EUR technical selling leads broad USD bid to start week

Summary

-

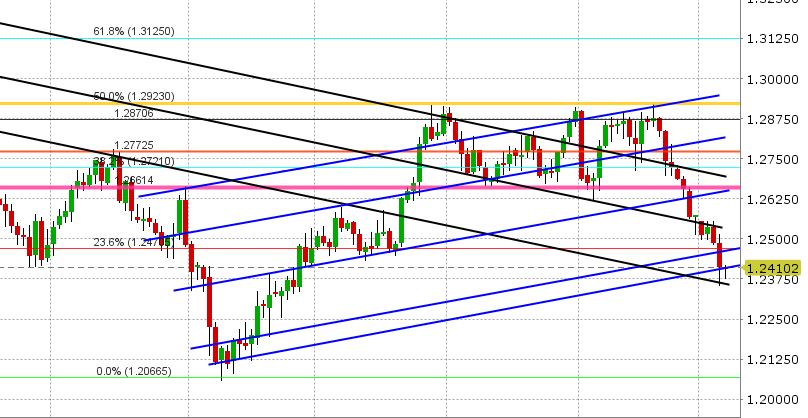

USDCAD: Dollar/CAD is starting the week steady after a plunge on Friday to new 3 month lows post Canadian and US payrolls. The US number came in +148k (weaker than expected) and the Canadian number blew away expectations for the second month in a row (+78k jobs vs. +2k expected), which made for a uber-ly bearish fundamental update for USDCAD traders. Odds for a 25bp rate hike from the Bank of Canada next Wednesday have shot up to 80%. The CA/US 2 yr yield spread has contracted to +18bp. The chart technical deteriorated further on Friday, but the market managed to hold support in the mid-1.23s before the weekend and these levels are holding so far in Asian and European trading overnight. The latest CFTC futures positioning data for CAD shows a market that started to build positions once again on the move from 1.27 down to 1.25. Both longs and shorts added, leaving the net USD short (CAD long) slightly less short than the week prior, but still significantly less short compared to month ago levels. The Canadian economic calendar is light this week, with the Q4 Business Outlook survey out 10:30amET today, Housing Starts tomorrow and Building Permits on Wednesday. The US calendar is quiet too this week until Friday when we’ll get US CPI and Retail Sales. The EURCAD chart fell apart on Friday and so naturally it’s not lending much support at all today USDCAD this morning. GBPCAD is fairing a touch better relatively speaking but it is treading water. We expect USDCAD to hold steady today, perhaps catch a small bid as current support is holding and the USD is broadly higher against AUD, EUR and GBP this morning, but we still anticipate sellers on rallies back to 1.2460-1.2470. Next support is currently 1.2360.

-

AUDUSD: The AUDUSD market held up relatively well on Friday despite the reversal lower in EURUSD post US payrolls and despite lower copper prices, but AUD longs are finally starting to buckle here as EURUSD continues lower in European trade today. Technically speaking, we’re testing the familiar trend-line extension level which resisted price action earlier last week, then supported it late last week. Should this level break, we would expect some further selling, but we’d be on the lookout for buyers from 0.7780 to 0.7810. Copper prices aren’t looking too hot to start this week, but the AU/US 2 yr yield spread is much firmer today at +4bp. The Australian economic calendar is very light this week, with just Nov Building Approvals tomorrow (markets expecting +5% YoY). We expect AUDUSD to continue to trade off broad USD and commodity themes given the lack of Australian data, and would continue to note Friday’s technical reversal lower in EURUSD as a near-term headwind. The latest CFTC futures positioning data for AUD showed the net short position growing to a new 23 month high as of Jan 2nd, which is good news for AUD longs as these positions continue to experience pain and could spur another round of buying should they liquidate.

-

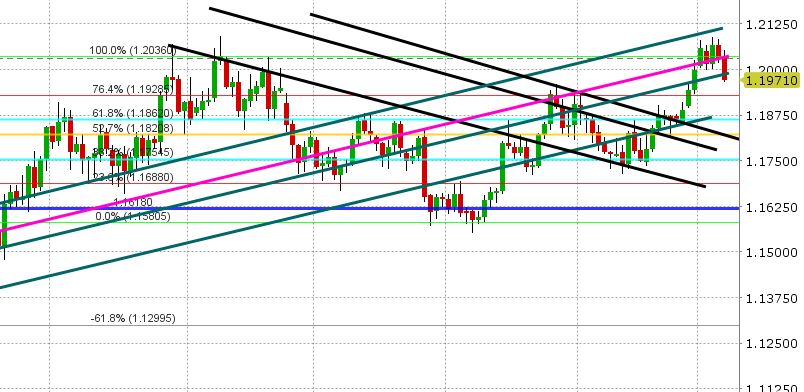

EURUSD: It’s been all about the EUR to start the week. The first blow to EUR longs came as the market couldn’t capitalize on the weaker than expected US payrolls number on Friday. This led to an intra-day reversal on the hourly charts and then a mediocre NY close on Friday. Combine that with a new high in the net long EUR futures position (reported by CFTC on Friday), softer than expected German factory orders (released this morning), reports of a large 2bln+ EUR option expiry at 1.1985 today, and a technical break on the chart below 1.2020-1.2030 during Asian trade, and EURUSD traders have their thesis for selling today. The EUR selling is broad based too, hitting EURGBP and EURJPY as well. The US/GE 10yr yield spread remains stubbornly wide (now +204bp), adding further weight to EURUSD. It’s a quiet week for European data too, with just the German Industrial Production data and Trade Balance figures tomorrow, and German GDP/ECB minutes on Thursday. We see the EURUSD under a little bit of trouble here given Friday’s intra-day chart failure. Support at 1.1980-1.2000 needs to be regained soon to entice buyers, otherwise we see a test of the 1.1920s.

-

GBPUSD: Sterling has been quiet to start the week and while GBPUSD didn’t have a great NY close on Friday post disappointing US payrolls, it’s not selling off nearly as much as EURUSD today, so relatively speaking it’s holding up well on the charts. There was talk over the weekend of a Theresa May cabinet reshuffle, but not much else. Brexit news continues to be non-existent as well. Combine this with no major UK economic data on tap for this week and GBPUSD will likely trade at the whims of the broader USD and its crosses EURGBP and GBPJPY. The weak EURGBP is lending support today while the GBPJPY is starting to look a little troublesome (market could not hold new highs above 153.50 on Friday). Chart resistance today is 1.3560-1.3570. Support is 1.3510-1.3520. The CFTC reported a net long GBP position for the 6th week in a row ending Jan 2nd, but it is still slightly less than mid-December levels as shorts have entered more aggressively in the last 2-3 weeks.

-

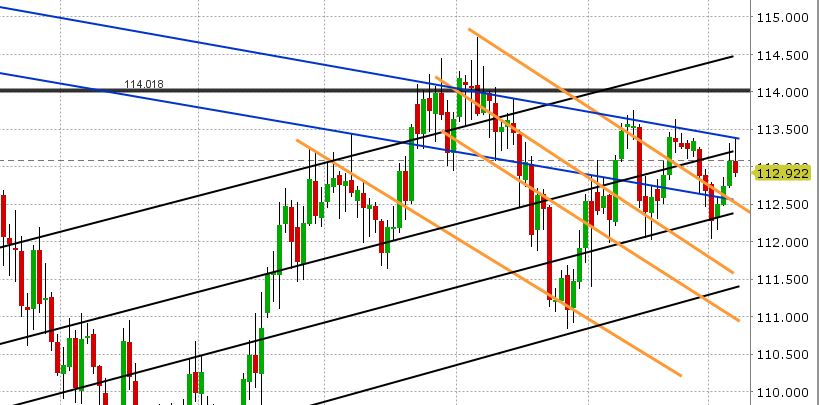

USDJPY: Dollar/yen is taking some heat this morning. While the market had a strong NY close on Friday, it failed miserably again at the same trend-line resistance that capped price action twice in December (blue line on chart). And so traders are selling. We’ve also seen a pause in the global stock market rally after an incredible start to 2018 last week. US yields are lower too from Friday’s levels, despite the weaker than expected US payrolls print. It feels like EURUSD is leading the EURJPY cross today, either way the cross is supportive USDJPY right now. Support checks in at the 112.80s today. A recovery rally above 113.10 would be need to bring back some positive momentum.

Market Analysis Charts

USD/CAD Chart

AUD/USD Chart

EUR/USD Chart

GBP/USD Chart

USD/JPY Chart

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.