Theresa May heads back to Brussels in last ditch attempt to renegotiate Brexit deal

Summary

-

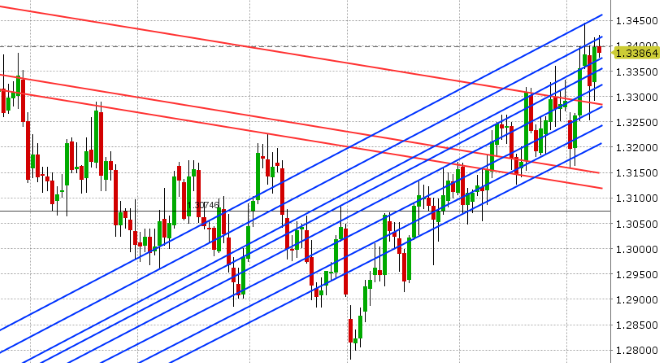

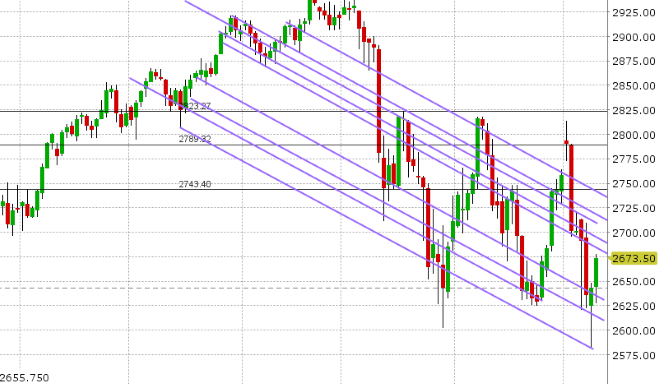

USDCAD: Dollar/CAD is backing off the 1.34 handle this morning as some “risk-on” sentiment sweeps over markets. The big headlines overnight came from Chinese vice premier Liu He wanting to push forward the timetable and road map for trade discussions with the US, and reports that China is moving towards cutting tariffs on imported US-made cars. This is helping the S&Ps rally 25pts higher here and it’s putting some broad pressure on the USD. January crude oil is seeing a mild bounce back above the $51 mark, and this is not helping USDCAD either at this hour. The US core PPI figures for November were just announced +2.7% YoY vs +2.5% expected. While this wholesale inflation read is leading to a slight uptick in the USD broadly here, we think USDCAD might waffle around here and search for buyers in the 1.3350-60 area. Any further buying in crude today will also likely pressure USDCAD, or at the very least keep us under 1.3415.

-

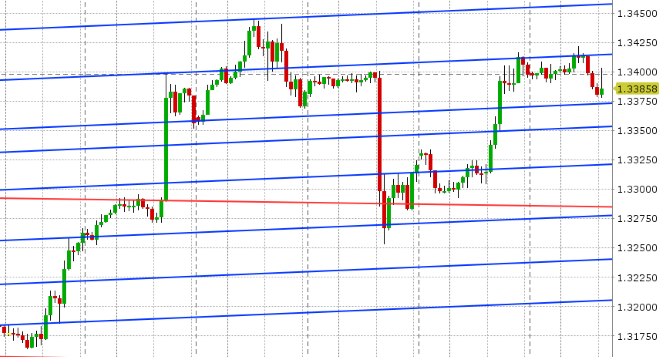

EURUSD: Euro/dollar has retraced half of its GBP driven losses yesterday, but the market is struggling to regain the 1.14 level. There’s some chatter that option traders are defending a sizable expiry at the 1.1400 strike this morning (1.6blnEUR), but we think some flows in EURGBP and EURJPY are influencing the selling as well, as we head into NY trading today. Headlines out of Europe this morning suggest the EU won’t discipline Italy if Rome agrees to a deficit target of 2.0%. The Italian coalition parities said however they would not accept anything below 2.2%, while PM Conte appears to be gunning for 2.1% when he speaks to the EU’s Juncker at 10amET tomorrow. The BTP/Bund spread continues to trade steady at +286bp. We think EURUSD might remain stuck around current levels now after yesterday’s technical failure in the 1.1430s.

-

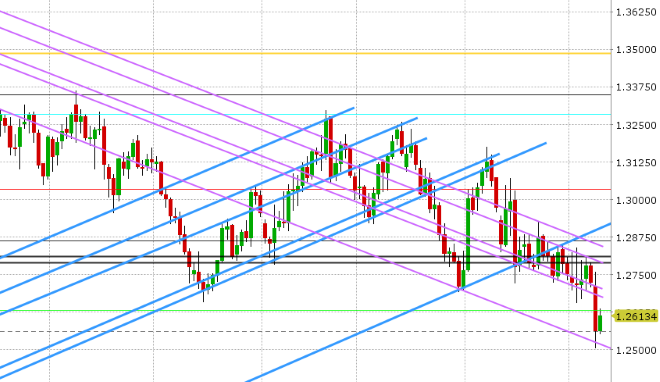

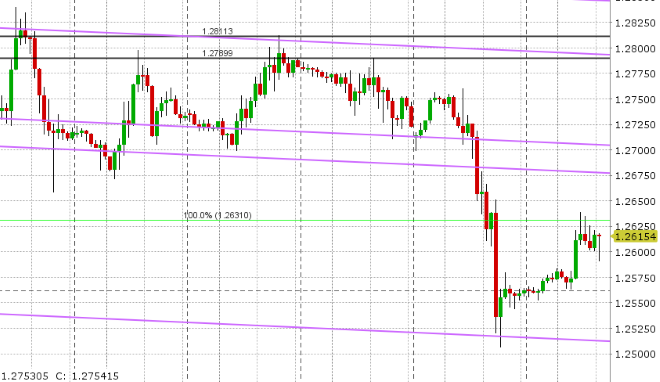

GBPUSD: Sterling is bouncing this morning, as Theresa May heads back to Brussels today to get some much needed legal assurances on the Irish backstop. This comes after yesterday cancellation of a key Brexit vote in Parliament, which the UK PM conceded she would have lost by a wide margin. The EU has been vocal about their unwillingness to renegotiate, but it appears the market is giving the UK PM the benefit of the doubt here today. Some higher than expected wage growth in the UK’s October employment report (+3.3% 3M/Yr vs +3.0%) is also helping the mood this morning. GBPUSD is now trading back to 1.2630 Fib level that the market collapsed below yesterday, and this level is now acting as resistance. EURGBP traders continued to fade yesterday’s explosive move higher, which is understandable. A quiet NY session ahead will likely keep the focus on Brexit headlines.

-

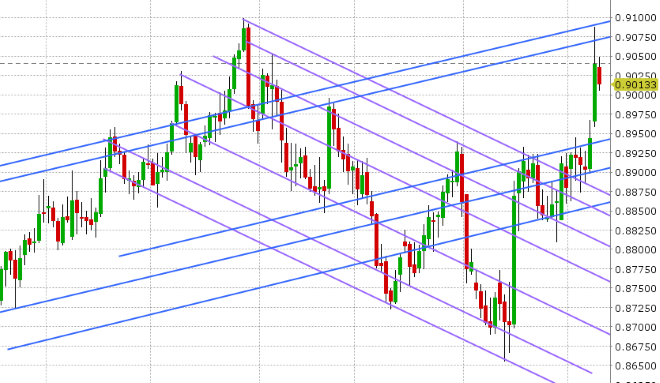

AUDUSD: Sterling is bouncing this morning, as Theresa May heads back to Brussels today to get some much needed legal assurances on the Irish backstop. This comes after yesterday cancellation of a key Brexit vote in Parliament, which the UK PM conceded she would have lost by a wide margin. The EU has been vocal about their unwillingness to renegotiate, but it appears the market is giving the UK PM the benefit of the doubt here today. Some higher than expected wage growth in the UK’s October employment report (+3.3% 3M/Yr vs +3.0%) is also helping the mood this morning. GBPUSD is now trading back to 1.2630 Fib level that the market collapsed below yesterday, and this level is now acting as resistance. EURGBP traders continued to fade yesterday’s explosive move higher, which is understandable. A quiet NY session ahead will likely keep the focus on Brexit headlines.

-

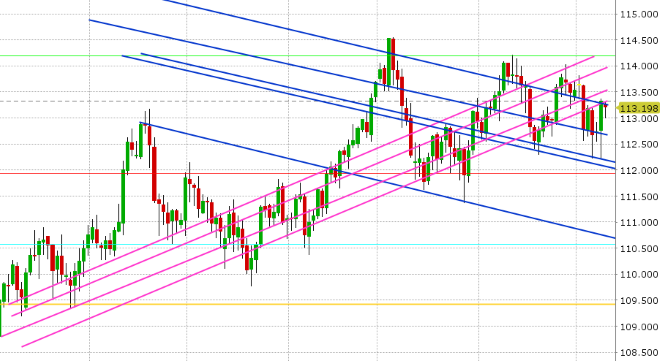

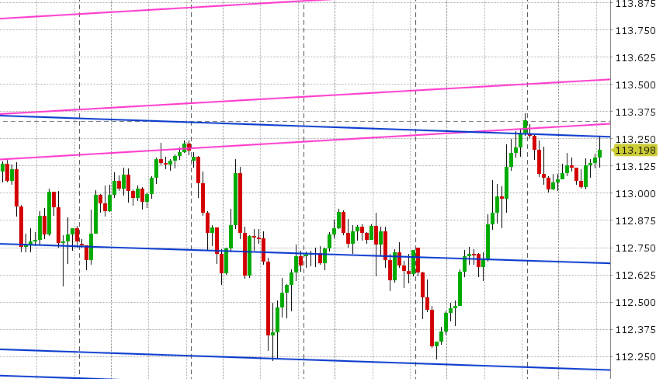

USDJPY: Dollar/yen is pulling back a touch today after yesterday’s explosive rally took the market straight up to the next chart resistance level in the 113.20s. The S&P futures are trading at their overnight session highs, but it appears USDJPY traders are little tired here. Some JPY cross sales also seem to be flowing through as we head into NY trade today. We think USDJPY retains an upward bias here.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

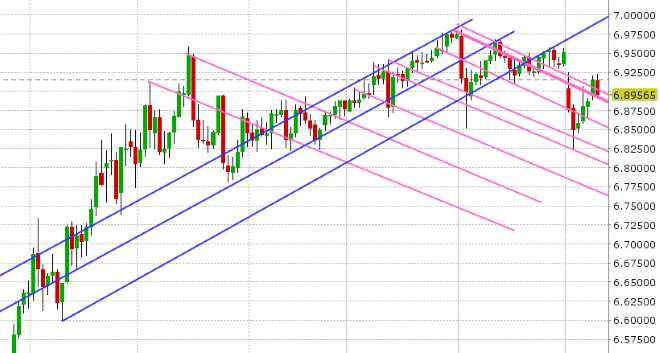

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

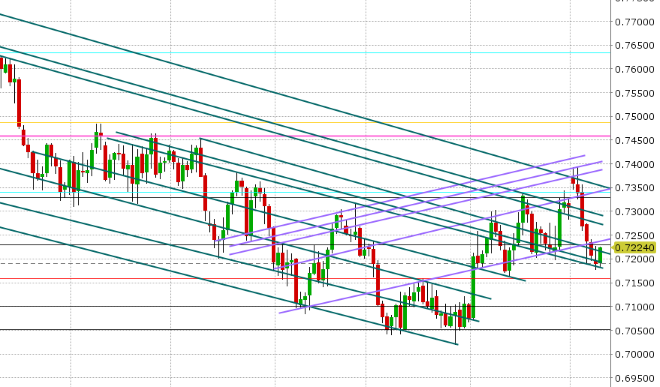

AUD/USD Daily Chart

AUD/USD Hourly Chart

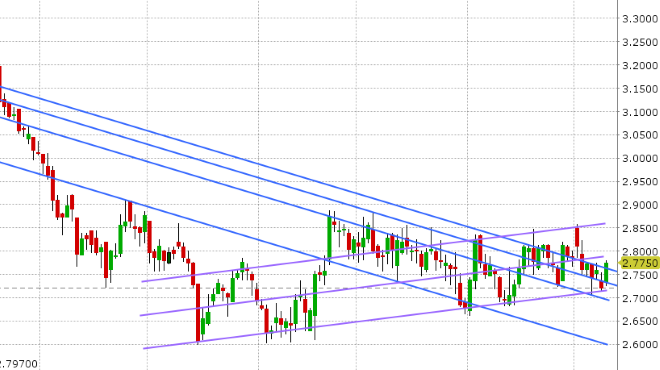

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.