Brexit mood sours as two-day EU summit begins

Summary

-

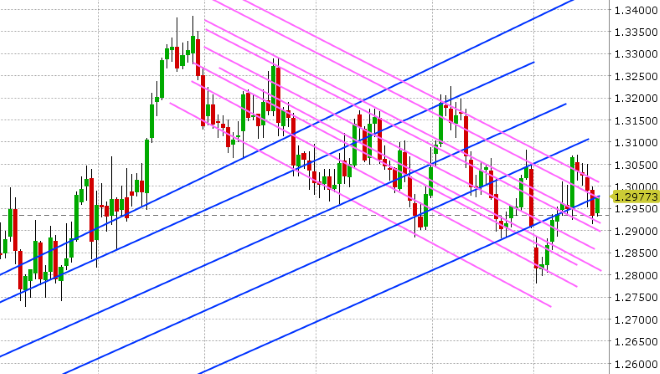

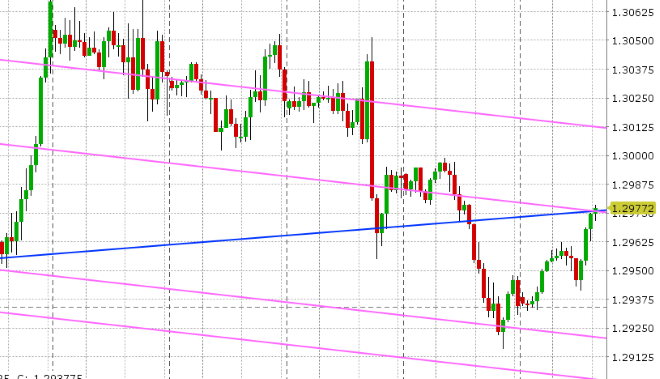

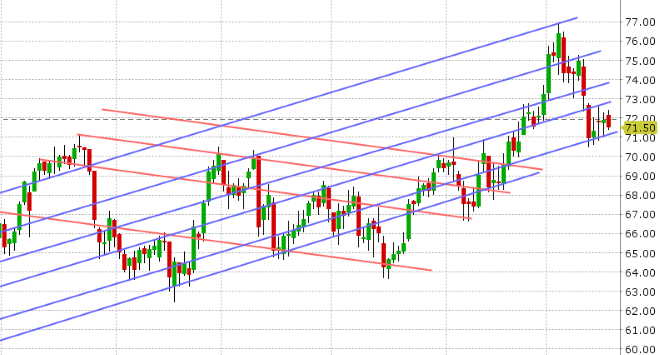

USDCAD: Dollar/CAD extended losses down to the next support level in the 1.2910-20 area yesterday like clockwork, after breaking back below 1.2960-70 in early NY trade. The market has since bounced however, led by broad based USD buying in Europe in the wake of the Brexit mood turning sour once again. November crude is also trading modestly lower ahead of today's November option expiry, which is helping. Today’s calendar features US Housing Starts for September and Canadian Manufacturing Shipments for August (both out at 8:30amET), followed by the weekly EIA oil inventory report at 10:30amET and the FOMC Minutes at 2pmET. We think USDCAD trades in a bit of a range here, but we would not be surprised to see some further upward momentum should we regain the 1.2970s and hold.

-

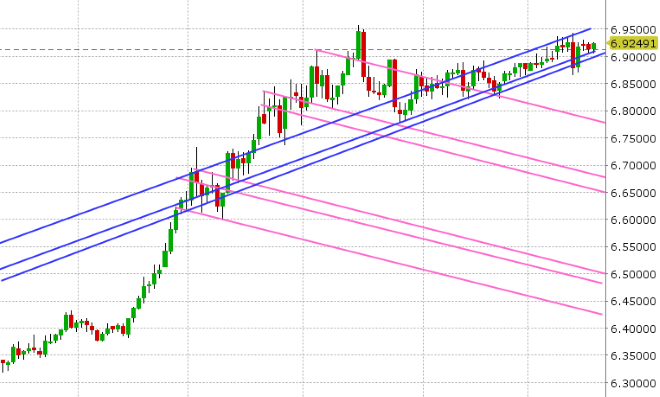

EURUSD: Euro/dollar shorts are breathing a sigh of relief today as the market further gives up on its attempt to rally into the 1.16s. Yesterday’s spike above the 1.16 handle and quick reversal lower had all the hallmarks of a stop hunt on fund short positions, especially when you consider futures open interest fell by over 1800 contracts. Today’s breach of upward sloping support in the 1.1550-60 area is not positive technically. Brexit negativity definitely seems to be souring the mood here and EURUSD looks content to follow GBPUSD lower. USDCNH has bounced off the 6.9050-6.9100 level two times in the last 24hs and December gold has rejected the 1235 level twice; developments that both don’t help EURUSD at the moment. Today’s Eurozone CPI data was reported in-line with expectations of +2.1% YoY in September. We think we could see further selling in EURUSD here should the market not regain the 1.1560 level quickly. Next support is 1.1500-1.1510.

-

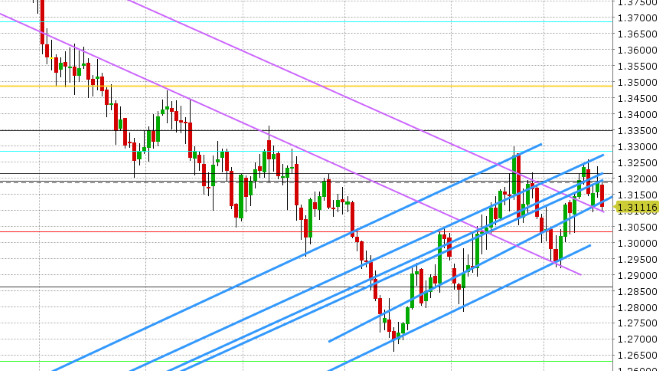

GBPUSD: Sterling is leading the FX headlines this morning as the Brexit mood has turned sour in Brussels at the start of the two-day EU summit. Word is the special Brexit summit (penciled in for November 17-18) is not set in stone, and now there’s talk that many EU countries want a “no-deal Brexit” summit to occur instead, if there’s no progress made on negotiations soon. This is naturally adding validity to the entrenched fund short position, and GBPUSD is plunging lower this morning. Yesterday’s post London retraction back into the 1.3190-1.3210 support zone was a bit of a warning sign, as were Tusk’s comments about “no grounds for optimism”. Today’s miss on UK September CPI is not helping the mood either. The figures were reported +2.4% YoY and +0.1% MoM versus +2.8% and +0.5% expected. GBPUSD is currently testing chart support in the 1.3100-1.3110 area. Expect range bound action should the level hold, and further selling down to the 1.3030s should it break.

-

AUDUSD: The Aussie is pulling back this morning, as one might expect given the broad based USD buying we’re seeing today. This comes however after a spike higher in early European trade and a formal reject of chart resistance at the 0.7150-60 level (which is significant we feel). It puts the fund shorts back in charge near term and could very well see us extend back down to support at the 0.7100 area. Over 1blnAUD in options expire at the 0.7125 strike this morning. Australia reports its September employment figures at 8:30pmET tonight, with traders expecting +15k jobs gained.

-

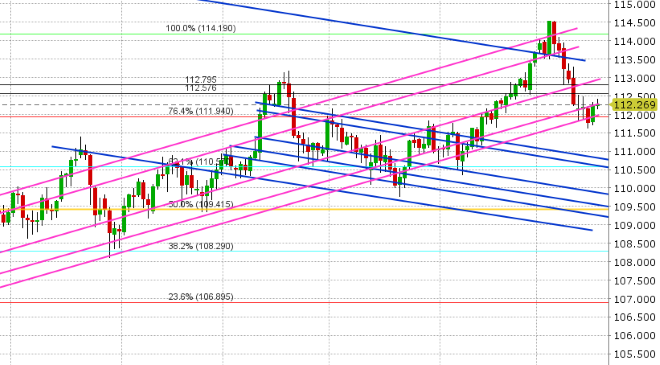

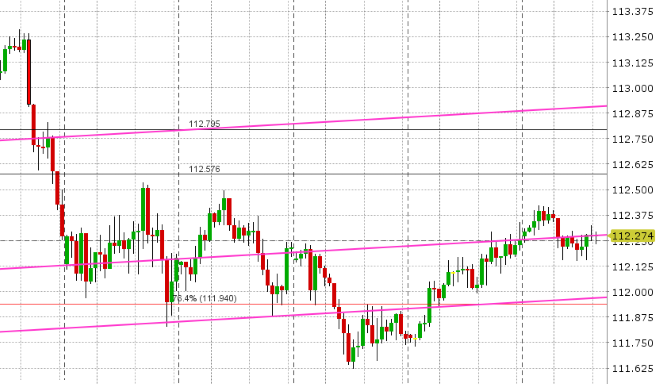

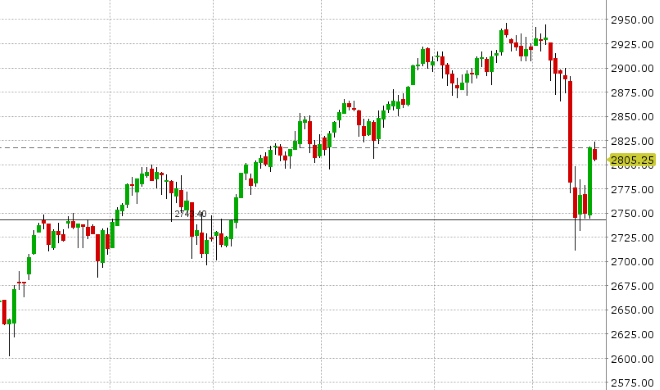

USDJPY: Dollar/yen continued higher yesterday; driven by somewhat more positive chart technicals and a strong rebound in US stocks. However, we’re starting to see selling re-emerge again today (something we alluded to yesterday), as trapped fund longs are given a chance to get out. The S&Ps are almost 20pts off their overnight highs, which isn’t helping. We’re also seeing a big reversal of yesterday’s gains in GBPJPY. We think USDJPY coasts here for a bit until the FOMC Minutes out later today.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

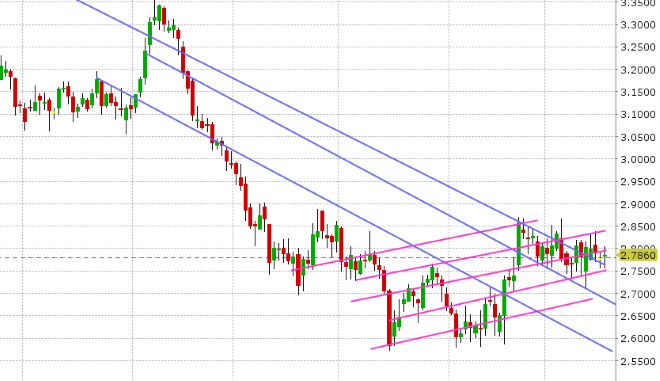

November Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

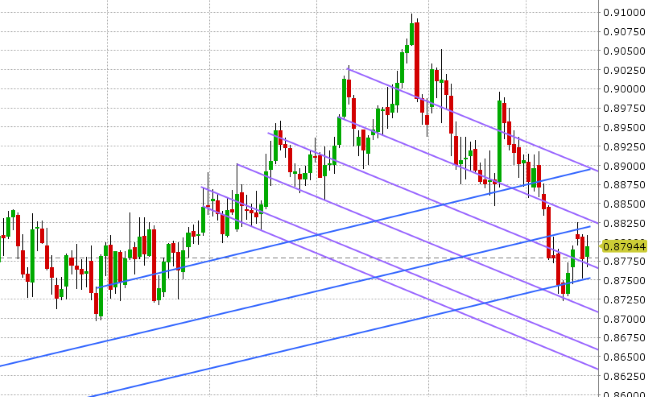

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

December Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

DEC S&P 500 Daily

Charts: TWS Workspace

About the Author

Exchange Bank of Canada (EBC) is a Schedule 1 bank based in Toronto, Canada. EBC specializes in foreign exchange services and international payments providing a wide range of services to financial institutions and corporations, including banknote foreign currency exchange, travelers' cheques, foreign currency cheque clearing, foreign currency bank drafts, Global EFT and international wire transfers through the use of EBC's innovative EBCFX web-based FX software www.ebcfx.com.