Powell comments, Iran deal angst, strong technicals drives broader USD to new swing highs. Trump Iran annoucement at 2pmET. USDCAD breaks higher.

Summary

-

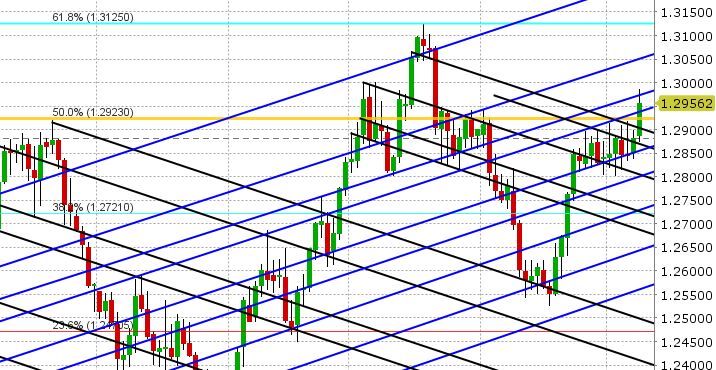

USDCAD: North American traders are waking up this morning to a USDCAD market that has broken out to the upside. The broad USD buying theme, which stalled a bit mid-day yesterday, resumed in full force when European traders stepped in this morning, and so we have new swing lows in EURUSD and AUDUSD as USDCAD makes new highs. There isn’t a specific headline we can point to for the broad USD strength this morning, but with the Fed’s Powell speaking positively above rate hikes in Zurich earlier, a little angst today over Trump’s Iran decision at 2pmET and a strong USD uptrend at the moment, it’s not surprising to see traders take the path of least resistance here. The break higher above 1.2910 in USDCAD has seen the market vault to trend-line resistance in the 1.2980s. This level is currently capping as NY trading gets underway. June crude oil is steady after yesterday break lower from new highs. The CAD crosses, while bid earlier, are coming off at this hour. Canadian Housing Starts for April were just released (+214.4k vs +222k expected). All eyes will now turn to Trump, who is expected to announce a withdrawal from the Iran nuclear deal when he speaks later. We think USDCAD continues to have legs here so long as support in the 1.2925-40 area holds.

-

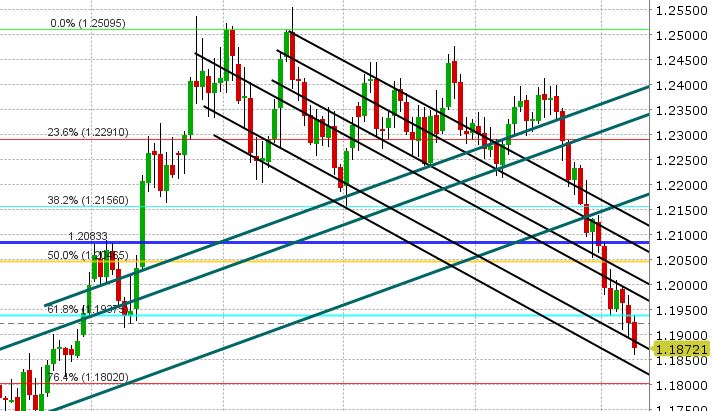

EURUSD: The pummelling in EUR continues today despite better than expected German trade and industrial production numbers announced earlier this morning. Two attempts were made to regain a key Fibonacci retracement level (1.1940) in the last 24hrs but both attempts failed, and when you combine that with the factors we mentioned above (Powell, Iran announcement, and the broader USD trend) it’s not surprising to see EUR lower again here. The next support level lies at 1.1800-1.1825. Resistance today lies at 1.1885-90 (the downward sloping, trend-line extension, support level the market bounced off of yesterday). The 9-day bloodbath lower in EURJPY is not helping. After receding almost 400pts from its April highs, the cross is still grasping for support.

-

GBPUSD: Sterling held steady yesterday, but it retrospect it was probably just because UK traders weren’t around to keep selling. They came back today from holidays, however, and did just that as EURUSD and AUDUSD resumed their moves lower. Traders are now focused on the 1.3480-1.3490 support level, which is the 50% Fibonacci retracement of the June-April rally. Resistance today lies at 1.3545-50, then 1.3580. EURGBP is trying to form a base in the 0.8780-90 area, and this is not helping GBP at this hour. Expect GBPUSD to follow the broader USD theme until Thursday morning, where we’ll get UK Trade and Industrial Production data (4:30amET) and then of course the latest BoE rate decision (7amET).

-

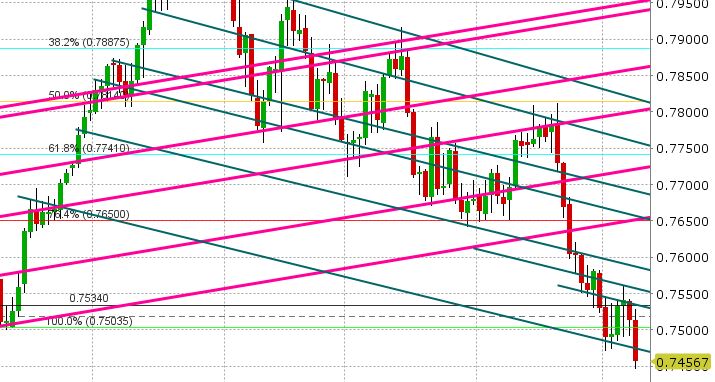

AUDUSD: The Aussie extended lower overnight as well, following EURUSD. Copper prices today are partly to blame, with July futures off 1.4%. The break below trend-line support in the 0.7460s overnight was decidedly bearish and the charts don’t show any decent weekly support until the mid 73s. We wouldn’t be surprised to see traders try to rally AUD above 0.7460 if the EUR can hold here.

-

USDJPY: Dollar/yen has had a relatively quiet overnight session considering the broader USD rally; hovering around the same 109.05 support level we mentioned yesterday. US yields have been directionless for the past 24hrs and equity futures are steady. We think USDJPY possibly takes another crack at resistance in the 109.40 area (which capped trade yesterday). An oversold bounce in EURJPY would be helpful.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

USD/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.