USD trading mixed into NY session

Summary

-

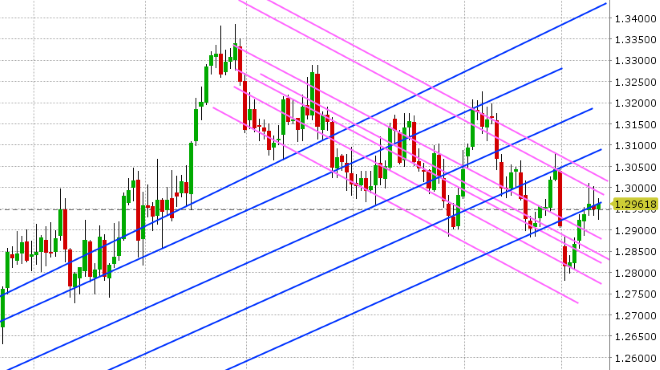

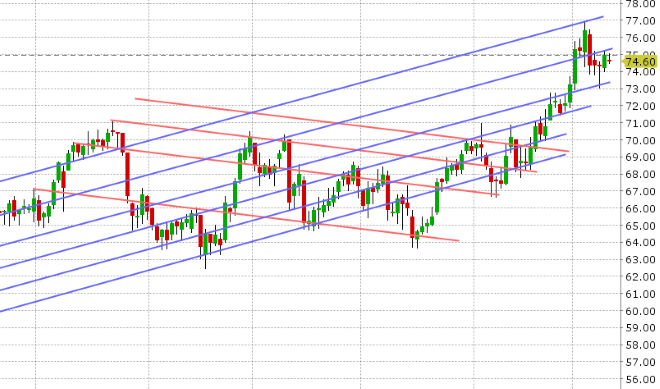

USDCAD: Dollar/CAD is entering NY trading this morning with a neutral tone after the market broadly sold USD in Asian trade overnight and bought those dollars back in Europe. Asia’s move was largely an extension of yesterday’s recovery in risk sentiment due to negative USD technicals going into the NY close, plus some favorable consumer confidence data out of Australia, while the European move to buy dollars today appears to be related to weak UK data and more Italian politicians talking about markets. US PPI for September was just reported +0.2% MoM (in-line with estimates) and +2.6% YoY (slightly below consensus). Canadian Building Permits for August were just reported +0.4% MoM (slightly below consensus as well, with a negative revision to July). November crude oil is trading remarkably steady after Hurricane Michael was upgraded to a Category 4. We also got some relatively bullish comments today from the major energy trading house CEOs about the upcoming Iran sanctions. With USDCAD now regaining the 1.2960 level, we think the market makes another attempt higher today, but there might not be much momentum behind if EURUSD finds its bearings. Support 1.2955-60. Resistance is 1.2995-1.3000, 1.3010, 1.3040-50.

-

EURUSD: Euro/dollar is also entering the NY session this morning with a neutral tone. The market extended higher in Asia after breaking above some chart resistance in the 1.1480s yesterday, but pulled back after Italian bonds opened lower again. Comments from Italian senator Bagnai about Italian default risk and rhetoric out of deputy Italian PM Salvini about not backing down on the budget/assertion that spreads won’t reach 400bp appear to be the culprits. Again, like what we saw yesterday, these are not the sort of topics you want to put into the heads of traders. That being said, Italian bonds have calmed down and now trade higher on the day, and this has allowed EURUSD to bounce off the 1.1480 level (resistance now turned into support). We think EURUSD chops around today baring any surprise headlines out of Italy. Support 1.1480s. Resistance 1.1540-50.

-

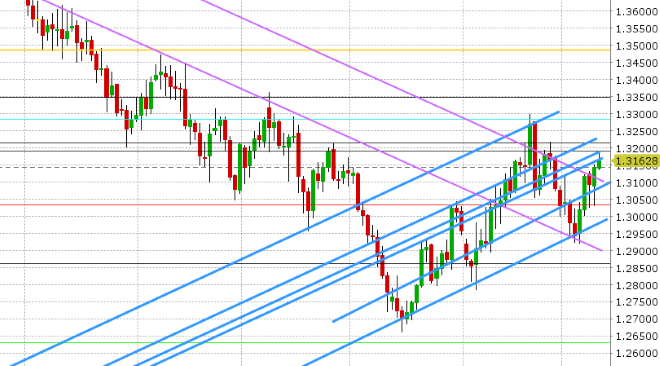

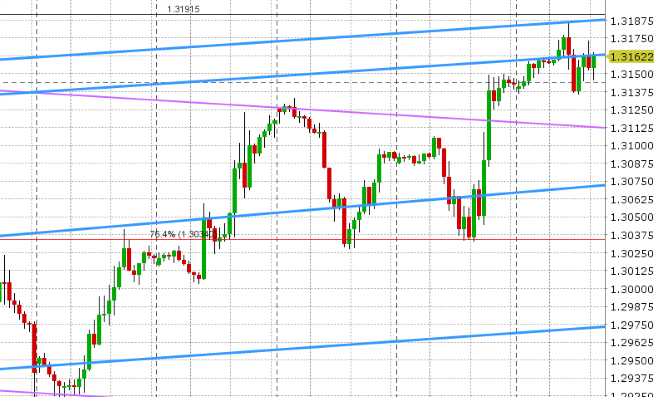

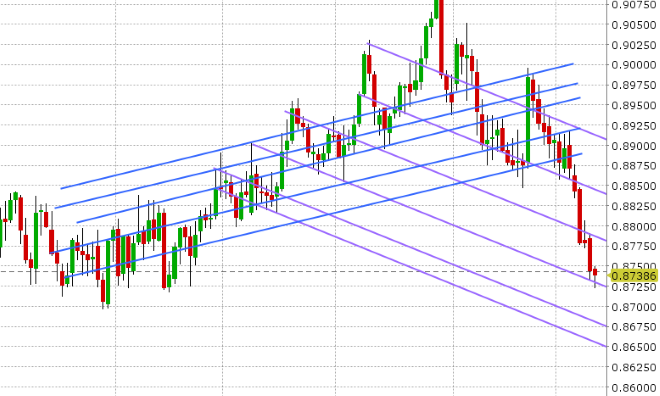

GBPUSD: Sterling is trading with a bit of a negative tone this morning after the market rejected trend-line resistance in the 1.3180s earlier. The impetus for the move higher into the level appeared to come from some more positive Brexit headlines, this time from the EU’s Danuta Hubner. “My feeling is that there is a smaller probability for lack of deal now than we have had for some time,” Hubner told a sitting of a European Parliament committee [Reuters]. Weaker than expected UK manufacturing production and GDP data for August then led to further GBPUSD selling, but the market has since bounced with EURUSD, back to breakeven, going into the NY session. With GBPUSD stalling at the 1.3180s, then the 1.3160s, and with EURGBP looking like it’s finally going to bottom here in the 0.8720s, we think sterling may very well pull back here and chop around too. Support lies in the 1.3110s. The EU Summit takes place next week (Oct 17-18). Keep an eye out for comments from the UK's Raab and/or the EU’s Barnier, along with a potential meeting between the two early next week.

-

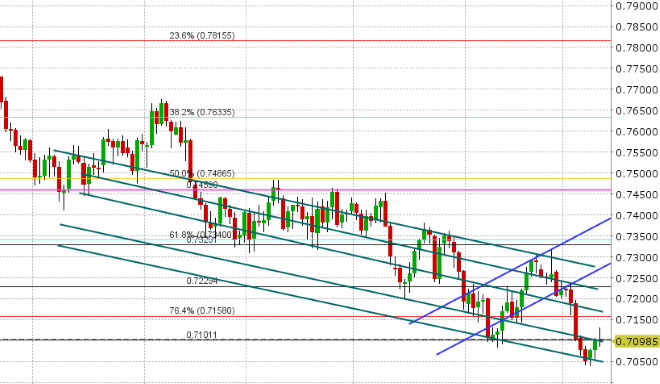

AUDUSD: The Aussie is having a rough session so far today, as yesterday’s strong NY close and subsequent breakout above the 0.7100 level has completely reversed course ahead of the NY open today. Australia’s Westpac Consumer Confidence figures for October were reported +1.0% MoM vs -3.0% in September, but it appears the broad USD buying wave in early European trade was too much for skittish new long positions, which appeared to enter the market yesterday. Today’s candle, as it looks right now, is not great technically. The copper price chart, on the other hand, looks to be holding support just shy of 2.80. We think a rally in copper here could help correct the damage to the AUDUSD, but the day is still young.

-

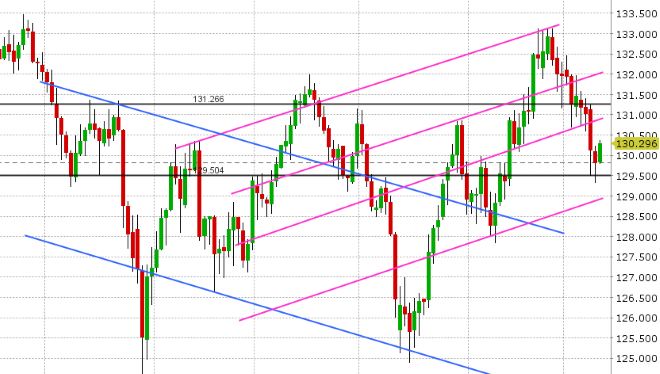

USDJPY: Dollar/yen continues to trade with the same, quiet, range-bound, tone it had yesterday. Longs managed to hold the 112.80s despite broad USD selling for most of the NY session yesterday. US 10s remain near recent highs (3.23%). The S&P futures have dropped a quick 10pts here and so we’d watch the cash open closely as usual. We still think USDJPY is vulnerable to another decline so long it stays below 113.50-60. Japanese Machine Orders for August blew away expectations (+6.8% MoM vs -3.9% expected), but this news had no effect on the market.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

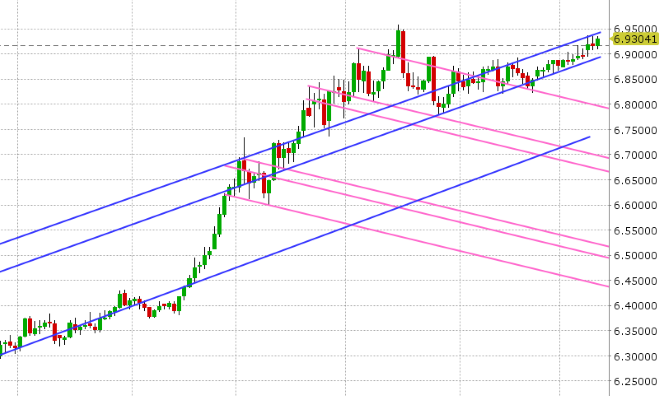

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

EUR/JPY Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.