Equities, Italian bonds and crude oil bounce

Summary

-

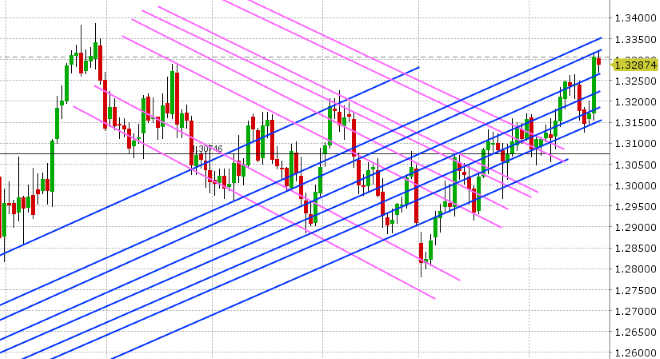

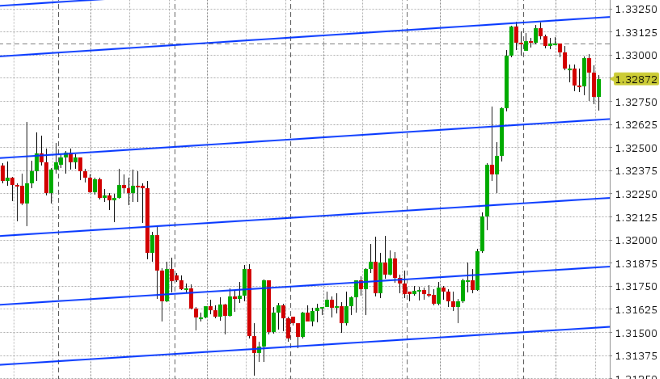

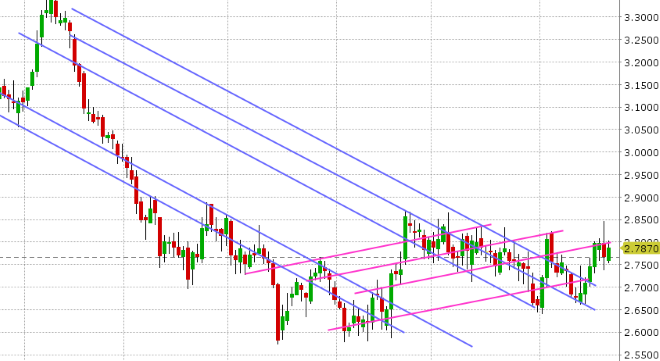

USDCAD: Dollar/CAD surged higher yesterday, fueled by early morning gains back above the 1.3180s pivot level we mentioned and then some ferocious selling in oil futures. The risk-off sentiment tone to equities seemed to be the culprit coming into the session, as demand worries are the last thing a well-supplied oil market needs right now. Prices collapsed 7% at one point during the day, allowing USDCAD to catapult to the 1.33 handle. Trend-line resistance in the 1.3310s is holding back further gains for the time being as global equities and oil prices now recover somewhat this morning. There’s an MNI headline making the rounds this morning about the Fed pausing rate hikes as early as the spring 2019, citing senior Fed officials, but nobody is officially talking like this out of the Fed just yet. US Durable Goods for October were just announced -4.4% MoM vs -2.5% expected, with a negative revision to September’s numbers. The weekly EIA oil inventory report is up next at 10:30amET and traders are expecting another build (+2.94M barrels). We think USDCAD will likely consolidate today, and we would not be surprised to see choppy price action and a pull back to the 1.3250-60s.

-

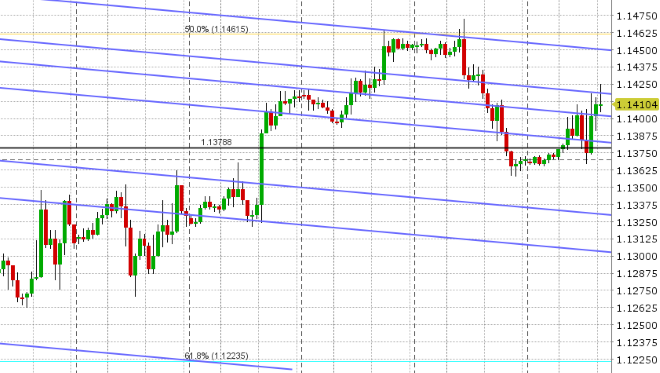

EURUSD: The selling in EURUSD indeed picked up steam yesterday as the rout in equities saw broad demand for US dollars. Monday’s gains completely evaporated and traders scrambled to find support at the 1.1390-1.1400 level we talked about. This support zone ultimately broke in afternoon trade, which led to an ugly NY closing pattern on the charts, but some conciliatory tones out of Italy this morning seems to be helping the market recover here after the European Commission formally rejected Italy’s revised budget (which was expected). Deputy PM Salvini has reportedly said he is open to an Italian budget revision and PM Conte has said Italy will respond to the European Commission with reforms; and while both leaders continue to talk out of both ends of their mouths without much detail, Italian bond traders are breathing a sigh of relief for now by narrowing the BTP/Bund spread back to +312bp this morning. EURUSD has regained the 1.1390s, but the action has been very choppy and some trend-line resistance in the 1.1410s is capping at the moment. Some lousy US Durable Goods numbers for October are now seeing some buying come in. Italy’s Tria and Salvini will be taking questions in the Italian lower house at 9amET. We think EURUSD could full rebound today should the 1.1410s hold. Failure though will likely see us chop around into holiday trading tomorrow.

-

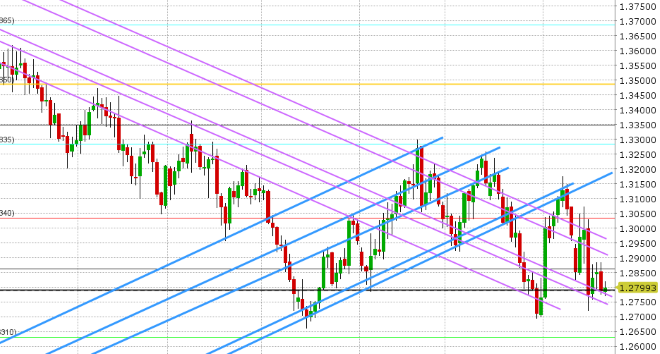

GBPUSD: Sterling finally succumbed to the broad, risk-off, USD buying that swept across markets yesterday, but it was one of the last pairs to fall as every hour that passes without a formal no-confidence motion against Theresa May makes the fund short position a bit more uneasy. The UK PM will be meeting European Commission President Juncker this morning at 11:30amET, so be on the lookout for more Brexit headlines as the FX markets will start to thin out ahead of the US Thanksgiving holidays. We think GBPUSD may be vulnerable to some upside surprises here should the 1.2770-80s hold.

-

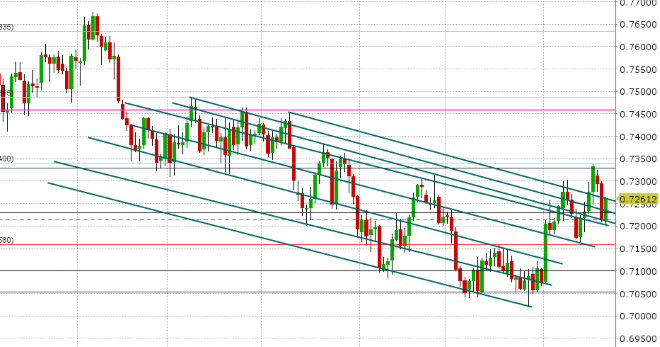

AUDUSD: The Aussie is fighting back yesterday’s losses this morning, and the market has now regained the 0.7240s support level that was lost when the S&Ps continued lower in afternoon trade. We think this helps repair the AUDUSD chart here, but we would need to see a close above the 0.7260s in our opinion before upward momentum returns. The technicals for copper have turned mixed, after yesterday’s wild price action produced a bearish outside day pattern on the charts.

-

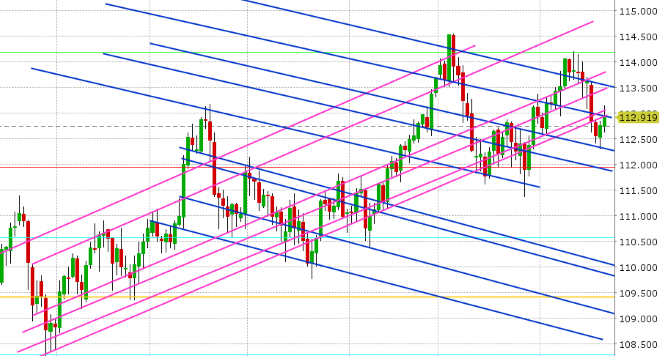

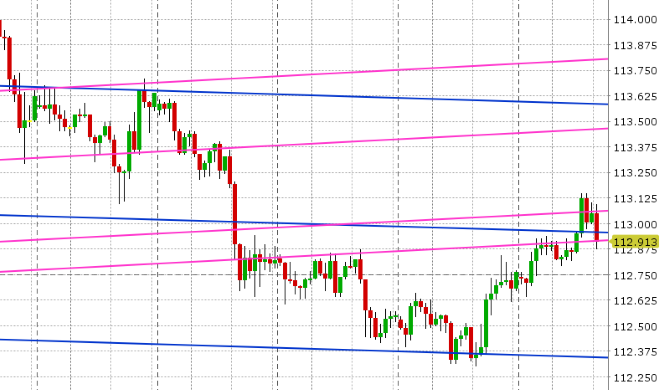

USDJPY: Dollar/yen continues higher this morning, after traders staunchly defended chart support in the 112.30s despite the bloodbath in US stocks yesterday. We think this could be an important technical development, and could indicate a more pronounced move higher in USDJPY for the rest of the holiday shortened week, but the market would need to close above the 113.10 level today to confirm that. Over 1.1blnUSD in options expire at the 113.00 strike this morning, which will likely keep us stuck for the moment. The improved risk sentiment this morning across global markets is also helping USDJPY this morning, as is broad JPY selling on the crosses.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

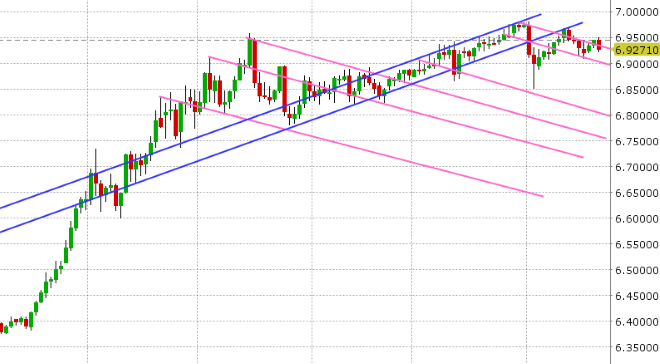

h3 style="text-decoration:underline;"> USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

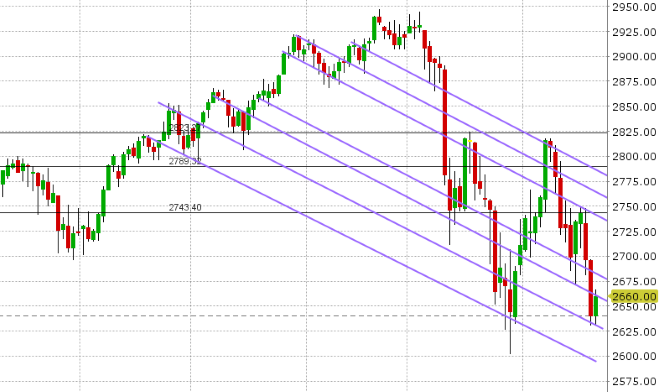

December S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.