Risk-on mood in markets this morning despite Trump backing out of Iran deal. USD topping out across the board. Big day for UK markets tomorrow.

Summary

-

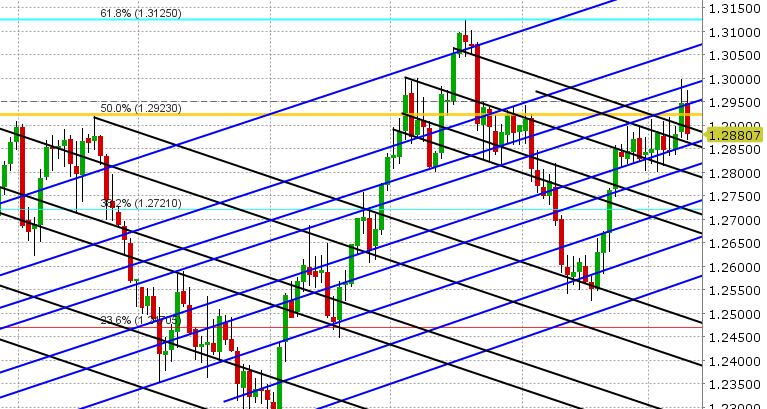

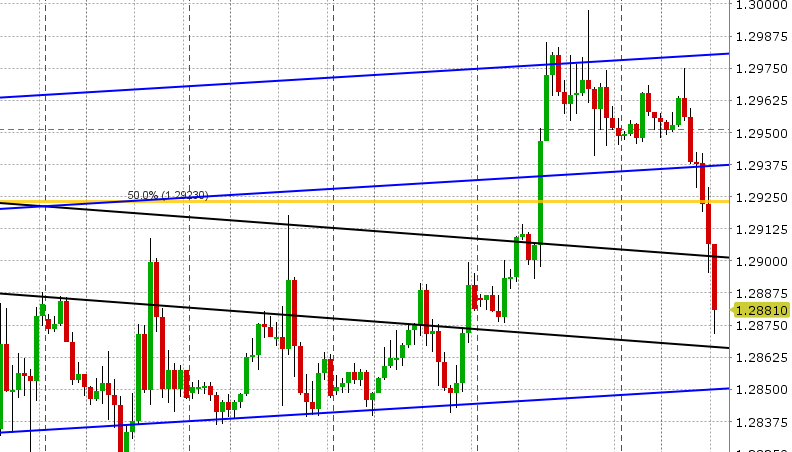

USDCAD: Dollar/CAD is entering NY trading this morning under pressure as crude oil continues its rally higher post Trump and as EURUSD forges a short-term bottom overnight. The support zone of 1.2925-40 has given way and this has now changed the momentum on the charts. The next support level is 1.2890-1.2900, followed by the 1.2870s. Canada reports Building Permits for March at 8:30amET this morning, but it’s a 2nd tier release and shouldn’t get much attention. The US calendar is dead quiet today, with just the release of the weekly DOE oil inventory data at 10:30amET. We think USDCAD risks completely unravelling yesterday’s move higher today, which could mark a near term top. Watch crude oil and EURUSD as usual.

-

EURUSD: Euro/dollar looks like it’s finally putting in a short term bottom on the charts. The market broke trend-line support in the 1.1830s earlier today, but then quickly reversed higher and is now gunning for trend-line resistance in the 1.1890-1.1900 area. USDCNH failed spectacularly in its attempt to break above 6.38 overnight, and this is helping. So is EURJPY, which is bouncing 0.7% higher today in what could be argued was a long overdue relief rally. Global markets are exhibiting a little bit of “risk-on” today (strong equities, higher yields, weak JPY), which is a bit odd considering the tone of Trump’s Iran speech yesterday, but we have to respect it. If EURUSD can close firmly above resistance today, we think we see a short covering rally into the mid 1.19s.

-

GBPUSD: Sterling has had a volatile overnight session; first resuming lower when multiple attempts to breach 1.3550 in Asia failed and EURUSD broke lower, then turning higher as EURUSD bottomed. Chart resistance in the 1.3580s is now being attacked, but the market is struggling here a little bit. While we think EURUSD strength and EURGBP weakness likely continues to support GBPUSD today, we think traders will the kill momentum ultimately ahead of Super Thursday for the UK tomorrow. Early tomorrow we’ll get UK Trade and Industrial Production data (4:30amET), followed by the Bank of England rate decision at 7amET. While markets are no longer expecting a rate hike (given the slew of weak UK data recently), we’re hearing talk that the tone of the BoE’s comments may still be hawkish.

-

AUDUSD: Like EURUSD, the Aussie looks like it’s finally putting in a bottom today as well. A inverted hammer reversal candle reversal is in the works and traders are focused on the 0.7460s again (but with much more upward momentum than compared to yesterday). Copper has recovered half of yesterday’s losses, which is helping. So is the broad “risk-on” vibe we mentioned above. Should AUDUSD close above resistance in the 0.7460s, we see scope for a recovery up to the low 75s.

-

USDJPY: Dollar/yen is up handsomely today, riding the coattails of higher US yields and higher US equities in the wake of Trump’s decision to pull out of the Iran nuclear deal. The broad “risk-on” mood is hurting the JPY across the board, especially on the crosses, with EURJPY up 0.7% and GBPJPY +0.8%. Chart resistance in the 109.40 gave way easily and now acts as support. The next resistance area is 109.85-90. We think USDJPY consolidates today a little bit.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

EUR/CAD Daily Chart

GBP/CAD Daily Chart

EUR/USD Daily Chart

GBP/USD Daily Chart

AUD/USD Daily Chart

USD/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.