US ADP beats. USD still broadly offered on weak technicals. Global stocks surge, hurting JPY

Summary

-

ECONOMIC DATA UPDATE: US ISM beat expectations yesterday, coming in at 59.7. The prices paid and new order sub-components were higher than expected, while the employment sub-index came in a bit light. The FOMC minutes were deemed by the market to be hawkish in tone. It appears the committee debated quite a bit but the need for gradual rate hikes was still the consensus. The FOMC also expects faster inflation as a result of the recent Trump tax cut. The big data day is tomorrow, with the twin job reports (US and Canada), US trade balance and US services ISM. The US Dec ADP employment report just came in at +250k, handily beating expectations of +190k.

-

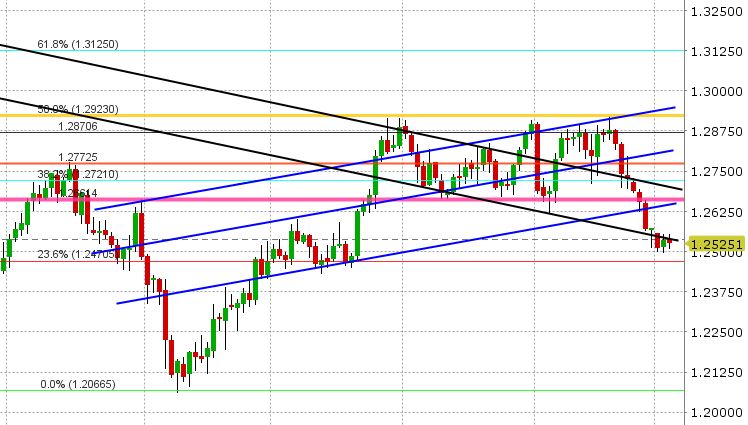

USDCAD: Dollar/CAD made an attempt to break above key near-term resistance (1.2530-1.2540) in late NY/early Asian trade but it failed, and so the market has maintained a weak tone in overnight trade. This resistance level is still on the radar for today’s trade, and support today lies at 1.2500-1.2510, then the 1.2470s. EURCAD and GBPCAD have recovered strongly in European trade so far today, and that is stemming further losses in USDCAD. Feb crude oil maintains its bid after roaring higher yesterday. The US/CAD 2yr yield spread has perked back up to +26bp, which is also USDCAD supportive. However, the overall tone for the broader USD is still negative going into the heavy economic data set for tomorrow. We maintain our neutral to lower view on USDCAD, and would adopt a more neutral tone should near term resistance give way. Reuters is reporting another sizable option expiry tomorrow for USDCAD at 1.2700 ($1bln+). It’s a little ways away but could become a factor if the US jobs data exceeds expectations and the Cdn job figures disappoint.

-

AUDUSD: The Aussie is now amazingly working on its 12th up day in a row, but it’s a marginal new high and like yesterday its struggling at the same trend-line resistance level (which today checks in the 0.7840s). Like yesterday’s action too, Asia sold and Europe bought. AUDUSD now sits right at the resistance level after trying to break higher earlier. Copper had a nice pop higher at the start of European trade (now 1% higher on the day), and this is a positive backdrop for AUDUSD as usual. The AU/US 2yr yield spread fell apart over the last couple sessions however and is now flat, which is not supportive AUDUSD, and so some caution is warranted here. Traders will also be watching the Australian trade balance data tonight, out at 7pmET.

-

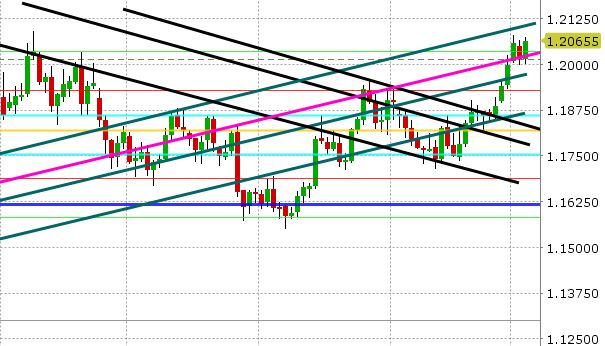

EURUSD: The Euro was under some pressure yesterday, first from EURJPY cross selling, then the option expiry, then from a strong ISM print, and finally from what was deemed a hawkish FOMC minutes. Despite all this, EURUSD managed to hold support at 1.2000-1.2010 going into the NY close, and that has given traders the confidence to buy the dip in European trade. The market is now right back up to its recent highs, with traders focused on resistance at 1.2080, then 1.2110. EURJPY has also completely recovered from yesterday’s selling and is surging to new highs as we type. EURGBP erased Tuesday’s bearish reversal with a bullish reversal yesterday, and so that chart is looking better too. The US/GE 10yr yield spread is steady at +201bp. Early tomorrow we get Eurozone CPI (markets expecting +1.4% YoY in December), and then of course the US jobs report.

-

GBPUSD: Sterling took some heat yesterday after the upbeat US ISM figure as GBPUSD lost the support level we mentioned (1.3540-1.3550) more or less around the same time the report came out. Add to this continued selling in GBPJPY and a sharp reversal higher in EURGBP, and GBPUSD nosedived back to 1.35 looking for support. Some buyers have crept back in overnight on the heels of broad JPY cross selling (GBPJPY supportive), but GBPUSD is now running into trend-line resistance at 1.3550-60 (the same trend-line that supported early yesterday but then gave way).

-

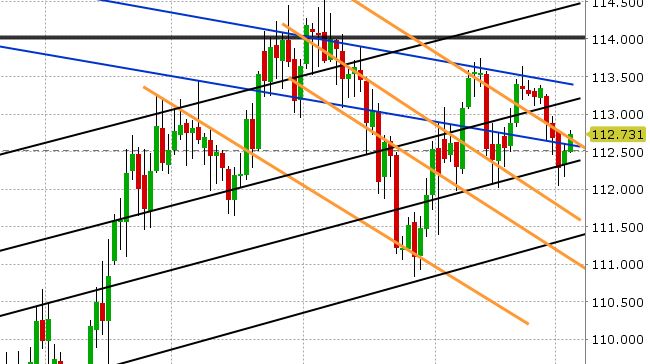

USDJPY: Dollar/yen staged the recovery it needed yesterday and that was made easy by the beat on US ISM and the hawkishly sounding FOMC minutes. Add to this another surge higher for US stocks, and the Nikkei (which exploded over 3% higher in its first day of trading for 2018) and we have the perfect “risk-on, sell JPY across the board” scenario at play right now. USDJPY ran into some trend-line resistance overnight in the 112.70s. A break back above would invite further buying to 113. Support today lies at 112.40-50.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.