Negative headlines out of APEC summit dial back Fed Clarida's dovish tones from Friday

Summary

-

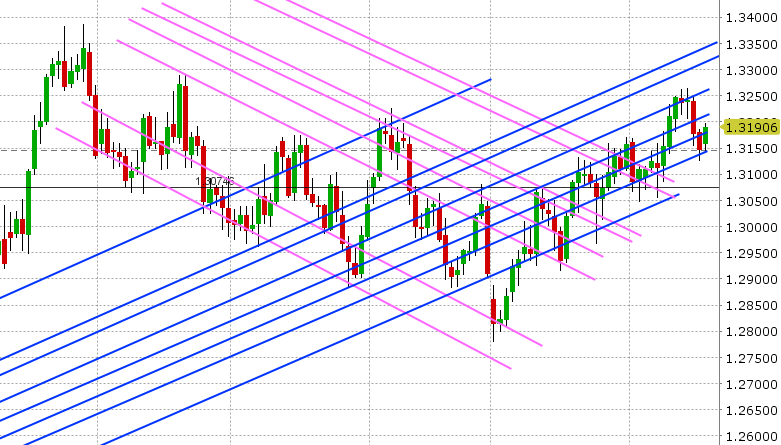

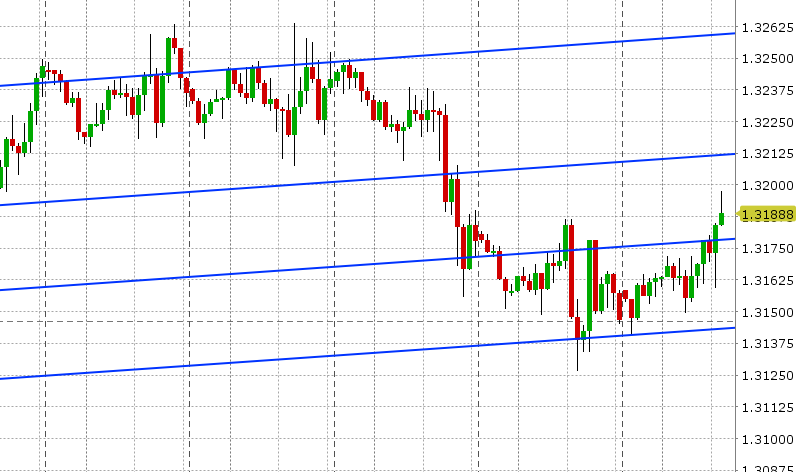

USDCAD: Dollar/CAD is starting the week bid as the broader markets trade with slight “risk-off” tone following the APEC summit on the weekend. Tensions between the US and China were clearly on display as Vice President Mike Pence said there would be no end to US tariffs until China changed its ways. The press is also having a bit of a field day with the fact the summit failed to produce a joint communique for the first time in its history. This, along with some renewed Brexit angst this morning, now sees USDCAD bumping back up against the 1.3180s; a level the market struggled to regain on Friday. January crude oil has failed to regain the 57.50s this morning, and we think this is helping USDCAD as well at this hour. The funds added to both long and short positions in equal amounts during the week ending Nov 13th, leaving the net long USD (CAD short) position more or less unchanged. They are still the least long they’ve been all year. This week’s calendar will be holiday shortened, due to the US Thanksgiving holiday on Thursday, but traders will still have headlines to chew on. The ball gets rolling later this Monday with a speech from the Fed’s Williams, and this will probably get more scrutiny than usual following Friday’s “global growth concern” headline out of Fed vice chair Clarida. Tomorrow then brings US Housing Starts for October, followed by two speeches from the Bank of Canada (Wilkins and Lane). Wednesday sees US Durable Goods for October. Wilkins will take the mic again on Thursday following the Bank of Canada’s twice a year Financial System Review. Finally, we’ll get Canadian Retail Sales and CPI on Friday where market liquidity will be likely poor due to US traders taking long weekends. We think USDCAD could bounce further today if the 1.3170s hold.

-

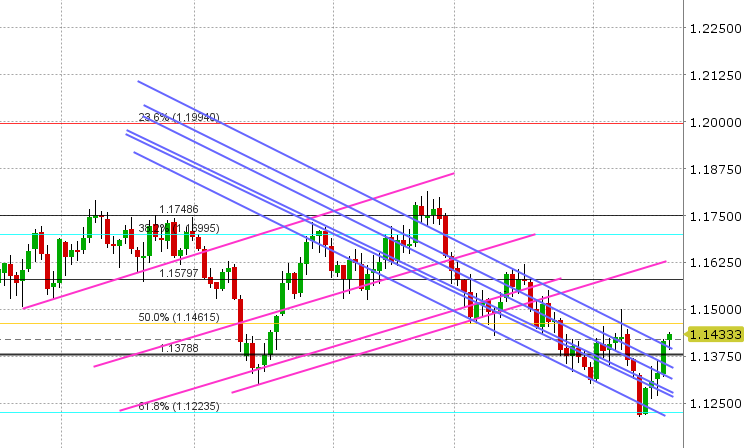

EURUSD: Euro/dollar is beginning this holiday shortened week on a strong technical footing after Friday’s comments from Fed vice chair Clarida saw the market shoot past the 1.1370s on the charts. The market eventually surpassed trend-line resistance at the 1.1400 level as well, which made for a very positive NY closing pattern. The key takeaways from Clarida’s interview with CNBC on Friday were that Fed policy is “getting closer to the vicinity of neutral” and that the Fed “has to factor global slowing” into its outlook. This finally put some doubt in the Fed’s unwavering rate hiking narrative and saw December rate hike odds recede from 90% to 75%. The USD was sold broadly after the NY open and this pattern held for most of the trading day. The APEC summit rhetoric is hurting “risk” a tad to start the week, but EURUSD continues to hold the 1.14 handle, which is positive. The funds added to both long and short positions during the week ending Nov 13th, but the longs more so, which meant the speculative net short EUR (long USD) position declined back down to October levels. This week’s European calendar is rather quiet on the economic data front, but we may likely have some volatility on Wednesday when the EU set to start discipling Italy over its 2019 budget. For the time being though, the EUR bulls are in charge and market looks poised to test Fibo chart resistance in the 1.1460s.

-

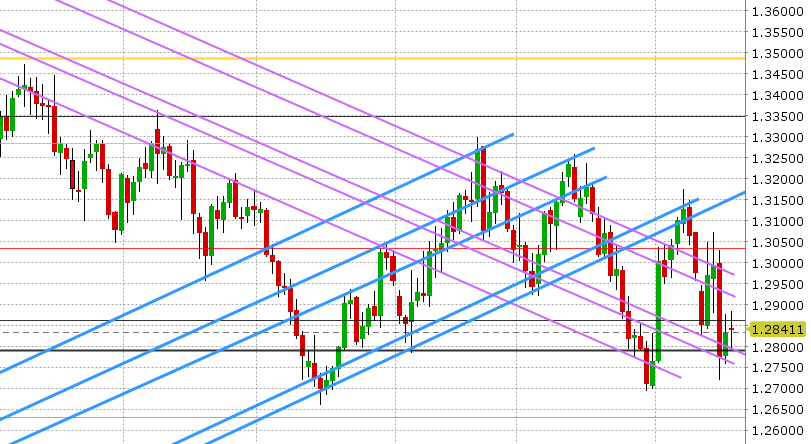

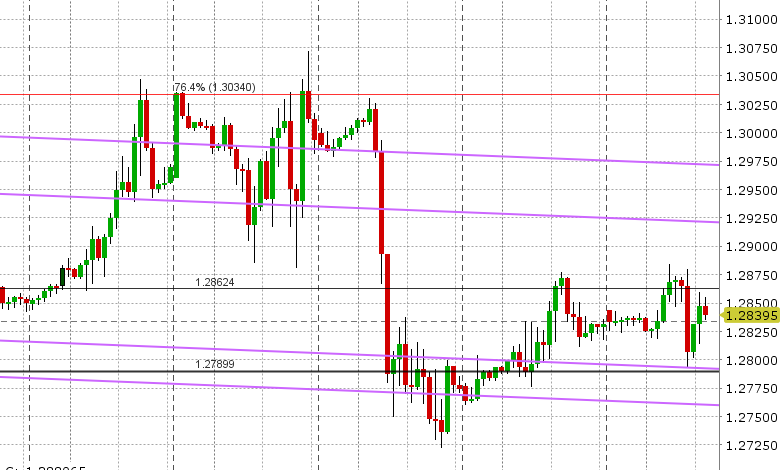

GBPUSD: Sterling has had a volatile start to the week. Rumors continue to swirl about a no-confidence vote against Theresa May as reporters try to figure out how many of the requisite 48 letters have actually been received. In the meantime, the UK PM continues to press on with fine tuning her Brexit deal ahead of this Sunday’s (Nov 25) special Brexit summit with the EU. The EU’s Barnier has reportedly proposed extending Britain’s transition period by 2 years (GBP positive), but a Reuters headline then citing the UK PM’s spokesperson said that the “UK does not need an extension”, which then saw GBPUSD plunge by 70pts back into support at the 1.2800 level. The market is bouncing again now as EURUSD extends gains, but we’re still trading within Friday’s daily range. The funds trimmed shorts and added to long positions during the week ending Nov 13th, reducing the overall speculative net short GBP (long USD) position back down to early October levels. This week’s UK economic calendar is uneventful, which means the focus will continue to be on the no-confidence vote and UK parliament posturing ahead of next weekend’s summit.

-

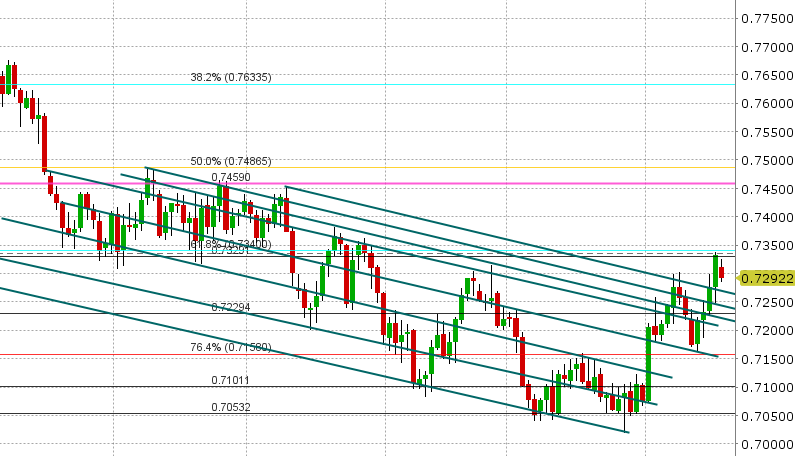

AUDUSD: The Aussie is leading the declines this morning as the trade-sensitive currency trades lower with equities and the Chinese yuan following the negative tone out of the APEC summit on the weekend. The market has now given back half of the Clarida gains from Friday and looks poised to retest the 0.7270s; the level which the market broke above after Fed signaled some concern about global growth. Horizontal chart resistance at the 0.7330-40 level has now proved formidable it seems as well. The Australian calendar is light this week as well, with just the RBA Minutes out tonight and RBA Governor Lowe speaking early tomorrow morning. We think AUDUSD tests support in the 0.7250-70 area in the coming days.

-

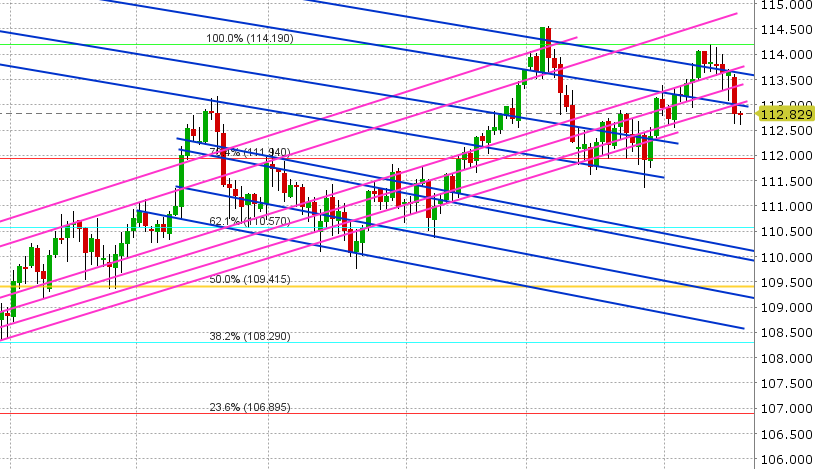

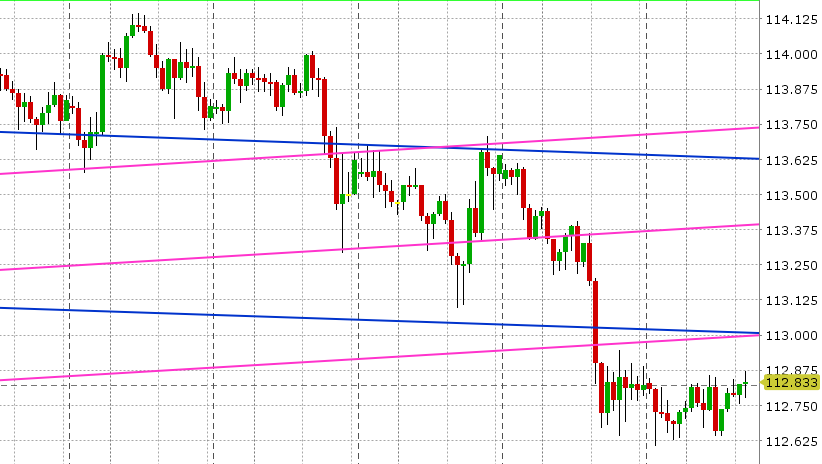

USDJPY: Dollar/yen continued lower on Friday, with Clarida’s dovish comments adding to an already weak chart structure coming into the NY session. The losses saw support at the 113 level break, and this negative technical development held into the NY close. The negative vibes out of this weekend’s APEC summit is helping to keep the JPY bid at this hour, but we wouldn’t be surprised to see a bounce back up to the 113 mark to test recent shorts. Over 1.1blnUSD in options expire at the 112.50 strike on Wednesday, which might give traders a target for mid week. The funds added to both long and short positions during the week ending Nov 13th but the longs more so, which means the speculative net long USD (short JPY) position is now back to its October highs…not something that longs want to see frankly after the market started to break down technically last week.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

January Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.