Sterling collapses as Theresa May now rumored to cancel tomorrow's Brexit vote

Summary

-

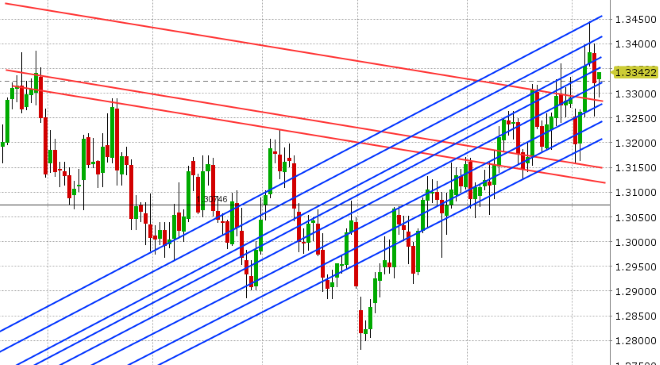

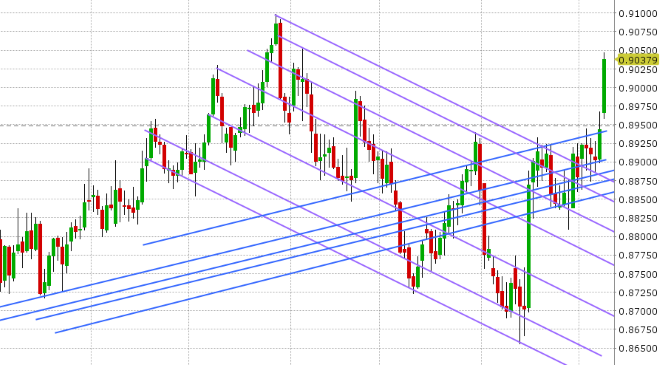

USDCAD: Dollar/CAD is starting the week with a neutral to bid tone as the broader USD trades mixed and oil prices recede. Friday’s plunge lower came after the US reported November job gains below expectations while Canada announced a surge in job growth last month. An OPEC+ cut of 1.2mln barrels per day (towards the higher end of expectations) and the subsequent rally in oil prices also helped with the offered tone in USDCAD. Chart support in the 1.3275-90 area stemmed the selling however, and traders have been trying to bounce the market higher ever since, but there hasn’t been much momentum to overnight USD flows. The weekend headlines were not necessarily positive for risk sentiment (Chinese threats over Huawei case, John Kelly out at the White House, weak Chinese trade and inflation data, sharp drop in Japanese GDP, Brexit, French riots, etc.), but the markets are largely shrugging this off for the moment. This week’s economic calendar kicks off with Canadian Housing Starts (which just beat expectations +215.9k vs +198k) and Building Permits (which just beat as well -0.2% vs -0.3%). Tomorrow features US PPI; Wednesday will bring US CPI, and finally Friday will give us both US Retail Sales and US Industrial Production. We think USDCAD could resume its two-month rally here, but we’d like to see a close above the 1.3370s to confirm that, and we think it needs to occur quickly otherwise we’ll likely start to chop around in the 1.33s as the December seasonal pattern would suggest.

-

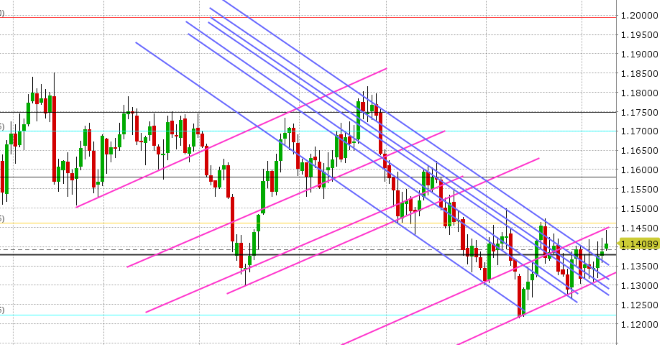

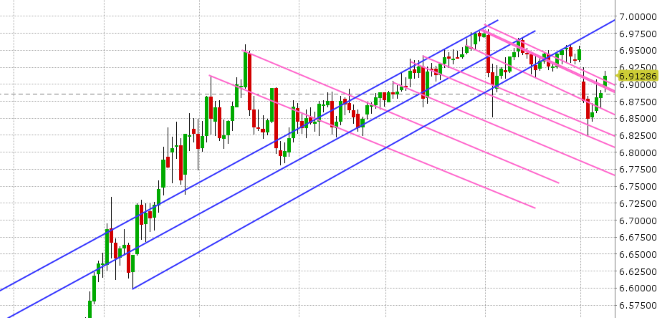

EURUSD: Euro/dollar is trading higher this morning as traders remain hopeful that Italy can present a budget revision that will appease the EU when they meet again on Wednesday. The BTP/Bund spread continues to trade in the +280-290bp range. Trend-line chart resistance in the 1.1440s is capping prices however, and when we look at the breakout higher in USDCNH this morning (drop in the Chinese yuan) toward its chart gap in the 6.93-6.94s, it makes us a little wary EURUSD being able to hold gains here. Aside from the big meeting between Italy and the EU on Wednesday, this week also features the German ZEW survey (tomorrow), Eurozone Industrial Production data (Wednesday), the latest ECB meeting (Thursday) and the EU summit (Thursday & Friday).

-

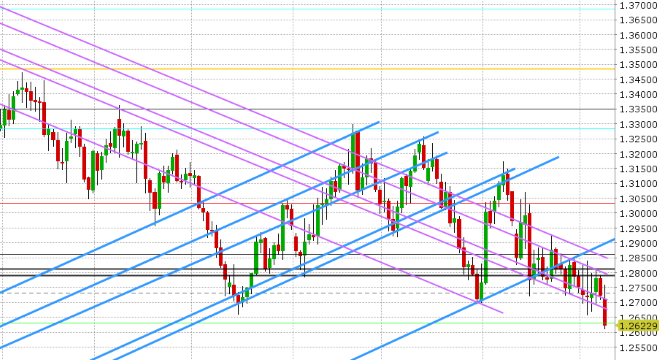

GBPUSD: Sterling is breaking down this morning as rumors swirl that Theresa May will now delay tomorrow’s historic Brexit vote in parliament. The UK PM is expected to speak on the matter at 10:30amET this morning, but traders are not waiting to sell GBPUSD because such a move from May can only mean she surely does not have the votes to see her Brexit plan pass. The EU was also on the wires subsequent to these headlines saying they will not renegotiate, and this is adding to the negative sentiment. The EURGBP cross is surging this morning, after breaking above the key 0.8950 mark late Friday. All this spells continued trouble for the GBP more broadly here as there is not much technical support on the charts now.

-

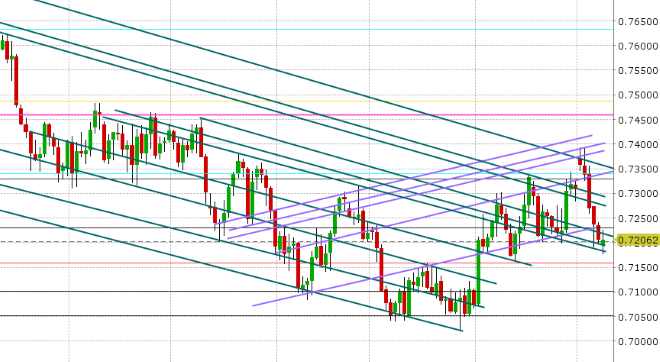

AUDUSD: The Aussie is starting the week with a neutral tone, after the market rallied earlier today to fill its Sunday opening chart gap. One could argue the small gap lower was the result of the weak Chinese trade and inflation data out over the weekend, but that’s a distant memory now as AUDUSD trades back above chart support in the 0.7190s. This week’s Australian calendar is light, with just a couple surveys out in the next 48hrs (NAB + Westpac), which means AUDUSD likely follows the tone of EURUSD and copper here. Last week’s bearish outside week pattern on the charts is hard to ignore, and so we think AUDUSD now finds sellers on rallies.

-

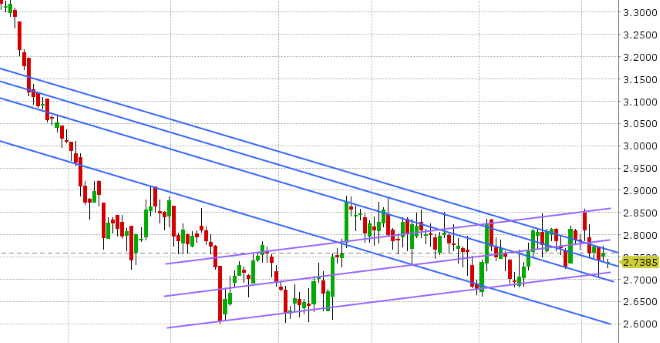

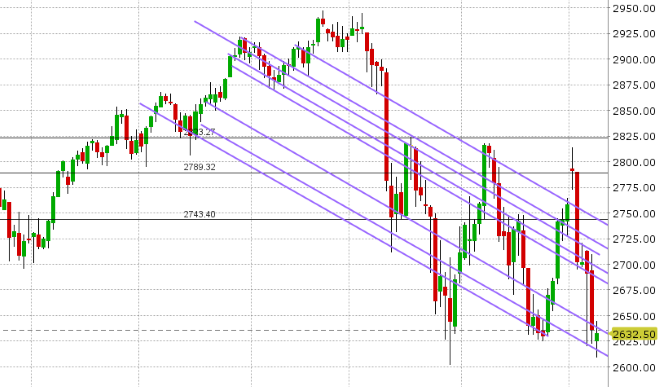

USDJPY: Dollar/yen is bouncing strongly as we head into NY trading this morning as the S&P futures now trade back into the green for the overnight session. Chart support in the 112.20s held yet again, and trend-line resistance in the 112.70s has now been surpassed; technical developments that are quite notable we think and could support further gains this week. Japan reported its final Q3 GDP figures last night at -0.6% QoQ vs -0.5% expected. While it was a slight miss, it solidifies Japan sharp contraction from +0.8% growth in Q2 and adds ammunition to the long USDJPY thesis for the leveraged fund community here. This week’s Japanese economic calendar features October Machine Orders tomorrow night and the Tankan Manufacturing survey on Thursday night.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

DEC S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.