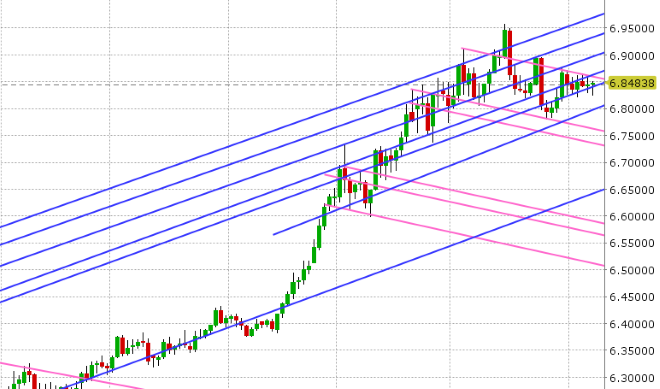

EURUSD: Euro/dollar traders failed to make much progress yesterday, chopping the market above and below a key upward sloping trend-line level (which today comes in at 1.1640). Overnight we saw a small wave of EM FX led, USD selling come in around the 2am hour, and an attempt to move above 1.1640 in EURUSD, but the move was short lived and EURUSD now trades with a negative tone ahead of the US jobs report. The German Industrial Production figures disappointed today (coming in at -1.1% MoM in July vs +0.2% expected), and sort of helps to explain why EURUSD hasn’t benefited from the GBP move higher on the latest Brexit headline. Traders are also just digesting dovish comments from the ECB’s Couere, who said “there are mounting risks surrounding the Euro area”. USDCNH continues to coil in what now appears to be a triangular consolidation that may resolve itself to the upside (break above 6.87 would be needed to confirm). We think EURUSD is looking vulnerable here to a positive US jobs report.

-

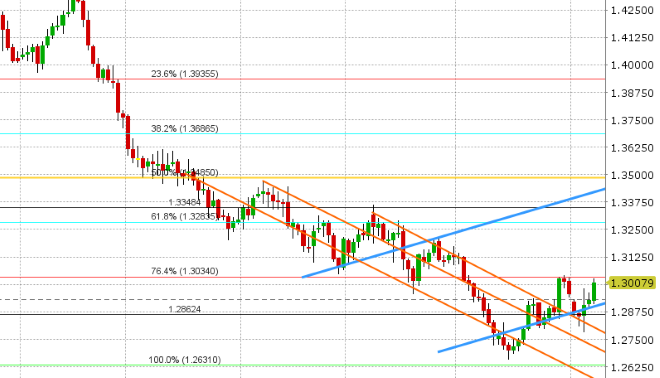

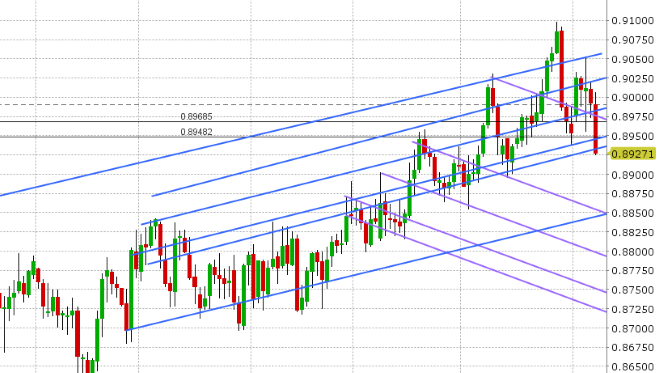

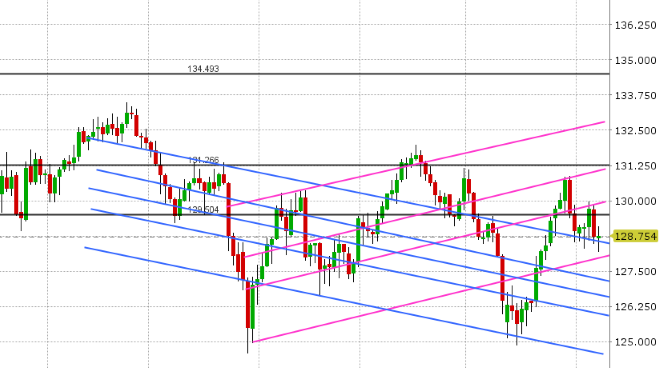

GBPUSD: Sterling is leading gains in the G10 FX space this morning after some positive Brexit headlines crossed from the EU’s Barnier. It reads : BARNIER: OPEN TO `OTHER BACKSTOPS' FOR IRISH BORDER, WE AR READY TO SIMPLIFY THESE CHECKS. With that, GBPUSD has extended the week’s gains into last week’s resistance level around 1.3020-30 level. EURGBP has plunged lower on the headlines, and is grappling for support in the 0.8920s. We're seeing a bit of a reversal as the US jobs report looms. Sterling could potentially have a very wide range today, with sporadic chart support at 1.2900, then 1.2860, then 1.2800. Resistance is 1.3030s, but there’s very little above that level right now. We’ll get an updated read on the fund short position later today from the CFTC.

-

AUDUSD: The Aussie couldn’t make progress above the 0.7200 level yesterday. The market meandered around like EURUSD and ultimately gave up its upward momentum when the 0.7190s broke to the downside overnight. Fibo chart support in the 0.7150s appears to be the line in the sand this morning, with traders pushing the market above and below it numerous times. Copper saw a wave of selling in Asia, but the negative momentum has stalled with the bounce back above the 2.6250s, basis December futures. We think AUDUSD follows the broader USDs response to the US employment figures.

-

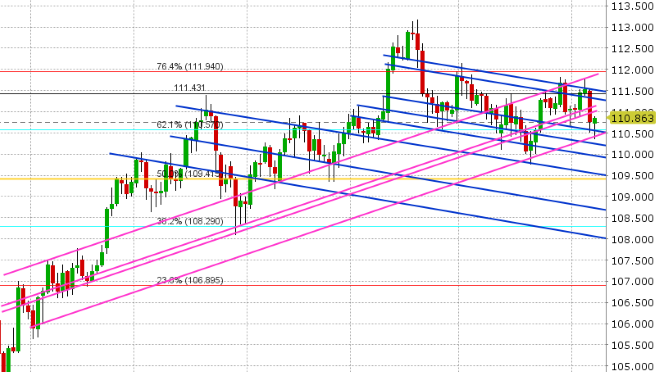

USDJPY: Dollar/yen is bouncing a bit this morning after a combination of downside option expiries and US equity market weakness smashed the market down through support levels yesterday. Trend-line support in the 110.30-50s finally held the line overnight, and the market is now wandering back to the 111 level with close to 1blnUSD in options expire today. Another 1.3blnUSD goes off at 111.40 as well. Expect these levels to be tested should we get a good US jobs figure.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

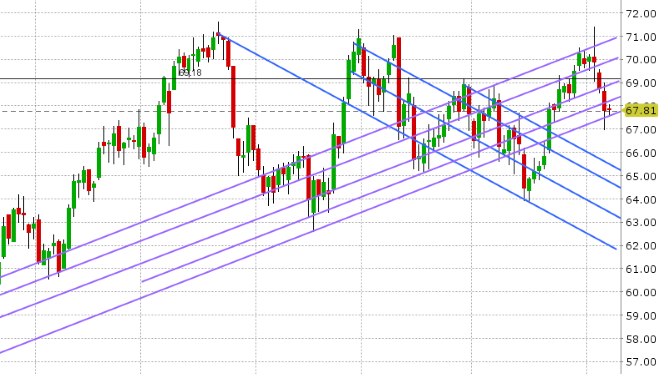

October Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

September Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.