USD higher as US yields break higher. Aggregate USD short grows for 4th straight week. Trump State of the Union, FOMC and US payrolls in focus this week.

Summary

-

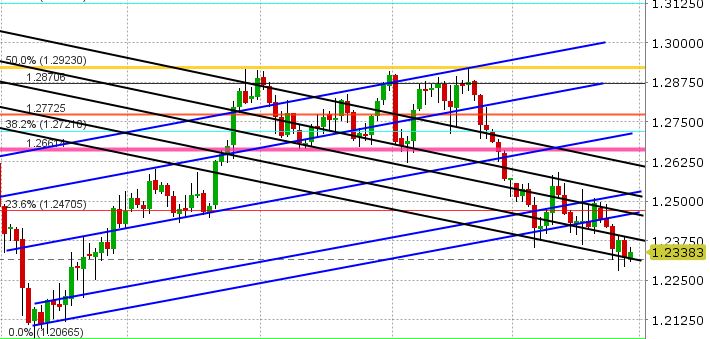

USDCAD: Traders are focused on rising global treasury yields this morning, as the US 10yr yield breaks out above 2.70 and German 5yr bund yields trade positive for the first time in almost three years. This seems be supporting the USD broadly in an otherwise quiet tape. It will be a busy week ahead with the Fed’s favorite inflation gauge (US PCE Index) out today along with expected NAFTA headlines as the 6th round of talks end. Tomorrow sees US Consumer Confidence for Jan, along with Trump’s state of the union address. On Wednesday, traders will be focused on the US ADP report, Canadian Nov GDP, the Chicago PMI and of course, the FOMC meeting (Janet Yellen’s final meeting as Fed Chair). Markets are not expecting any changes to monetary policy and there won’t be a press conference afterwards this time around. Thursday brings the US January ISM number, and on Friday everybody will be watching the US jobs report. While the headline Canadian CPI reading was reported in-line with estimates on Friday, the month-over-month decline was a touch larger than expected, giving USDCAD a floor it seemed. Traders probed below the important trend-line support level (1.2325) intra-day but managed to close the market back above it, which has bode well for the USDCAD to start the week. Activity is quiet though as traders watch the broader USD and await further catalysts. Resistance today checks in at 1.2370-1.2380 in our opinion. A firm close above would be constructive for price. EURCAD and GBPCAD selling has been a bit of a drag on USDCAD this morning (USD is up not nearly as much as it is against EUR and GBP). The US/CA 2yr yield spread continues to firm, now at +31bp (USDCAD supportive). The latest read on futures positioning from the CFTC shows the market slightly more net short USD (net long CAD) going into Jan 23rd. Both longs and shorts added over the course of the Bank of Canada meeting week, but as we have said a few times in the past few weeks, the net short USD position still dwarfs what it was the last time we were at these levels. This continues to help the USDCAD bear case in our opinion as there is room for further CAD length (USD short accumulation) without the net position appearing overextended.

-

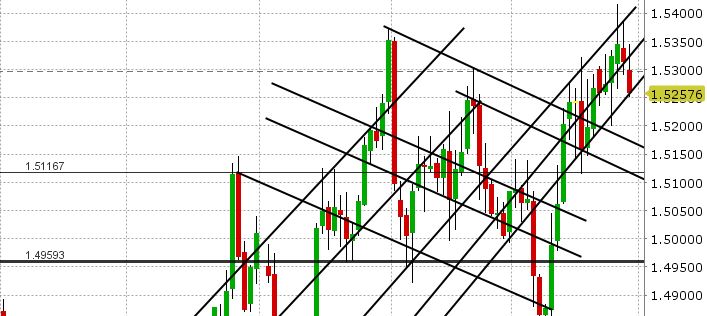

AUDUSD: The Aussie had another great NY close on Friday, cancelling out Thursday’s negative momentum completely. AUDUSD is trading moderately lower overnight as the broader USD finds a bid, and it’s testing new trend-line support as we type (0.8080s). A push below where we are now would invite some selling into 0.8030-0.8050 in our opinion. The ability to stay above here would be positive naturally. After an incredible recovery last week for copper prices, that market is feeling range-bound to lower to start the week. The key data item for Australia this week is CPI, out Wednesday. The RBA meets next Tuesday.

-

EURUSD: The Euro is starting the week with a offered tone after failing to close strongly on Friday and today’s pop higher in US treasury yields isn’t helping. Eurozone data this week will be focused on EZ GDP/German CPI on Tuesday, and German employment/EZ CPI on Wednesday. EURUSD is searching for support as we type, and there’s some in the 1.2370s, then 1.2340s. A firm close above the 1.2430s would see some positive momentum return. Reuters is reporting 3.5bln EUR in option expiries for Wednesday at 1.25 (which could have a magnetic effect if the 1.2430s give way). Cross flows have been mixed with EURGBP supporting and EURJPY dragging. USDCNH is drifting higher (EUR negative), but it’s running into chart resistance now at 6.34. Positions continue to build in the EUR futures arena, with the latest read from the CFTC showing the market slightly longer in the week ending Jan 23rd, but this was before the surge higher into the 1.25s and before the ECB meeting last Thursday. We think this Friday’s CFTC report will be more interesting.

-

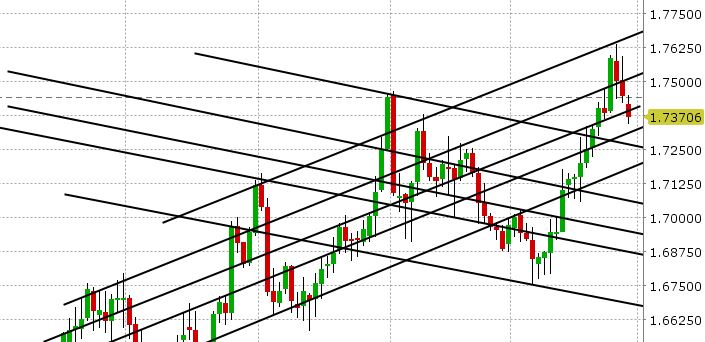

GBPUSD: Sterling is starting the week softer too, as Friday’s close was weak too. GBPUSD has broken trend-line support at the 1.41s in the last hour, which is not great technically. If the market can regain the level soon, we could see a move back to the high 1.41s. Should we continue to trade below here, we would not be surprised to see further selling into the low 1.40s where we find a Fibo support level. The calendar is light for the UK this week, with governor Carney speaking before lawmakers tomorrow and the UK manufacturing/construction PMIs out later in the week. The charts for GBPJPY and EURGBP are starting to turn a little GBP negative (GBPJPY losing 153.50 and EURGBP breaking back above trend-line resistance in the 0.8780s). CFTC reports further position accumulation in GBP in the week ending Jan 23rd, and with more longs added than shorts the new net long position now sits at a 10 week high, which is not surprising given the huge rally up to 1.40.

-

USDJPY: Dollar/yen is having a tough start to the week after a volatile session on Friday. Some comments from the BOJ’s Kuroda on Friday regarding progress on inflation saw us smash through support at 108.90-109.00, but this was later denied and so we whipped higher, but USDJPY was not able to regain the support level it broke with any confidence. The market is sitting just below the 108.90-109.00 support level now, awaiting further catalysts. Support checks in at 108.25 today. The latest read on futures positioning from the CFTC shows the market amazingly more long USD (short JPY) into Jan 23rd, despite the bounce off support on Jan 17th (which was a chance to get out for entrenched longs). This net long USD (JPY short) continues to take pain as USDJPY is down another 200 pts since Tuesday. We feel this over-extended positioning will continue to be a drag on USDJPY rallies, and risks giving us a capitulation-type plunge lower in USDJPY at some point (perhaps sub 107).

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

USD/CNH Chart

EUR/CAD Chart

GBP/CAD Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.