USD on the backfoot again despite Trump stick save yesterday. Trump's Davos speech awaited along with US GDP/Cdn CPI. Mario Draghi's tone deemed not dovish enough.

Summary

-

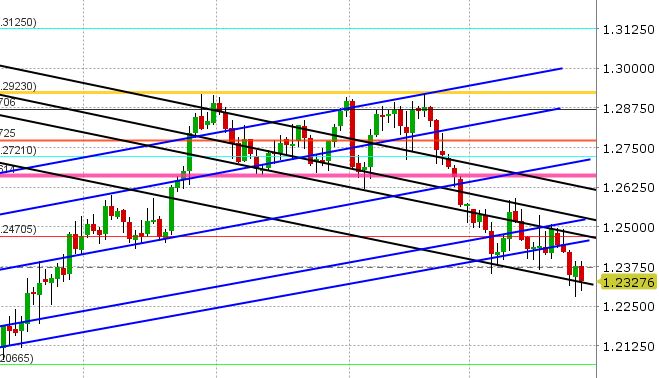

USDCAD: Trump rescued the USD single handily yesterday with his comments during an interview with CNBC in Davos. He said the “dollar is going to get stronger and stronger, ultimately I want to see a strong dollar” and he also said Mnuchin’s comments about the USD were out of context. This put a fiery bid back into the USD during afternoon trading yesterday, after Mario Draghi delivered a press conference that traders are saying “wasn’t dovish enough”. USDCAD recovered smartly, after probing below 1.23 several times, and it managed to close NY trading well above the 1.2330s (which we said could mark a short-term button). This recovery fizzled out overnight as the broader USD traded lower again (Mnuchin keeps talking) and markets await Trump’s speech in Davos at 8amET, but USDCAD is still hugging the trend-line extension support level we’ve been mentioning of late (checks in at 1.2325 today). This will be the key level to watch again today, in our opinion. After Trump, traders will be watching US Durable Goods, Q4 Advance GDP at 8:30amET along with Canadian Dec CPI (markets are expecting +0.9%, +3.0% QoQ, and +1.9% YoY respectively). EURCAD is not looking so hot today, with yesterday’s late EURUSD plunge bringing the cross back below 1.5350 (Nov highs), and an attempt overnight to regain the level having failed. GBPCAD is consolidating recent gains, and it managed to regain the 1.75s overnight after some late day GBP selling yesterday. Yield spreads everywhere seem to be taking a back seat lately to the broader USD theme, when it comes to fundamental FX drivers, for various currency pairs. Case in point with the US/CA 2yr spreads, which remain firm at +29bp (but it’s not helping USDCAD one bit).

-

AUDUSD: It was Australia Day down under today, but that had no dampening effect on AUDUSD trading overnight. AUDUSD sold off like everything else on the Trump comments yesterday, and it has regained much of those losses this morning as the USD is broadly weaker again in Europe. Yesterday’s NY close was negative technically (because of the swift move below support at 0.8030-0.8040), but the fact that everything is getting cancelled out as we write is a positive development. The market is simply in the mood for selling USD. AUDUSD traders will be watching Trump’s speech early on here. We finally get some Australian data next Wednesday (Q4 CPI). That’s a long way away though. Buyers are still in control so long as the market trades above 0.8030-0.8040. Copper is looking a little heavy this morning.

-

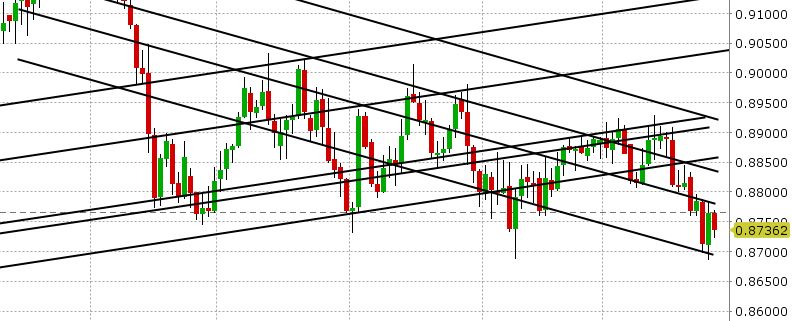

EURUSD: It was a volatile day yesterday for the Euro. First we had the ECB press conference, where Mario Draghi sounded clearly dovish on monetary policy (no expected change to interest rates this year and no change to the QE bond buying program schedule), but traders concluded he wasn’t dovish enough. That sent EURUSD roaring higher. Then we had the late day stick save from Trump. That sent EURUSD plunging lower. Like AUDUSD, the daily candle and NY close were decidedly negative, but as we said above, there is such a negative USD mood out there right now and that’s on display again overnight as traders wait for Trump to speak in Davos. The fact that Treasury Secretary Mnuchin keeps speaking (trying to clarifying what he said) is not helpful in our opinion, as markets are driven more and more nowadays by trading algorithms that scan newswire headlines by the word. Today, Mnuchin seemed to be responding to Mario Draghi’s criticism of him yesterday, where Draghi said: “The exchange rate has moved in part because of endogenous reasons, namely the improvement in the economy, in part due to exogenous reasons that have to do with communication. But not by the ECB, but by “someone else”. This someone else’s communication doesn’t comply with the agreed terms of references”. If we look at the charts, EURUSD is making an attempt to cancel out yesterday’s negative candle pattern. A close above 1.2480 would do that in our opinion. A close below 1.24 would likely invite a continuation of selling with the mid to low 1.23s as the next stop. For now, the markets are on Trump watch. USDCNH is well bid here (EURUSD negative), as it hasn’t fallen again overnight, but it still has 6.3450 to clear before shorts have anything to worry about.

-

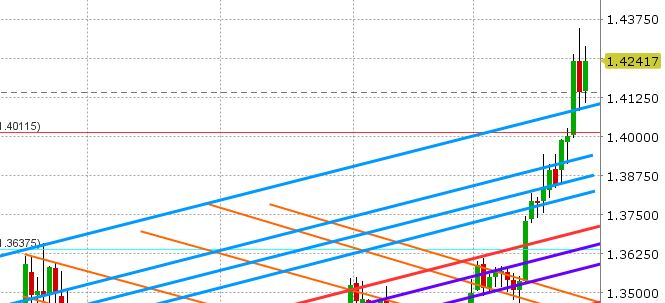

GBPUSD: Sterling was the biggest victim of the late day USD recovery yesterday. So that saying goes, the faster they rise, the hard they fall. Much of the move made sense technically too, as Wednesday’s 250pt rally left no meaningful support levels behind. As soon as GBPUSD failed at intra-highs again post ECB, it was a ripe condition for selling (and the Trump comments just added fuel to the fire). A solid bounce in EURGBP didn’t help either. The NY close saw the market test a new trend-line support level (plotted in parallel off the September 2017 highs), and it managed to hold this level. GBPUSD is now significantly higher once again as the broader USD weakens again and the UK reported Q4 advance GDP above expectations (+1.5% vs. +1.4%). We feel the support levels to watch today are 1.4150-60, then 1.4090-1.4100. Resistance is light again as usual, with 1.4270-1.4310 as yesterday’s topping range.

-

USDJPY: Dollar/yen was probably the biggest beneficiary from yesterday’s USD positive comments from Trump. The market regained the important 108.90 trend-line extension support level and it continues to hold it in overnight trading. Japanese Dec CPI came out overnight slightly below expectations (+1.0% vs +1.1% expected), but it wasn’t a market mover. Next up is the Trump speech and the US data at 8:30amET. The 108.90-109.00 level needs to hold for any hope of a rally here. Traders will also need to push through resistance at 109.80-110.00 as well. We feel a broad USD bid is needed here to help USDJPY, as the correlation with rising US equities and firm US yields has broken down.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/GBP Chart

March Copper

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.