Italian bond sell off, China RRR cut, IMF growth downgrade sours risk appetite

Summary

-

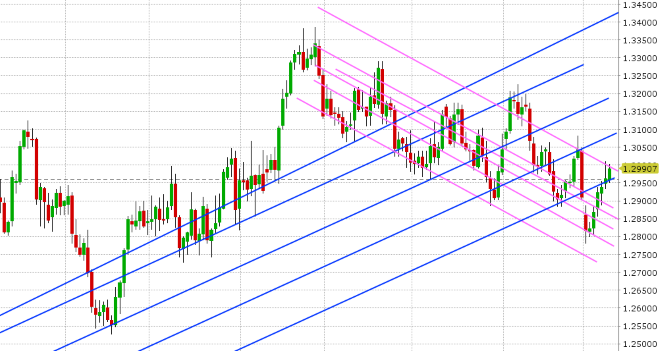

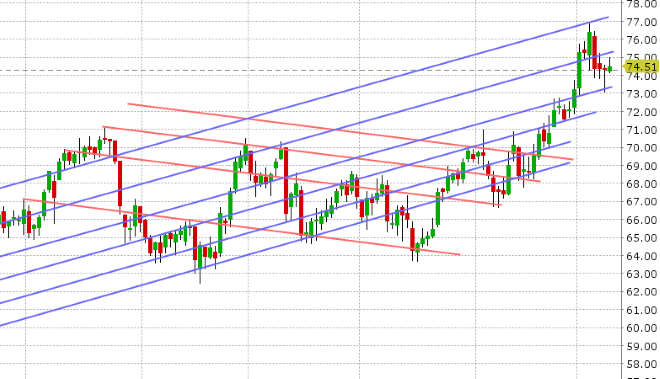

USDCAD: Canadian traders return from the Thanksgiving holiday today to find the market well above Friday’s closing levels. Crude oil was the driver in thin trade yesterday, but another wave of “risk-off” USD buying today seems to be the underlying theme that bought buyers back in at chart support in the 1.2950-60s. Call it concern about Italy once again, China’s RRR cut over the weekend or the IMF’s latest downgrade on global growth, but the mood for “risk” is sour this morning and this is causing broad demand for US dollars. November crude oil is trading back within Friday’s range this morning after dropping down to support in the low 73s yesterday and bouncing. Canadian Housing Starts for September were just announced +188.7k vs +210k expected. We think how the market responds to trend-line resistance at the 1.3000 level today will determine the direction near term. Trade above and further gains into the 1.3070s are quite possible, whereas a stall (like yesterday) would invite some selling back in. The calendar for the rest of today should be uneventful, with just speeches from the Fed’s Evans and the BoC’s Wilkins. Tomorrow sees US PPI and Canadian Building Permits and Thursday brings US CPI. The funds added to both long and short positions in equal amounts during the lead up to the USMCA announcement early last week, leaving the net long USD (CAD short) position more or less the same going into Oct 2nd.

-

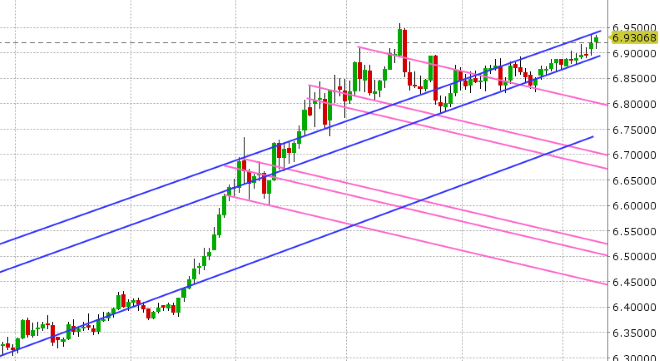

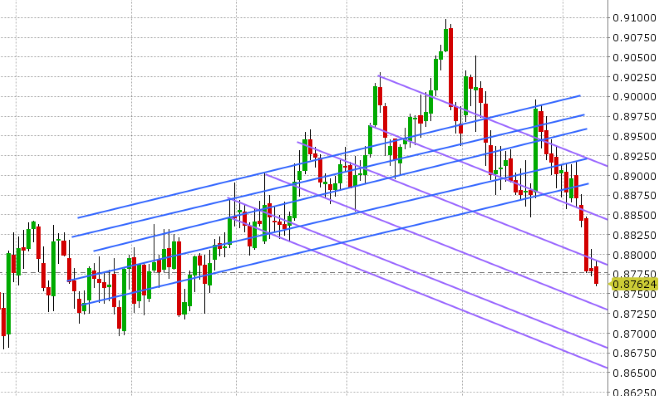

EURUSD: Italy’s finance minister Tria did not say the right things today to soothe investors when he addressed parliament earlier. While he reiterated the Italian government’s commitment to a 2.4% deficit for 2019, he didn’t speak positively about Italian GDP growth and said the government would do what it takes (like Mario Draghi did in 2012) in the event of a financial crisis and spreads blow out 400-500bp. Just the wrong thoughts to put in trader’s minds if you ask us, and this helps to explain why Italian 2s and 10s are trading to new swing highs, BTPs/Bunds are trading at +314bp and EURUSD has broken lower this morning. The market is trying to find some support now at a trend-line in the 1.1430s, and so far so good. China’s RRR cut over the weekend is not helping Chinese equities, CNY and the broader risk tone (all EURUSD negative). More here. The European calendar is light this week, with just a speech from the ECB’s Mersch tomorrow, the ECB Minutes on Thursday and German CPI on Friday. We think EURUSD stays on the defensive sub 1.1540. The funds flipped back to a net short position during the week ending Oct 2nd as traders liquidated longs and added new short positions.

-

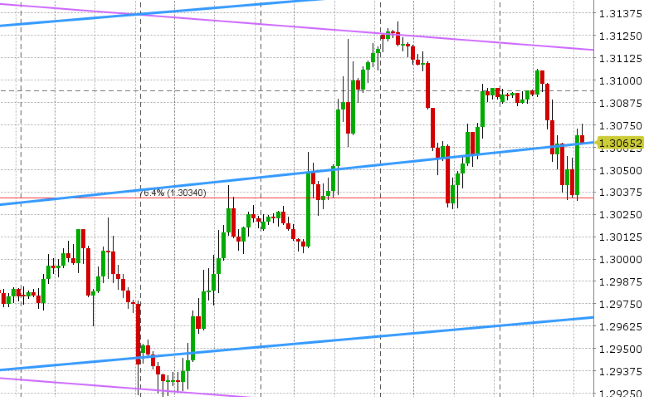

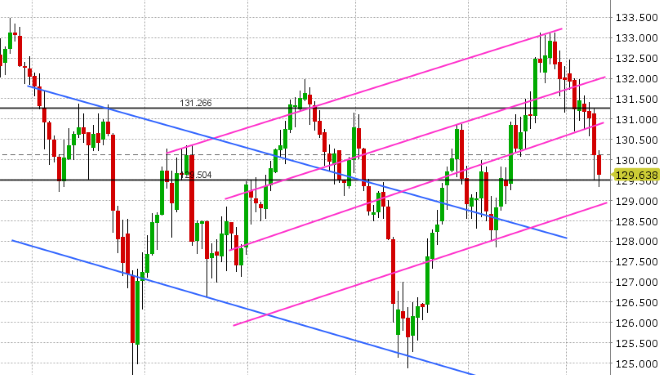

GBPUSD: Sterling traders have been content to follow EURUSD so far this week amidst the absence of major Brexit headlines, but we would note the dip buyers here appear a tad more confident because EURGBP continues to trend lower. GBPUSD continues to toy with the upward sloping trend-line (1.3060s) that the market broke above on Friday. After losing the level and regaining it yesterday, and losing it once again this morning, the market looks poised to try the upside one more time. The BoE’s Broadbent will be speaking shortly after 10:30amET this morning. The UK reports Manufacturing/Industrial Production, Trade and GDP numbers for August tomorrow. The funds liquidated short positions for the 2nd week in a row during the week ending Oct 2nd. We think the prospects of further short covering increase should GBPUSD stay above 1.3040-60. The next resistance level would be 1.3110-20, but we don’t see traders putting up much of a fight there.

-

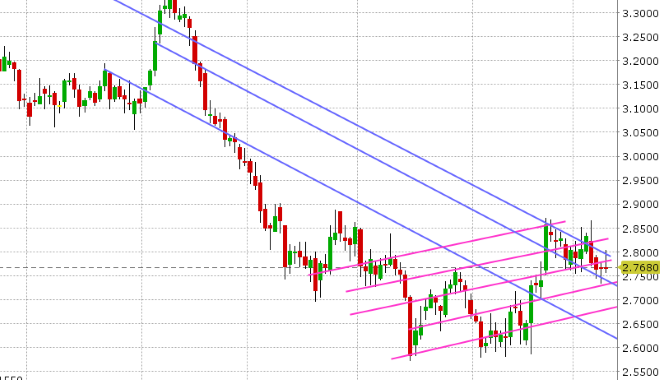

AUDUSD: The Aussie has had a quiet start to the week; bouncing mildly back above trend-line support in the 0.7050s yesterday but then falling back to that level now as “risk off” permeates across all markets this morning. December copper is rejecting chart resistance at the 2.80 level today. The net fund short in AUDUSD barely changed during the week ending Oct 2nd as both longs and short trimmed positions by marginally amounts. The Australian calendar won’t be offering up much in terms of excitement this week. After last night’s higher NAB survey for September, we’ll get Westpac Consumer Confidence tonight, a speech from the RBA’s Ellis on Wednesday night and the RBA’s (twice a year) Financial Stability Review on Thursday. We think AUDUSD stays on the defensive so long as we stay below 0.7100.

-

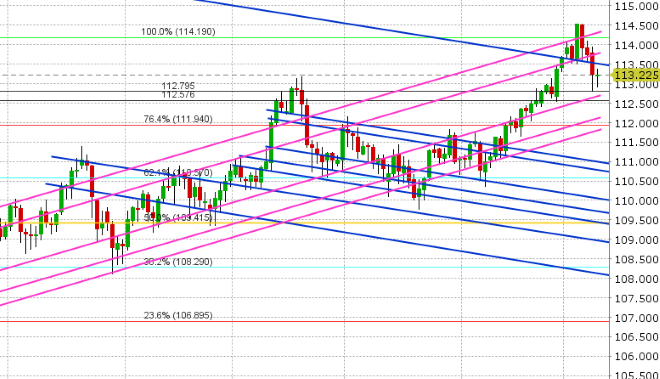

USDJPY: Dollar/yen broke down in NY trade yesterday after the 113.50-60 gave way. This led to selling, all the way down to support in the 112.80s, where some buyers finally stepped in. Traders appear to be shaking off today’s “risk-off” tone as the S&P futures and the JPY crosses bounce into the NY open. Over 1blnUSD in options also go off at the 113.25 level this morning, which could keep us bid until 10am at least. The funds piled into USD long (JPY short) positions during the week ending Oct 2, which in retrospect wasn’t great timing. This helps explain USDJPY’s swift move off the 114.50 highs as soon as equities turned last week. We think USDJPY risks further downside should the market not be able to recover back above 113.50-60 in short order. Tonight’s Japanese calendar features Machine Orders for August at 7:50pmET.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.