USDCAD struggling to find support. EUR & GBP off on JPY cross demand. Traders eyeing US ISM and FOMC minutes

Summary

-

ECONOMIC DATA UPDATE: The UK construction PMI comes in a 52.2, slightly weaker than expectations. The German employment report showed 29k jobs lost in December, but the unemployment rate still remains at a record low (5.5%). On deck for the US session: US ISM for December at 10amET (markets expecting 58.2) and the FOMC minutes from the December 13th meeting (out at 2pmET today).

-

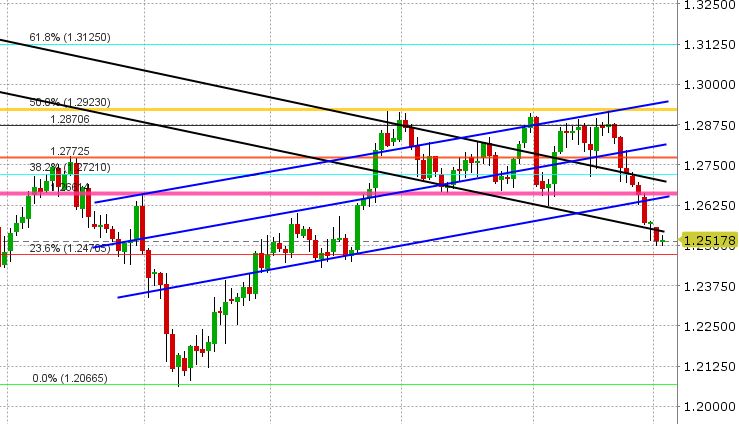

USDCAD: It wasn’t a great day again for USDCAD yesterday as the market failed to hold the 1.2520-1.2530 support level after the large option expiry. The market traded as low as 1.25 the figure and has been attempting to crawl back in overnight trade. Key near term resistance is now 1.2530-1.2540. A firm daily close back above would invite some short covering back to 1.2600. However, if we stay below, there’s not much support on the charts until 1.2470 (the 23.6% Fibo retrace of the May-Sep down move). EURCAD and GBPCAD are not supportive today, with both CAD crosses succumbing to broad EUR and GBP weakness that started in Asia overnight. Feb Crude oil has traded to yet another swing high (just shy of $61). The US/CA 2yr yield spread is steady at +22bp. AUDUSD (CAD’s commodity cousin) also recovered smartly from some profit taking in Asia. We feel USDCAD continues to drift lower here, unless we get a firm daily close above key resistance just mentioned. Traders will be watching the US ISM and FOMC minutes today.

-

AUDUSD: Trend-line resistance continues to cap AUDUSD trade for now. Overnight trade was quiet with some profit taking being met with buyers in the low 0.78s. The market is testing the same trend-line resistance again now as the US session gets underway. This is a key level to watch now, 0.7840-0.7850. A firm daily close above would invite a quick move to the 79 handle (as there’s very little chart resistance overhead). Failure at this key level would be an excuse to sell and possibly see us testing support in the 0.7780-0.7800 level. With copper now trading lower for two days in a row, and the AUDUSD chart working on its 11th up day in a row, we would not be surprised to see the latter scenario play out. There are no signs of technical chart failure yet however, as traders wait for the two key US data points today.

-

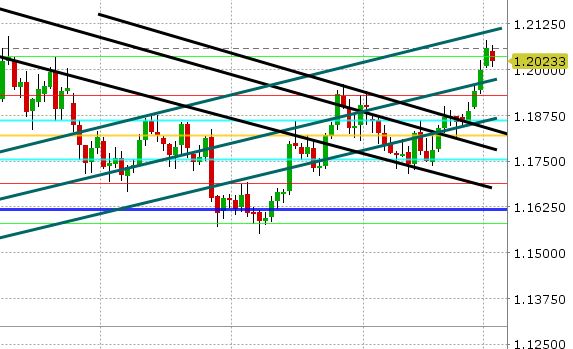

EURUSD: The Euro seems to finally be succumbing to some profit taking after a tremendous holiday run. While yesterday’s brief bout of selling seemed to be off a broad USD bid, today’s selling seems to be more JPY driven, with EURJPY trading swiftly below 135 in the last couple hours and EURUSD going along for the ride. EURGBP closed out trading yesterday with a bearish reversal lower, which is not helping. There is also market chatter about a $1bln+ EUR option expiry at 1.2030 today, which seems to be having a magnetic effect on the market. The German employment report was a non-event for the market, but traders will be watching US ISM and the FOMC minutes today. Anything that is negative sounding or dovish should invite EUR buyers back in. Support today lies at 1.2000-1.2010, then 1.1970-1.1990. Near term resistance is 1.2030-1.2040. The US/GE 10 yr yield spread has regained +200bp. Option traders report a steady upside bias for EUR calls 1-2mths out, however there has been demand for 3mth EUR puts which cover the Italian elections (the date of which was just announced to be March 4th). We think EURUSD continues to have legs here, so long as the market can stay above 1.1960-1.1970.

-

GBPUSD: Sterling had a great session yesterday, blasting through the trend-line resistance level we mentioned yesterday (1.3550). The reversal lower in EURGBP certainly helped. However, the market ran into multiple resistance levels at 1.3600-1.3610 and is now giving back almost half of yesterday’s gains. GBPJPY selling is not helping either. There’s really not much to talk about from a Brexit/UK political perspective, and so traders are left to the techincals and watching the broader USD and the GBP crosses. Support today lies at 1.3540-1.3550. Resistance 1.3580-1.3590.

-

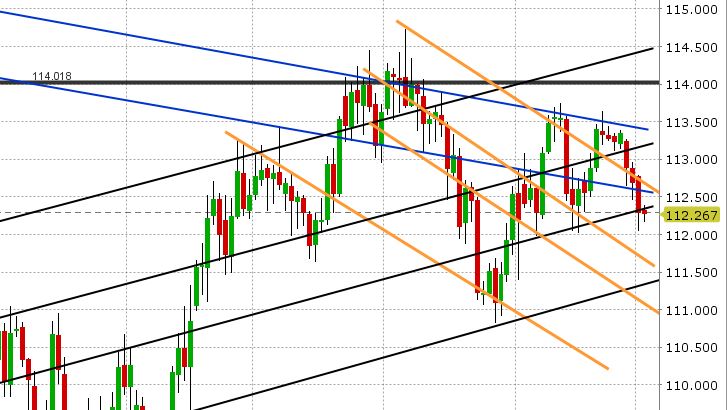

USDJPY: Tokyo was on holiday for the second straight day today, leaving USDJPY directionless, but as we’ve noted above, there’s been steady demand for JPY on the EURJPY and GBPJPY crosses, which is dragging down EURUSD and GBPUSD. Technically speaking, USDJPY is not doing what it needs to do in order to encourage bulls. It couldn’t rally yesterday despite the rally in US stocks and US yields. It continues to sit below trend-line support in the 112.20s. Resistance is starting to thicken at 112.50 (many chart lines converging at that point). If the USDJPY doesn’t stage some sort of recovery soon, we see the risk of a move lower into the 111s. All eyes will be on US ISM and the FOMC minutes today.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.